bear market

Could an Earnings Recession Lead to More Pain for Crypto? – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

By Marcus Sotiriou, Analyst at the UK based digital asset broker GlobalBlock

Bitcoin fell further this morning to $19,000, as it trades below the 200-weekly SMA. So far, Bitcoin has not retested this level as resistance, but if it does and rejects back down, this would be a very bearish signal. This is because it would be the first time that this level has been broken on a long-time frame and could suggest an extended bear market is on the horizon.

There is a “risk off” tone in European markets this morning which has contributed to sell pressure on U.S. stock market futures and the crypto market. Spain’s year-over-year headline inflation for June came in at 10.2% which is significantly higher than the expected 9% as well as May’s 8.7%. This is contrast to Germany’s year-over-year CPI data showing a decrease from 8.7% to 8.2%, and less than the expected 8.8%. Despite Germany’s reading coming in lower than anticipated, the ECB (European Central Bank) will be forced to raise rates. This means that a recession is more likely to occur in Germany as growth is due to slow. Inflation in Spain, Belgium and France soaring to the highest levels since the 1980s led ECB President Christine Lagarde to concede yesterday that “low inflation is unlikely to return”. This has resulted in more fear around European economies in the near future.

In the U.S., consumer sentiment is now lower than what it was during the GFC (Global Financial Crisis) in 2008, shown by the University of Michigan Index of Consumer Sentiment. This gives further indication of growth slowing in the U.S. in the coming months, coinciding with elevated inflation. This relates to crypto as crypto correlates extremely impacted by high inflation data (demonstrated by the chart below showing BTC and ETH plotted alongside inflation prints).

Stock prices are driven by two main aspects – future earnings and a multiple of what you are willing to pay for those forward earnings. Multiples have been compressed due to expectations of rising interest rates, hence leading to the downtrend in equities. A recession may not be fully priced in by most investment fund analysts, many of whom have not experienced a macro environment similar to what we are currently experiencing. Hence the following months could result in iterations of lower earnings revisions. If this is the case, equities could be forced lower and bring crypto along too.

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

bear market

Bitcoin ‘tends to bounce back’ in July after negative June

Published

3 days agoon

June 30, 2024By

admin

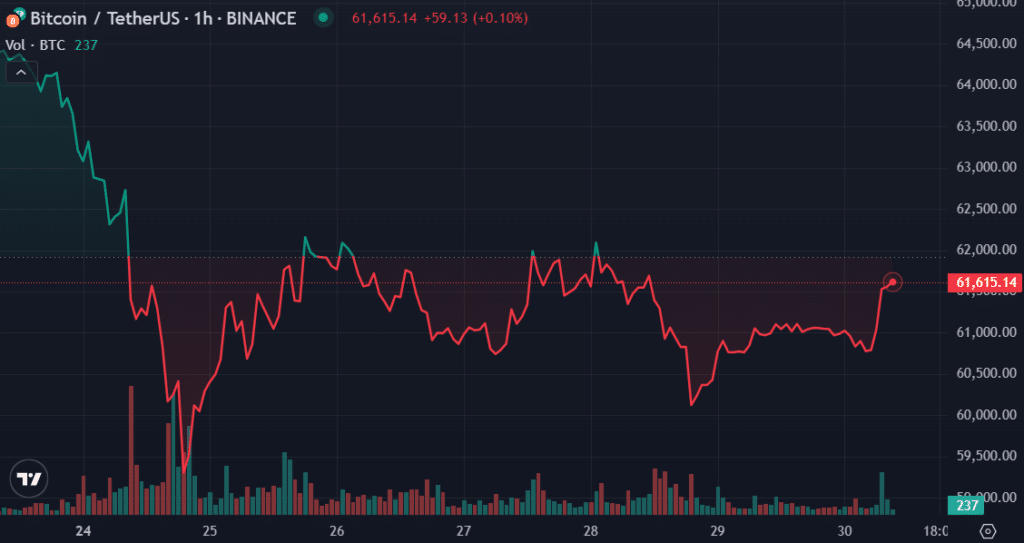

Crypto market analyst Ali Martinez expects a price rebound for the Bitcoin (BTC) price in July after a month of bearish momentum.

According to Martinez’s X post on Sunday, the Bitcoin price recorded an average price rebound of 7.98% in July after a “negative June.” Data shows that the BTC price plunged by 9.25% over the past 30 days.

Historically, when #Bitcoin has had a negative June, it tends to bounce back strongly in July. In fact, $BTC has shown an average return of 7.98% and a median return of 9.60% during this month. pic.twitter.com/fJaIwc7Eob

— Ali (@ali_charts) June 30, 2024

Bitcoin recorded a 30-day-high of $71,907 and a low of $58,554 in the mentioned timeframe.

Moreover, data provided by Martinez shows that Bitcoin’s largest average price return of 46.81% happened in November.

Bitcoin gained a slightly bullish momentum over the past 24 hours, rising by 0.94%. The flagship cryptocurrency is currently trading at $61,450 at the time of writing. BTC’s market cap again surpassed the $1.2 trillion mark with a daily trading volume of $13.1 billion.

Due to the declining trading volume, lower price volatility and liquidations would be expected for Bitcoin.

On the other hand, Billionaire entrepreneur and Bitcoin supporter Peter Thiel believes that the BTC price might not witness a dramatic rally. Thiel’s comments come while he still holds a portion of Bitcoin.

Last year, Thiel’s Founders Fund invested roughly $200 million in Bitcoin when the asset’s price was hovering at around $30,000.

Bitcoin’s downward momentum started on June 10 when the spot BTC exchange-traded funds (ETFs) in the U.S. recorded their first set of net outflows in one month.

Last week, spot BTC ETFs saw $137.2 million in net inflows in their last four trading days. This pushed the total amount of ETF net flows past the $14.5 billion mark.

Source link

bear market

Veteran Trader Peter Brandt Issues Ethereum Alert, Says ETH Could Crash by up to 70% – Here Are His Targets

Published

7 months agoon

December 18, 2023By

admin

A widely followed crypto analyst is issuing a warning about the second-largest digital asset by market cap.

Veteran trader Peter Brandt warns his 707,300 followers on the social media platform X that top altcoin Ethereum (ETH) could soon see an epic crash that sends it below $700.

“Classical chart patterns in price charts are not sacred – they fail to perform according to the textbooks all the time.

But, if the rising wedge in Ethereum complies with the script, the target is $1,000, then $650.

I shorted ETH on Friday — I have a protective B/E stop.”

When questioned by a follower if the pattern Brandt characterized as a rising wedge was not interpreted as an ascending triangle, a typically more bullish technical analysis pattern, Brandt offers further insight into his technical analysis process.

“1. I did consider (and still might consider) the ascending triangle interpretation.

- When in doubt on a pattern I look at [the] closing price line chart — in this case, a wedge.

- Too many on Twitter are calling this an ascending triangle – my contrarian tendencies.

- Super low risk shorting set up.”

With ETH currently worth $2,156 at time of writing, a fall to $650 would represent a nearly 70% decline for the leading smart contract platform.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/CYB3RUSS

Source link

Altcoins

Benjamin Cowen Warns Majority of Altcoins Will Never See New All-Time Highs Again Amid ‘Serious Declines’

Published

9 months agoon

October 16, 2023By

admin

A widely followed crypto analyst is issuing a warning that most altcoins are in the midst of severe downtrends that will ultimately keep them below their all-time highs forever.

In a new video update, crypto trader Benjamin Cowen tells his 787,000 YouTube subscribers that most altcoins currently find themselves in “serious declines” that are being overlooked due to Bitcoin’s (BTC) relative resilience.

Cowen also notes that if Bitcoin were to decline, it would crush altcoins even worse.

“A lot of altcoins in the top 100 that are in pretty serious declines right now and a lot of people are completely ignoring it… The only reason people are ignoring it is because Bitcoin’s doing okay so it’s easy to discount [altcoins]…

If you want exposure to the cryptoverse in the pre-halving year, Bitcoin can often offer you a decent amount of exposure to the upside while also minimizing your downside risk in the altcoin market. Some people think that that means that Bitcoin can’t go down – it can.

I mean it went down in the second half of 2019, it even went down in the early phase of the halving year last cycle, so it can go down. It’s just that if it does go down it’s likely going to take the altcoin market with it.”

According to Cowen, very few altcoins that exist right now will ever hit new all-time highs again.

“I think that as a whole the altcoin market will recover. The issue is not ‘will the altcoin market recover?’

In my mind, it’s ‘will the altcoins that people are [dollar cost averaging], will those recover?’ And there might be one out of 10 or one out of 50 or one out of 100 that go on to put in new all-time highs but a lot of them can just go away.”

Cowen goes on to note that the next bull market could be sparked by a massive capitulation event for BTC that rinses out weak hands before springing to the upside.

“Even Bitcoin will probably bend the knee and we’ll have to figure out how low the secondary scare goes before we really get that move into sort of a more sustained bull market.

There’s one interesting thing to look at with Bitcoin in the last two cycles and that [is] what really kickstarted the bull market… The real move to all-time highs did not come until [a] massive capitulation wick.”

Bitcoin is trading for $27,927 at time of writing.

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/tdhster/Andy Chipus

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs