Ripple

Crypto CEO Delivers Bad News For The Altcoin

Published

9 months agoon

By

admin

Amidst the debate on the XRP price future trajectory, the CEO of Evai Crypto Ratings, Matthew Dixon, has provided insights into the token’s direction using the Elliot Wave Theory. However, his analysis doesn’t provide any relief to XRP holders as he projects a further decline for the token and its ecosystem.

How XRP Price Is Looking On The Charts

In a tweet shared on his X (formerly Twitter) platform, Dixon shared a price chart of XRP dating back to July, when Judge Analisa Torres ruled in favor of Ripple against the US Securities and Exchange Commission (SEC). As part of his analysis, he noted that XRP aligned with the BTC outlook.

Source: X (formerly Twitter)

Looking at the chart, he highlighted the bearish divergence, which indicated that the 5th wave was expected to cause a decline in the XRP price. However, before then, he projected that there is a likelihood of the token experiencing an upward trend to complete wave 4.

While Dixon’s analysis suggests a bearish outlook, he quickly noted that nothing was certain in technical analysis, although there is a high probability of this happening.

The Elliot Wave Theory, which he used to come to this conclusion, is a popular technical analysis indicator used to predict future price trends. The theory propounds that markets like XRP follow predictable sequences of optimism and pessimism driven by investor sentiment and psychology. Simply put, it agrees with the trend that there will always be a correction or retracement after a particular trend (upward or downward).

XRP sitting at $0.48 | Source: XRPUSD on Tradingview.com

Time To Lower Expectations

Many crypto analysts have made far-fetched predictions of the XRP price, with one, in particular, stating that the token could rise as high as $10,000. However, a crypto influencer (Crypto Assets Guy) advised those in the XRP community to lower their expectations as the token won’t hit “$10,000, $1,000, $50” or even $10 any time soon.

He took a more conservative stance by stating that the token could hit a new all-time high late this year or in 2024, suggesting it could add around $3.70 to its current all-time high of $3.84. He believes the XRP community should be more than satisfied if that happens.

Meanwhile, many in the XRP community seem tired of these price predictions. This was evident when some expressed frustration after XRP influencer Jack The Rippler posted the headline of an article (dated July 31, 2023), which stated that a Wells Fargo staff had predicted the XRP price to hit $100 to $500 in the next 2 to 7 months.

One particular X user stated, “Bla bla bla evey [every] goddamn day the same shit.”

Bla bla bla evey goddamn day the same shit

— rovadi 𓄿 (@RoVaDi2001) October 10, 2023

Featured image from Shutterstock, chart from Tradingview.com

Source link

You may like

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

News

Ripple’s Big Court Win Nonetheless Muddied Waters on Whether XRP Is a Security Deserving Tougher Regulation

Published

1 week agoon

June 30, 2024By

admin

In a near-vacuum of legal and regulatory clarity for crypto, district judges’ opinions on whether a given token is a security or not – which determines the level of regulation – can vary from court to court.

Source link

24/7 Cryptocurrency News

Here’s What Happened In Crypto This Week

Published

1 week agoon

June 30, 2024By

admin

Another week draws to a close within the crypto landscape, keeping crypto market traders and investors on their toes. Bitcoin’s (BTC) price slipped from the $64K price level to as low as $59K this week, raising investor concerns. This tumbled movement comes against the backdrop of massive dumps to exchanges.

Meanwhile, Pepe Coin (PEPE) and Ripple’s XRP piqued significant interest. While developments related to the SEC lawsuit unfolded, market analysts ruled out a highly bullish forecast for XRP. Simultaneously, PEPE whales have taken action, moving billions of coins, garnering investor attention.

So, let’s take a closer look at some of the top crypto headlines for this week.

Bitcoin Price Struggles

BTC encountered immense volatility this week, primarily due to massive token dumps to exchanges. Notably, the U.S. and the German governments moved whopping amounts of Bitcoin to CEXs this week, stirring worldwide speculation amid crypto’s turbulent movement.

Simultaneously, a report by CoinGape further spotlighted massive whale dumps, generating bearish market sentiments.

Institutional investors saw this week as an opportunity to shift focus from Bitcoin to altcoins, as the broader industry expects a true correction is underway. The beleaguered exchange Mt. Gox’s plans to repay creditors in Bitcoin and Bitcoin cash has further raised price uncertainty.

However, the US PCE and core PCE inflation cooled down, triggering some positive sentiments in the market. Nonetheless, the broader sentiments convey a further dip in Bitcoin price is possible.

Despite Bitcoin ETFs recording a 4-day inflow streak, the crypto’s price has failed to gain a notable upside momentum. The inflows remain undermined as BTC miners sold whopping amounts of Bitcoin this week, aligning with miner capitulation.

However, the Binance CEO remained immensely bullish on Bitcoin’s long-term prospects.

Pepe Coin Stirs Speculations

Meanwhile, PEPE’s weekly chart showed a highly volatile movement, with the meme coin down to the $0.000011 price level at press time.

A smart money dumped billions of PEPE with 11-fold returns this week, birthing speculations over a topped price action for Pepe coin. Simultaneously, in light of the looming ETH ETF launch, a whale offloaded nearly 1 trillion PEPE to Binance, swapping it for Ethereum.

This strategic shift has sparked negative sentiments over PEPE’s future, although it added a bullish tint to ETH’s future movements.

Also Read: Promising Cathie Wood Stocks To Watch Out For

XRP Creates Buzz

Meanwhile, despite a sluggish price action, analysts took the stage to forecast a highly optimistic $2 price target for the crypto XRP. Amid this optimistic buzz, it was recorded that XRP whales bagged hundreds of millions of the Ripple-backed coin, indicating a potential bolstered price movement ahead.

Ripple president Monica Long further talked about Ripple vs the SEC lawsuit, the RLUSD stablecoin, and a potential XRP ETF launch. This garnered notable bullish sentiments for XRP across the broader industry.

Also Read: Floki Inu Warns Against Scam Tokens on Solana and Base

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins

Forget The Dip! XRP Primed For Epic Rally To $36, Expert Claims

Published

2 weeks agoon

June 24, 2024By

admin

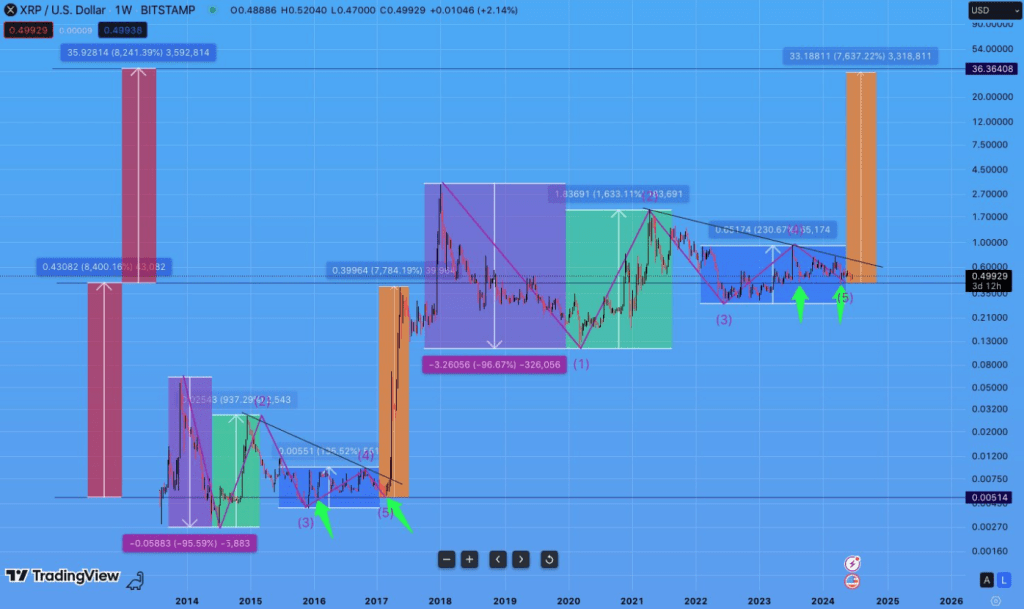

The price of XRP, the native token of RippleNet, has been caught in the crosshairs of a bearish crypto market. Currently trading below the crucial $0.50 mark, XRP seems to be following the broader market trend. However, a recent analysis by market analyst Tylie Eric throws a glimmer of hope for XRP holders, predicting a potential price surge based on a technical indicator.

Related Reading

Understanding Elliott Wave Theory

Eric argues that XRP’s price movements might be following a historical pattern known as the Elliott Wave theory. This theory proposes that market trends unfold in a specific five-wave structure, with each wave representing a distinct phase in the price cycle.

According to Eric, XRP has exhibited this five-wave structure on multiple occasions in the past on its weekly chart. Notably, each time this pattern materialized, the fifth and final wave culminated in a significant price increase.

#XRP.

BEAT BY BEAT

I think XRP has ticked all the boxes and held all requirements to continue with wave 3 of wave 5,

Same way it did in 2017! pic.twitter.com/qqexAC7b1X— Tylie E (@TylieEric) June 20, 2024

Eric cites the example of early 2017, where the completion of the fifth wave triggered a surge that propelled XRP to a high of $0.39, a staggering 7,700% increase. This upswing was followed by a brief consolidation period before another decisive rally to $3.30.

A Potential Fifth Wave?

Building on this historical precedent, Eric believes XRP is nearing the conclusion of another five-wave structure that began its formation after the 2017 price drop. His analysis suggests that all four preceding waves have unfolded over the past six years, paving the way for a potential fifth wave that could mirror the dramatic rise witnessed in 2017.

Eric’s audacious prediction hinges on the assumption that the fifth wave will again translate to a substantial price increase. His chart projects a potential upsurge of a staggering 7,630%, which would propel XRP to a price target of a phenomenal $36. This prediction aligns with forecasts from other analysts like CryptoInsightUK, who projected an XRP price surge to $34 last September.

Related Reading

Long Way Ahead

Eric’s prediction hinges on the completion of the Elliott Wave structure, a technical theory that remains a subject of debate among financial experts. Furthermore, the $36 price target appears highly ambitious. It’s important to remember that achieving such a price point would require XRP to surpass the current market capitalization of all cryptocurrencies combined.

Featured image from Getty Images, chart from TradingView

Source link

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: