Circle

Circle Awarded Europe’s First Stablecoin License Under New MiCA Crypto Rules

Published

4 days agoon

By

admin

Cryptocurrency firm Circle has achieved a significant milestone by securing registration as an electronic money institution (EMI) in France. This move grants Circle a crucial license to operate as a compliant stablecoin issuer under the European Union’s rigorous crypto laws.

Circle Breakthrough

According to a CNBC report, the approved license positions Circle as the first global stablecoin issuer to achieve compliance with the European Union’s regulatory framework known as Markets in Crypto-Assets (MiCA).

This framework, considered a cornerstone in the EU’s approach to governing cryptocurrencies, sets out comprehensive rules and obligations for crypto companies to ensure investor protection and safeguard against market manipulation.

Related Reading

Circle’s acceptance into the MiCA regulatory framework means that both its USDC and Euro Coin (EURC) tokens can now be issued within the European Union while meeting the stablecoin regulatory obligations outlined by MiCA.

Additionally, Circle is opening up its Circle Mint service, enabling businesses to mint and redeem Circle stablecoins, to customers in France.

Expressing his satisfaction with the achievement, Jeremy Allaire, co-founder and CEO of Circle, emphasized the company’s longstanding commitment to building compliant and well-regulated infrastructure for stablecoins. He stated:

Our adherence to MiCA, which represents one of the most comprehensive crypto regulatory regimes in the world, is a huge milestone in bringing digital currency into mainstream scale and acceptance.

European Stablecoin Adoption

The EU’s MiCA law, which officially came into effect in May 2023, introduced the world’s first comprehensive regulatory framework for cryptocurrency operations.

Last week, provisions specifically governing stablecoins were approved, imposing stringent measures on trading volume limitations for certain stablecoins, particularly those denominated in US dollars.

As a registered EMI in France, Circle can now extend its services, including the minting and redemption of USDC through Circle Mint, not only to customers in France but also to individuals and businesses across the European Union.

This is made possible by the concept of “passporting” outlined in MiCA, which allows crypto businesses to offer services in one EU country and expand into other markets within the bloc.

Related Reading

While Circle’s achievement is commendable, it should be noted that additional obligations under MiCA about crypto asset service providers will become applicable by December 30, 2024. Crypto companies will then have until July 2026 to ensure full compliance with MiCA’s requirements.

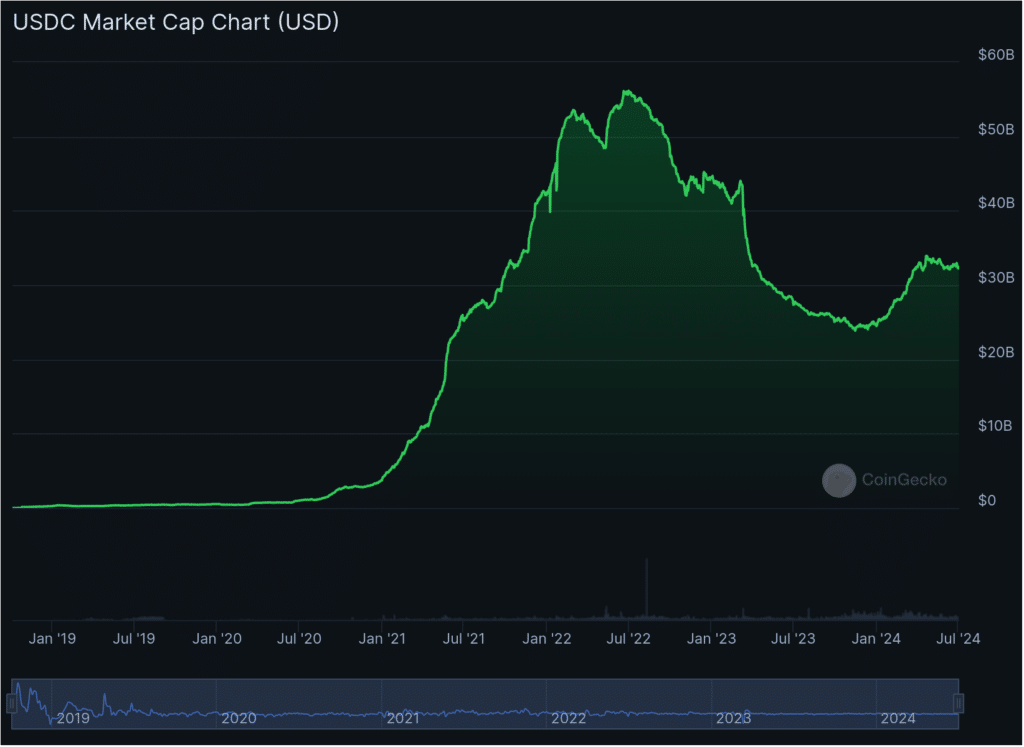

Since its launch in September 2018 by Circle and crypto exchange Coinbase, USDC has gained significant traction and now holds the position of the second-largest stablecoin globally.

According to CoinGecko data, USDC’s circulation amounts to $32.4 billion, trailing only Tether’s USDT, which holds the title of the world’s largest stablecoin with a circulation of $112.7 billion.

Featured image from Shutterstock, chart from TradingView.com

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

Circle

Circle wins Europe’s first stablecoin license via MiCA

Published

4 days agoon

July 1, 2024By

admin

Circle has authorization to market its USDC stablecoin services across Europe under the bloc’s MiCA laws.

Stablecoin issuer Circle is the first stablecoin company to achieve compliance with the European Union’s (EU) Markets in Crypto Asset (MiCA) policies designed to oversee digital asset business operations.

Having obtained an Electronic Money Institution (EMI) license from French regulators, CEO Jeremy Allaire said Circle Mint France will manage EURC and USDC issuance for European users.

BREAKING NEWS: @Circle announces that USDC and EURC are now available under new EU stablecoin laws; Circle is the first global stablecoin issuer to be compliant with MiCA. Circle is now natively issuing both USDC and EURC to European customers effective July 1st.

Details… pic.twitter.com/isNBumoi3e

— Jeremy Allaire – jda.eth (@jerallaire) July 1, 2024

Stablecoins offer an avenue to trade in and out of cryptocurrencies without suffering from the volatility associated with most digital assets, such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Assets like Tether’s USDT and USDC are pegged to a sovereign currency, like the U.S. dollar or the euro.

The development dispelled previous uncertainty surrounding stablecoins in the EU, as MiCA promised to install strict rules on how these assets may be used. For instance, under the bloc’s framework, firms have a daily issuance limit of $215 million in transaction value.

Is Circle positioned to upend Tether?

Circle’s EMI license and MiCA compliance could prove strategic in claiming European market change and even challenging crypto’s largest stablecoin issuer, Tether.

Speculation circulated about Tether’s European future after some platforms, like Bitstamp, delisted the firm’s euro-denominated offering, Tether EURT. Uphold also shuttered support for USDT and several other dollar-pegged stabelcoins.

With a vacuum emerging and Circle claiming the first MiCA stablecoin license, Allaire and his company could flip Tether and USDT as the dominant stablecoin in multiple jurisdictions. The USDC issuer plans to redomicile its legal base from Ireland to the U.S. before an initial public offering (IPO). Looming U.S. stablecoin regulations might further solidify the company as a global stablecoin powerhouse.

Still, USDC has an uphill road before catching up to Tether in market cap. USDT holds the number one spot with $113 billion to USDC’s $32 billion. At press time, USDC is below its June 2022 peak of around $55 billion.

Source link

Altcoins

Stablecoins Remain Blockchain and Crypto’s ‘Killer App’ Amid Tech Advancements, Says Circle CEO Jeremy Allaire

Published

6 months agoon

January 17, 2024By

admin

Circle chief executive Jeremy Allaire thinks additional regulatory clarity will pave the way for increased stablecoin adoption in 2024.

In a new interview with CNBC International TV, Allaire predicts that the recent approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) in the US will act as “the tide that lifts all boats” in the crypto sector.

The Circle CEO notes stablecoins remained resilient throughout the crypto space’s turbulence over the past few years.

“What I can say about stablecoins and what we’ve seen in the market is really a lot of people were paying attention to a lot of the scandals in this industry, and failures and bankruptcies, but at the same time, we were seeing tremendous progress being made in continued technology development.

And this is a little bit like after the dot com boom and bust – people ignored consumer internet e-commerce, but actually the technology continued to develop, and so we saw that happen last year, and we’ve seen stablecoins in particular remain the killer app of blockchain technology and start to see widening usage all around the world.”

Circle issues USDC, the second-largest stablecoin by market cap. Last week, the company announced that it submitted a draft registration statement to the U.S. Securities and Exchange Commission (SEC) related to a proposed initial public offering (IPO) of its equity securities.

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

USDC Issuer Circle Submits Preliminary Documents to the SEC in Preparation for a Proposed IPO in the US

Published

6 months agoon

January 12, 2024By

admin

USDC issuer Circle wants to become a publicly traded company in the US.

The stablecoin company says in a new announcement that it submitted a draft registration statement to the Securities and Exchange Commission (SEC) related to a proposed initial public offering (IPO) of its equity securities.

Circle notes that it has not determined the number of shares it plans to offer or the price range for those shares. The company says the IPO is expected to happen after the SEC completes its review process.

USDC, the second-largest stablecoin by market cap, aims to maintain a 1:1 peg with the US dollar. The digital asset completed a new upgrade on Thursday that is designed to reduce gas costs, improve support for account abstraction, and bolster security for transactions on Ethereum Virtual Machine (EVM) blockchains.

Circle and Coinbase co-created USDC in 2018 and jointly managed the asset through the Centre Consortium until last year.

In August, Circle CEO Jeremy Allaire announced that his company would bring all of USDC’s governance and operations responsibilities in-house to streamline management of the stablecoin.

Coinbase said at the time that it would purchase an equity stake in Circle. The top US crypto exchange became a public company in April 2021.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs