crypto

Court Filing Suggests FTX’s $2 Billion Lawsuit Against Genesis Is Coming To An End

Published

11 months agoon

By

admin

The legal tussle between bankrupt crypto exchange FTX and crypto lender Genesis seems to be coming to a resolution, a recent court filing reveals. According to the letter filed yesterday at the US bankruptcy court for the Southern District of New York, both firms – who happened to have filed for bankruptcy – have agreed to settle their ongoing billion-dollar dispute.

How The Feud Began

FTX filed a motion in May this year to recover its funds from Genesis and “non-debtor affiliates” so the company could pay back its creditors. The motion went as far as describing Genesis (who attributed its solvency issues to FTX’s collapse) as “one of the main feeder funds and instrumental to its [FTX and Sister company Alameda Research] fraudulent business model.”

FTX further claimed that Genesis received “avoidable transfers” from FTX’s debtors totaling almost $3.9 billion. In response, Genesis denied owing FTX and filed a motion asking the bankruptcy judge to rule its debt to FTX as zero. However, a subsequent letter from FTX to the bankruptcy judge showed that the company had reduced its claim from $3.9 billion to $2 billion.

FTT token trades at $1.3 amid exchange's woes | Source: FTTUSD on Tradingview.com

FTX’s claim could have delayed a creditor payout and slowed Genesis’ bankruptcy proceedings. However, with settlement in sight, things are likely to move along quickly, as according to the letter, FTX, its associated debtors, and debtors in its Chapter 11 bankruptcy case have reached a preliminary agreement.

The court filing reads:

The parties have reached an agreement in principle, subject to documentation, regarding a settlement that would resolve, among other things, the claims asserted by the FTX debtors against the debtors in these Chapter 11 Cases and the claims asserted by the Genesis debtors against the FTX debtors in the FTX Chapter 11 cases.

Genesis Still Not In The Clear

Despite reaching a settlement with FTX, crypto lending platform Genesis still has other lawsuits to deal with, including one filed by Gemini against its parent company, Digital Currency Group (DCG), and its CEO, Barry Silbert. Gemini’s co-founder Cameron Winklevoss called out Barry Silbert on Twitter in an open letter, claiming that Silbert and DCG had engaged in “Fraudulent Behavior.”

He warned that Silbert’s failure to reply and come to the negotiation table by Friday would result in a lawsuit. In a follow-up tweet, Winklevoss also tabled a “best and final offer” involving a repayment plan.

Still, Silbert and DCG failed to reply, and true to his words, Winklevoss and Gemini filed a lawsuit against DCG and Silbert for fraud on July 7.

Featured image from SlashGear, chart from Tradingview.com

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Altcoins

Is Dogwifhat (WIF) Out? Price Tanks 15% On Whale Exodus

Published

2 days agoon

July 6, 2024By

admin

Dogwifhat, the once-high-flying Solana-based meme coin, suffered a brutal week, mirroring a broader crypto market correction and raising questions about the sustainability of the meme coin craze.

Related Reading

Meme Coin Mania Meets Market Mayhem

WIF, the token powering Dogwifhat, saw its price plummet 15% in just 24 hours. This dramatic drop erased all the gains from a recent rebound rally. The sell-off wasn’t isolated to Dogwifhat; the entire crypto market experienced a double-digit tumble, with major altcoins like Ethereum and Cardano feeling the heat.

Analysts point to a combination of factors behind the downturn, including renewed concerns about inflation and a recent sell-off by the German government and Mt. Gox, a defunct cryptocurrency exchange.

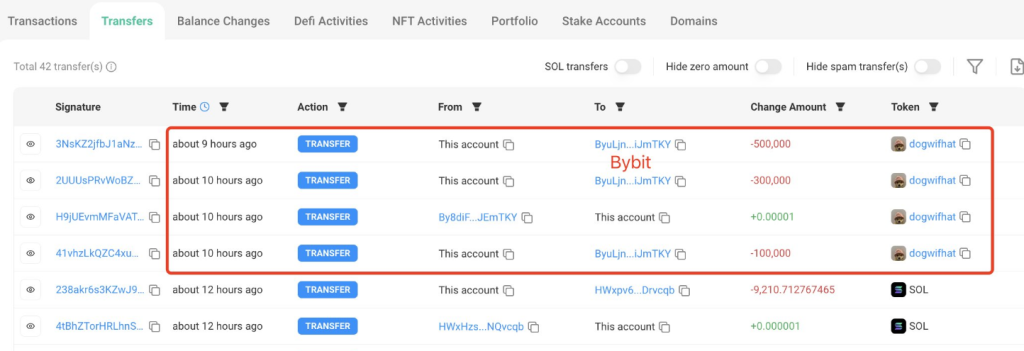

The price of $WIF dropped 15% as the market fell.

A whale deposited 900K $WIF($1.64M) to #Bybit 10 hours ago, leaving 974K $WIF($1.76M).https://t.co/qJwlxcWy15 pic.twitter.com/amIkvwKfNG

— Lookonchain (@lookonchain) July 4, 2024

The pain for Dogwifhat was further amplified by a whale of a different kind: a large investor. LookOnChain, a blockchain whale tracking agency, identified a major Solana whale dumping 900,000 WIF tokens in a series of transactions. This fire sale, amounting to roughly $1.64 million, undoubtedly contributed to the downward spiral.

Dogfight On Derivatives: Bulls Trampled, Bears Feast

While the Spot market witnessed a bloodbath, the WIF derivatives market displayed a curious mix of activity. Trading volume surged by a surprising 25%, propelling Dogwifhat to the coveted title of third most-demanded meme coin behind Dogecoin and Pepe Token. This surge in volume might suggest increased interest, but a closer look reveals a different story.

Lurking beneath the surface was a brutal battle between bullish and bearish investors. More than $3 million in WIF positions were liquidated in the last 24 hours. This liquidation primarily targeted long positions, meaning investors who bet on the price going up were forced to sell at a loss as the price plummeted.

While some might see the increased volume as a sign of potential revival, the liquidation figures paint a starker picture – many bulls got trampled by the bears feasting on the market downturn.

A Buying Opportunity Or A Boneheaded Move?

Despite the carnage, not everyone has lost faith in Dogwifhat. The plummeting price has attracted some opportunistic “Solana whales” who view the current price as an attractive entry point. This glimmer of hope hinges on the possibility that Dogwifhat can recapture its past glory.

Related Reading

In Q1 2024, Dogwifhat was a meme coin darling, riding the wave of the meme coin craze to a $4 billion market cap and a place in the top 30 global crypto rankings. However, the recent downturn serves as a stark reminder of the inherent volatility of meme coins, which often lack the utility or strong fundamentals of established cryptocurrencies.

The future of Dogwifhat remains uncertain. Whether it can claw its way back from the doghouse or fade into obscurity depends on several factors, including broader market trends, community support, and potential developments within the Dogwifhat ecosystem.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

Solana-Based Memecoin Defies Market Downturn, Jumps Over 30% in 24 Hours Amid Listing on Multiple Exchanges

Published

3 days agoon

July 5, 2024By

admin

One Solana-based (SOL) meme asset is defying market doldrums and rallying after being listed on numerous crypto exchange platforms.

New data reveals that Billy (BILLY), a dog-themed memecoin built over Solana, has jumped over 30% during the last 24 hours after multiple crypto exchange platforms added support for it.

The crypto exchange platforms that listed Billy include Bittrue, Bitget, MEXC, and Gate.io, who all announced support for the meme asset earlier this week.

Billy is trading for $0.1659 at time of writing, a 36% gain during the last day. On June 26th, Billy was moving for just $0.0286.

Billy, which was launched earlier this year in June and features a picture of a puppy, is outpacing other prominent meme assets during the market’s current consolidation period, which has caused sharp decreases across the board.

Other dog-theme assets, such as dogwifhat (WIF), Shiba Inu (SHIB), Bonk (BONK), and Dogecoin (DOGE), are trading for $1.91, $0.000014, $0.000023, and $0.1046 at time of writing, respectively.

However, DOGE, WIF, SHIB, and BONK are all down between 30-40% during the last month while BILLY is up a staggering 150% during the same time frame.

According to data from blockchain tracker Dexscreener, Billy’s market cap is sitting at $161 million at time of writing while its 24-hour volume is at $24.6 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Quardia/Sensvector

Source link

Altcoins

20% Price Drop Follows $87 Million Spending Outrage

Published

3 days agoon

July 5, 2024By

admin

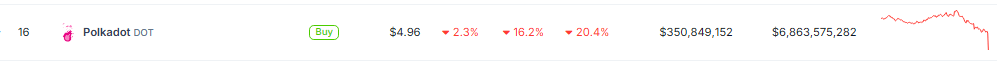

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

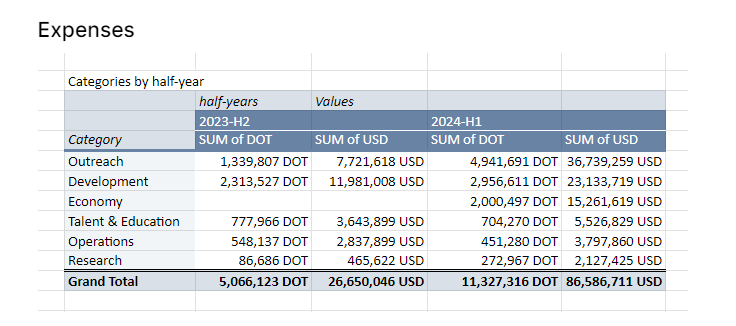

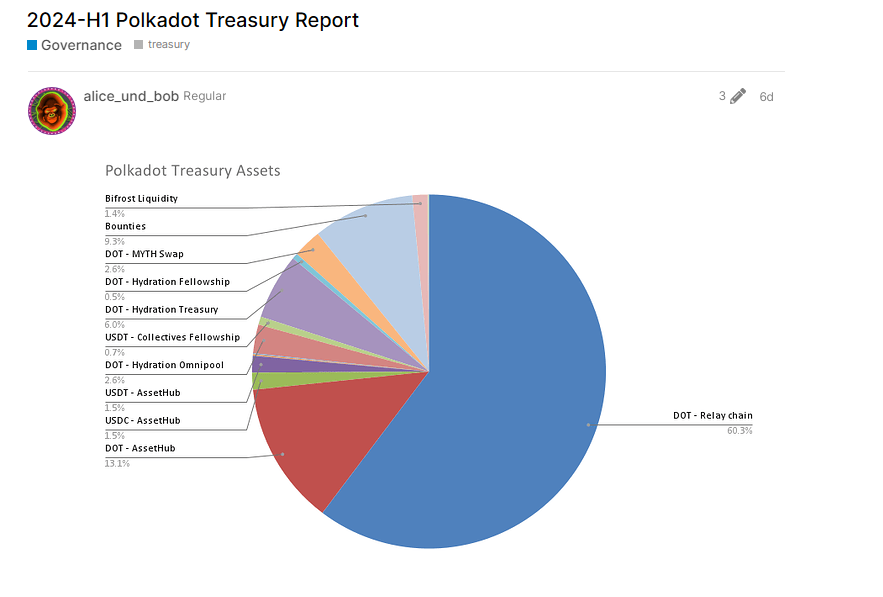

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs