Binance

Dormant Crypto Whale Wakes Up, Moves $3,050,000 Worth of Bitcoin (BTC) to Binance

Published

3 days agoon

By

admin

A long-dormant crypto whale has woken up after years of slumber to move millions of dollars worth of Bitcoin (BTC) to Binance, the world’s largest crypto exchange platform by volume.

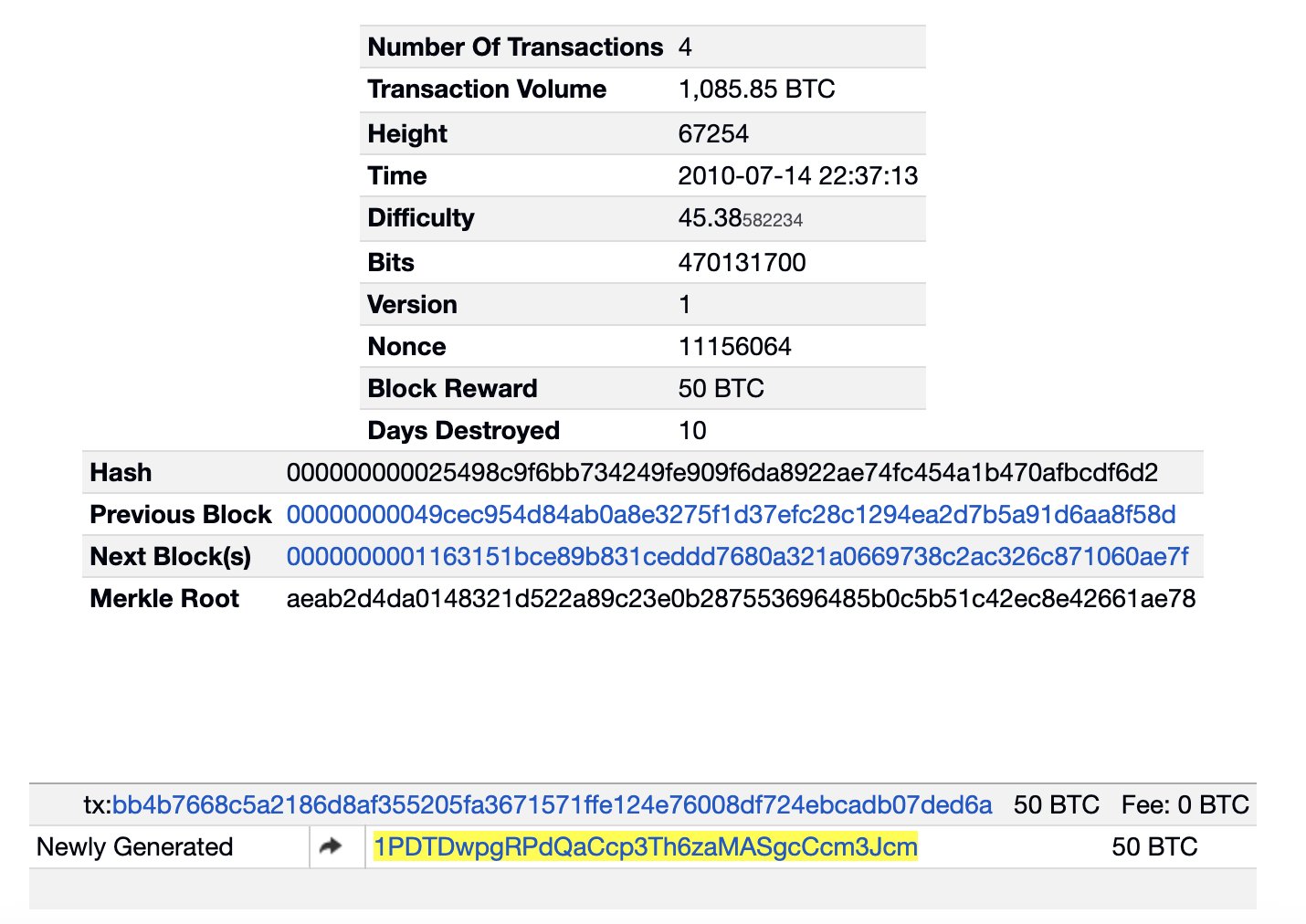

New data from market intelligence firm Lookonchain reveals a crypto mining wallet that has been asleep for 14 years has abruptly woken up and deposited 50 BTC, worth about $3.05 million at time of writing, to Binance on June 26th.

According to the crypto analytics platform, the miner earned the tokens during July 2010 when the crypto king was trading for under $1.

“A miner wallet woke up after being dormant for 14 years and deposited 50 BTC ( $3.05 million) to Binance seven hours ago. The miner earned 50 BTC from mining on July 14, 2010.

Address: 1PDTDwpgRPdQaCcp3Th6zaMASgcCcm3Jcm”

Earlier this year in May, Lookonchain also found that two wallets that had seen no activity since 2013 also suddenly shifted around millions of dollars worth of BTC.

At the time, Lookonchain found that the deep-pocketed investors moved a combined $61 million worth of Bitcoin 11 years after purchasing 500 tokens for just $124 each. According to the on-chain data, the wallets printed staggering gains of nearly 50,000%.

The top crypto asset by market cap is trading for $61,630 at time of writing, a marginal increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

Source link

You may like

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

24/7 Cryptocurrency News

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Published

5 mins agoon

July 1, 2024By

admin

Binance has issued a new warning that has taken the crypto community by storm. The leading cryptocurrency exchange announced plans to extend its Monitoring Tag to 11 tokens, putting them at risk of future delisting.

Meanwhile, tokens affected include Balancer (BAL), and Cortex (CTXC), among others, while Enzyme (MLN) and Horizon (ZEN) will be removed from the risk list. Notably, this development could signal potential price volatility for the affected tokens.

Binance Adds Monitoring Tag To 11 Tokens

Binance’s recent announcement about its Monitoring Tag has sent ripples through the crypto market. As of July 1, the exchange will add several tokens, including Balancer (BAL), Cortex (CTXC), and Convex Finance (CVX), to its Monitoring Tag list.

Meanwhile, as per the announcement, tokens with this tag are considered high-risk and are closely monitored for volatility and compliance with Binance’s listing criteria. The tokens newly added to the Monitoring Tag list are:

Balancer (BAL), Cortex (CTXC), PowerPool (CVP), Convex Finance (CVX), Dock (DOCK), Kava Lend (HARD), IRISnet (IRIS), MovieBloc (MBL), Polkastarter (POLS), Status (SNT), Sun (SUN).

In contrast, Enzyme (MLN) and Horizon (ZEN) will be removed from the Monitoring Tag list. This shift indicates a reassessment of the risks and stability associated with these tokens. However, Binance’s decision to tag these 11 tokens highlights their increased volatility and potential for not meeting the platform’s listing criteria in the future.

Meanwhile, according to Binance, the Monitoring Tag serves as a warning that the listed tokens are under scrutiny and may face delisting if they fail to meet specific standards. These standards include the project’s commitment, development activity, trading volume, network stability, public communication, and ethical conduct.

Binance emphasizes that the Monitoring Tag aims to maintain a healthy and sustainable cryptocurrency ecosystem.

Also Read: 900M SHIB Burn Sparks Optimism Over $0.00003 Price Target Ahead

Price Drop Ahead?

The introduction of the Monitoring Tag for these tokens has significant implications for investors. Historically, announcements of this nature from major crypto exchanges like Binance tend to impact market sentiment and token performance. Positive announcements usually boost market confidence, while warnings and potential delistings can weigh on investors’ sentiment.

Meanwhile, the affected tokens could experience increased price volatility and reduced trading volume as investors respond to the perceived risk. Tokens under the Monitoring Tag are also subject to additional trading restrictions on Binance.

In addition, users must complete a quiz every 90 days to trade these tokens, ensuring they understand the associated risks. This additional layer of scrutiny aims to protect users and promote informed trading decisions.

The announcement underscores the importance of due diligence in the rapidly evolving crypto market. Investors must stay informed about the status and compliance of their holdings, particularly in light of such warnings from leading exchanges. In other words, Binance’s criteria for the Monitoring Tag emphasize the importance of project transparency, network stability, and ethical conduct.

Also Read: Elon Musk Announces JARVIS-Inspired xAI Grok 2 AI Chatbot Release Date

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

U.S. District Court Judge Amy Berman Jackson is allowing U.S. the Securities and Exchange Commission’s (SEC) lawsuit against Binance to proceed.

However, Judge Jackson also dismissed certain charges in the case.

The SEC accuses Binance of offering unregistered broker, trading, and clearing services for digital asset securities in the U.S.

In its ruling, the court upheld charges related to Binance’s initial coin offering (ICO), ongoing sales for BNB, BNB Vault, and staking services, as well as allegations of failure to register and fraud.

But Jackson also granted Binance’s motion to dismiss charges concerning secondary sales of BNB and Simple Earn.

The decision emphasized the evolving nature of tokens. Just because a token may have initially been considered part of an investment contract does not necessarily mean it retains that classification indefinitely.

Commenting on the ruling, Cody Carbone, chief policy officer at the Digital Chamber, highlighted the court’s clarification on the evolving nature of token classifications. He underscored the importance of distinguishing between tokens that function as securities and those that do not in today’s marketplace.

🚨🚨COURT RULES that just because a token was part of an investment contract in the past, it doesn’t mean it should always be considered a security.

Judge Amy Berman Jackson of the U.S. District Court for the District of Columbia providing the clarity the #crypto industry…

— Cody Carbone (@CodyCarboneDC) June 29, 2024

The SEC’s approach to crypto regulation has been a subject of debate, with Judge Jackson criticizing the agency’s evolving stance and the lack of a comprehensive regulatory framework tailored to the crypto industry.

U.S. Treasury implements tax reporting requirements for crypto

Meanwhile, the U.S. Treasury Department moved forward with long-awaited tax regulations targeting cryptocurrency transactions.

Under the new rules finalized on June 28, crypto brokers, including exchanges and payment processors, are now required to report users’ sales and exchanges of digital assets to the Internal Revenue Service (IRS).

This move, part of the $1 trillion bipartisan 2021 Infrastructure Investment and Jobs Act, seeks to tackle tax evasion in the crypto space.

The regulations are set to phase in from next year for the 2026 tax season. They are expected to align crypto tax reporting with existing requirements for traditional financial instruments like stocks and bonds.

Treasury officials noted adjustments were made from the original proposal to ease burdens on brokers and introduce the requirements gradually.

Lawrence Zlatkin, VP of Tax at Coinbase, welcomed the finalized regulations on X and commended the IRS for developing more practical rules focused on custodial brokers like Coinbase. He highlighted improvements in the implementation timeline and measures to prevent duplicate reporting.

Final crypto tax regs are here!

– We commend the IRS for developing more reasonable, rational rules that focus on custodial brokers, like @coinbase. The rules lay out a more practical timeline for implementation, and include a provision to prevent reporting duplication. 1/4— Lawrence Zlatkin (@LawrenceZlatkin) June 28, 2024

However, Zlatkin expressed concerns over the absence of a de minimis rule and the inclusion of non-financial transactions, advocating for rules comparable to those for traditional financial brokers.

The Treasury’s final rule also includes a provision setting a $10,000 threshold for reporting transactions involving stablecoins.

Supreme Court limits regulatory powers

In a separate development, the Supreme Court delivered a landmark ruling curtailing the executive branch’s authority to interpret laws, significantly impacting the regulatory powers of federal agencies.

The decision, which overturned the long-standing “Chevron deference” doctrine, empowers the judiciary to scrutinize agency actions more closely across various policy domains, including crypto.

It underscores a move towards greater judicial oversight, giving courts more influence over the scope and interpretation of federal agency regulations.

In response to this legal backdrop, Paul Grewal, Coinbase’s chief legal officer, took to X to highlight ongoing legal battles involving regulatory transparency.

Chevron: gone. Secondary sales in the Binance case: gone (more to say about that…). And now, late on a Friday, more stonewalling from @SECGov to stop Coinbase from obtaining documents from Gary Gensler in our litigation. 🧵⬇️

— paulgrewal.eth (@iampaulgrewal) June 29, 2024

Grewal criticized what he described as stonewalling tactics by the SEC, aimed at hindering Coinbase’s efforts to obtain documents from SEC Chair Gary Gensler as part of their litigation.

Coinbase has requested documents related to Gensler’s communications, arguing that they are crucial to revealing potential due process violations in the SEC’s enforcement actions.

This request stems from statements made by Gensler in March 2021, where he indicated the SEC’s limited regulatory authority over digital asset exchanges, a stance Coinbase believes is pertinent to their case against the regulator.

Source link

Binance

U.S. Judge Lets Most of SEC Case Against Binance Proceed, Dismisses Secondary Sales Charge

Published

2 days agoon

June 29, 2024By

admin

In a late Friday order, Judge Amy Berman Jackson, of the District Court for the District of Columbia, ruled that the SEC’s charges against Binance for the initial coin offering and ongoing sales for BNB, BNB Vault, staking services, failure to register and fraud charges can proceed. She granted Binance and Zhao’s motion to dismiss charges tied to secondary BNB sales and Simple Earn.

Source link

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: