Bitcoin

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Published

3 days agoon

By

admin

The price of Bitcoin has continued its descending movement, sliding under the $55,000 threshold, returning back to levels last seen in February.

Bitcoin’s (BTC) sell-off has intensified amid reports that the collapsed crypto exchange Mt. Gox moved over 47,000 BTC (worth around $2.6 billion) to a new wallet ahead of its $9 billion payout. At the time of writing, the price of Bitcoin is $54,561, a mark last witnessed in February, when the largest by market capitalization cryptocurrency was surging to a new all-time high.

Following the transaction, Mt. Gox trustee officially confirmed on Jul. 5 during Friday’s Asian trading hours that the collapsed exchange “made repayments in Bitcoin and Bitcoin Cash to some of the rehabilitation creditors.” The trustee didn’t specify though the amount of BTCs sent to creditors.

The crypto market has faced significant pressure recently, affecting both investor sentiment and miner operations following the April halving, which reduced mining rewards from 6.25 BTC to 3.125 BTC. At Bitcoin’s current price, only five ASIC rigs from Avalon and Antminer remain profitable, according to f2pool’s X post.

⛏️With #Bitcoin trading below $58k, what is the current profitability for mining?

At a rate of $0.08/kWh, ASICs less efficient than 23 W/T operate at a loss.

For more details on mainstream miners, please refer to the table below. pic.twitter.com/hJS1lsVnmK

— f2pool 🐟 (@f2pool_official) July 4, 2024

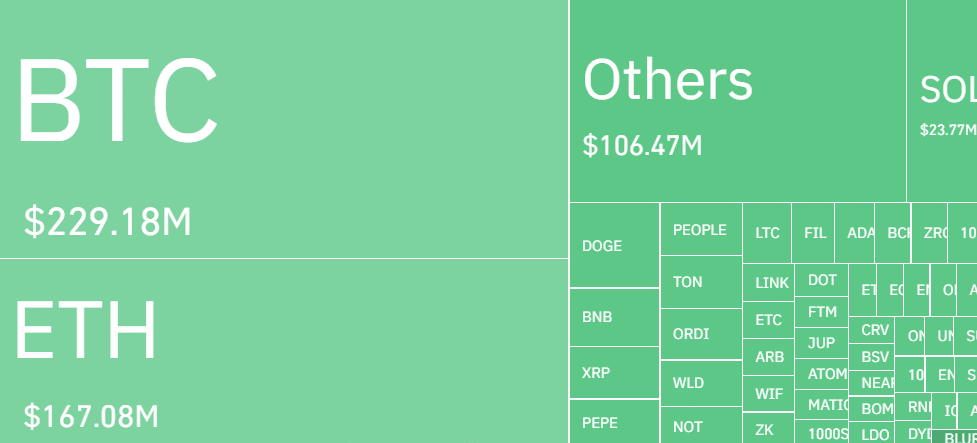

The rapid drop below $55,000 has pressured speculators, resulting in $682 million in liquidations of both long and short positions across multiple exchanges, according to Coinglass.

Over the past 24 hours, more than 235,000 traders were liquidated, with the largest single liquidation order on Binance’s ETH/USDT trading pair valued at over $18.4 million. According to CoinGecko, the total crypto market capitalization dropped by over 8% to $2 trillion, increasing sell-offs among speculators.

As crypto.news reported earlier, TRON founder Justin Sun offered to help the industry by teasing his “willingness” to buy confiscated Bitcoins from the German government over-the-counter. It’s unclear when these negotiations will begin, but with the recent movement of Bitcoins to centralized exchanges from Germany-labeled addresses, Mt. Gox’s repayments have seemingly become the primary concern among traders.

Source link

You may like

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Published

7 hours agoon

July 8, 2024By

admin

The Ethereum-based BUIDL fund from the leading asset manager BlackRock has gulped over $5 million in assets over the past week despite the ongoing market turbulence.

Market analytics resource IntoTheBlock (ITB) revealed this in a recent disclosure, stressing that the fund has commanded considerable interest among investors.

While the crypto market struggles, BlackRock’s $BUIDL fund, operating on the Ethereum network, continues to attract new investors.

The fund requires a minimum entry of $5 million, and its total assets have now reached $491 million. pic.twitter.com/Bl19tVVxbW

— IntoTheBlock (@intotheblock) July 8, 2024

Launched in March on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) marks the company’s first tokenized fund. It allows qualified investors to procure yields in U.S. dollars by subscribing through the fintech company Securitize.

Notably, two months after the fund’s launch, Securitize secured a $47 million funding round from multiple investors, including BlackRock.

The BUIDL fund allocates investments into U.S. Treasury bills, cash, and repurchase agreements. This enables investors to generate yield while maintaining their holdings as tokens on the blockchain. Despite a correlation with the crypto industry, the fund has maintained a positive path amid the ongoing market turmoil.

According to data sourced by ITB, BUIDL now boasts $491 million in assets under management (AUM) amid a sustained growth trajectory. This feat comes as the broader global crypto market lost $290 billion in July, with Bitcoin (BTC) collapsing below $57,000.

On-chain data shows that BUIDL’s AUM stood at $486.46 million as of July 2. Interestingly, this figure has since increased to $491.83 million, recent data confirms. The growth rate indicates an addition of $5.37 million in the last week despite the bearish atmosphere.

With this bullish performance, BUIDL has maintained its position as the largest blockchain-based money market fund. Notably, BUIDL surpassed the BENJI fund from Franklin Templeton to become the largest money market fund in May, when its AUM soared to $375 million.

1/ Blackrock’s BUIDL has surpassed Franklin Templeton’s BENJI (FOBXX) in AUM and became the largest On-Chain Money Market Fund

– BUIDL has grown 36.5% MoM from $274M to $375M

– BENJI only grew 2.1% MoM from $360M to $368M pic.twitter.com/zcMzThfAAh— Tom Wan (@tomwanhh) April 30, 2024

As such, BUIDL has recorded inflows totaling $116.83 million. Meanwhile, BENJI has only seen $33.97 million in capital inflows within the same period.

Source link

Bitcoin

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Published

10 hours agoon

July 8, 2024By

admin

Canadian Bitcoin mining company HIVE Digital has released a June financial report, revealing it has increased its reserves to 2,503 BTC stored on the balance sheet.

HIVE Digital Technologies, the Vancouver-based Bitcoin mining company, seems unaffected by the recent miner capitulation that caused Bitcoin (BTC) to plunge below the $56,000 mark.

In a Jul. 8 press release, the company revealed that as of Jul. 7, its crypto holdings on the balance sheet had increased to 2,503 BTC, a more than 2% increase compared to the prior month. In total, HIVE Digital mined 119 BTC in June, keeping the same performance as in May.

Despite recent market turbulence that saw Bitcoin plunge below the $56,000 mark, HIVE Digital appears unaffected. CEO Aydin Kilic addressed the firm’s operational expansion, noting that the remaining batch of Bitmain S21 orders “are ready to ship, and in fact have been upgraded to S21 Pro, representing approximately 1,150 S21 Pro miners from HIVE’s original order in December.” Kilic added that the latest acquisition of 1,000 S21 Pro Miners revealed in May is now “ready to ship,” with the total fleet of new rigs expected to be installed by the end of July.

“Therefore, we expect the total 2,150 pending S21 Pro miners to ship in the next week, bringing HIVE’s total operational hashrate to 5.5 EH/s once fully installed, with a global fleet efficiency of 24.5 J/TH. HIVE expects these machines to be installed before the end of July.”

Aydin Kilic

Following the release of the positive report, HIVE Digital’s shares (HIVE) soared by over 9.5% on Nasdaq, jumping to $3.34, according to data from Google Finance.

HIVE Digital’s reserve boosting comes despite massive capitulation among its rivals. As QCP analysts noted in a research report, Bitcoin miners are showing “signs of capitulation” as the cryptocurrency’s price slid below $56,000 late Jul. 5. Amid the deteriorating landscape, the hashprice mark neared “its all-time low,” a level last seen during the bear market.

Source link

24/7 Cryptocurrency News

Is Ethereum Becoming Scarcer than Bitcoin on Exchanges?

Published

17 hours agoon

July 8, 2024By

admin

Ethereum (ETH) metrics have shown that the digital currency might be suffering from scarcity than earlier projected. According to on-chain data, Ethereum is now being accumulated at a faster rate than Bitcoin.

The Ethereum and Bitcoin Divergence

According to data insights from Leon Waidmann from BTC-Echo, Ethereum is becoming scarcer than Bitcoin. While there are metrics that show the individual performance of BTC and ETH, their correlation per exchange balances is also a crucial one.

🚨HUGE divergence between #Ethereum and #Bitcoin!

ETH is becoming SCARCER than BTC.#ETH Exchange Balance: 10.189% 📉#BTC Exchange Balance: 15.086% 📈

The gap is WIDENING! pic.twitter.com/UnuejbnS8l

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) July 7, 2024

According to the accompanying Glassnode data shared by Waidmann, the current Ethereum exchange balance is pegged at 10.189%. In contrast, that of Bitcoin comes in at 15.08%, a figure that suggests a tightening gap.

Since the conversation around spot Ethereum ETF came into the limelight, demand for ETH has grown. Investors suddenly started buying Ethereum at a frantic pace, accounting for the drain on trading platforms. The investor action is explainable, considering how Wall Street money is projected to buy Ethereum upon ETF launch.

This projection is not unfounded judging by the trend seen in spot Bitcoin ETF products. When the BTC ETF came into the market in January, top firms like Susquehanna International Group (SIG) went all out to buy the asset. The buyups played a crucial role in sending the price of Bitcoin to an All-Time High (ATH) of $73,750.07.

Despite the exchange balance for Ethereum draining fast, the impact on the price of ETH is not visible. At the time of writing, Ethereum is changing hands for $2,983.03, down by 2.31% in the past 24 hours. The coin’s 24-hour low and high trading price comes in at $2,956.99 and $3,080.11 respectively.

Revival Plans for ETH

The future growth of ETH is now hinged on the new long-awaited decision from the US SEC. After it greenlighted the 19b-4 forms for the spot Ethereum ETF application weeks ago, the wait for S-1 is near.

Though the timeline for launch remains largely speculative, the coming 2 weeks appear pivotal. ETF Store President Nate Geraci believes the regulator will do everything it has to do to make Ethereum ETF start trading in 2 weeks.

Read More: Peter Schiff Claims Bitcoin Whales Set Up ETF Investors As “Bag Holders”

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: