ETH

Ethereum Price Hints Major Reversal as Whales Buy 700,000 ETH Amid Market Dip

Published

1 week agoon

By

admin

The first half of June was notably bearish for the crypto market as Bitcoin price hit a low of $65000 amid several unfavorable updates. The FUD surrounding macroeconomic development, Bitcoin miners capitulating, the ETFs outflow, and whale distribution combined to fuel the recent correction in the majority of major cryptocurrencies including Ether. The Ethereum price dropped to a three-week low of $3362 on Friday but has now witnessed an ease in selling pressure amis stable the weekend.

Also Read: Crypto Headlines of The Week: Bitcoin & ETH Ride Rollercoaster, XRP & LUNC Make Waves

SEC’s Potential ETF Approval and Whale Investments Boost Ethereum Price

During the recent market downturn, Ethereum formed a new lower high at the $3950 resistance level on the daily chart. The coin buyers failed to surpass the last high indicating an initial shift in market sentiment where traders prefer to sell on bullish bounces.

On June 14th, the coin’s price peaked at $3,887 before experiencing a significant drop of 13.5%, bringing it down to a low of $3,364. This price level coincides with the 100-day EMA, which has now begun to stabilize the declining Ethereum price, aiding its recovery to $3,509. Concurrently, the market capitalization has increased to $431.2 billion.

This surge is likely triggered by SEC Chair Gary Gensler’s recent statement to lawmakers, suggesting that the agency could finalize the approvals for listing and trading spot ETH exchange-traded funds (ETFs) over the summer.

Moreover, in a recent tweet, renowned trader Ali (@ali_charts) highlighted a significant trend in the Ethereum market. According to his analysis, Ethereum whales have made substantial investments over the past three weeks, purchasing more than 700,000 ETH, which amounts to approximately $2.45 billion.

#Ethereum whales have bought over 700,000 $ETH in the past three weeks, totaling approximately $2.45 billion! pic.twitter.com/sfmXnkqD49

— Ali (@ali_charts) June 15, 2024

This notable accumulation by large holders despite the ongoing correction indicates strong confidence for the Ethereum price to rebound.

Also Read: Ethereum Permanent Holders Scoop 298K ETH In A Day, ETH Price Rally Soon?

If the broader market correction persists, the ETH price may dive to $3200 and seek support from the long-coming support trendline. As per the past record, the Ethereum coin rebound thrice from dynamic support indicates a high accumulation for investors.

That said, the daily chart indicates a new resistance trendline forming above, suggesting that Ethereum might enter a sideways trading pattern. A breakout above this barrier is needed for buyers to regain control, and bolster a rally to $3900.

Technical Indicator:

- Exponential Moving Average (EMA): The 100-and-200-day EMAs as dynamic support preventing ETH price from a major correction

- MACD: A bearish crossover between the MACD (blue) and signal (orange) indicates a seller as the key driving force behind the current price movement.

Related Articles

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

ETH

This Historical Ethereum Top Signal Is Yet To Appear This Cycle

Published

11 hours agoon

June 26, 2024By

admin

On-chain data suggests this signal that has historically occurred around Ethereum peaks has yet to appear in the current cycle.

Ethereum Foundation Wallets Haven’t Made Large Outflows This Cycle So Far

In a new post on X, the market intelligence platform IntoTheBlock has discussed a pattern that Ethereum has witnessed alongside its previous market peaks.

The pattern in question is related to the netflows for the wallets associated with the Ethereum Foundation. The ETH Foundation is a non-profit entity supporting the cryptocurrency and its ecosystem.

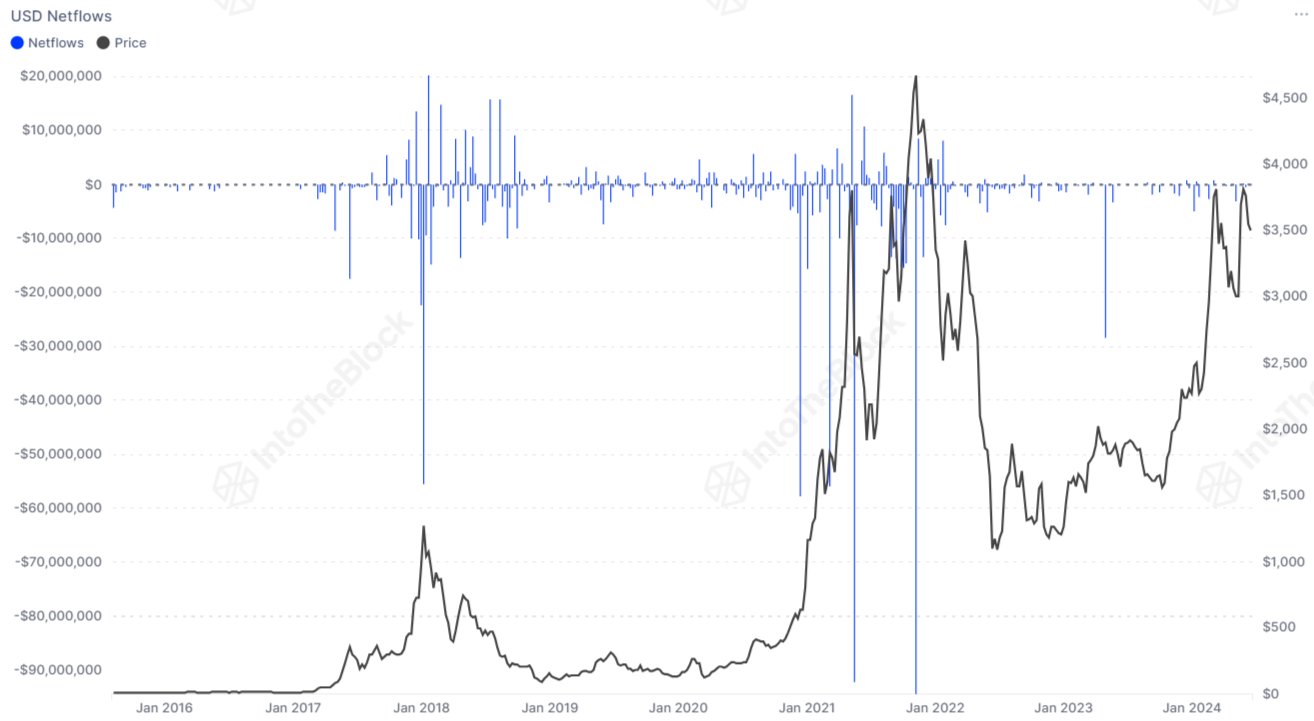

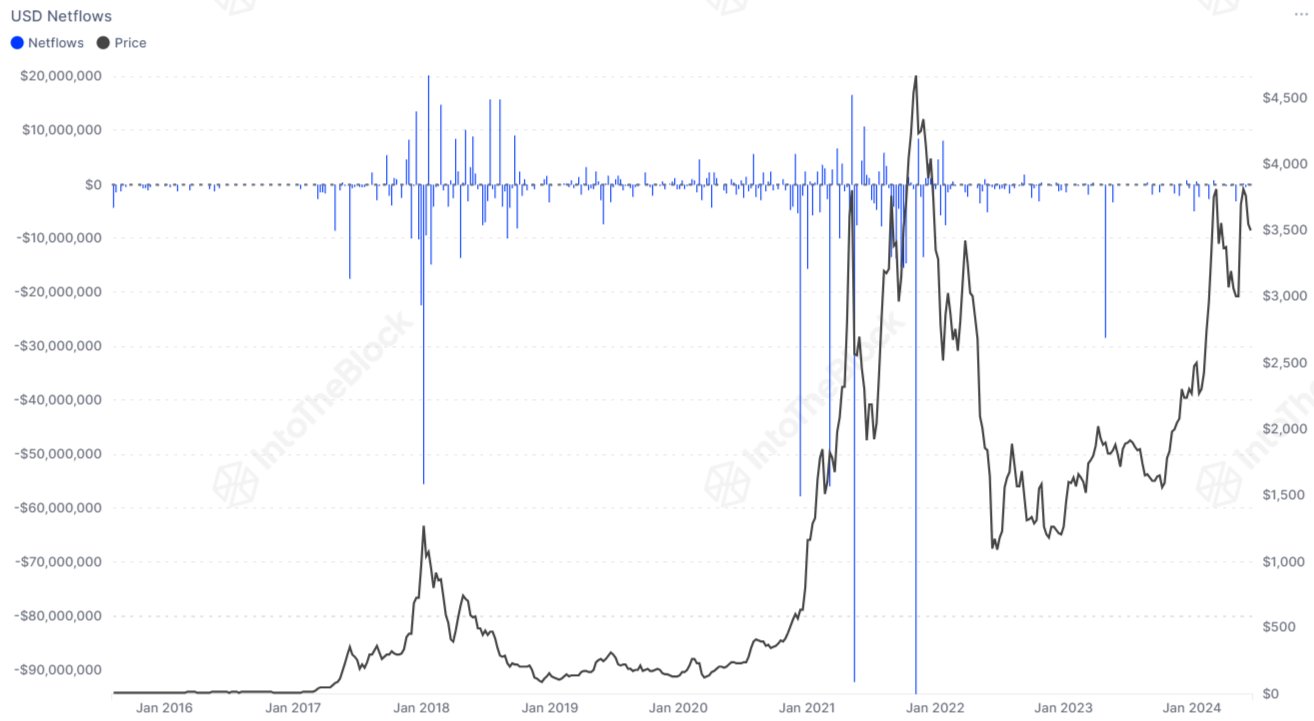

Below is the chart shared by the analytics firm that shows the trend in the net amount of ETH (in USD) moving in or out of the wallets connected to this organization.

As is visible in the above graph, the netflows for the Ethereum Foundation have generally taken negative values during the past bull markets. Negative netflows naturally correlate to a net amount of ETH movement away from the wallets connected to the company.

Interestingly, the indicator has seen especially large red spikes around the tops of the cryptocurrency. As IntoTheBlock explains,

Historically, during each bull market, the Foundation has strategically sold substantial amounts, often aligning these sales almost perfectly with market peaks.

The chart shows that the indicator’s value has been more or less neutral during the past few months, even though the asset’s price has increased significantly.

This suggests that the Ethereum Foundation hasn’t been making any major sales during this bull market. Given the historical pattern, this may be a sign that a top isn’t yet here for the cryptocurrency, or at least the organization doesn’t judge it to be so.

Another explanation, however, could be that the non-profit entity has changed its strategy for this new cycle, meaning that the past trend would no longer hold the same weight.

In some other news, the official email of the Ethereum Foundation was recently compromised, as Tim Beiko, one of the ETH developers, had revealed in an X post.

The developer had noted that the organization was trying to reach out to SendPulse, an email automation service used by the firm, to resolve the problem.

In a follow-up post, Beiko confirmed that the team sent out an update to subscribers of the Ethereum Foundation blog, warning them that the previous email, announcing a “staking platform” by the organization, resulted from the compromise.

“We should have locked down all external access, but we are still confirming,” said the developer in the post.

ETH Price

Ethereum plunged under the $3,300 level yesterday, but the asset has since recovered above $3,400.

Source link

Altcoins

Ethereum On-Chain Metric Suggests Potential for Altcoin Market Rallies, According to Analytics Firm CryptoQuant

Published

3 days agoon

June 23, 2024By

admin

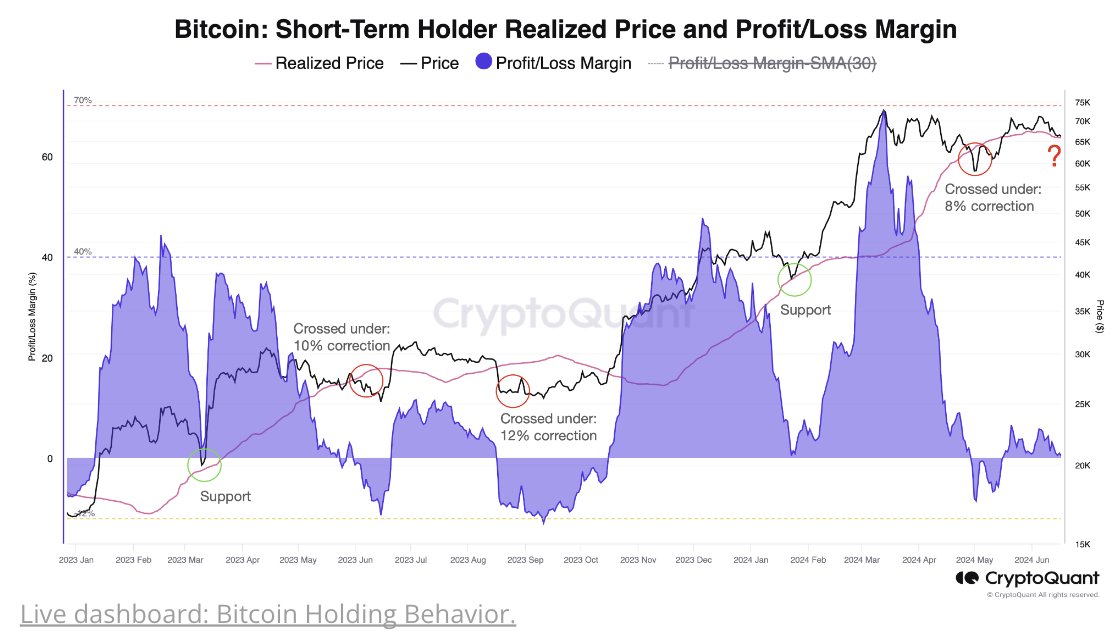

An Ethereum (ETH) on-chain metric suggests the altcoin market could be primed for a price surge, according to the digital asset analytics firm CryptoQuant.

The firm says on the social media platform X that Ethereum’s Market Value to Realized Value (MVRV) indicator is rising faster than Bitcoin’s (BTC) MVRV.

“This suggests that ETH’s market is heating up. Historically, when Ethereum surges, other alts tend to follow.”

MVRV is the ratio of a digital asset’s market capitalization relative to its realized capitalization (the value of all the assets at the price they were bought). It is used to assess whether the token is undervalued or overvalued.

ETH is trading at $3,514 at time of writing. The second-ranked crypto asset by market cap has largely traded sideways this week.

CryptoQuant also notes that Bitcoin is trading below the critical support level of $65,800, which the firm says suggests a potential 8%-12% correction toward $60,000.

BTC is priced at $64,148 at time of writing. The top-ranked crypto asset by market cap is down nearly 1.5% in the past 24 hours and more than 3% in the past week.

Julio Moreno, CryptoQuant’s head of research, says on X that the Bitcoin market is currently at its least bullish point since September 2023, based on its bull market cycle indicator.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin Could Skyrocket Nearly 300%, Says SkyBridge Capital CEO Anthony Scaramucci – Here’s the Timeline

Published

4 days agoon

June 22, 2024By

admin

SkyBridge Capital founder Anthony Scaramucci is making a massive prediction for Bitcoin (BTC) and Ethereum (ETH) this cycle.

In a new interview on the Unchained Crypto YouTube channel, Scaramucci says he believes Bitcoin could soar nearly 300% and Ethereum nearly 240% from their current values.

“I can only give you my guess [for the market top] and so I think we get to $10,000 to $12,000 on Ethereum. And I do think we get to somewhere [between] $170,000 to $250,000 on Bitcoin.”

He also predicts that US President Joe Biden will win re-election in November over former President Donald Trump and crypto assets will surge to new all-time highs (ATH) afterward.

“I think we’ll we’ll see all-time highs for Bitcoin and other assets in this category during a second Biden administration.”

According to Scaramucci, one of the biggest bullish catalysts for Bitcoin this cycle could be greater adoption of the top digital asset by institutional investors.

“The number one thing for me is somebody is going to declare Bitcoin an asset class. It’ll be a consultant. These large pension funds, in order to preserve their jobs, go to outside consultants and ask them for advice on asset allocation, who to put the money with, where to put the money, private equity, hedge funds, etc., stocks and bonds.

And somebody is going to declare Bitcoin an asset class, and then offer a suggestion that Bitcoin should be 1%, 2%, 3% of an institutional tactical asset allocated portfolio. And when that happens, it’s going to open up a huge vein of demand for Bitcoin.

The state of Wisconsin, as you know, announced last month that they have about $160 million worth of Bitcoin at the price that they bought them at…

The state of Wisconsin is saying, ‘Okay, this is going to be part of an asset-allocated portfolio for institutions. And so if I’m not long Bitcoin, I’m short Bitcoin and if I’m short Bitcoin, and it’s a high-performing asset, my total portfolio may underperform my peer group.’

And so I think that’s happening, and that will create an acceleration of adoption and an acceleration upward in price.”

Bitcoin is trading for $64,163 at time of writing, down slightly in the last 24 hours. Meanwhile, Ethereum is trading for $3,531 at time of writing, up slightly in the last 24 hours.

?

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

Ron Wyden on FISA Reform and Crypto

Latin America's Largest Fintech Bank Integrates Bitcoin Lightning Payments Via Lightspark

bitter pills in crypto mass adoption?

Solana and Cardano Lead Top 10 Crypto Rebound

This Historical Ethereum Top Signal Is Yet To Appear This Cycle

Bitcoin's Trump Card: Dividing Is The Wrong Move

Florida lawmaker pitches ‘Bitcoin for Taxes’ bill

SEC Chair Says Approval Is Going Smoothly

Bitcoin on Cusp of ‘Top Heavy’ Zone As New Phase Begins, According to On-Chain Analyst – Here’s What He Means

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: