Investing

Bitcoin Traders Position for ‘Bullish July’ as BTC ETFs Record $124M Inflows

Published

7 days agoon

By

admin

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

crypto

Should You Buy Crypto in a Downmarket? | by Blockchain.com | @blockchain | May, 2023

Published

1 year agoon

May 31, 2023By

admin

Cryptocurrency can be a volatile investment. Prices can swing wildly in a matter of hours or days, making it difficult for individuals to know when to buy or sell.

However, downturns in the market can be the perfect time to buy crypto. Here’s why:

During a downmarket, crypto prices are generally lower than during a bullish market. This presents an opportunity for individuals to buy the same amount of cryptocurrency for a lower price. When the market eventually recovers, the value of the cryptocurrency will rise, and the investor will have made a profit.

Cryptocurrency is still a relatively new technology. It has the potential to revolutionize the way we do business, store value, and transfer funds. Buying crypto during a downmarket means investing in this potential for the long term. While the market may be down now, the potential rewards could be significant in the future.

Buying cryptocurrency can be a way to diversify your investment portfolio. It offers a different type of asset than traditional stocks and bonds. By buying crypto during a downmarket, individuals can spread their risk across different types of investments.

During a downmarket, you have the opportunity to learn more about cryptocurrency and the market — learn about the technology behind different cryptos, and develop a better understanding of how the market works.

This knowledge can be valuable for future purchases and can help individuals make informed decisions.

- Go to Blockchain.com and create an account.

- Verify your identity

- Add funds to your account: Add funds to your account using a credit card, bank transfer, or other payment methods.

- Navigate to the “Buy Crypto” tab and select the cryptocurrency you want to buy. Enter the amount you want to buy and confirm the transaction.

- Once your purchase is complete, you can store your crypto in your Blockchain.com wallet.

It’s important to remember that the market is unpredictable, and individuals should always do their due diligence before making any purchase decisions.

This information is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax or financial advice from a professional advisor.

Source link

crypto

Blockchain.com Survey Reveals Crypto Investors Are Cautiously Optimistic Heading into 2023 | by Blockchain.com | @blockchain | Dec, 2022

Published

2 years agoon

December 22, 2022By

admin

In 2022, crypto hit a new level of mainstream awareness, for better or worse. Coming off the highs of a 2021 bull run where Bitcoin topped $69,000, we end the year with fewer players and many lessons for us all. Despite the ups and downs, Blockchain.com’s long-term vision remains focused on the users — so we decided to ask how they’re feeling.

Blockchain.com polled consumer crypto investors to gain insight regarding their thoughts and opinions in an inaugural poll, ‘Crypto Confidence: A Survey on Investor Sentiment.’ The survey focused on crypto usage and sentiment leading into the holiday season and the new year.

More than 40,000 respondents from around the world painted a picture of cautious optimism. Despite Crypto Winter, 40% of respondents purchased crypto this year and also plan to do so in 2023, demonstrating that many investors remain measured but bullish. In addition, nearly 40% of respondents say they will discuss crypto around the holiday table this season, a clear indication that crypto has hit mainstream awareness.

Overall results include:

- 41% purchased crypto this year

- Nearly 40% plan to purchase crypto next year

Looking at some geographic and seasonal findings, the survey revealed that certain countries are more bullish than others.

- 44% of US respondents bought crypto this year and 40% plan to buy next year

- Ghana respondents are pro-crypto, with 44% purchasing crypto this year, 60% planning to next year, and 53% planning to discuss crypto at the holiday table

- Representing the largest group of respondents, 50% of Nigerians purchased crypto this year, 46% plan to next year, and 46% also plan to discuss crypto at the holiday table

- Brazilians were split almost 50/50 on purchasing crypto

- Only 34% of Germans purchased crypto this year and 30% plan to next year

- Italians were overwhelmingly skeptical of crypto, with only 31% purchasing crypto this year, 29% planning to purchase next year, and 31% planning to discuss crypto at the holiday table

Countries with the highest responses, in order, were Nigeria, United States, United Kingdom, Ghana, and Germany.

Methodology

More than 40,000 people from all over the world who visited the Blockchain.com Explorer site, one of the top 3 crypto sites in terms of web traffic, responded to survey questions between November 28 — December 9, 2022.

Source link

dollar-cost-average

Dollar Cost Averaging, Explained. Investing in crypto can be tricky. The… | by Blockchain.com | @blockchain | Aug, 2022

Published

2 years agoon

August 26, 2022By

admin

Investing in crypto can be tricky. The complexities of deciding what to invest in, when to double down, and when to hold cash are often amplified by crypto’s volatility.

To avoid banking on the “perfect” time to buy, beginners, seasoned investors, and even experts often use dollar cost averaging, a popular investment strategy.

In this article, we’ll explain:

- What dollar cost averaging is

- What the benefits and drawbacks are to this approach

- Steps on how you can adopt a dollar cost averaging strategy today

What is dollar cost averaging?

Dollar cost averaging is an investment strategy in which an investor evenly splits their investment into periodic purchases regardless of the asset’s price.

Investing in smaller amounts over time means that you’ll buy both when the price is high and when the price is low.

In turn, this smooths out your average purchase price.

Dollar cost averaging is popular in crypto given how quickly prices go up and down in a short period of time due to volatility. The basic idea is that you spread your investment into equal amounts over regular intervals instead of trying to decide on the “perfect” time to buy.

How does dollar cost averaging work?

It’s important to start off by remembering that when investing in bitcoin, you don’t need to buy a “full” bitcoin, despite what many new investors often think. Instead, investors will often purchase a small amount or fraction of “one” bitcoin.

So, say you have $500 to invest in Bitcoin. Instead of buying $500 worth today which would be worth 0.023035 BTC, if you were to adopt a dollar cost averaging investment strategy you would buy $50 worth of BTC every week for ten weeks to diversify your entry point and spend the same $500.

When the price of bitcoin is high, you’ll only be able to afford a certain amount of bitcoin with your fixed amount of investment. When the price drops, however, you’ll be able to purchase more.

As a result, when the market stabilizes, this evens out your average purchase price and you’ll benefit from having more bitcoin when you buy them at a low price.

Here at Blockchain.com our records indicate that over the last 5 years, buying Bitcoin every week has performed better than timing the market 82% of the time.

What are the main benefits of using dollar cost averaging?

While there are many benefits to this approach, here are some of the key ways dollar cost averaging may help your long-term investment plans.

- Saves time and effort. When trying to “time the market”, constantly refreshing portfolios and reviewing price fluctuations can be time consuming, not to mention nearly impossible l to get right. Dollar cost averaging gives you this time back to focus on other areas of your life, particularly if you set up an automated recurring buy.

- Less emotional. Every investor is prone to acting with the heart and not the head. With crypto’s volatility, the risk of allowing emotion to take over can lead to us neglecting trading plans and potentially investing more than we can afford. Dollar cost averaging advocates wait several years for their assets to appreciate and so can better weather short-term volatility in exchange for long-term gains.

- Potential long term capital gains. In some places, crypto profits from short-term gains get taxed less favorably than long-term gains, playing a significant role in total returns. A long-term approach shields your funds from taxes, and if you wait until you retire before selling your assets you’ll pay even less tax.

To find out more about how crypto taxes work, listen to our recent podcast episode on ‘Your Guide to Crypto Taxes in 2022’

Using dollar cost averaging in a bear market

In a recent article by Wealth Professional, Investment Advisor Graham Priest told Wealth Professional,

“I’m advising clients that dollar-cost averaging over the upcoming time period is one strategy to mitigate risk. Some clients have placed greater amounts in the past few weeks to take advantage of the drop in many stocks. But overall, dollar-cost averaging is prudent.”

While dollar cost averaging can be used in any market, such as in a bull market where prices are rising, and in a bear market where prices are falling, utilizing this strategy during a down market or recession can be particularly powerful.

Does dollar cost averaging really work?

While you should avoid making investment decisions based on what others are doing, many legendary investors embrace a dollar cost averaging approach instead of timing the market.

Warren Buffett believes you should only buy stocks if you have no problem holding onto them for 10 years and buys companies because of their fundamentals and long-term possibilities.

This approach can be applied across a range of assets, including crypto.

Instead of swinging for the fences, strive to build your portfolio incrementally.

If you’re still not convinced, there are plenty of online dollar cost averaging calculators that let you test this strategy out for yourself.

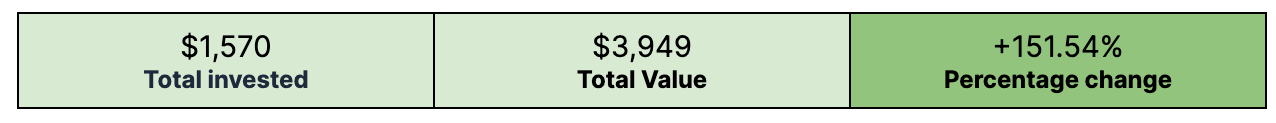

The data below from dcaBTC shows the total value of investment when $10 Bitcoin is purchased weekly for three years, starting in 2019.

What are the disadvantages of using dollar cost averaging?

Adopting a dollar cost averaging approach to investment does not guarantee protection against losses or gains in profit. There are a few disadvantages to consider ahead of determining if this is the right investment strategy for you.

- Time. It can take a long time to build up a position if you’re investing small amounts regularly.

- “Mooning.” If the asset you’re investing in never goes down, you may have been better off just buying all at once.

Remember: Dollar cost averaging does not guarantee that you will make a profit, and as with all crypto investments, your capital is at risk.

How to get started with dollar cost averaging

- Choose an amount to regularly invest. It could be a flat amount, a percentage of your paycheck, or something else. It’s important to choose an amount you can sustain and remember, only invest what you can afford to lose and what you do not need access to in the short term.

- Choose assets. You can choose one or more assets to build a position in.

- Choose a purchase interval. It can be every week, every month, or even every day.

BONUS: Automate your buys. Most apps, including the Blockchain.com Wallet, let you make recurring buys at an interval of your choosing.

Why not put this strategy to work? Setup a recurring buy today.

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs