Bitcoin

HRF Grants 10 BTC To Worldwide Projects Advancing Bitcoin

Published

3 weeks agoon

By

admin

Today, the Human Rights Foundation (HRF) announced its most recent round of Bitcoin Development Fund grants at the Oslo Freedom Forum, per a press release sent to Bitcoin Magazine.

10 bitcoin, currently worth $704,740 at the time of writing, is being granted across 13 different projects around the world. The funds will be used to advance education for people living under authoritarian regimes, privacy and Lightning Network development, decentralized communications, and providing nonprofits and human rights groups with easier onramps to financial freedom tools, according to the release.

The HRF’s main areas of focus with this round of grants is countries and regions in Latin America, the Middle East, Asia, and Africa.

This announcement comes only a few months after the HRF’s last round of grants in March, where it donated $500,000 to 14 worldwide Bitcoin projects. While the HRF did not disclose exactly how much money each project is receiving, the following 13 projects are the recipients of today’s round of grants worth 10 BTC in total:

- RoboSats, a Tor-only, KYC-free platform enabling the exchange of Bitcoin for national currencies in a peer-to-peer fashion via the Lightning Network. As an open-source and privacy-first project, Robosats is a significant platform for individuals living under authoritarian regimes. Funding will support its ongoing development (including Android app development), enhancing the RoboSats node, and boosting its social media presence.

- Bitshala Internship Program, a grassroots, Bitcoin educational initiative from India offering mentorship, resources, and opportunities to aspiring Bitcoin developers. Amid India’s increasing financial repression, Bitcoin development is crucial for helping citizens remain financially free. The program enables students to contribute to vital free and open-source Bitcoin projects such as Bitcoin Core, coin selection, and more. Funding will support these internships and help Bitshala establish a hackerspace and community center in Bangalore inspired by Bitcoin Park and Chaincode Labs.

- Building Bridges to Bitcoin (BBB), an educational initiative in the Middle East and North Africa region by Ideas Beyond Borders (IBB). By providing educational material in Arabic, the project empowers local youth to combat tyranny with Bitcoin, secure their financial autonomy, protect their human rights, and transform their region. Funding will support the translation, publishing of educational resources, and management costs.

- Flash, a Nostr-enabled Lightning wallet designed to connect island economies in the Caribbean with Bitcoin. Founded by Dread, Flash aims to provide this historically-underbanked and politically-repressed region with access to global online marketplaces and physical Bitcoin on and off ramps. Funding will support Flash’s development, educational materials, local businesses onboarding, and a Caribbean-wide adoption campaign.

- Bitcoin Seoul, a Bitcoin conference in Seoul, Korea, dedicated to broadening the understanding and adoption of Bitcoin. The event will convene industry experts, local policymakers, diverse speakers, and attendees to explore Bitcoin from both general and technical perspectives. Funding will support open-source initiatives as well as help create spaces for North Korean defectors to meet Bitcoin developers to collaborate on human rights work in North Korea.

- Margot Paez’s research examining the relationship between Bitcoin mining, human rights, and sovereignty. Her study will explore how Bitcoin mining can reduce corruption and waste in energy systems, and expand power and electricity for people who lack it, given that without electric power, people cannot easily realize civil liberties. She will also examine how certain trends in Bitcoin mining can lead to overall network decentralization, making the software a more censorship-resistant tool for the world’s most vulnerable populations. This funding will help Margot’s graduate research.

- Validating Lightning Signer (VLS), an open-source project enhancing the Lightning Network’s security by separating private keys from a Lightning Node. VLS adds an extra layer of protection for Bitcoin users and lowers barriers to running a Lightning node. This enables more users to enforce their own financial autonomy. The allocated funding will be used to hire a full-time Rust developer to fix bugs and address feature requests.

- OpenSats, a 501(c)(3) public charity funding free and open-source projects, education, and research. With most OpenSats donations going directly and 100% to open-source contributors, this funding will support OpenSats core operational expenses, and will allow them to scale their operations and grow their team.

- The Core, a non-profit Bitcoin educational platform in Kenya founded by Felix Mukungu. The East African initiative aims to increase the financial freedom of Kenyans and others in the wider Great Lakes region through education, entertainment, and engaging content. Funding will support in-person meetups, course creation, salaries, and rewarding students upon course completion.

- Terry Yiu, a software engineer working on three Nostr-related projects: the Nostr SDK, helping developers create Nostr-based apps for Apple devices; Comingle, a conference app; and Damus, a decentralized social platform. The grant will support Terry’s continued development of these projects, helping strengthen freedom of speech and censorship-resistant communications for people worldwide.

- Paulo Sacramento, a Bitcoin-focused UX designer and researcher. He is studying the successful adoption of Brazil’s Pix digital payment system to derive lessons for broader Bitcoin adoption, especially for unbanked and underprivileged communities. There are big lessons here when it comes to the choice of citizens between CBDC-like platforms and open-source options like Bitcoin. The grant will help serve as support for the research endeavors carried out over the last two years.

- Blockchain Commons, a nonprofit supporting the continued development of FROST, a next-generation security protocol to improve the resilience and security of private keys. This is a crucial building block for allowing users to control their identities and Bitcoin in a self-sovereign way. For example, FROST can help make “multi-sig” solutions (appealing to human rights activists) much more flexible and robust. Funding will support the organization of two FROST roundtable meetings among members of the FROST ecosystem.

- Summer of Bitcoin, a global internship program enabling university students to contribute to Bitcoin open-source development and design. Students gain valuable experience and potential career opportunities while earning Bitcoin stipends. This grant will support student stipends, mentor compensation, and program operations. This program attracts thousands of applications from more than 50 countries each year, and helps promising individuals from all over, especially from authoritarian regimes, find roles in the Bitcoin community.

The HRF is a nonpartisan, nonprofit 501(c)(3) organization that promotes and protects human rights globally, with a focus on closed societies. The HRF continues to raise support for the Bitcoin Development Fund, and interested donors can find more info on how to donate bitcoin here. Applications for grant support by the HRF can be submitted here.

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Bitcoin

crypto will get positive regulation ‘no matter who wins’ election

Published

5 hours agoon

July 3, 2024By

admin

Galaxy Digital founder and CEO Mike Novogratz told CNBC’s ‘Squawk Box’ on Tuesday that the US crypto sector is headed for positive regulations regardless of who wins the upcoming election.

Mike Novogratz, one of the biggest crypto bulls, shared his outlook during an interview that touched on the current US political scene, Biden’s disastrous debate and crypto. The billionaire asserted that despite the current status of crypto regulation in the US, he believes the next regime will take a positive stance and help the industry grow.

“I am not a single issue voter and I do fundamentally believe crypto should be a bipartisan and needs to be bipartisan. We cannot have one party that likes this and another party that doesn’t like it,” Novogratz said.

Crypto regulatory landscape “shifting”

According to Novogratz, crypto is already largely a bipartisan issue in the US, with only a small group of Democrats taking a negative stance against this burgeoning industry. While it’s been frustrating, in terms of lack of regulatory clarity or the negative impact of government crackdown on the industry, Novogratz believes it’s “all shifting.”

“I’ll tell you that most Democrats, outside of Elizabeth Warren and a small group of people, are pretty pro-innovation and pro-crypto… Listen, no matter who wins the next election, we are going to get positive crypto legislation. I know that” he added.

Novogratz says BTC is a core holding

Commenting on Bitcoin following the ETF-buoyed upside that pushed prices above $73k in March, Novogratz referred back to earlier comments he shared about BTC price post-ETF approval. In his opinion, the benchmark cryptocurrency was likely to stay in the $55k-$73k range until the market got a dose of new news.

“It takes a while for things to digest,” he noted, adding that Bitcoin’s surge to its all-time high this year was “a huge move up.”

Novogratz believes BTC as a core portfolio holding makes sense, especially as the US debt balloons amid the government’s “spending like drunken sailors.”

Bitcoin traded around $61,862 at the time of writing, about 9% down in the past 30 days. However, its up 44% year-to-date and 102% in the past year.

Source link

Bitcoin

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Published

9 hours agoon

July 2, 2024By

admin

CleanSpark capped a busy June with an uptick in mined Bitcoin and a 2x increase in hashrate compared to December.

According to a Tuesday press statement, CleanSpark mined 445 Bitcoin (BTC) in June after adding five new mining facilities in Georgia. The mining startup also surpassed its 20 EH/s operational hashrate target set for mid-year.

“We continue to maximize efficiency at our existing sites and look forward to the opportunities ahead of us in Wyoming and Tennessee,” said CEO Zach Bradford.

CleanSpark’s mining numbers for last month indicate strength from the company after the Bitcoin halving event in April. A halving happens every four years and cuts mining rewards in half. The company mined 46 less BTC than last June, a modest difference considering Bitcoin’s code change.

Bradford added that the firm is “laser-focused” on increasing mining hashrate and generating more revenue following the halving. Meanwhile, other miners are facing difficulties and exploring business sales to maximize shareholder value.

CleanSpark’s post-halving performance has been the envy of the mining landscape as the startup has improved its hashrate and mined more BTC in recent months. Per crypto.news, Bradford’s firm also acquired GRIID facilities in a $155 million deal, and analysts at H.C. Wainright are bullish on the CLSK stock. CLSK is up 58% year-to-date and changed hands for $17.19 on the Nasdaq as of writing.

Source link

Bitcoin

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Published

15 hours agoon

July 2, 2024By

admin

On-chain data shows that selling pressure from Bitcoin miners has recently slowed down. This is significant considering the impact it could have on Bitcoin’s price heading into the third quarter of the year.

Bitcoin Miners’ Selling Pressure Has Significantly Declined

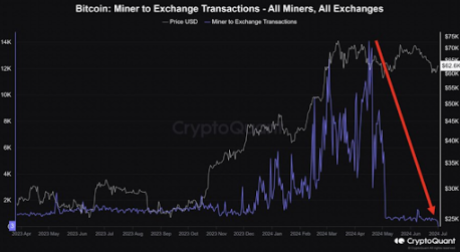

Referencing data from the on-chain analytics platform CryptoQuant, crypto analyst Crypto Dan noted that selling pressure from miners has significantly declined for two reasons. One is that the quantity of Bitcoin these miners sent to exchanges to sell has reduced drastically since May.

Related Reading

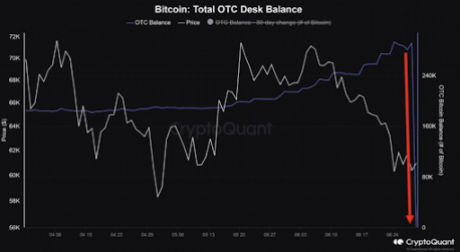

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for selling has been consumed, suggesting that someone recently bought up all the available Bitcoin supply from these miners. The volume of the OTC Desk is said to have piled up until June 29th, as there was no willing buyer to purchase these crypto tokens.

Bitcoin miners greatly contributed to the price crashes the flagship crypto suffered in June. Data from the market intelligence platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) throughout the month. This put significant selling pressure on Bitcoin, which caused it to drop below $60,000 at some point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue the bull run for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” to continue the upward rally for Bitcoin in this third quarter of the year.

Crypto analyst Willy Woo had also previously predicted that Bitcoin’s price would recover once miners capitulate. With that out of the way, Bitcoin could enjoy an upward trend this month and make massive moves to the upside.

BTC’s Uptrend Has Begun

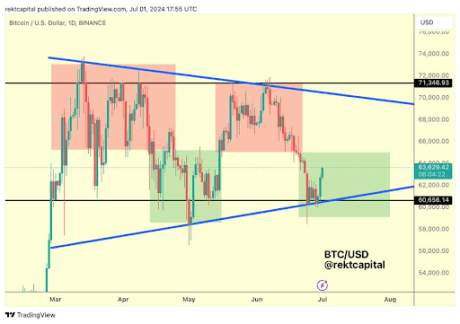

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) post that Bitcoin’s uptrend has begun. He claimed that the macro higher low has been confirmed, and Bitcoin is now rallying to the upside. He added that the flagship crypto is developing a macro bull flag, providing a bullish outlook for the crypto token.

Related Reading

In another X post, the crypto analyst remarked that the goal for Bitcoin following its strong start to July is to build a “foundation from which it will be able to springboard to the Range High area at $71,500 over time.”

Crypto analyst Michaël van de Poppe also suggested that Bitcoin’s downtrend is over and a bullish reversal was underway as the flagship crypto makes significant moves to the upside. He also mentioned that he believes that Bitcoin has bottomed out and has found support at $60,000, meaning a decline below that price level anytime soon was unlikely.

At the time of writing, Bitcoin is trading at around $62,900, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs