Altcoins

Circle Launches New ‘Bridged USDC Standard’ To Reduce Fragmentation Across Chains

Published

8 months agoon

By

admin

The firm behind the second-largest dollar-pegged crypto asset by market cap is launching a new token standard for their stablecoin.

According to a new announcement, Circle is introducing the Bridged USDC Standard, a new standard and process for deploying a bridged form of USDC on Ethereum Virtual Machine (EVM) blockchains.

Circle says that the bridged USDC standard is permissionless, equitable, standardized, extensible, secure, and audited.

“Here’s how it works:

- Third-party team follows the standard to deploy their bridged USDC token contract.

- Bridged USDC is used to bootstrap initial liquidity in the ecosystem and begins to proliferate.

- Bridged USDC reaches a significant supply, amount of holders, and number of app integrations.

- Circle and third-party team jointly elect to securely transfer ownership of the bridged USDC token contract to Circle.

- Upon obtaining ownership, Circle upgrades bridged USDC to native USDC and seamlessly retains existing supply, holders, and app integrations.”

Circle also says that the new token standard for USDC will result in a less fragmented user experience, and can make the stablecoin compatible with multiple blockchains via the Cross-Chain Transfer Protocol (CCTP).

The announcement says the Bridged USDC Standard is already live on Linea and Scroll testnets and mainnets. Circle will expand the standard to support modular EVM architectures and simplify the deployment of new blockchains with a pre-set bridged USDC token contract compatible by default.

The firm aims for the Bridged USDC Standard to be a big step forward in USDC’s evolution and will boost its adoption in the blockchain ecosystem.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Altcoins

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Published

5 hours agoon

July 8, 2024By

admin

Justin Sun has announced that developers are now working on a stablecoin transfer solution that can function without gas fees on the TRON (TRX) network.

The crypto billionaire says the new service is set to roll out later this year, initially on TRON before expanding to Ethereum (ETH) and other EVM-compatible chains.

“Our team is developing a new solution that enables gas-free stablecoin transfers. In other words, transfers can be made without paying any gas tokens, with the fees being entirely covered by the stablecoins themselves.

This innovation will first be implemented on the Tron blockchain and later support Ethereum and all EVM-compatible public chains.

We anticipate launching this service in Q4 of this year. I believe that similar services will greatly facilitate large companies in deploying stablecoin services on the blockchain, elevating blockchain mass adoption to a new level.”

At time of writing, it’s unclear how the new service will be able to operate without gas fees.

Last month, market intelligence firm Lookonchain reported that the 24-hour trading volume of Tether’s USDT on TRON stood at $53 billion while payment giant Visa’s was only at $42 billion.

“The 24-hour trading volume of USDT on TRON Network is $53 billion, exceeding Visa’s average daily trading volume. Visa’s trading volume in Q1 2024 was $3.78 trillion and the average daily trading volume was $42 billion.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Is Dogwifhat (WIF) Out? Price Tanks 15% On Whale Exodus

Published

2 days agoon

July 6, 2024By

admin

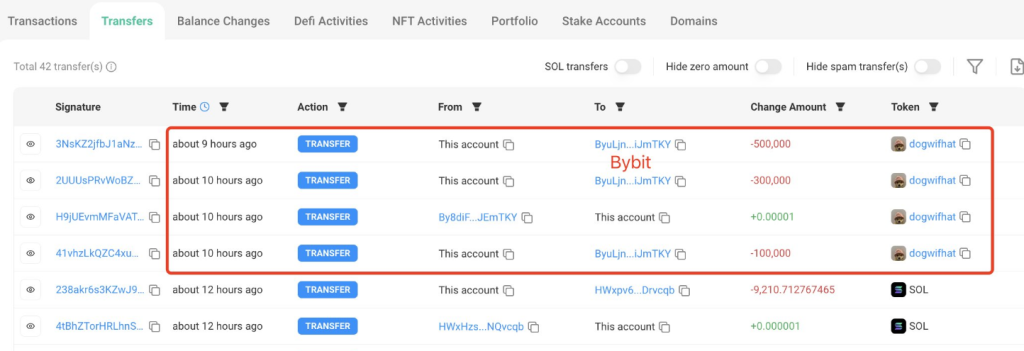

Dogwifhat, the once-high-flying Solana-based meme coin, suffered a brutal week, mirroring a broader crypto market correction and raising questions about the sustainability of the meme coin craze.

Related Reading

Meme Coin Mania Meets Market Mayhem

WIF, the token powering Dogwifhat, saw its price plummet 15% in just 24 hours. This dramatic drop erased all the gains from a recent rebound rally. The sell-off wasn’t isolated to Dogwifhat; the entire crypto market experienced a double-digit tumble, with major altcoins like Ethereum and Cardano feeling the heat.

Analysts point to a combination of factors behind the downturn, including renewed concerns about inflation and a recent sell-off by the German government and Mt. Gox, a defunct cryptocurrency exchange.

The price of $WIF dropped 15% as the market fell.

A whale deposited 900K $WIF($1.64M) to #Bybit 10 hours ago, leaving 974K $WIF($1.76M).https://t.co/qJwlxcWy15 pic.twitter.com/amIkvwKfNG

— Lookonchain (@lookonchain) July 4, 2024

The pain for Dogwifhat was further amplified by a whale of a different kind: a large investor. LookOnChain, a blockchain whale tracking agency, identified a major Solana whale dumping 900,000 WIF tokens in a series of transactions. This fire sale, amounting to roughly $1.64 million, undoubtedly contributed to the downward spiral.

Dogfight On Derivatives: Bulls Trampled, Bears Feast

While the Spot market witnessed a bloodbath, the WIF derivatives market displayed a curious mix of activity. Trading volume surged by a surprising 25%, propelling Dogwifhat to the coveted title of third most-demanded meme coin behind Dogecoin and Pepe Token. This surge in volume might suggest increased interest, but a closer look reveals a different story.

Lurking beneath the surface was a brutal battle between bullish and bearish investors. More than $3 million in WIF positions were liquidated in the last 24 hours. This liquidation primarily targeted long positions, meaning investors who bet on the price going up were forced to sell at a loss as the price plummeted.

While some might see the increased volume as a sign of potential revival, the liquidation figures paint a starker picture – many bulls got trampled by the bears feasting on the market downturn.

A Buying Opportunity Or A Boneheaded Move?

Despite the carnage, not everyone has lost faith in Dogwifhat. The plummeting price has attracted some opportunistic “Solana whales” who view the current price as an attractive entry point. This glimmer of hope hinges on the possibility that Dogwifhat can recapture its past glory.

Related Reading

In Q1 2024, Dogwifhat was a meme coin darling, riding the wave of the meme coin craze to a $4 billion market cap and a place in the top 30 global crypto rankings. However, the recent downturn serves as a stark reminder of the inherent volatility of meme coins, which often lack the utility or strong fundamentals of established cryptocurrencies.

The future of Dogwifhat remains uncertain. Whether it can claw its way back from the doghouse or fade into obscurity depends on several factors, including broader market trends, community support, and potential developments within the Dogwifhat ecosystem.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

Solana-Based Memecoin Defies Market Downturn, Jumps Over 30% in 24 Hours Amid Listing on Multiple Exchanges

Published

3 days agoon

July 5, 2024By

admin

One Solana-based (SOL) meme asset is defying market doldrums and rallying after being listed on numerous crypto exchange platforms.

New data reveals that Billy (BILLY), a dog-themed memecoin built over Solana, has jumped over 30% during the last 24 hours after multiple crypto exchange platforms added support for it.

The crypto exchange platforms that listed Billy include Bittrue, Bitget, MEXC, and Gate.io, who all announced support for the meme asset earlier this week.

Billy is trading for $0.1659 at time of writing, a 36% gain during the last day. On June 26th, Billy was moving for just $0.0286.

Billy, which was launched earlier this year in June and features a picture of a puppy, is outpacing other prominent meme assets during the market’s current consolidation period, which has caused sharp decreases across the board.

Other dog-theme assets, such as dogwifhat (WIF), Shiba Inu (SHIB), Bonk (BONK), and Dogecoin (DOGE), are trading for $1.91, $0.000014, $0.000023, and $0.1046 at time of writing, respectively.

However, DOGE, WIF, SHIB, and BONK are all down between 30-40% during the last month while BILLY is up a staggering 150% during the same time frame.

According to data from blockchain tracker Dexscreener, Billy’s market cap is sitting at $161 million at time of writing while its 24-hour volume is at $24.6 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Quardia/Sensvector

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs