Bitcoin

Here’s What At Stake This Week

Published

1 week agoon

By

admin

As Bitcoin enters a pivotal week, market participants are closely monitoring several key indicators and events that could determine its near-term trajectory. Renowned crypto analyst Ted (@tedtalksmacro) has provided an in-depth analysis, highlighting the critical factors at play.

Weekly Bitcoin Preview

Ted’s analysis begins by contextualizing the broader macroeconomic environment. Last week’s US Consumer Price Index (CPI) and Producer Price Index (PPI) data were optimistic for risk assets, highlighting a continued disinflationary trend. “Both CPI and PPI data were optimistic for risk assets, with each showing that the disinflationary trend remains,” Ted noted. However, he cautioned that the Federal Reserve’s communication suggested that the market should not be overly enthusiastic about imminent rate cuts.

Related Reading

The focal point for this week is the Federal Open Market Committee (FOMC) meeting and its revised dot plot. In March, the dot plot indicated potential rate cuts of 2-3 times in 2024. However, the June dot plot revision suggests a more conservative outlook, indicating only 1-2 cuts. Ted explained, “The March dot plot indicated cutting rates 2-3 times in 2024, but June’s dot plot suggests only 1-2 cuts should be expected.”

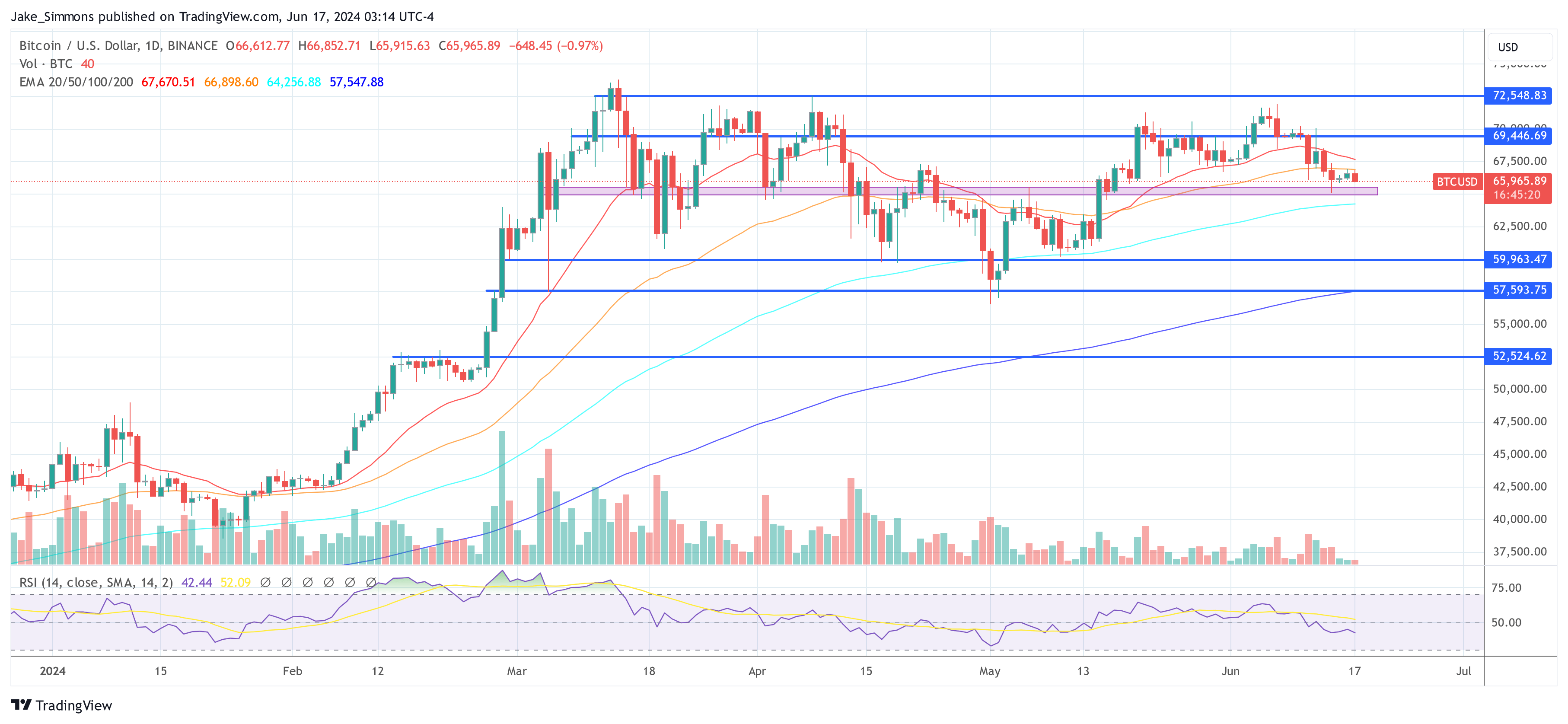

This alignment between the Fed’s projections and market expectations likely provides the central bank with greater flexibility in future communications about interest rates. For Bitcoin, maintaining the $66,000 support level is crucial.

Ted emphasized the importance of this threshold, stating, “It’s critical that Bitcoin maintains its support at $66,000. If broken, sellers could take a stronghold on the market and force quick liquidations out of the bulls.” This support level is seen as a critical threshold, with potential implications for broader market sentiment.

The implied weekly ranges for Bitcoin and Ethereum reflect the cautious optimism among traders. Bitcoin is expected to trade between $65,100 and $74,100, while Ethereum is projected to fluctuate between $3,388 and $4,025. Ted highlighted, “This week is crucial for maintaining BTC’s (and by extension, the broader crypto market’s) short-term trend.”

Related Reading

Ted also pointed out the performance of US tech stocks, particularly the NASDAQ, which has recently hit new all-time highs. “US tech stocks are certainly feeling the disinflationary vibes, with the NASDAQ breaking out to new all-time highs in anticipation of easier central bank policy to come,” he noted. This disconnect shows that something could be cooking for Bitcoin.

Ethereum’s performance relative to Bitcoin is another area of focus. Ted suggested that Ethereum could begin to “play catch up versus Bitcoin,” particularly with the anticipated launch of spot Ethereum ETFs on Wall Street. This potential for Ethereum to close the performance gap with Bitcoin is an important dynamic to monitor in the coming days.

Additionally, rate decisions from the Swiss National Bank (SNB) and the Reserve Bank of Australia (RBA) are on the radar. While no rate cuts are expected from these central banks, their decisions will be scrutinized for any indications of future monetary policy shifts. Ted mentioned, “It’s not expected that the Australian or Swiss Central Banks cut rates at this week’s meeting, but rather remain on hold.”

ETF flows, which slowed last week due to market jitters ahead of key macro events, are also expected to play a critical role. Ted noted, “Last week saw slowing ETF flows on Wall Street for Bitcoin. Likely owed to jitters ahead of key macro events, it will be key for BTC strength that flows return in the week ahead.” Strong ETF flows are essential for maintaining liquidity and supporting Bitcoin’s price.

In conclusion, this week is set to be pivotal for Bitcoin and the broader crypto market. The interplay of disinflation trends, Federal Reserve communications, key support levels, and external economic factors will shape the market’s direction. Ted concluded, “The data is clearly pointing towards a shift to more accommodative monetary policy—and potentially sooner rather than later. This reinforces my view that dips are buying opportunities for risk assets like cryptocurrencies and stocks.”

At press time, BTC traded at $65,965.

Featured image created with DALL·E, chart from TradingView.com

Source link

You may like

Anonymous Donor Pays $500,000 in Bitcoin for Julian Assange's Freedom Flight

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Australia

Anonymous Donor Pays $500,000 in Bitcoin for Julian Assange's Freedom Flight

Published

1 min agoon

June 26, 2024By

admin

An anonymous Bitcoin donor has paid over $500,000 in BTC to cover WikiLeaks founder Julian Assange’s expenses for his flight home to Australia. Assange is now a free man after pleading guilty in a US court under a deal ending his 14-year legal battle.

JUST IN: #Bitcoin pioneer and freedom fighter Julian Assange has landed in Australia. He is officially a free man!

A win for free speech and freedom 👏 pic.twitter.com/lDyPabqa8u

— Bitcoin Magazine (@BitcoinMagazine) June 26, 2024

Assange was released from prison in the UK on June 24th and flew to the US territory of Saipan to enter his plea. He had been fighting extradition to the US on espionage charges related to WikiLeaks publication of classified documents.

On June 26th, Assange arrived back in his native Australia and embraced family members in Canberra. He has been a pioneer for Bitcoin and WikiLeaks since its inception, even receiving donations in BTC in 2010 when few knew about it.

Just a day earlier, to cover the $520,000 cost of his private charter flight arranged by the Australian government, Assange’s wife issued an urgent appeal for donations. She also provided a Bitcoin address for contributions.

Remarkably, a single Bitcoin donor sent over 8 BTC worth nearly $500,000 to the address to cover the entire debt. This allowed Assange to return home without financial burden.

The anonymous donor’s massive contribution highlights the Bitcoin community’s enduring support for Assange and his work revealing government secrets. Bitcoiners have long advocated for his release.

While the whale’s identity remains unknown, the donation underscores Bitcoin’s role in enabling uncensored free speech and financial freedom.

The weeks ahead will focus on helping Assange recuperate after prolonged confinement. However, given his longstanding history with the technology, his engagement with Bitcoin will likely continue. Assange’s saga symbolized the battle between individual liberties and unchecked government power.

Source link

Bitcoin

German Government Moves Millions in Bitcoin to Exchanges

Published

4 hours agoon

June 26, 2024By

admin

The German government has transferred millions in seized Bitcoin to major Bitcoin and crypto exchanges Kraken and Coinbase, according to blockchain analysis firm Arkham.

The transfers originated from a wallet connected to the German Federal Criminal Police Office (BKA). In 2013, the BKA seized almost 50,000 Bitcoin, from a film piracy website.

On Tuesday, the BKA wallet moved $24 million in Bitcoin across two transactions to Kraken and Coinbase. An additional $30 million in Bitcoin was sent to an unknown wallet not affiliated with an exchange.

Arkham data shows that these transfers follow previous movements of $195 million in Bitcoin to exchanges on June 19 and 20. Over $425 million has been shifted in the past week.

While the German government still holds the majority of the seized Bitcoin, the transfers to exchanges may signal an intent to liquidate some of the assets.

Selling government-held Bitcoin introduces potential downward price pressure. However, the amounts moved so far represent a relatively small portion of daily Bitcoin trading volume.

Nonetheless, Bitcoin dipped below $60,000 on Tuesday amid this news. The German government’s Bitcoin wallet still holds over 46,000 Bitcoin worth nearly $3 billion.

For German police, the Bitcoin seized from illegal activities has dramatically increased in value. Selling even a fraction provides an unexpected windfall. However, concerns about potential impacts on the broader Bitcoin market remain.

Source link

24/7 Cryptocurrency News

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

Published

6 hours agoon

June 26, 2024By

admin

Robert Kiyosaki, renowned financial educator and author of the influential book “Rich Dad Poor Dad,” has recently shared his insights on Bitcoin’s “Banana Zone,” a term popularized by financial expert Raoul Pal. He contrasts this with the inherent weaknesses of fiat currency, shedding light on why Bitcoin’s rules-based monetary system offers a more secure and prosperous future. Through his unique perspective, Kiyosaki continues to educate and guide investors on navigating the evolving financial landscape.

Robert Kiyosaki’s Perspective: Bitcoin’s “Banana Zone” vs. Fiat Currency

Robert Kiyosaki, emphasizes the fundamental differences between Bitcoin and fiat currency, highlighting Bitcoin’s superiority as a store of value. Kiyosaki describes fiat money as “debt-based,” subject to inflation and financial instability due to governments’ ability to print it at will.

In contrast, Bitcoin’s “rules-based” system, with its fixed supply and decentralized nature, makes it a more reliable store of value, designed to appreciate over time. Kiyosaki’s endorsement is bolstered by Raoul Pal, a former Goldman Sachs executive, who predicted Bitcoin’s entry into “the Banana Zone” a phase of parabolic price increase where those who missed out regret not investing earlier.

Pal’s advice led Kiyosaki to invest in Bitcoin at $6,000, with current values around $60,000, showcasing significant growth. This success story underscores Pal’s market predictions and Bitcoin’s long-term potential. As Bitcoin approaches the “Banana Zone,” Kiyosaki advocates understanding its investment benefits over fiat currencies, which may decline in value.

Also Read: US Spot Bitcoin ETFs Record Net Inflows, Has Bitcoin Price Really Bottomed?

Current Bitcoin Market Dynamics

Bitcoin’s price trajectory has illustrated a notable uptick of 0.78% over the past day, with the token trading at $61,639.67 at press time. Its 24-hour lows and highs were $60,626.97 and $62,466.32, respectively. Intriguingly, after a sluggish period of trading in recent days, primarily because of macroeconomic factors and ETF outflows, Bitcoin gains momentum on the backdrop of $31 million inflows in BTC ETFs on June 25, per data by Farside.

This renewed investor interest highlights the resilience and potential of Bitcoin as an asset. Meanwhile, Bitcoin’s dominance in the cryptocurrency market rested at 53.42%, up 0.10% from the previous day, indicating a steady consolidation of its market position. This dominance and price increase signify growing confidence in Bitcoin’s role as a leading digital asset, reinforcing the arguments made by financial experts like Kiyosaki and Pal.

Also Read: VanEck Declares Zero Fee for Spot Ethereum ETF Gearing Up for July 2 Launch

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Anonymous Donor Pays $500,000 in Bitcoin for Julian Assange's Freedom Flight

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

Ron Wyden on FISA Reform and Crypto

Latin America's Largest Fintech Bank Integrates Bitcoin Lightning Payments Via Lightspark

bitter pills in crypto mass adoption?

Solana and Cardano Lead Top 10 Crypto Rebound

This Historical Ethereum Top Signal Is Yet To Appear This Cycle

Bitcoin's Trump Card: Dividing Is The Wrong Move

Florida lawmaker pitches ‘Bitcoin for Taxes’ bill

SEC Chair Says Approval Is Going Smoothly

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: