DeFi

Farcana (FAR) plunges 60% amid reports of hacked wallet

Published

2 weeks agoon

By

admin

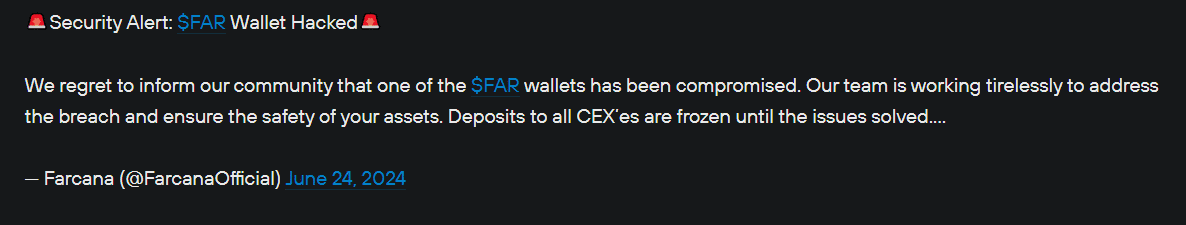

In a now-deleted X post, blockchain game Farcana said that one of its crypto wallets “has been compromised,” triggering a 60% plunge for FAR.

Farcana, a blockchain-based shooter game with tournaments, seems to have suffered a significant security breach, resulting in a sharp decline of over 60% in the value of its native token, FAR.

In a now-deleted X post, which can still be seen on the Turkish version of crypto.news, Farcana said that “one of the FAR wallets has been compromised,” adding that deposits to all centralized crypto exchanges have been “frozen until the issues solved.”

As of press time, Farcana has not provided an explanation for the removal of the post. In a separate X post, the team advised users to avoid clicking on any links and reassured them that they are “working tirelessly to address the breach and ensure the safety of your assets.”

While the scale of the attack remains unclear, it has had an immediate impact on FAR’s price, which plummeted by 60% to $0.015, according to CoinGecko data.

Founded in 2022, Farcana raised $10 million in seed funding from Animoca Brands, Polygon Ventures, Fenbushi Capital, and Merit Circle among others. Built on Unreal Engine 5, Farcana shares a similar graphical style with Overwatch, a team-based multiplayer first-person shooter game by Blizzard Entertainment. The game is understood to operate under a free-to-play model.

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

cryptocurrency

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Published

9 hours agoon

July 5, 2024By

admin

Defunct cryptocurrency exchange Mt. Gox has started payments to rehabilitation creditors as part of its rehabilitation plan.

More than 10 years after its collapse, Mt Gox creditors are finally getting paid back.

According to a July 5 announcement, payments are being made in Bitcoin and Bitcoin cash via centralized crypto exchanges designated to handle the transactions.

However, rehabilitation creditors need to satisfy some prerequisites before receiving the payments. These include confirming the validity of their accounts and agreeing to the terms of the agreement from intermediary agencies handling the receipt of the funds.

Additionally, the Rehabilitation Trustee and designated cryptocurrency exchanges need to finish their discussions about how to handle the repayments. This ensures that both parties are aligned on the repayment process.

Several recipients have also confirmed the development on Reddit. One user confirmed receiving the exact amount that they were expecting to receive on the crypto exchange Bitbank.

“The BTC/BCC coins are already under my control,” the user wrote.

Another user shared an email received from Mt. Gox stating that their exchange had been credited via a Japan-based creditor. Mt. Gox Co., Ltd. was labeled as the Rehabilitation Debtor, and Nobuaki Kobayashi, Attorney-at-law, as the Rehabilitation Trustee.

“This transfer was made to [your exchange], which you designated as your Designated Cryptocurrency Exchange etc., on the MTGOX Online Rehabilitation Claim Filing System […] In accordance with the Rehabilitation Plan, the repayment took effect at the time the transfer was recorded on the blockchain.” the email stated.

According to some responses to the user’s post, only those who selected cryptocurrencies as a means of repayment at the time of filing their claims are receiving the repayments.

At the time of writing, only BitBank and SBI, both Japanese cryptocurrency exchanges, had been confirmed by users as having received the repayments.

Mt. Gox was one of the largest cryptocurrency exchanges before filing for bankruptcy in 2014. The reason was a catastrophic security attack that led to the loss of around 650,000 BTC belonging to customers and about 100,000 of the exchange’s own.

A compensation plan was approved by a court in 2021. The plan was supported by the majority of affected users.

This led to years of waiting before the exchange finally started paying out customers in December 2023.

The recent cryptocurrency repayments come as Bitcoin has dropped below the $55,000 mark for the first time since February. With Mt. Gox moving over 47,000 Bitcoin, the transfers have been flagged as one of the key reasons behind dwindling price pressure on the original cryptocurrency.

Source link

cryptocurrency

Polkadot’s multi-million marketing expenses spark fury in blockchain community

Published

3 days agoon

July 2, 2024By

admin

Blockchain project Polkadot is under fire after revealing $37 million in expenses on the marketing budget, triggering criticism and scrutiny from its community.

Polkadot, a sharded multi-chain network founded by the Ethereum co-founder Gavin Wood, is facing backlash after disclosing $37 million in marketing expenses, leading to criticism and scrutiny from its community.

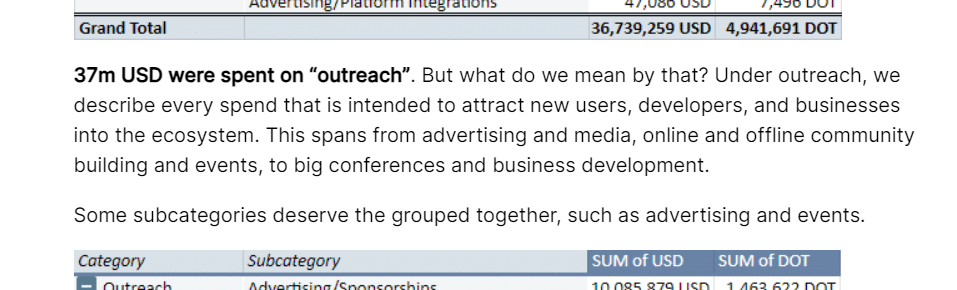

In its H1 2024 treasury report, Polkadot said that nearly $40 million was spent on “outreach,” saying that under outreach, the company describes “every spend that is intended to attract new users, developers, and businesses into the ecosystem.”

“This spans from advertising and media, online and offline community building and events, to big conferences and business development.”

Polkadot

Of the total marketing budget, over $20 million was allocated to advertising, while $10 million worth of DOT tokens were used for sponsorships. These sponsorships included sports deals, collaborations with a race car driver, and a partnership with an e-sports tournament organizer. For comparison, the report noted that Polkadot spent $23 million on developments in the first half of the year.

The marketing expenses quickly triggered outrage within the blockchain community, with accusations of centralization and frivolous financial campaigns. Victor Ji, co-founder of Manta Network, expressed his dissatisfaction in an X thread, calling Polkadot a “highly toxic ecosystem that lacks any real value for web3” and accusing it of discrimination and lack of support for network-built projects.

A concrete example is the Polkadot Academy event held in Hong Kong this February, where less than a quarter of the participants were Asian, even though this was an event in Asia (costing over a million dollars). It was at this event that I first encountered Gavin Wood, and when I… https://t.co/JxyvyIM6S9

— victorji.eth ✨ (@victorJi15) July 2, 2024

Another core developer at Polkadot, using the alias @seunlanlege, also criticized the project’s approach, saying it’s “insane to me how much money the Polkadot treasury is wasting on misplaced marketing,” and drawing parallels between Polkadot and the bankrupt FTX crypto exchange.

The report noted that at the current spending rate, Polkadot’s treasury has about “two years of runway left,” while acknowledging the unpredictable nature of crypto-denominated treasuries. As of now, Gavin Wood has not made any public statements on the matter.

Source link

DeFi

Solana DEX Zeta Markets’ Airdrop Goes Off With a Bang as ZEX Token Soars

Published

1 week agoon

June 27, 2024By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Zeta Markets, a Solana-based decentralized exchange (DEX) that also aims to build the chain’s first layer-2 scaling network, launched an airdrop for users on Thursday that has so far blasted past initial expectations.

The ZEX airdrop, which consists of 100 million tokens—10% of the token’s total supply—was tailored to reward long term users of Zeta, which facilitates the trade of on-chain perpetuals. Perpetuals are a type of derivative contract that allow traders to speculate on the future price of crypto assets, but crucially have no expiration date.

Early this morning, ZEX debuted at $0.13, slightly above pre-market trading forecasts. It then quickly tripled in value, shooting up above $0.30—and pumping the value of Zeta’s airdrop to some $30.78 million.

At writing, ZEX has since leveled out to roughly $0.25.

The Zeta airdrop will land in two phases. Today, 80% of the airdrop became available to early users of the platform, and has been allocated based on users’ “Z scores,” a points system that tracked individual trading volumes among other criteria. At a second, later date, the remaining 20% of the airdrop will be doled out to ZEX holders who stake their tokens with Zeta.

Staking is a central component of ZEX, which will serve as Zeta Markets’ governance token. In a bid to encourage commitment to the token, the longer holders stake ZEX, the exponentially greater influence they will be able to exert over Zeta’s direction—and the more financial incentives they will accrue.

ZEX will also, eventually, serve as the native gas token for Zeta X—a DeFi-focused blockchain built on top of Solana, which Zeta’s team aims to debut by early next year.

Zeta is currently one of Solana’s largest decentralized exchanges. In May alone—perhaps in build-up to today’s airdrop—the platform saw some $3.24 billion worth of trading volume, according to DeFi Llama.

It’s been a big summer for crypto airdrops. Just yesterday, Ethereum layer-2 network Blast launched a massive $354 million airdrop for users. Despite the scale of that free token giveaway, however, many Blast users were underwhelmed with the result—in part thanks to sky-high forecasts of the airdrop’s value—though the price did tick up later in the day.

Another sign that, in crypto, expectations can often matter more than size.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs