Bitcoin

Coin Cafe will reimburse investors for $4.3M in fees that “wiped out” their Bitcoin accounts.

Published

1 year agoon

By

admin

According to the complaint, the platform was charging investors “exorbitant and undisclosed fees,” with one user being charged $51,000 in recurring costs over the course of 13 months.

Coin Cafe, a cryptocurrency trading platform, was forced to pay back $4.3 million to its users after it was claimed that it had charged “exorbitant and undisclosed fees” for keeping Bitcoin, which caused some accounts to be completely depleted of their cash.

Brooklyn-based Coin Cafe submitted its original application to the New York State Department of Financial Services for a virtual currency license in July 2015, but it wasn’t accepted until January of this year.

It was permitted to operate during the seven and a half year application process, despite being marked as placing “investors at risk” due to its failure to comply with the requirement that all New York broker-dealers register with the Office of the Attorney General for New York.

On May 18, it was discovered that the exchange had been charging customers “exorbitant” fees for storing Bitcoin without properly disclosing this to them. As a result, some customers’ accounts were completely wiped out, according to Letitia James, attorney general of New York State.

James claimed in a statement that Coin Cafe cheated “hundreds of New Yorkers” out of thousands of dollars by regularly levying and raising “fees without properly informing investors.”

One New York investor paid more than $10,000 in fees in a single month, while another was charged costs totaling $51,000 over the course of 13 months. It was observed:

Despite advertising its wallet storage as “free” on its website, the corporation was charging investors exorbitant and secret fees to utilize it.

According to the inquiry conducted by the Office of the Attorney General (OAG), Coin Cafe modified the fee structure four times since September 2020 without “clearly informing investors of the increase.”

When investors started being paid a fee for inactivity in October 2022, this was the “most drastic fee structure change” that had ever taken place. It read:

“If an investor did not buy, sell, or transfer Bitcoin on the Coin Cafe site within 30 days, it charged investors the greater of 7.99 percent of the account or $99 worth of Bitcoin per month.”

In addition to criticizing the “deceptive marketing” involved, James cited the “lack of effective regulation” as a contributing cause.

This is yet another illustration of the necessity for tighter regulation of the bitcoin market, James said.

According to a settlement, Coin Cafe must reimburse all fees to investors in the United States who ask for a refund within the following 12 months.

The site must also inform all US-based users via email by May 23 if they qualify for a refund.

By the time this article was published, Cointelegraph had contacted Coin Cafe for a reaction, but had not heard back.

The post Coin Cafe will reimburse investors for $4.3M in fees that “wiped out” their Bitcoin accounts. first appeared on BTC Wires.

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Bitcoin

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Published

2 hours agoon

July 8, 2024By

admin

Recent data shows that the Bitcoin mining difficulty is on the decline and has hit its lowest since May. This is significant considering what this could mean for the Bitcoin ecosystem, specifically Bitcoin’s price.

Bitcoin Mining Difficulty Drops To 79.5 T

Data from CoinWarz shows that Bitcoin mining difficulty has dropped to 79.5 T at block 851,204 and hasn’t changed in the last 24 hours. This mining difficulty has continued to fall for a while, with further data from CoinWarz showing that it is down 5% in the last seven and 30 days.

Bitcoin mining difficulty refers to how hard it is for miners to mine a new block on the Bitcoin network. The difficulty usually reduces when there is less computational power on the power and increases when miners are mining faster than the block average time of ten minutes. The recent drop in mining difficulty suggests that more miners are leaving the Bitcoin network.

This is most likely due to the effects of the Bitcoin halving, which cut miners’ rewards in half. This has reduced the revenue from their mining operations, with many miners struggling to stay afloat, especially with increased competition. Bitcoin’s price action since the halving has also not helped, as the drop in the flagship crypto’s price has also affected their income.

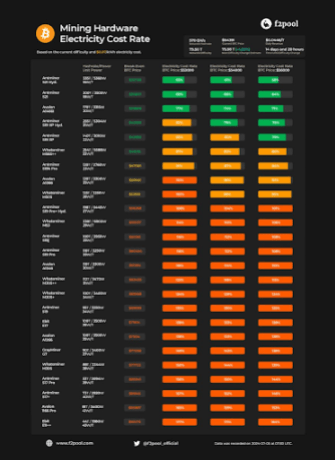

Bitcoin miner f2pool recently highlighted the profitability of various categories of miners at Bitcoin’s current price. The mining firm noted that only ASICs with a Unit Power of 26 W/T or less can make a profit at Bitcoin’s current price range.

Crypto analyst James Van Straten also recently highlighted how “weak and inefficient miners” continue to be purged from the Bitcoin network. He claimed that the recent drop in mining difficulty shows that miner capitulation is closer to ending. Due to the low profitability that miners have faced since the halving, some have had to offload a significant amount of their Bitcoin reserves to meet operational costs, and others have had to exit the Bitcoin ecosystem entirely.

What This Means For Bitcoin’s Price

The decline in mining difficulty suggests that miner capitulation might be ending soon, which is a positive for Bitcoin’s price considering the selling pressure these miners have put on it. Bitcoinist reported that Bitcoin miners sold over 30,000 BTC ($2 billion) last month, which ultimately caused the flagship crypto to experience significant price crashes.

Crypto expert Willy Woo also attributed Bitcoin’s tepid price action to these miners and mentioned that the flagship crypto will only recover when the “weak miners die and hash rate recovers.” He stated that Bitcoin would have to shed weak hands for this to happen, with inefficient miners going into bankruptcy while other mines are forced to buy more efficient hardware.

Source link

24/7 Cryptocurrency News

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

Published

3 hours agoon

July 8, 2024By

adminThe price of Bitcoin (BTC)e is yet to wriggle off from its bearish sentiment. It has doubled down on its selloffs from the past week.

BTC Trading Volume Records 94% Surge

At the time of this writing, Bitcoin was trading at $55,677.54 with a 2.34% drop in the last 24 hours. This has been the trend with the cryptocurrency in the last few weeks.

Markedly, this downtrend has been since the German government began to transfer Bitcoin to cryptocurrency exchanges, in addition to Mt.Gox repayment of its customers. The frequent offloads are an indication that Bitcoin investors including wallets that have stayed dormant for several years, are beginning to exit their positions, both short and long.

On the flip side, Bitcoin trading volume is moving upward. According to CoinMarketCap, Bitcoin’s trading volume has shot up by approximately 94.66% within the last 24 hours. Currently, BTC has hit a trading volume of $38,838,830,710. This suggests that investors are still showing interest in the coin amidst a broad market downturn. It reflects the change in market dynamics on the upside. This suggest that the market may be heading towards a bullish sentiment and probably hit a new all-time-high (ATH) as earlier projected.

For now, the selling pressure is still mounting. According to QCP Capital analysts, Bitcoin prices are continuing “to chop violently on very thin liquidity.”

Bitcoin Liquidation Continues With Mt.Gox And the German Government

More Bitcoin are still leaving the German government wallet, triggering more selling pressure. In the early hours of Monday, the German government dumped BTC to crypto market maker Cumberland DRW and Flow Traders, including crypto exchanges Coinbase, Bitstamp, and Kraken and other wallet addresses. This time around, almost 5,000 BTC were sent out by the German government.

The transfer to Cumberland DRW was made in two transactions. Markedly, the first one was a transfer of 0.001, likely a test transfer to follow with large transfers in the future. The total Bitcoin transfer to the crypto market maker summed up to 133.723 BTC worth nearly $7.63 million.

Just before publishing this story, the government moved another 2,300 BTC in its ongoing liquidations. It is believed that the German government still has as much as 32,488 BTC with an estimated worth of $1.855 billion

Similarly, Bitstamp is working on hastening the Mt.Gox repayment process. The exchange has a 60-day window to distribute tokens but aims to compensate investors much sooner. When this Bitcoin hit the market, the trajectory of Bitcoin is bound to change but the direction remains uncertain.

Read More: Bitcoin Miner Bitfarms Appoints New CEO Amid Riot Takeover Bid

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Published

11 hours agoon

July 8, 2024By

admin

The Ethereum-based BUIDL fund from the leading asset manager BlackRock has gulped over $5 million in assets over the past week despite the ongoing market turbulence.

Market analytics resource IntoTheBlock (ITB) revealed this in a recent disclosure, stressing that the fund has commanded considerable interest among investors.

While the crypto market struggles, BlackRock’s $BUIDL fund, operating on the Ethereum network, continues to attract new investors.

The fund requires a minimum entry of $5 million, and its total assets have now reached $491 million. pic.twitter.com/Bl19tVVxbW

— IntoTheBlock (@intotheblock) July 8, 2024

Launched in March on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) marks the company’s first tokenized fund. It allows qualified investors to procure yields in U.S. dollars by subscribing through the fintech company Securitize.

Notably, two months after the fund’s launch, Securitize secured a $47 million funding round from multiple investors, including BlackRock.

The BUIDL fund allocates investments into U.S. Treasury bills, cash, and repurchase agreements. This enables investors to generate yield while maintaining their holdings as tokens on the blockchain. Despite a correlation with the crypto industry, the fund has maintained a positive path amid the ongoing market turmoil.

According to data sourced by ITB, BUIDL now boasts $491 million in assets under management (AUM) amid a sustained growth trajectory. This feat comes as the broader global crypto market lost $290 billion in July, with Bitcoin (BTC) collapsing below $57,000.

On-chain data shows that BUIDL’s AUM stood at $486.46 million as of July 2. Interestingly, this figure has since increased to $491.83 million, recent data confirms. The growth rate indicates an addition of $5.37 million in the last week despite the bearish atmosphere.

With this bullish performance, BUIDL has maintained its position as the largest blockchain-based money market fund. Notably, BUIDL surpassed the BENJI fund from Franklin Templeton to become the largest money market fund in May, when its AUM soared to $375 million.

1/ Blackrock’s BUIDL has surpassed Franklin Templeton’s BENJI (FOBXX) in AUM and became the largest On-Chain Money Market Fund

– BUIDL has grown 36.5% MoM from $274M to $375M

– BENJI only grew 2.1% MoM from $360M to $368M pic.twitter.com/zcMzThfAAh— Tom Wan (@tomwanhh) April 30, 2024

As such, BUIDL has recorded inflows totaling $116.83 million. Meanwhile, BENJI has only seen $33.97 million in capital inflows within the same period.

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: