Cryptocurrency Market News

FTX CEO’s Asset Recovery Escalates As Sam Bankman-Fried Trial Looms

Published

10 months agoon

By

admin

In a battle to recover billions of dollars following the collapse of FTX, Chief Executive and Restructuring Officer John J. Ray III, is intensifying efforts just weeks before FTX founder Sam Bankman-Fried faces trial in what has been labeled one of the largest financial frauds in American history.

Bankruptcy court proceedings kicked off the week as FTX filed a lawsuit against Bankman-Fried’s parents, Allan Joseph Bankman and Barbara Fried.

The suit aims to reclaim millions of dollars allegedly fraudulently transferred and misappropriated by the couple, who purportedly took advantage of their access and influence within FTX to enrich themselves at the expense of debtors and creditors.

Continuing the pursuit of recovery, FTX Trading Ltd. subsequently filed a lawsuit on Thursday against four former employees of Alameda Ltd., an FTX affiliate based in Hong Kong.

The complaint alleges that these employees received $153 million in transfers shortly before the collapse of the crypto trading platform.

According to Bloomberg, these individuals allegedly leveraged personal connections to prioritize the withdrawal of their funds and digital assets from FTX once it became evident that the company was facing financial turmoil.

FTX CEO Ramps Up Efforts To Reclaim Assets

Per Bloomberg’s report, the bankruptcy proceedings have attracted the attention of outside investors and speculators, including prominent distressed-debt investors like Silver Point Capital, Diameter Capital Partners, and Attestor Capital.

These entities have seized the opportunity to acquire discounted FTX claims, anticipating that the protracted bankruptcy process will uncover additional valuable assets.

Court records show that they have already purchased over $250 million worth of FTX debts since the beginning of the year, according to a Bloomberg analysis.

While legal actions are in progress, some funds are being voluntarily returned. Stanford University, where Bankman and Fried held teaching positions and enjoyed reputations as legal scholars, announced its decision to return millions of dollars received from FTX and its associated entities.

According to court documents, Stanford received gifts totaling approximately $5.5 million from FTX-related entities between November 2021 and May 2022.

Bankman-Fried Family Turns To Risky Strategy

According to a Fortune Magazine report, The Bankman-Fried family has adopted a risky strategy in their legal battle, shifting blame onto prominent law firm Sullivan & Cromwell.

They argue that the firm failed to act in its best interests, downplaying its involvement in FTX’s downfall. This move aims to establish an “advice of counsel” defense, painting Sam Bankman-Fried as a well-meaning individual who received “poor legal advice”.

Criticism of Sullivan & Cromwell’s substantial legal fees, exceeding $100 million in the FTX bankruptcy case, raises ethical concerns but not necessarily legal wrongdoing.

Per the report, the family’s strategy may backfire, as it could provide prosecutors with access to new evidence by waiving attorney-client privilege.

Furthermore, the defense’s focus on blaming the law firm invites scrutiny of Bankman-Fried’s father, an active participant in key business decisions. Additionally, Bankman-Fried’s father received $10 million in FTX funds that he has yet to return, potentially for his son’s legal defense.

The Bankman-Fried family’s attempt to discredit Sullivan & Cromwell introduces complexity to the case. However, its effectiveness remains uncertain. As the legal proceedings continue, the implications of these strategies on the case and public perception of the family remain to be seen.

Featured image from Shutterstock, chart from TradingView.com

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Altcoins

Is Dogwifhat (WIF) Out? Price Tanks 15% On Whale Exodus

Published

2 days agoon

July 6, 2024By

admin

Dogwifhat, the once-high-flying Solana-based meme coin, suffered a brutal week, mirroring a broader crypto market correction and raising questions about the sustainability of the meme coin craze.

Related Reading

Meme Coin Mania Meets Market Mayhem

WIF, the token powering Dogwifhat, saw its price plummet 15% in just 24 hours. This dramatic drop erased all the gains from a recent rebound rally. The sell-off wasn’t isolated to Dogwifhat; the entire crypto market experienced a double-digit tumble, with major altcoins like Ethereum and Cardano feeling the heat.

Analysts point to a combination of factors behind the downturn, including renewed concerns about inflation and a recent sell-off by the German government and Mt. Gox, a defunct cryptocurrency exchange.

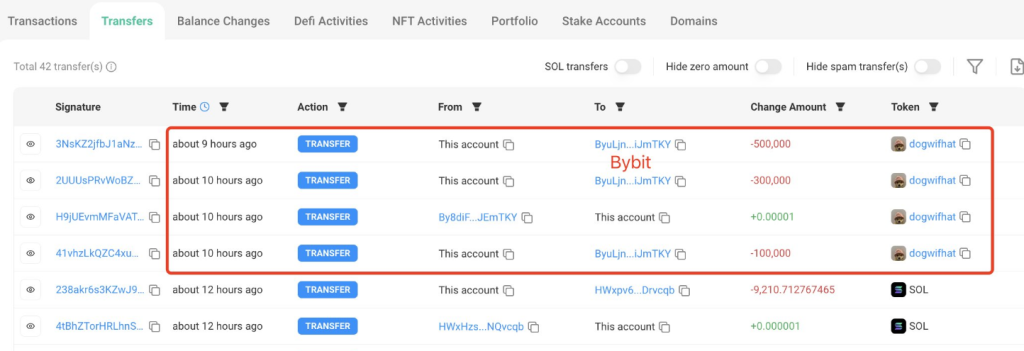

The price of $WIF dropped 15% as the market fell.

A whale deposited 900K $WIF($1.64M) to #Bybit 10 hours ago, leaving 974K $WIF($1.76M).https://t.co/qJwlxcWy15 pic.twitter.com/amIkvwKfNG

— Lookonchain (@lookonchain) July 4, 2024

The pain for Dogwifhat was further amplified by a whale of a different kind: a large investor. LookOnChain, a blockchain whale tracking agency, identified a major Solana whale dumping 900,000 WIF tokens in a series of transactions. This fire sale, amounting to roughly $1.64 million, undoubtedly contributed to the downward spiral.

Dogfight On Derivatives: Bulls Trampled, Bears Feast

While the Spot market witnessed a bloodbath, the WIF derivatives market displayed a curious mix of activity. Trading volume surged by a surprising 25%, propelling Dogwifhat to the coveted title of third most-demanded meme coin behind Dogecoin and Pepe Token. This surge in volume might suggest increased interest, but a closer look reveals a different story.

Lurking beneath the surface was a brutal battle between bullish and bearish investors. More than $3 million in WIF positions were liquidated in the last 24 hours. This liquidation primarily targeted long positions, meaning investors who bet on the price going up were forced to sell at a loss as the price plummeted.

While some might see the increased volume as a sign of potential revival, the liquidation figures paint a starker picture – many bulls got trampled by the bears feasting on the market downturn.

A Buying Opportunity Or A Boneheaded Move?

Despite the carnage, not everyone has lost faith in Dogwifhat. The plummeting price has attracted some opportunistic “Solana whales” who view the current price as an attractive entry point. This glimmer of hope hinges on the possibility that Dogwifhat can recapture its past glory.

Related Reading

In Q1 2024, Dogwifhat was a meme coin darling, riding the wave of the meme coin craze to a $4 billion market cap and a place in the top 30 global crypto rankings. However, the recent downturn serves as a stark reminder of the inherent volatility of meme coins, which often lack the utility or strong fundamentals of established cryptocurrencies.

The future of Dogwifhat remains uncertain. Whether it can claw its way back from the doghouse or fade into obscurity depends on several factors, including broader market trends, community support, and potential developments within the Dogwifhat ecosystem.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

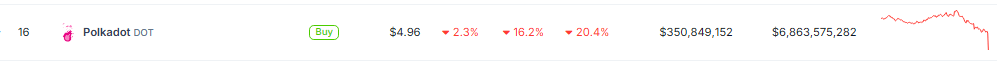

20% Price Drop Follows $87 Million Spending Outrage

Published

3 days agoon

July 5, 2024By

admin

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

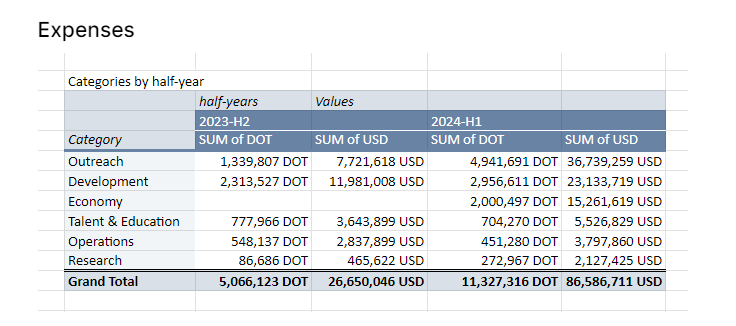

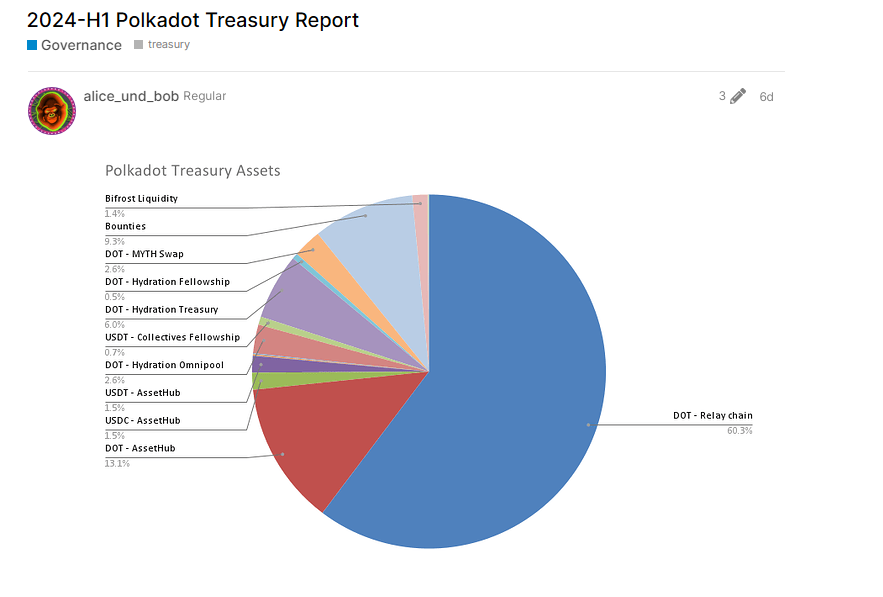

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Circle

Circle Awarded Europe’s First Stablecoin License Under New MiCA Crypto Rules

Published

7 days agoon

July 2, 2024By

admin

Cryptocurrency firm Circle has achieved a significant milestone by securing registration as an electronic money institution (EMI) in France. This move grants Circle a crucial license to operate as a compliant stablecoin issuer under the European Union’s rigorous crypto laws.

Circle Breakthrough

According to a CNBC report, the approved license positions Circle as the first global stablecoin issuer to achieve compliance with the European Union’s regulatory framework known as Markets in Crypto-Assets (MiCA).

This framework, considered a cornerstone in the EU’s approach to governing cryptocurrencies, sets out comprehensive rules and obligations for crypto companies to ensure investor protection and safeguard against market manipulation.

Related Reading

Circle’s acceptance into the MiCA regulatory framework means that both its USDC and Euro Coin (EURC) tokens can now be issued within the European Union while meeting the stablecoin regulatory obligations outlined by MiCA.

Additionally, Circle is opening up its Circle Mint service, enabling businesses to mint and redeem Circle stablecoins, to customers in France.

Expressing his satisfaction with the achievement, Jeremy Allaire, co-founder and CEO of Circle, emphasized the company’s longstanding commitment to building compliant and well-regulated infrastructure for stablecoins. He stated:

Our adherence to MiCA, which represents one of the most comprehensive crypto regulatory regimes in the world, is a huge milestone in bringing digital currency into mainstream scale and acceptance.

European Stablecoin Adoption

The EU’s MiCA law, which officially came into effect in May 2023, introduced the world’s first comprehensive regulatory framework for cryptocurrency operations.

Last week, provisions specifically governing stablecoins were approved, imposing stringent measures on trading volume limitations for certain stablecoins, particularly those denominated in US dollars.

As a registered EMI in France, Circle can now extend its services, including the minting and redemption of USDC through Circle Mint, not only to customers in France but also to individuals and businesses across the European Union.

This is made possible by the concept of “passporting” outlined in MiCA, which allows crypto businesses to offer services in one EU country and expand into other markets within the bloc.

Related Reading

While Circle’s achievement is commendable, it should be noted that additional obligations under MiCA about crypto asset service providers will become applicable by December 30, 2024. Crypto companies will then have until July 2026 to ensure full compliance with MiCA’s requirements.

Since its launch in September 2018 by Circle and crypto exchange Coinbase, USDC has gained significant traction and now holds the position of the second-largest stablecoin globally.

According to CoinGecko data, USDC’s circulation amounts to $32.4 billion, trailing only Tether’s USDT, which holds the title of the world’s largest stablecoin with a circulation of $112.7 billion.

Featured image from Shutterstock, chart from TradingView.com

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs