Banking

Fold Adds New Feature And Team Member To Better Bank Bitcoiners

Published

3 weeks agoon

By

admin

Fold recently released its Direct to Bitcoin feature as part of a set of features that the team at Fold calls its Bitcoin Checking Account. Fold Users can now auto-convert anywhere from 1% to 100% of their fiat deposits to bitcoin from a checking account through which they can also make payments.

This new feature is the first of many that the company plans to release in the coming months that will help its users more easily live on a bitcoin standard.

You can now transition to a bitcoin standard in two taps using @fold_app.

Earn in bitcoin and maintain access to all the day to day financial tools you need. pic.twitter.com/V8BQgwTs7S

— WILL REEVES (@wlrvs) May 31, 2024

“Direct to Bitcoin is an automated way to balance between dollars and bitcoin for any funds coming in, and it’s essentially the base on top of which the Fold product works,” Fold CEO Will Reeves told Bitcoin Magazine.

“It really brings a fully functional banking experience to Bitcoiners, which really hasn’t existed in a great way until now,” he added.

In this new phase for Fold, Reeves and his team want to make it easier for Bitcoiners to use bitcoin as their base money, something that they not only accumulate through the app but can also easily convert to US dollars when they want to make a payment, as well.

To help usher in this new era, Fold has hired Ecosystem Lead Brian Harrington, whose first major task has been bringing features for the Bitcoin Checking Account to market.

The banking features you need

The currency you prefer

Bitcoin is better than dollars https://t.co/eKxJplD11i

— Brian Harrington (@BrainHarrington) May 31, 2024

Harrington is well known for his work at Choice App, where he directed the marketing efforts for the first Bitcoin IRA account in 2020, an offering that changed the public’s perception about holding bitcoin in an IRA. Now, many companies offer bitcoin IRAs.

Harrington seems extremely excited as he prepares to bring attention to Fold’s Bitcoin Checking Account. He wants people to be able to convert their bitcoin to US dollars and then spend those dollars all in one app, an idea that was born from his own frustration.

“I was tired of switching back and forth between a bank and a bitcoin exchange,” Harrington told Bitcoin Magazine.

“The checking account product solves what I call having an ACH portal. What is a bank? It’s access to the ACH network. I didn’t want to use the ACH portal at a USD maximalist institution anymore,” he added.

“After searching for these solutions for myself, I’m excited to work with Will and the team on making this a cohesive thing.”

With that said, both Harrington and Reeves stressed that what Fold is looking to accomplish is bigger than just these two features as they stand on their own.

“What Fold is doing is bigger than a single feature,” Harrington said.

“It’s not about features. It’s about this thing that’s happening with Fold,” he added.

Reeves chimed in to elaborate.

“Bitcoin is coming more and more to the center of our lives and to millions of lives,” he explained.

“The world is getting much more expensive for people that hold dollars, it’s getting cheaper for Bitcoiners, but there’s no bank for Bitcoiners,” he added.

“We’re focusing on how we can be the bank for Bitcoiners that doesn’t exist today.”

To learn more about Fold and its future plans, check out our recent Founders profile on Reeves.

Download the Fold app here.

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

bank of america

Bank of America To Pay $12,000,000 Fine for Repeatedly Breaking the Law, Sending False Information to Regulators

Published

7 months agoon

December 4, 2023By

admin

One of the largest banks in the country is getting slapped with a multi-million dollar fine from the Consumer Financial Protection Bureau (CFPB).

The agency says Bank of America will pay $12 million for repeatedly sending false information to federal regulators.

The CFPB says BofA has routinely violated the Home Mortgage Disclosure Act, which was enacted in 1975.

The law requires lenders to maintain certain records and submit data about loan applications and originations to the CFPB to protect consumers against predatory practices in the residential mortgage market.

The CPFB says that hundreds of BofA loan officers neglected their duty to ask mortgage applicants a number of demographic questions as mandated by federal law. But instead of following up to get the necessary details, the loan officers falsely reported that 100% of mortgage applicants opted not to provide their demographic data over a three-month period.

The regulator also says that BofA failed to ensure that its loan officers were providing accurate information on mortgage applications. According to the CFPB, the lender’s loan officers were not collecting the required demographic data from mortgage applicants as early as 2013 but BofA chose to overlook the shortcoming.

Says CFPB Director Rohit Chopra,

“Bank of America violated a federal law that thousands of mortgage lenders have routinely followed for decades. It is illegal to report false information to federal regulators, and we will be taking additional steps to ensure that Bank of America stops breaking the law.”

In addition to the $12 million fine, the CFPB is requiring Bank of America to take measures that would stop its illegal data-collection practice.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Banking

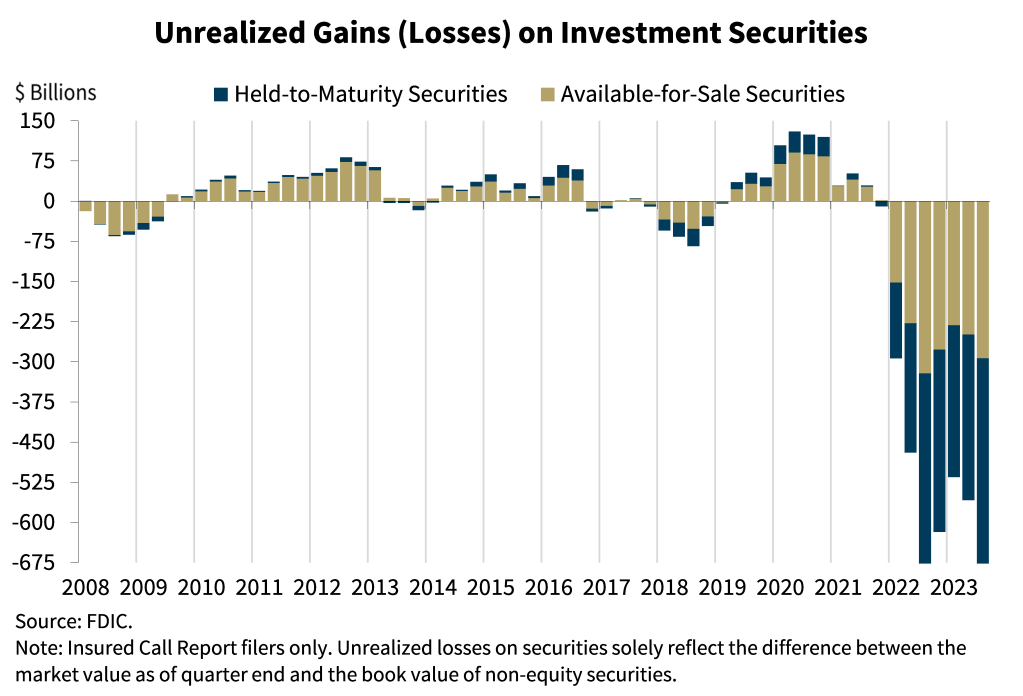

$684,000,000,000 in Unrealized Losses Hammer US Banks As Fed Reveals Surge in Underwater Assets

Published

7 months agoon

December 3, 2023By

admin

US banks are now saddled with a staggering $684 billion in losses on securities, according to a new report from the Federal Deposit Insurance Corporation (FDIC).

The agency says the total number of unrealized securities in the banking system at the end of Q3 surged by $126 billion – a 22.5% increase in the span of a few months.

Unrealized losses represent the difference between the price banks paid for bonds and the current value of those securities on the open market.

Although banks can simply hold their bonds until they mature, they can become an extreme liability when banks need injection of liquidity.

The dangers of unrealized losses came into focus early this year amid the collapse of Silicon Valley Bank.

The bank’s sudden failure back in March was sparked by an announcement that it had booked a $1.8 billion loss from selling a portion of its underwater bond portfolio.

Those losses stem from a historic collapse in bonds amid the Fed’s push to keep interest rates higher for longer.

In response to the failures of SVB and Signature bank, the Federal Reserve launched the Bank Term Funding Program (BTFP), which offers one-year emergency funding to banks in distress.

The FDIC says the banking industry’s profits margins have remained remarkably resilient, although deposit flight continues.

“In the third quarter, domestic deposits declined for the sixth consecutive quarter, though the outflow of deposits continued to moderate from the large outflows experienced in the first quarter. The level of liquid assets fell in the third quarter due to a reduction in securities portfolios…

Though the U.S. economy has remained strong in 2023, the banking industry still faces significant downside risks from the continued effects of inflation, rising market interest rates, and geopolitical uncertainty. These issues could cause credit quality, earnings, and liquidity challenges for the industry.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Banking

$120,000 Exits Citibank Account in Mysterious Scam – And Bank Tells Customer to Get a Lawyer

Published

8 months agoon

November 12, 2023By

admin

A resident of Skokie, Illinois is suing banking giant Citibank on behalf of his disabled sister over the sudden disappearance of $120,000.

Scott Jacobson says his mother left $150,000 in a Citibank trust account to pay for the expenses of his 65 year-old sister, who’s been fighting Alzheimer’s disease for years, reports NBC Chicago.

Jacobson says that caring for her disabled sister was manageable until October 14th, 2021, when he realized thieves somehow stole $120,000 from the account.

“I was shaking because I was more concerned about my sister than I was about anything else.”

According to Jacobson, a Citibank teller told him that someone made three international wire transfers from Bangkok, Thailand, which he says he never authorized.

In his effort to recoup the funds, Jacobson says he filed three fraud affidavits with the lending titan on the same day, expecting the bank to get to the bottom of the case. However, a bank representative told him that he should seek help from the US justice system.

“I had a personal banker, and I went in there and I asked him about all this. He says, ‘Well, you’re gonna have to get attorneys.’”

Jacobson also says he did not receive any notifications about the wire transfers.

Although the bank says it did not get Jacobson’s approval before greenlighting the wire transfers, Citibank says it did alert him via text and email, and is “in compliance with all regulations regarding wire transfers.”

Jacobson says he filed fraud affidavits on October 14th, 2021, but Citibank argues that he took legal action long after the 60-day record-keeping deadline had passed.

“Jacobson, through counsel, first made demand on Citibank to repay the three wire amounts on Aug. 29, 2022. By that time, [the third-party vendor] had already deleted the emails and text messages sent to Jacobson.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs