crypto

Blockchain.com strengthens leadership team to position company for sustainable growth | by Peter Smith | @blockchain | Sep, 2022

Published

2 years agoon

By

admin

As Blockchain.com looks to build on a decade of innovation within both crypto and the business, we’ve strengthened our leadership team. The business has scaled 5x over the past two years across nearly every division, function and activity. I’m excited to welcome our new leaders and recognize the outstanding work of promoted leaders as we partner to grow the company and industry.

Please join me in welcoming a new colleague and celebrating well-deserved promotions.

- Lane Kasselman, who has led the company’s 5x growth in the last two years as Chief Business Officer, has been promoted to President. A seasoned leader for brands such as AT&T, Uber, The Messina Group and high-profile political leaders, Lane now oversees corporate development, capital markets, investor relations, communications, marketing, customer success, operations, partnerships, global expansion, public policy and scaling our teams and processes at Blockchain.com. As the industry and company look optimistically towards the future, we know it’s not enough to just build revolutionary products and serve our customers. Building the future of finance requires new and disruptive approaches and Blockchain.com needs to be at the forefront of political, business and industry movements. With Lane, we are well-positioned to continue to grow our user base, advocate for pro-innovation policy, and build the future of finance.

- Dan Bookstaber has been promoted to Chief Strategy Officer and Global Head of Institutional. Previously VP of Markets, over the last 18 months Dan has led the team in developing the tools and strategies we use to scale the business with systems and technology, as well as overseeing the sales team that onboards and manages institutional clients. Leveraging his nearly 20 years of experience working at the intersection of quantitative modeling and trading for companies like Citadel, Addepar, Frontpoint Partners and AQR Capital, Dan will take the lead in unifying our institutional business across business development, technology, strategy and client management to make our offering the bar others try to meet.

- Jason Karsh has been promoted to Chief Marketing Officer. Since joining the company in 2020, Jason has worked tirelessly to make Blockchain.com one of the most recognized and trusted names in crypto. Prior to Blockchain.com, Jason supported marketing at brands like Coinbase, Bitwise, Google, and more. As we direct more resources into customer acquisition across both retail and institutional, Jason will take the lead and ensure we continue to win the hearts and minds of our customers.

- Amy Yeap has been named the company’s first Vice President of Investor Relations. Amy comes to Blockchain.com from a multi-strategy hedge fund where she led the firm’s capital markets, fundraising and investor relations programs. Through Amy’s capital raising experience, she has worked with sovereign wealth funds, institutional asset managers, pension funds, family offices, endowments and foundations. She previously worked with JPMorgan and CitiBank, and is well regarded in the international institutional investor community. Amy will take the lead in continuing to deepen our investor relationships and professionalize our IR function as the crypto market’s growth rate expands and continues to generate institutional interest.

- Tim Lubans has been promoted to Vice President and Deputy General Counsel overseeing our international regulatory expansion. After spending more than a decade at BlackRock, Tim has dedicated the last three years to Blockchain.com, previously serving as Corporate Deputy General Counsel. During his tenure, he’s played a critical role in establishing regulatory licenses across the globe and scaling our legal function.

- Valerii Babushkin has been promoted to Vice President of Data Science. With a storied career in Machine Learning, Analytics, and Software Engineering at some of the world’s leading tech companies like Meta/Facebook and Alibaba Group, Valerii has grown Blockchain.com’s Data Science function to a global team. His approach has enabled the company to base growth on data-informed actionable insights.

Source link

You may like

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Published

22 mins agoon

July 1, 2024By

admin

Bitcoin has long been a hallmark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend trading, once a notorious breeding ground for volatility, has been especially significant in the cryptocurrency landscape.

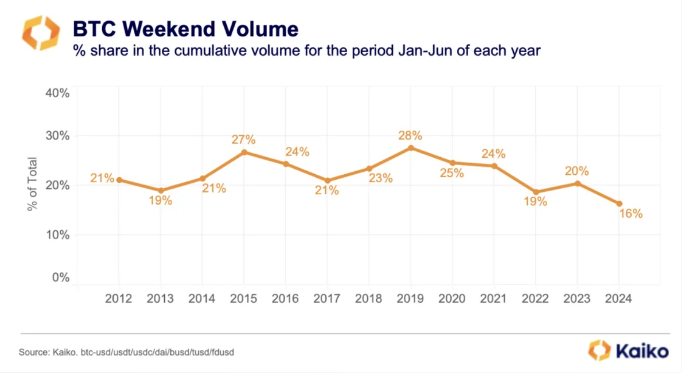

However, a recent report by Kaiko reveals a not so rosy picture – BTC weekend trading volumes have plunged to historic lows, potentially marking a new era dominated by institutional weekday warriors.

Related Reading

Bitcoin Trading Activity Takes A Nap

Kaiko’s data is straightforward: Bitcoin weekend trading activity has shrunk dramatically, dropping from a high of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the highly anticipated launch of spot Bitcoin ETFs in the US. These exchange-traded funds, mirroring the behavior of stocks, can only be traded during traditional market hours.

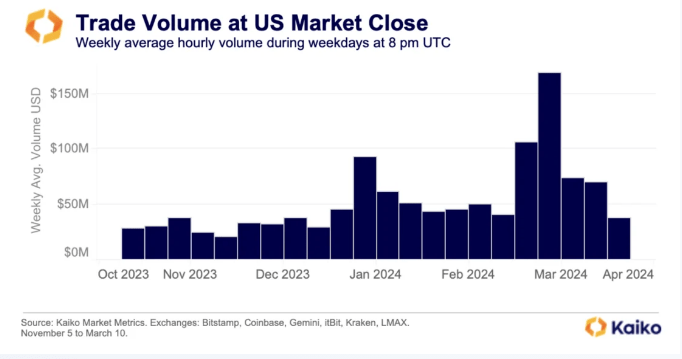

The influence of institutional investors, who tend to favor these regulated products, is evident. The report highlights a surge in Bitcoin trading activity during the “benchmark fixing window” – the final hour of US stock market trading. This suggests institutions are shaping new trading patterns, prioritizing weekdays over the once-active weekends.

Beyond Weekends: A Multifaceted Market Transformation

The decline in weekend activity isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank in March 2023 is another contributing factor. These institutions provided 24/7 infrastructure that enabled market makers to constantly place buy and sell orders. Their absence has created a void in weekend liquidity, further dampening trading activity.

However, the changing landscape isn’t all doom and gloom. The report offers a glimmer of hope for investors seeking stability. The reduced weekend volatility could make Bitcoin a more predictable asset, potentially attracting a new wave of institutional interest. Additionally, the historical trend suggests July could be a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters On The Horizon?

While the weekend trading scene may be quieting down, the coming weeks look to be somewhat turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and potentially impact Bitcoin’s dominance.

Related Reading

The Road Ahead

The dwindling weekend trading activity signifies a potential paradigm shift in the Bitcoin market. While the once-volatile weekends may become a relic of the past, the coming months promise to be eventful.

Institutional investors are now in the spotlight, shaping new trading patterns and potentially ushering in an era of greater stability. However, this month could still introduce significant volatility, keeping investors on the edge of their seats.

Featured image from Inc. Magazine, chart from TradingView

Source link

Bitcoin

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Published

16 hours agoon

June 30, 2024By

adminJune was much rougher for Bitcoin than many expected at the beginning of the month. This is because the price of Bitcoin virtually declined throughout the month, leaving many investors, especially short-term holders, disappointed.

Related Reading

However, despite the price decline, on-chain data suggests that Bitcoin adoption is growing. New data shows the number of new Bitcoin addresses being created has surged to the highest level in two months. This growth suggests the long-term prospects for Bitcoin remain strong.

New BTC Addresses Surge To 2-Month High

Despite the price slump, the network is exhibiting a promising trend that signals future growth for the world’s largest cryptocurrency. According to Glassnode chart data initially shared on social media platform X by crypto analyst Ali Martinez, new BTC wallet addresses have risen steadily over the past week to reach 352,124, their highest level since April.

Interestingly, the chart shows that the recent uptick in new addresses contrasts with a larger decrease in the creation of new addresses since November 2023. This new increase points to an influx of new users entering the crypto space. As more people adopt Bitcoin, demand will inevitably grow, which is a catalyst for price surges down the line.

Furthermore, Martinez suggested that the uptick in new addresses is from retail investors making a comeback. While institutional investors often drive major market moves, retail interest is crucial for Bitcoin’s mainstream adoption.

Retail #Bitcoin investors are making a comeback! The number of new $BTC addresses on the network surged to 352,124, marking the highest level since April. pic.twitter.com/GFOHnsokz0

— Ali (@ali_charts) June 29, 2024

A major part of the increase in new addresses can be attributed to recent adoption in the Brazilian market. Nubank, Brazil’s biggest neobank, recently announced plans to integrate Bitcoin’s lightning network into its services. As the largest fintech bank in Latin America, this integration could potentially expose a significant portion of its 100 million customers to the digital asset.

What’s Next For Bitcoin?

At the time of writing, Bitcoin was trading at $61,446. The leading digital asset has lost over 10% of its market cap in a 30-day time frame and the bulls are struggling to break above $61,000. This downtrend could be attributed to a selloff by miners and many long-term holders. Specifically, around 40,000 BTC were sold by long-term holders in June.

Bear markets are temporary. Bull runs will return. It’s just a matter of when, not if. With the second half of the year now approaching, time can only tell how the price of Bitcoin unfolds. Of course, new wallet addresses don’t directly impact price, but they are a leading indicator of growing Bitcoin adoption.

Related Reading

This adoption and demand, coupled with a recent decrease in the number of new Bitcoins entering the market, points to an increase in the price of Bitcoin in July.

Featured image from CNBC, chart from TradingView

Source link

21shares

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Published

3 days agoon

June 28, 2024By

admin

In a significant development for the cryptocurrency industry, investment firm 21Shares filed an S-1 registration form for a Spot Solana ETF with the US Securities and Exchange Commission (SEC) on Friday.

The 21Shares application follows a similar filing by Bitcoin ETF issuer and asset manager VanEck on Thursday, indicating a growing interest in Solana as a potential competitor to the anticipated Ethereum ETF market, which is expected to begin trading in July.

21Shares Introduces Core Solana ETF

The 21Shares Core Solana ETF, as described in the filing, is designed to issue common shares of beneficial interest that trade on the Cboe BZX Exchange.

Its investment objective is to track the performance of SOL, providing investors with a convenient and cost-effective method to gain exposure to SOL without making a direct investment in the asset. Based on the index, the ETF will hold SOL and value its shares daily.

The Trust will be sponsored by 21Shares, with CSC Delaware Trust Company acting as the trustee. Coinbase Custody Trust Company will serve as the SOL custodian, holding all of the Trust’s SOL on its behalf.

SOL Price Consolidates After Initial ETF Announcement

While the SEC’s approval of a Solana ETF is subject to regulatory review and compliance, these filings demonstrate the increasing demand for investment products that expose Solana’s digital assets.

If approved, the ETFs would provide investors with a regulated and accessible way to participate in Solana’s potential growth and performance.

Notably, this could be the start of new filings with the SEC by the world’s largest asset managers, as has already been the case with Bitcoin and Ethereum ETFs.

Nonetheless, SOL has not had the same reaction as it did on Thursday with VanEck’s announcement of its Solana ETF filing, which sent SOL’s price to a 9% price recovery towards $150 after a dip to $121 earlier in the week. Now SOL is trading at $142 due to a 4% price correction experienced over the past 24 hours.

Featured image from DALL-E, chart from TradingView.com

Source link

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs