cryptocurrency

Conduit raises $37m while MegaLabs, Ora secure $20m each

Published

3 days agoon

By

admin

The blockchain space saw a big week of venture capital (VC) activity, with 23 startups securing over $154 million in funding.

According to data from Crypto Fundraiser, the amount of money that flooded the crypto space exceeded last week’s total by almost $91 million.

VC firms also funded 10 more projects this week than last week.

Here’s a breakdown of the top deals:

Conduit, $37 million

Conduit led the pack. The crypto infrastructure dominated with a $37 million series A round.

Paradigm and Haun Ventures co-led the effort. Robot Ventures, Credibly Neutral, Coinbase Ventures, Bankless Ventures and several angel investors participated as well.

Funds are expected to go toward developing Conduit’s customizable blockchain-based products, such as rollups. The funds will also help the firm realize its vision of making on-chain computing more accessible, thus simplifying the development process for blockchain innovators.

MegaLabs, $20 million

MegaLabs, the brain behind a new Ethereum (ETH) scaling protocol, raised $20 million in a seed round led by Dragonfly Capital.

Announced on June 27, the round included noteworthy angel investors like Ethereum co-founder Vitalik Buterin, ConsenSys CEO Joseph Lubin, EigenLayer creator Sreeram Kannan, and Hasu of Flashbots.

According to MegaLabs, the fresh capital injection will accelerate the development of its MegaETH protocol. The company plans to launch a testnet within the coming months.

Ora, $20 million

Ora, a blockchain project focused on integrating AI into decentralized applications, also raised $20 million. Investors like Polychain, HF0, and Hashkey Capital participated.

Ora plans to use the funds to develop its technology and infrastructure for tokenizing AI models and bringing decentralized AI to the Ethereum ecosystem.

Central to Ora’s innovation is their optimistic machine learning (opML) technology, which underpins their flagship product, opp/ai. It uses optimistic systems and zero-knowledge technology to create secure and efficient on-chain machine learning with privacy-preserving features.

Additionally, Ora has introduced the concept of the “initial model offering” (IMO), which allows the tokenization of ownership of open-source AI models.

Crossover Markets, $12 million

Another big beneficiary of crypto VC activity this week was technology firm Crossover Markets. It raised $12 million in a series A round led by Illuminate Financial and DRW Venture Capital.

The round also attracted strategic investors, including Flow Traders and Wintermute, as well as retail brokers, such as Exness, Gate.io, and Think Markets.

Crossover Markets is renowned for its execution-only electronic communication network, CROSSx, which serves as an institutional trading venue for digital assets.

In the first quarter of 2024, the company reported over $3.15 billion in notional trading value, 415,450 trades, and over 141 billion quotes processed on CROSSx. It said it will use the new funding to continue investing in its team and technology in the hope of further solidifying its market position.

Redacted, $10 million

Elsewhere, Redacted, a web3 entertainment and gamification platform, raised $10 million in a round led by Spartan Group, with Animoca and P2 Ventures also participating.

Prominent crypto figures like Dingaling and Grail also contributed, underscoring their support for Redacted’s vision of a more engaging and rewarding user experience.

The project’s marketing is said to have captured the attention of web3 investors and enthusiasts alike. Over 150 influential figures in the web3 space have reportedly adopted “Redacted” profile pictures, signaling their involvement and backing the initiative.

It also uses a catchy slogan, “Don’t get rekt, get redacted,” which plays on crypto culture and encourages investors to choose reputable projects.

The funding will support the development of Reducted’s ecosystem, which will offer a range of entertainment and gamification products powered by the RDAC token.

AnchorZero, $8 million

AnchorZero, a New York-based platform enabling founders to leverage Roth IRAs for tax savings, secured $8 million in seed funding.

We’re announcing that AnchorZero raised $8M in seed funding to make sophisticated tax strategies available to everyone. Our first product is the AnchorZero Founder Roth IRA, which can save tech founders and early employees billions of dollars on their exits.

AnchorZero Founder… pic.twitter.com/YA2rYQ8FwG

— AnchorZero (@anchorzero) June 25, 2024

The round was led by Bain Capital Crypto and Spark Capital, with additional support from Ethereal Ventures, Robot Ventures, and Mischief Capital. Angel investor Sarah Meyohas also provided funding.

The platform offers a flagship product aiming to simplify the transfer of startup equity into Roth IRAs. This approach could unlock hundreds of millions in tax savings and allow for tax-free compounding of gains.

By holding equity within a Roth IRA, founders can benefit from significant tax advantages. Any gains realized upon exit are shielded from capital gains taxes, and these initial gains can be reinvested to grow tax-free.

Covalent, $5 million

Covalent, a blockchain data infrastructure firm, closed a $5 million strategic funding round led by RockTree Capital.

The round also had significant participation from CMCC Global, Moonrock Capital, and Double Peak Group.

Following the successful funding round, Covalent has launched the New Dawn Initiative, a comprehensive rebranding effort aimed at aligning it more closely with its crypto-native community and reducing corporate influences.

Covalent’s co-founder, Ganesh Swami, plans to expand the startup’s operations across Asia, particularly in China, Korea, and Singapore, supporting blockchain and AI innovations in the region.

SoSoValue, $4.15 million

SoSoValue successfully closed a $4.15 million seed round led by HongShan and GSR Markets. Other participants included Alumni Ventures, One Piece Labs, and CoinSummer Labs.

The platform, which aims to empower investors with AI-driven data services, says it will use the funds to expand its global researcher community.

In just five months since its launch, SoSoValue has reportedly attracted over 1.2 million organic registered users. The platform is designed to empower investors at all levels, providing them with the tools and resources necessary to make informed decisions in the fast-paced crypto market.

Source link

You may like

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

cryptocurrency

Polkadot’s multi-million marketing expenses spark fury in blockchain community

Published

19 hours agoon

July 2, 2024By

admin

Blockchain project Polkadot is under fire after revealing $37 million in expenses on the marketing budget, triggering criticism and scrutiny from its community.

Polkadot, a sharded multi-chain network founded by the Ethereum co-founder Gavin Wood, is facing backlash after disclosing $37 million in marketing expenses, leading to criticism and scrutiny from its community.

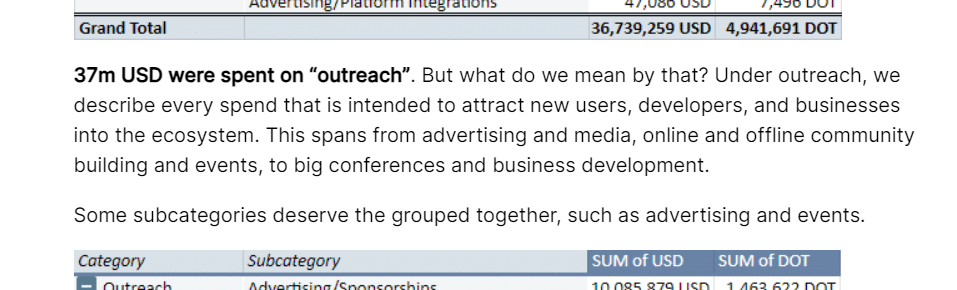

In its H1 2024 treasury report, Polkadot said that nearly $40 million was spent on “outreach,” saying that under outreach, the company describes “every spend that is intended to attract new users, developers, and businesses into the ecosystem.”

“This spans from advertising and media, online and offline community building and events, to big conferences and business development.”

Polkadot

Of the total marketing budget, over $20 million was allocated to advertising, while $10 million worth of DOT tokens were used for sponsorships. These sponsorships included sports deals, collaborations with a race car driver, and a partnership with an e-sports tournament organizer. For comparison, the report noted that Polkadot spent $23 million on developments in the first half of the year.

The marketing expenses quickly triggered outrage within the blockchain community, with accusations of centralization and frivolous financial campaigns. Victor Ji, co-founder of Manta Network, expressed his dissatisfaction in an X thread, calling Polkadot a “highly toxic ecosystem that lacks any real value for web3” and accusing it of discrimination and lack of support for network-built projects.

A concrete example is the Polkadot Academy event held in Hong Kong this February, where less than a quarter of the participants were Asian, even though this was an event in Asia (costing over a million dollars). It was at this event that I first encountered Gavin Wood, and when I… https://t.co/JxyvyIM6S9

— victorji.eth ✨ (@victorJi15) July 2, 2024

Another core developer at Polkadot, using the alias @seunlanlege, also criticized the project’s approach, saying it’s “insane to me how much money the Polkadot treasury is wasting on misplaced marketing,” and drawing parallels between Polkadot and the bankrupt FTX crypto exchange.

The report noted that at the current spending rate, Polkadot’s treasury has about “two years of runway left,” while acknowledging the unpredictable nature of crypto-denominated treasuries. As of now, Gavin Wood has not made any public statements on the matter.

Source link

Speaking with crypto.news, James Toledano, Chief Operating Officer at Savl, delved into money laundering and how tainted assets are putting crypto users at risk. Cryptocurrencies are increasingly becoming a tool that is being exploited for money laundering. The anonymity and…

Source link

cryptocurrency

Top cryptocurrencies to watch this week: MOG, KAS, FET

Published

2 days agoon

July 1, 2024By

admin

The prevailing bearish sentiment in the cryptocurrency market extended throughout June. Last week, Bitcoin (BTC) fell below the $59,000 threshold for the first time in eight weeks.

Widespread losses ensued across the market.

Some assets bucked the trend, recording new all-time highs. Selective bullishness wasn’t enough to prevent the overall crypto market cap from decreasing by 4.6% to $2.24 trillion.

Based on their strong performances last week, here are our top cryptocurrencies to watch this week:

MOG hits new ATH

MOG Coin (MOG) witnessed a bullish week. Dubbed the first culture coin on the internet, the meme coin started the week with the same bearish trend as the broader market, collapsing by 11.07% on June 23.

MOG spiked 45.32% on June 24 and June 25 thanks to increased social volume. Whale Insider confirmed that the rally solidified the token’s spot as the largest cat-themed meme coin by market cap.

JUST IN: Ethereum memecoin $MOG (@MogCoinEth) reclaims its spot as the #1 ‘cat meme’ in the world by market cap, as price rallies 30% in the past 24 hours.

— Whale Insider (@WhaleInsider) June 25, 2024

MOG hit a new all-time high of $0.00002123 on June 29 amid increased interest.

The asset closed the week at $0.0000018355, posting a 67% increase. Its Commodity Channel Index (CCI) currently sits at 130.83, suggesting that the asset is overbought, and a pullback might be imminent.

Kaspa slips into price discovery after new ATH

Kaspa (KAS) also witnessed an uptrend last week. With a 25% weekly rise, KAS recorded a less bullish performance than MOG.

However, the PoW community-based asset slipped into a price discovery phase after breaching its previous all-time high of $0.1939 on June 30. This rally was partly due to reports of Marathon Digital mining $16 million in KAS.

While MOG dropped following its new ATH, Kaspa continued to reach new record prices, entering the new week with this bullish push amid an 8.96% increase over the past 24 hours.

Consequently, KAS has flipped PEPE to become the 23rd largest cryptocurrency, with a market cap of $4.725 billion.

However, caution is advised as the new week begins. Notably, Kaspa’s daily relative strength index (RSI) has entered overbought territories, currently stationed at 71.76.

This suggests a looming retracement as the buying pressure reduces. The last time KAS became oversold, its price dropped 31% over two weeks.

FET drops 27% in three days

Fetch.ai (FET) is also among our top cryptocurrencies to watch this week. The Ethereum token looked to record a similar bullish momentum, but bearish pressure erased most of its gains toward the end of the week.

From June 23 to 26, FET spiked 26% from $1.472 to a near 3-week high of $1.860 as AI-focused tokens saw a massive uptrend.

However, this peak coincided with the upper Bollinger Band, a region that presented robust resistance from the bears.

Fetch.ai, a decentralized machine learning platform for applications such as asset trading and gig economy, saw its corresponding coin collapse from this high. Buying pressure was not sufficient to breach this resistance, resulting in massive declines over the following three days.

FET dropped by 27% from June 27 to June 29. It ultimately closed the week with an 8.56% loss. Despite a rebound effort, the asset remains below the 20-day SMA. While this might indicate a bearish trend, FET’s MACD line remains above the signal line, suggesting bullish momentum. The market remains indecisive at the moment.

Source link

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Accelerating Bitcoin Programmability With The Solana Virtual Machine

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs