Altcoins

BLUR Rules Today’s Top 100 Crypto Ranking With 88% Rally

Published

7 months agoon

By

admin

The news of BLUR, which saw an impressive 88% increase in price in the last week, has the cryptocurrency industry buzzing. This abrupt increase in value is directly related to what happened after the Season 2 airdrop. Coincidentally, the price spike also occurred following news of Binance CEO Changpeng Zhao’s resignation.

The cryptocurrency market saw a consecutive two-day period of downward trading activity subsequent to the disclosure of legal accusations against Zhao. Today, it seemed to have changed course and exhibited a favorable trend, with a notable increase of over 2.5% in value within the past 24 hours.

Blur trading at $0.626. Source: Coingecko

BLUR On A Tear: 200% Price Boost

In the 42 days since clearing a long-term descending resistance trend line, the price of BLUR has surged by more than 200%. The market movement indicates a positive outlook, despite the daily timeframe Relative Strength Index (RSI) providing a bearish reading.

Market analysts have reported a significant surge in purchasing activity, wherein a total of 51.3 million BLUR tokens were acquired by 19 entities. This acquisition amounts to a remarkable investment of $21 million in the aforementioned commodity.

BLUR is pumping after the Season 2 #airdrop!

19 addresses bought a total of 51.3M $BLUR($21M) after the Season 2 #airdrop. pic.twitter.com/hvgByltM5I

— Lookonchain (@lookonchain) November 22, 2023

BLUR’s recent price surge followed a consolidation phase, indicating market indecision as its value consistently traded below a critical resistance level. The subsequent airdrop triggered a substantial increase in token ownership, particularly among major stakeholders, signaling a surge in bullish sentiment and highlighting positive prospects for BLUR’s long-term potential.

New Yearly High Still In The Cards

Notably, experienced investors, possibly foreseeing enduring value, have actively engaged in sizeable BLUR positions, emphasizing a deliberate and informed move in response to the cryptocurrency’s potential.

The charts tell a tale of cautious optimism evolving into confidence in BLUR’s future. The consolidation phase hinted at a market awaiting direction, and the subsequent increase in token volume, especially post-airdrop, indicates a shift toward positivity.

BLURUSD trading at $0.620 on the 24-hour chart: TradingView.com

Though there has been a noticeable rising trend, BLUR has not yet hit a new annual high. Since February, BLUR has been trading below a trend line of declining resistance. The decline reached a low on August 17 at $0.15.

After that, the price started to rise, reaching a higher low on October 12. It emerged from the trend line of downward resistance after five days. The trend line had been in place for 245 days at that point.

As more investors became aware of the increase in activity, they might have joined the buying momentum that followed the airdrop. This kind of movement is common in the cryptocurrency space, where important transactions and news can cause asset values to fluctuate quickly.

Keeping A Close Tab On The Crypto

Even after substantial increases, BLUR is still warranting caution in this area. Waiting for confirmation of the bullish crossover could increase the risk-reward scenario for fresh long positions on a recovery off critical support zones, thus letting the RSI reset could be a good strategy.

Blur seven-day price action. Source: Coingecko

It will be very important to keep an eye on the important support level that is right now where the rise started. If the price of BLUR stays above this support, it could mean that the market has adjusted to the effects of the airdrop and is now setting a new price floor.

But if this level doesn’t hold, the price might go back down to the next important support zone. This could be a good chance for people who missed the first wave to buy again.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pexels

Source link

You may like

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

Altcoins

20% Price Drop Follows $87 Million Spending Outrage

Published

8 hours agoon

July 5, 2024By

admin

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

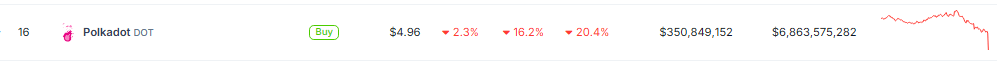

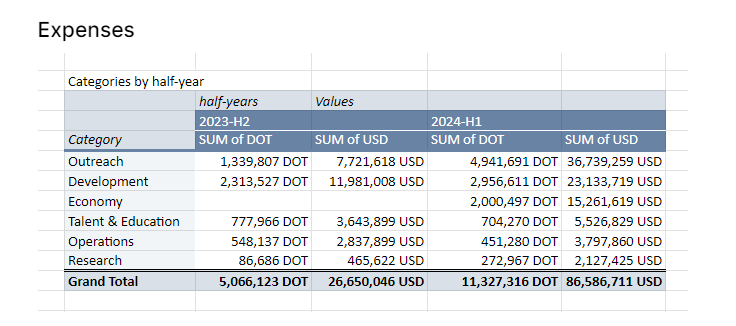

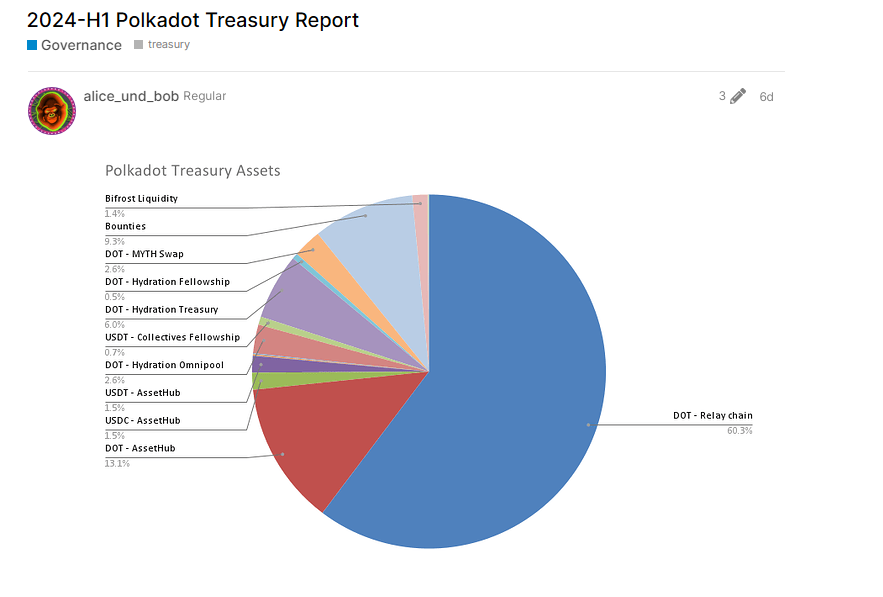

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Published

12 hours agoon

July 5, 2024By

admin

A closely followed crypto strategist and trader is revealing his price targets for Bitcoin (BTC) and two altcoin projects.

In a new strategy session, analyst Jason Pizzino tells his 329,000 YouTube subscribers that based on the average true range (ATR) indicator Bitcoin could soon break through key price target resistance levels.

The ATR indicator measures volatility by showing an asset’s trading range over a specified period.

“You can see the dying off here of the average true range of the bar. Previous cycles, look what happened. Average true range picks up, dies off, dies off, dies off, and then you start to get a higher low form and by that stage, you’re really a decent way from the stealth zone.”

According to the analyst, Bitcoin has historically made “stealth moves” to the upside when the ATR indicator reaches a local low and price continues to consolidate or puts in higher lows.

The analyst’s key price targets to the upside include $63,300 on the daily chart, $65,200 on the weekly chart and $72,000 on the monthly chart.

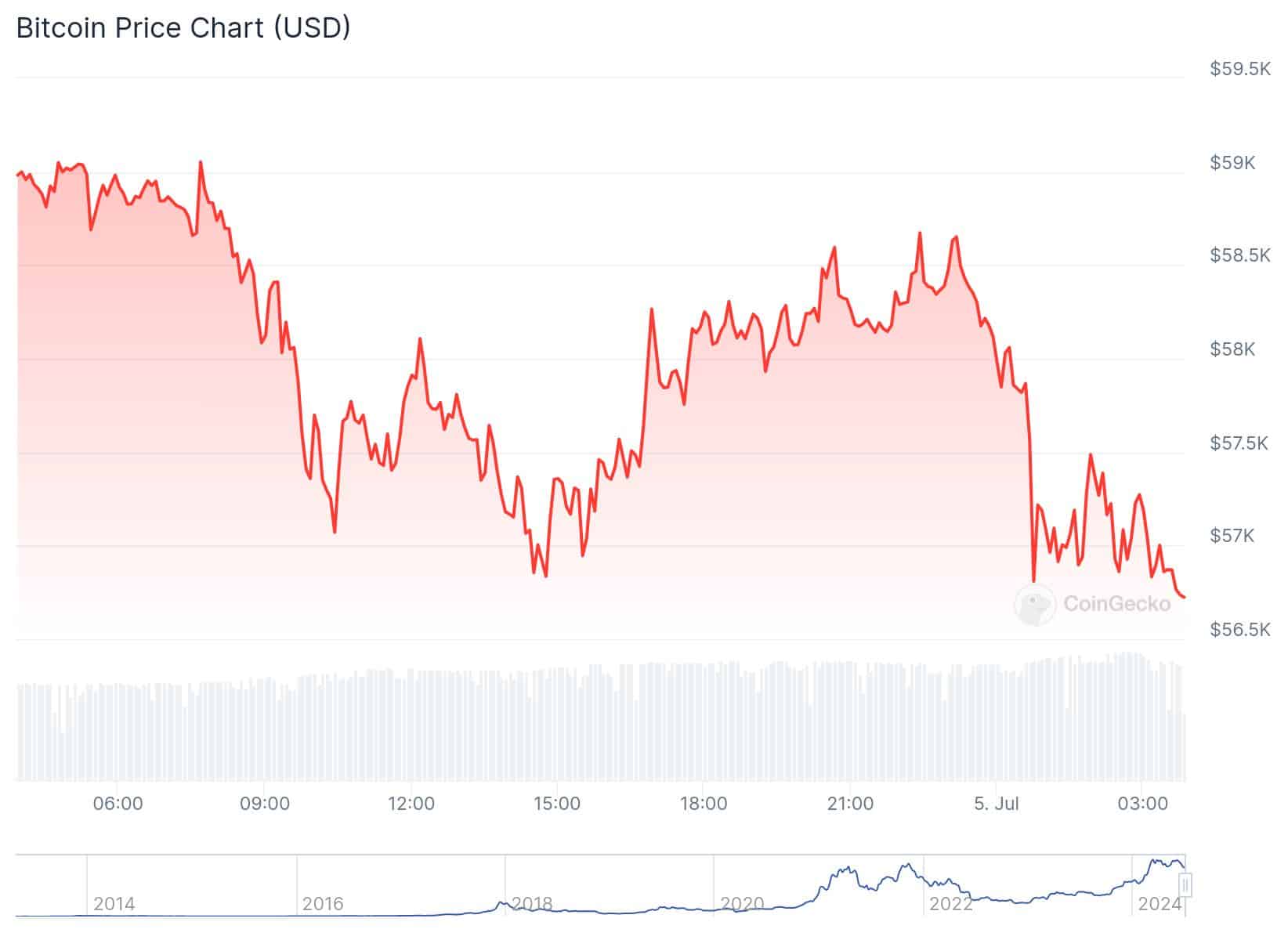

Bitcoin is trading for $60,176 at time of writing, down nearly 3% in the last 24 hours.

Next up, the analyst believes that Ethereum (ETH) competitor Solana (SOL) will move toward its current cycle top.

“With the higher lows and now trying to push higher above the 50% at $137. Next target on the weekly chart is $165. And then we go towards $190, $210. So $190 is above these tops. Then $210 is the current top for Solana. So it’s on its way. It hasn’t got those longer-term time frames confirmed yet, and those longer terms are the weeklies.”

Solana is trading for $141 at time of writing, down more than 8% in the last 24 hours.

Lastly, the analyst predicts that Render (RNDR), the graphics processing unit (GPU) rendering blockchain, will reclaim a double-digit value.

“Now, what do we need to see until it gets there? Obviously higher lows, and that would happen throughout this next couple of months, maybe even up to four months as we get to that [US presidential] election… If I keep seeing higher lows, it’s not going to stop me from getting into the market if it breaks out through that period.”

Render is trading for $7.04 at time of writing, down 7.7% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Published

16 hours agoon

July 5, 2024By

admin

Ethereum and other altcoins have tumbled to lows not recorded in several weeks. This bearish outlook was also recorded in Bitcoin (BTC) and other decentralized finance (DeFi) tokens. Ethereum price has taken steps back wiping out previously recorded gains this week. A major reason for the market decline is a fall in sentiments with many pointing to major market corrections.

The total crypto market fell to $2.11 trillion, a 4.8% decline in the last 24 hours. Meanwhile, several altcoins notched wider losses today deepening the negative sentiments. The drop in the ETH price also coincides with lower on-chain numbers and a transfer of assets to centralized exchanges which signals potential sales.

Ethereum Price Nears $3K

This year, Ethereum and other crypto assets surged to new highs amid the approval of spot Bitcoin ETFs in the United States. Despite the previous price gains and institutional inflows, massive sell-offs recorded in recent times have deepened sentiments. Ethereum trades at $3,075, a 7% drop in the last 24 hours. Weekly losses pierced double digits at 11% while monthly figures topped 19% in the red zone.

These outflows have sparked similar numbers in other altcoins. ETH’s market cap tanked to $367 billion while daily trading volume is over $20 billion. This year came with projections of sustained growth above $4k but plummeting price now sees ETH moving near $3k. The drop in crypto assets might force prices lower although many holders believe a rebound might be on the cards.

Altcoins Are Sinking

Like most commentators opine, Ethereum price can surge with positive mainstream factors. The listing of ETH ETFs can lead to a jump in the asset’s price. The recent slump has also affected altcoin prices with Solana trading below $130 and $126 and Ripple plunging over 8% in the last 24 hours. Toncoin and Cardano were also down today with larger numbers posted by meme coins.

Also Read: End of The Road for Meme Coins? Dogecoin Takes Heavy Losses

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: