Analyst

Crypto Analyst Predicts XRP 1,500% Move Against Bitcoin, What Are The Terms?

Published

7 months agoon

By

admin

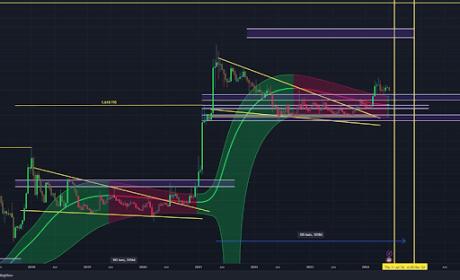

Crypto analyst CryptoInsightUk has once again given his projections as to the future trajectory of the XRP price. This time, the analyst predicts that the crypto token could enjoy unprecedented against the flagship cryptocurrency, Bitcoin. However, there is a caveat for this to materialize.

How XRP Could Gain 1500% Against Bitcoin

In a post shared on his X (formerly Twitter) platform, CryptoInsightUk said that XRP could see a move up to 1500% against Bitcoin. This, he stated, will happen if the crypto token could break and hold above the top grey box in the accompanying chart he shared. However, even if that doesn’t happen, he still expects XRP to make significant gains against Bitcoin.

Source: X

He had earlier laid out another scenario where XRP makes an 88% move against Bitcoin. The crypto analyst seemed more confident in this happening as he mentioned that it looks like it is just a “matter of time” before this move-up happens. Many will, however, be hoping that the move of 1500% also actualizes at some point.

CrytoInsightUK happens to be one of those who are very bullish on XRP’s future trajectory. The crypto analyst had previously suggested that XRP could recapture the 61,000% gain it saw back in 2017. He highlighted how the token was in a better place and had a lot of potential. He also alluded to how the token is in a “unique position” considering that it has gained legal clarity.

Token price shows strength | Source: XRPUSD On Tradingview.com

Stronger Than Bitcoin

Crypto analyst Egrag Crypto recently asserted that XRP is stronger than BTC. He made this statement in relation to the fact that XRP is trading at a higher price level now, with Bitcoin currently trading at around $42,000, than when the flagship cryptocurrency was trading at this same level two years ago. XRP is said to be trading at 0.00000637 BTC back then.

According to Egrag, XRP’s 129% gain against Bitcoin highlights the former’s strength. It also cements “XRP’s dominance” in the market cycle. Meanwhile, the crypto analyst once again called for patience from the XRP community as he says that XRP hitting between $1.3 and $1.5 is on the horizon.

The bullish price predictions keep flowing in as the bull market draws near. Patrick Riley, the founder of Reaper Financial, also recently stated that XRP will hit $22 at the peak of the next bull run. Interestingly, he even went on to assert that the crypto token will surpass Bitcoin at some point.

At the time of writing, XRP is trading at around $0.61, up almost 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Quora, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Analyst

Bernstein Analysts Revise Bitcoin Target, $200,000 And $1 Million Become Main Focus

Published

3 weeks agoon

June 16, 2024By

admin

Bernstein analysts Gautam Chhugani and Mahika Sapra recently revised their price targets for Bitcoin in their latest market report, which also initiated coverage on MicroStrategy. These analysts also outlined factors that they believe could contribute to BTC’s exponential price surge.

Bitcoin To Hit $200,000 And Then $1 Million

Chhugani and Sapra predicted in the report that BTC will rise to a cycle high of $200,000 by 2025 and that the flagship crypto will reach $1 million by 2033. Bernstein had previously predicted that Bitcoin would reach $150,000 by 2025. However, these analysts have now revised their targets and alluded to the institutional demand for BTC as one of the reasons they believe the flagship crypto can reach such heights.

Related Reading

The research firm predicts that the Spot Bitcoin ETFs will continue to record impressive demand and that the Bitcoin under management could reach $190 billion by 2025, a significant increase from the $60 billion in BTC that funds issuers already have under management.

In other words, these analysts expect BTC’s price to succumb to the supply and demand dynamics, considering that the Bitcoin in circulation is bound to drastically reduce as these Spot Bitcoin ETFs continue to accumulate a significant amount of the crypto token for their respective ETFs. Moreover, two Bitcoin halvings are set to occur before 2033, further reducing miners’ supply and thereby supporting their base case of BTC hitting $1 million.

MicroStrategy To Benefit From BTC’s Growth

These Berstein analysts also initiated coverage on MicroStrategy with an outperform rating. They predict that the software company’s stock can rise to $2,890 thanks to its BTC exposure. A rise to $2,890 represents about a 95% increase for MicroStrategy’s stock, which is currently valued at around $1,500.

The research firm noted that MicroStrategy has committed itself to “building the world’s largest Bitcoin company.” This has already paid off so far, with Chhugani and Sapra stating that the software company has transformed from a “small software company to the largest BTC holding company” since August 2020 (when it started accumulating BTC).

MicroStrategy already owns 1.1% of Bitcoin’s total supply, with holdings worth around $14.5 billion. The company’s BTC holdings are expected to increase soon enough, as they recently announced plans to offer $500 million of Convertible Senior Notes. Some of the proceeds from the proposed sale will be used to buy additional BTC.

Related Reading

Berstein highlighted how the company’s co-founder Michael Saylor has become synonymous with the Bitcoin brand and that the company’s position as the leading Bitcoin company has helped attract “at scale capital (both debt and equity) for an active Bitcoin acquisition strategy.” In dollar terms, Bernstein noted that MicroStrategy’s Bitcoin net asset value (NAV) per share “has grown nearly fourfold, surpassing the 2.4x growth in Bitcoin’s spot price.”

“We believe MSTR’s long term convertible debt strategy allows it enough time to gain from Bitcoin upside, with limited liquidation risk to its Bitcoin on balance sheet.” Chhugani and Sapra added.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Analyst

Analyst Who Correctly Predicted Bitcoin’s Surge And Crash Reveals Where Price Is Headed Next

Published

3 weeks agoon

June 14, 2024By

admin

Crypto analyst TechDev has provided insights into the Bitcoin future trajectory. The analyst suggested that the flagship crypto has yet to reach its full potential in this market cycle and that more price surges lie ahead for the crypto token.

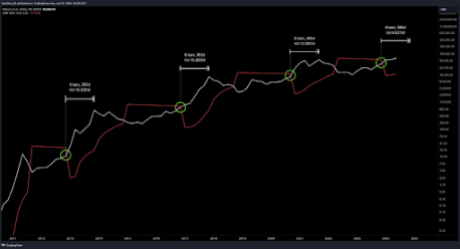

Not Yet Time For A Bitcoin Blowoff Top

TechDev remarked in an X (formerly Twitter) post that the Bitcoin blowoff tops only happen after the four-week Chaikin money flow (CMF) breaks a line he highlighted on the accompanying chart. His analysis suggests that Bitcoin is still bound to make a parabolic move to the upside before it experiences a significant decline.

Related Reading

Blowoff tops are a chart pattern that shows the rapid increase in an asset’s price followed by a sharp drop in its price. TechDev’s chart showed that something similar happened in the previous bull cycles, with Bitcoin enjoying a parabolic uptrend for about a year before its price dropped sharply.

Similarly, based on TechDev’s chart, Bitcoin is again set to enjoy a parabolic uptrend from now to sometime in 2025 before it reaches its market top and begins to decline significantly. In another X post, the analyst suggested that the time has almost for Bitcoin to enjoy its next leg up. As crypto analyst Rekt Capital claimed, this next move to the upside will take Bitcoin into the ‘parabolic uptrend’ phase of this market cycle.

Interestingly, this breakout for Bitcoin could happen sooner than expected, with TechDev claiming that in 18 days, Bitcoin will have a chance at a breakout that it has only seen once in its entire history. From a chart he shared, TechDev hinted at Bitcoin rising to as high as $190,000 in this bull run.

It is also worth mentioning that crypto analyst CrediBULL Crypto recently predicted that a Bitcoin breakout is imminent. He said Bitcoin would “absolutely giga send” in seven to ten days and rise to as high as $100,000 when this move happens.

Bitcoin’s Breakout May Still Take A While

Crypto analyst Rekt Capital recently stated that Bitcoin’s breakout from this Re-Accumulation range would occur in September 2024 if history repeats itself. The crypto analyst claimed that Bitcoin’s struggle to break out from this Re-Accumulation range is “beneficial for the overall cycle.”

Related Reading

He noted that Bitcoin has never broken out this early in the post-halving period. Rekt Capital remarked that a Bitcoin breakout this early means that this cycle would be accelerated and that the bull market would be shorter than usual. As such, he believes that this lengthy consolidation is helping Bitcoin’s price resynchronize with historical halving cycles so that the market can experience a “normal and usual bull run.”

At the time of writing, Bitcoin is trading at around $66,900, down almost 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Analyst

This Dogecoin Metric Just Turned Bullish For The First Time Since 2020

Published

4 weeks agoon

June 14, 2024By

admin

Dogecoin (DOGE) is again in the spotlight as the foremost meme coin could be ready for takeoff. This follows crypto analyst Kevin’s (formerly Yomi OG) analysis of Dogecoin, in which he highlighted an important indicator that has turned bullish for the crypto token.

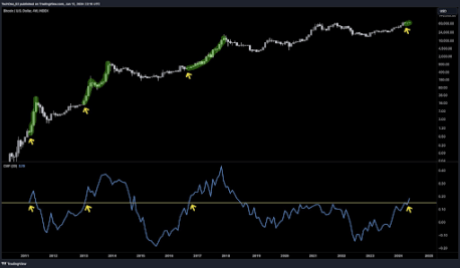

Dogecoin Indicator Turns Green For The First Since 2020

Kevin mentioned in an X (formerly Twitter) post that the 12-day time frame on the Gaussian channel just recently flipped green on Dogecoin’s chart for the first time since December 2020. He claimed that this indicates a “potential strong bullish trend” is on the cards for the meme coin in the coming months.

Related Reading

Kevin added that this indicator has never failed in indicating these trend changes, suggesting that Dogecoin has indeed undergone a bullish reversal.

In another X post, Kevin claimed that Dogecoin has looked much stronger than most altcoins throughout this period, during which the crypto market has continued to bleed and trade sideways. He added that Dogecoin will likely move into the golden pocket at the $0.26 to $0.33 range if it can stay above the Macro 0.382 FIB and the blue support zone on the weekly time frame.

Kevin also provided another bullish narrative for Dogecoin in another X post. Looking at the four-hour time frame chart, he highlighted a deviation back into the larger symmetrical triangle, which he claimed is a “bullish sign.” He stated that Dogecoin getting back above key moving averages will be important. He also added that he expects the foremost meme coin to test the $0.175 price level at some point, as there is a lot of liquidity in that price range.

The crypto analyst also hammered on liquidity at that price area. He claimed there is a “very big block of liquidity” at the $0.175 level, looking at the 3-month time frame. Additionally, he said that most of the liquidity beyond that level is between the $0.20 to $0.23 range. This is bullish for Dogecoin, as Kevin noted that market makers like to move where the liquidity is, and it is definitely higher for Dogecoin at the moment.

DOGE’s Next Move

Crypto analyst CrediBULL Crypto recently mentioned that Dogecoin has reached a ‘make it or break it’ level. He, however, seemed confident that Dogecoin could experience an upward trend from its current price level, noting that the meme coin had reached this ‘make it or break it’ level when Bitcoin hit its range lows. As such, he expects Dogecoin to enjoy a price rebound if the flagship crypto experiences a bullish reversal.

Related Reading

Meanwhile, crypto analyst Crypto Daily has made a short-term bullish forecast for DOGE. He predicted that Dogecoin would rise to between $0.33 and $0.35 soon. The analyst added that a daily close above $0.18308 could lead to further gains up to $0.57 for Dogecoin.

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs