crypto

Blockchain.com Names Tim Lubans as General Counsel | by Blockchain.com | @blockchain | Feb, 2023

Published

1 year agoon

By

admin

As we look towards the future of crypto, 2023 presents Blockchain.com with an opportunity to build upon our success, prepare for what’s ahead and — most importantly — continue to support our tens of millions of customers in over 150 countries.

To kick off this year, we are delighted to announce Tim Lubans has been promoted to General Counsel of Blockchain.com.

Tim manages the Legal and Compliance teams and is responsible for the oversight of all legal, regulatory and compliance matters globally. With 20 years in regulated financial services, Tim brings a wealth of industry knowledge and experience to his role of General Counsel as Blockchain.com faces a rapidly evolving regulatory environment.

Tim began his career as a regulatory lawyer at Clifford Chance in the early 2000s, making the move in-house at BlackRock (and the world of asset management) in 2006. Tim’s 12 years at BlackRock in London culminated in his time as Managing Director of the EMEA Legal & Compliance department, where he was the Co-Head of BlackRock EMEA’s Funds Legal Team, as well a member of the iShares ETF EMEA Executive Committee from 2015 to 2018.

Having joined Blockchain.com in 2019, Tim has led many aspects of the global expansion of the company and its maturation as a regulated services provider. Under Tim’s leadership, Blockchain.com will continue its evolution as one of the leading regulated digital asset providers in the world.

Source link

You may like

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

21shares

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Published

13 hours agoon

June 28, 2024By

admin

In a significant development for the cryptocurrency industry, investment firm 21Shares filed an S-1 registration form for a Spot Solana ETF with the US Securities and Exchange Commission (SEC) on Friday.

The 21Shares application follows a similar filing by Bitcoin ETF issuer and asset manager VanEck on Thursday, indicating a growing interest in Solana as a potential competitor to the anticipated Ethereum ETF market, which is expected to begin trading in July.

21Shares Introduces Core Solana ETF

The 21Shares Core Solana ETF, as described in the filing, is designed to issue common shares of beneficial interest that trade on the Cboe BZX Exchange.

Its investment objective is to track the performance of SOL, providing investors with a convenient and cost-effective method to gain exposure to SOL without making a direct investment in the asset. Based on the index, the ETF will hold SOL and value its shares daily.

The Trust will be sponsored by 21Shares, with CSC Delaware Trust Company acting as the trustee. Coinbase Custody Trust Company will serve as the SOL custodian, holding all of the Trust’s SOL on its behalf.

SOL Price Consolidates After Initial ETF Announcement

While the SEC’s approval of a Solana ETF is subject to regulatory review and compliance, these filings demonstrate the increasing demand for investment products that expose Solana’s digital assets.

If approved, the ETFs would provide investors with a regulated and accessible way to participate in Solana’s potential growth and performance.

Notably, this could be the start of new filings with the SEC by the world’s largest asset managers, as has already been the case with Bitcoin and Ethereum ETFs.

Nonetheless, SOL has not had the same reaction as it did on Thursday with VanEck’s announcement of its Solana ETF filing, which sent SOL’s price to a 9% price recovery towards $150 after a dip to $121 earlier in the week. Now SOL is trading at $142 due to a 4% price correction experienced over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com

Source link

Binance

Dormant Crypto Whale Wakes Up, Moves $3,050,000 Worth of Bitcoin (BTC) to Binance

Published

1 day agoon

June 27, 2024By

admin

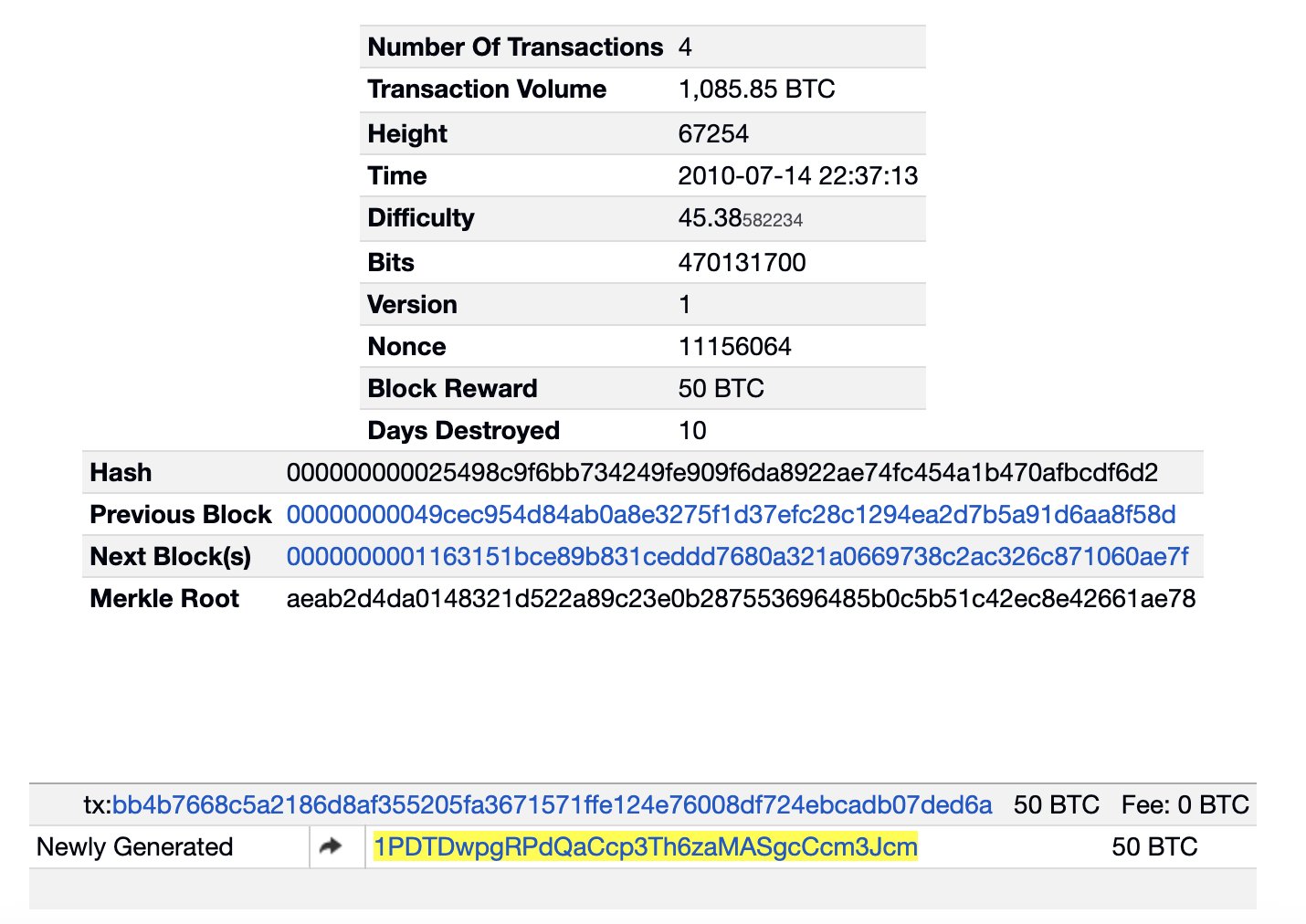

A long-dormant crypto whale has woken up after years of slumber to move millions of dollars worth of Bitcoin (BTC) to Binance, the world’s largest crypto exchange platform by volume.

New data from market intelligence firm Lookonchain reveals a crypto mining wallet that has been asleep for 14 years has abruptly woken up and deposited 50 BTC, worth about $3.05 million at time of writing, to Binance on June 26th.

According to the crypto analytics platform, the miner earned the tokens during July 2010 when the crypto king was trading for under $1.

“A miner wallet woke up after being dormant for 14 years and deposited 50 BTC ( $3.05 million) to Binance seven hours ago. The miner earned 50 BTC from mining on July 14, 2010.

Address: 1PDTDwpgRPdQaCcp3Th6zaMASgcCcm3Jcm”

Earlier this year in May, Lookonchain also found that two wallets that had seen no activity since 2013 also suddenly shifted around millions of dollars worth of BTC.

At the time, Lookonchain found that the deep-pocketed investors moved a combined $61 million worth of Bitcoin 11 years after purchasing 500 tokens for just $124 each. According to the on-chain data, the wallets printed staggering gains of nearly 50,000%.

The top crypto asset by market cap is trading for $61,630 at time of writing, a marginal increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

Source link

Altcoins

Lekker Capital CIO Spotlights Prime Opportunity

Published

2 days agoon

June 27, 2024By

admin

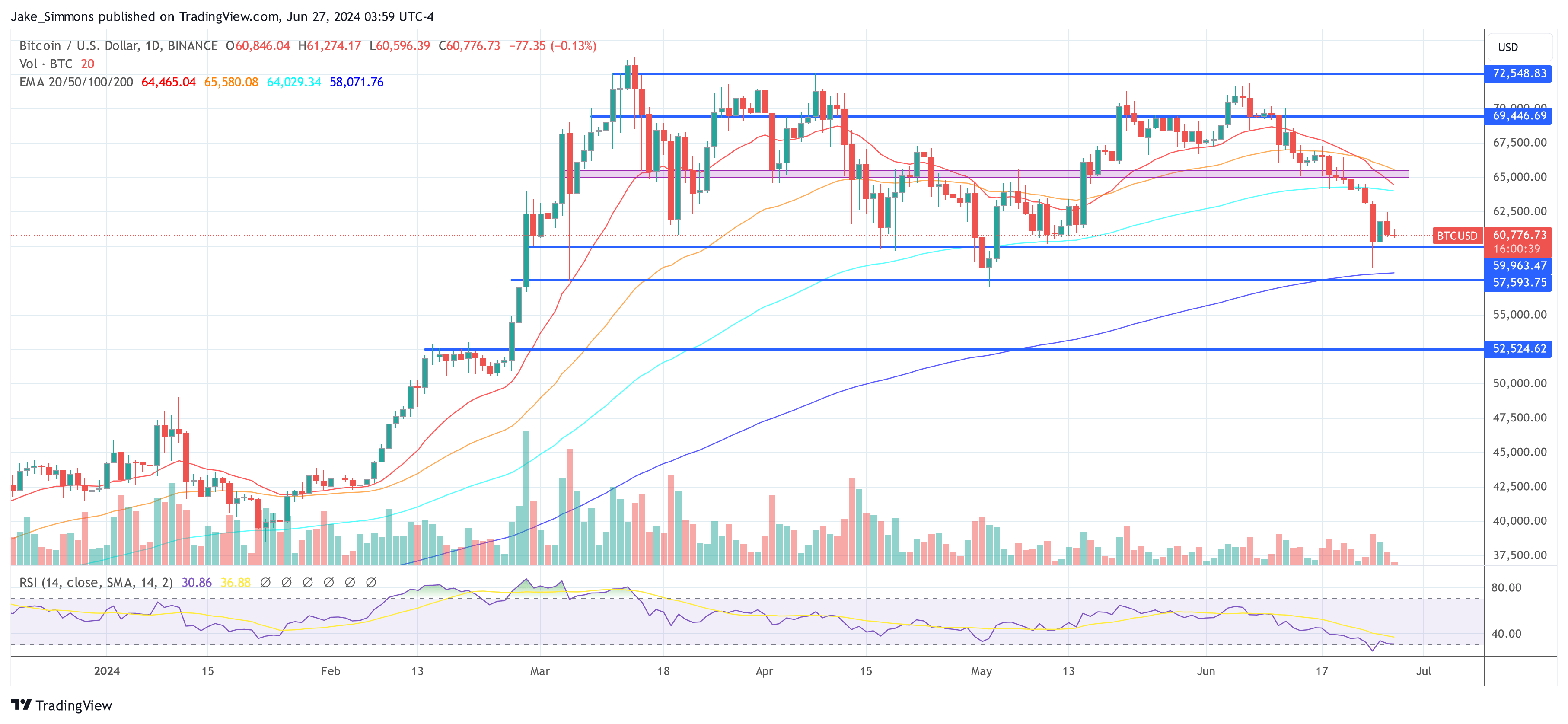

Quinn Thompson, Chief Investment Officer (CIO) at Lekker Capital, articulated a strong buy signal for cryptocurrencies amidst a landscape fraught with bearish sentiment. In a statement released through the social media platform X, Thompson described the present market conditions as “one of the most obvious and attractive crypto buying opportunities of recent memory.”

Lekker Capital, which has carved a niche in trading cryptocurrencies based on macroeconomic cues, provides an analysis that contrasts sharply with the prevailing market mood. Thompson’s commentary comes at a time when the broader crypto community appears enmeshed in pessimism. He expressed concern over the current trend where it’s become fashionable among crypto investors to adopt a bearish stance. “In all of my 5 years in crypto, I have never seen it be so ‘cool’ amongst crypto native investors as it is right now to be bearish,” Thompson noted, reflecting on the cyclical nature of market sentiments.

Related Reading

Thompson pointed to the reactive nature of the market, particularly surrounding major events like ETF launches. He revisited the aftermath of the US spot Bitcoin ETF launch, which contrary to the bullish anticipation, saw Bitcoin’s price plunge from $49,000 to $38,000, marking a steep 22% decline in just 12 days. This event, he argued, should serve as a cautionary tale about the market’s tendency to move against consensus expectations.

Addressing the most recent market dynamics, Thompson highlighted the significant impact of the sell-off that dampened the spirits of market participants, discouraging the usual strategies of buying the dip with leveraged positions. “It’s clear this most recent selloff has finally stung market participants given the lack of leveraged long dip buying,” he observed.

This scenario, according to him, sets the stage for a market correction that typically follows a pattern of initial slow recovery, stabilization, and then a rapid upward movement once a catalytic event occurs. He recalled the BTC ETF leak in October as a “buy the news” event that realigned market sentiment.

Furthermore, Thompson discussed the forward-looking nature of financial markets, emphasizing that the crypto market is no exception. He believes that the market has already adjusted to past events such as the Mt. Gox saga and Bitcoin sell-offs from the US and German governments. “The key thing to remember here is markets are forward looking. Citing the Mt. Gox or US and German government supply overhangs is old news – the market has priced this in. Fear and capitulation invokes an irrational near-sightedness,” the Lekker Capital CIO remarked.

Related Reading

Looking ahead, he underscored several macro and microeconomic developments poised to influence the market. “On the macro front, these include a November election and additional Fed liquidity. On the micro front, they are the ETH ETF, Circle IPO, and improved BTC miner profitability thanks to AI,” he explained. These factors are expected to reduce selling pressure (e.g. Bitcoin miners) and invigorate market sentiment.

Delving deeper into market technicals, Thompson pointed out that several key indicators are at cycle lows, which historically precede upward movements. He noted, “BTC and ETH CME basis, alt open interest as a percentage of total, and macro relative value all sit at cycle lows while stablecoin supply is finally growing again.” This combination of factors, according to Thompson, signals a potential market bottom forming.

In a bold closing prediction, Thompson projected significant rallies for major cryptocurrencies in the near future. “Personally, I think ETH will reach $7,000 and BTC will make its first attempt at $100,000 by the election in November,” he stated confidently.

At press time, BTC traded at $60,766.

Featured image from Shutterstock, chart from TradingView.com

Source link

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

CleanSpark’s acquisition of GRIID reiterates CLSK as a Buy

Treasury and IRS Finalize Broker Rule, Defers DeFi Decision

U.S. Treasury Issues Crypto Tax Regime For 2025, Delays Rules for Non-Custodians

Lido and Rocket Pool tokens tank after SEC sues Consensys

Consensys Responds to SEC Lawsuit Over MetaMask

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Supreme Court Decision Overturns Chevron: A Victory for Judicial Authority and Bitcoin

ADA short positions spike; experts double down on Dogecoin, Angry Pepe Fork

Crypto Airdrops To Watch Out For in July

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs