crypto

Ethereum (ETH) Products See Largest Institutional Outflows Since August 2022: CoinShares

Published

4 days agoon

By

admin

Digital assets manager CoinShares says that institutional crypto products sustained outflows last week for the third week in a row.

In its latest Digital Asset Fund Flows report, CoinShares says digital asset investment products suffered $30 million in outflows last week.

“Digital asset investment products saw a third consecutive week of outflows totaling US$30m, with last week indicating a significant stemming of the outflows. In contrast to prior weeks, most providers saw minor inflows, although this was offset by incumbent Grayscale seeing US$153m outflows.”

Despite overall outflows, the US, Brazil and Australian regions saw $43 million, $7.6 million and $3 million in inflows, respectively.

“Negative sentiment pervaded Germany, Hong Kong, Canada and Switzerland with outflows of US$29m, US$23m, US$14m and US$13m respectively.”

While the leading crypto by market cap Bitcoin (BTC), multi-asset investment vehicles, Solana (SOL) and Litecoin (LTC) brought in $18 million, $10 million, $1.6 million and $1.4 million in inflows, Ethereum (ETH) had one of its worst weeks in years.

“Ethereum saw the largest outflows since August 2022, totaling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.”

Chainlink (LINK) and XRP also brought in $0.6 million and $0.3 million, respectively.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/phive/Sensvector

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

Altcoins

20% Price Drop Follows $87 Million Spending Outrage

Published

8 hours agoon

July 5, 2024By

admin

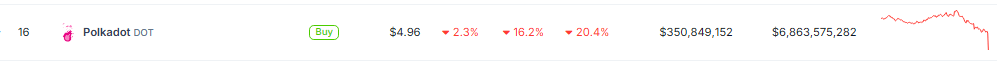

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

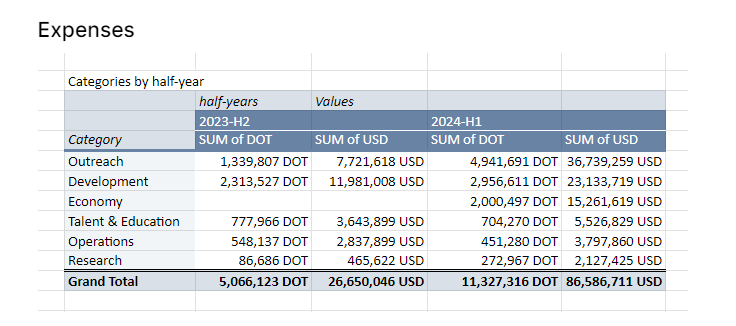

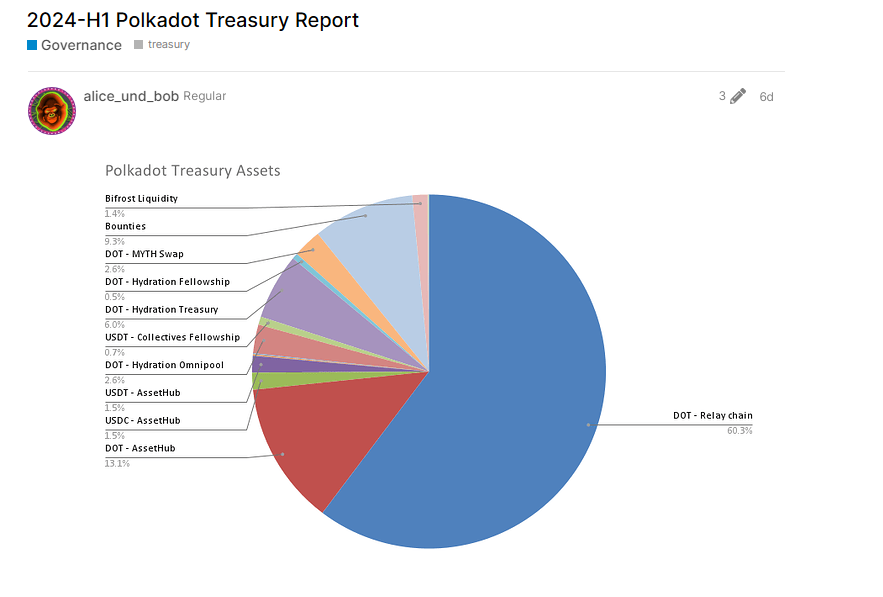

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Bitcoin

Bitcoin Closes CME Gap, Expert Predicts What Happens Next

Published

24 hours agoon

July 4, 2024By

admin

Crypto expert Michael van de Poppe has highlighted an important indicator which suggests that Bitcoin could make a crucial bounce from its current price level. This follows the flagship crypto’s recent decline below $60,000.

BTC’s CME Gap Has Closed

Van de Poppe revealed in an X (formerly Twitter) post that Bitcoin’s CME gap has closed and added that it is time for the crypto token to enjoy a relief bounce from its current price level. From the chart he shared, Bitcoin will reclaim $60,000 as support before moving further to the upside.

Related Reading: Shiba Inu Starts July On A High Note: Burn Rate Surges 16,854%, Trading Volume Rises 170%

Crypto analyst Mkybull Crypto also confirmed that the CME gap has been filled. Like Van de Poppe’s prediction, the analyst expects Bitcoin to reclaim the $60,000 range and possibly continue its upward trend. Mikybull Crypto revealed that Bitcoin has completed its inverse head-and-shoulder pattern on the daily chart. He predicted that the flagship crypto could reach a minimum breakout target of $70,000 when it successfully breaks out above $62,000.

Mikybull Crypto also mentioned that the Moving Average Convergence/Divergence (MACD) indicator indicates that a bullish cross is imminent for Bitcoin. He noted that this indicates strength for the flagship crypto and that its price is poised to rise. The crypto analyst is also undeterred by Bitcoin’s recent underperformance as he is confident that a parabolic rally will soon enough.

Contrary to what some might think, he claimed that the cycle top isn’t in yet and that this is simply a “final shakeout” before the market top is in. Based on the chart he shared, he predicts that Bitcoin will still climb above $100,000 and possibly reach $130,000. The analyst had previously mentioned between $138,000 and $150,000 as “optimal targets for Bitcoin in this bull run.”

What Next For Bitcoin?

With Bitcoin failing to hold above $60,000, the bearish calls are becoming louder in the crypto community. Some predict that the flagship crypto could drop to the $40,000 range soon enough. Crypto analyst CrediBULL Crypto claimed that “there is still a lot that must be done” for Bitcoin to drop that range, suggesting that it is unlikely to happen anytime soon.

Related Reading

He also provided insights into what will likely happen to Bitcoin at its current price level. According to CrediBULL Crypto, there is a chance that Bitcoin will wick the $58,000 low, hold a higher low above the $56,000 low, and then reverse from there. He further raised the possibility of Bitcoin dropping into the $53,000 demand area if the $56,000 lows are breached.

Additionally, the crypto analyst mentioned that $40,000 could become possible if Bitcoin fails to hold above $53,000. However, he believes this scenario of Bitcoin dropping to $40,000 is “the least likely to actually play out.” He remarked that this isn’t something anyone should be placing “heavy weight on at this time.”

Featured image created with Dall.E, chart from Tradingview.com

Source link

Alameda Research

Alameda-Backed Mining Firm Genesis Digital Assets Considering IPO in US: Report

Published

2 days agoon

July 3, 2024By

admin

A Bitcoin (BTC) mining firm backed by disgraced FTX founder Sam Bankman-Fried is reportedly considering an initial public offering (IPO) in the US.

According to a new report by Bloomberg, anonymous sources familiar with the matter say that Genesis Digital Assets, which is backed by Alameda Research, is currently working with advisors on the potential listing.

Alameda Research was once the investing branch of the former crypto exchange FTX.

One of the sources divulged that the firm is planning on launching a pre-IPO funding round in the coming weeks.

Genesis Digital Assets, which has its roots in 2014, eventually started large-scale operations in China before the nation banned the entire industry in 2021. Then, the company raised $550 million and moved to the US, according to the report.

Between 2021 and 2022, Alameda Research invested over $1 billion into Genesis Digital Assets, before the FTX empire collapsed and Bankman-Fried was accused and subsequently found guilty of defrauding investors and mishandling billions of dollars worth of customer funds.

In April 2022, Genesis Digital Assets was valued at $5.5 billion, according to an internal company memo seen by Bloomberg News. However, when FTX collapsed in November 2022, the digital assets industry saw sharp price decreases across the board.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/aslysun

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs