crypto hack

Indian police crack down on $200,000 ‘Max Crypto’ ponzi scheme

Published

3 days agoon

By

admin

A resident of Mangalore, Karnataka, has been arrested for defrauding over 50 people in a cryptocurrency ponzi scheme.

According to a local report, law enforcement in Hyderabad has arrested Kunjathbail Mujib Sayyad for operating the “Max Crypto trading” ponzi.

The investigation was originally initiated in late 2022. Back then, victims alleged that Sayyad, along with other accomplices, promised lucrative returns on investments.

The scam operated via an Android application dubbed the MAX App. The scheme promised returns within 150 days from investment.

Users were also offered a two percent commission for every new investor they brought in. The commission would be higher for bigger numbers.

Owners of the scheme claimed to be connected with big cryptocurrency traders. Further, they misled investors, stating that they were headquartered in Ajman in the United Arab Emirates.

The group held local events to promote their scheme. However, the scam operated completely online, without having any physical offices in India.

According to the victims, the scheme initially paid out returns in U.S. dollars. This is a common tactic leveraged by fraudsters to gain credibility.

The scam managed to draw in small-time investors and daily wagers hoping to see their investments multiply. However, the company, along with its app, disappeared within the first 50 days of launch.

In total, the scheme managed to accumulate INR 1.66 crore, worth approximately $200,000, from 52 victims.

The case was originally registered by local police after multiple complaints and was later directed towards the Economic Offences Wing of the Cyberabad police.

Sayyad is currently facing charges under Section 420 of the Indian Penal Code for cheating and dishonestly inducing the delivery of property. Additionally, he is charged under Section 406 for criminal breach of trust, which involves misappropriating property entrusted to him, along with charges under Section 120B for being part of a criminal conspiracy.

His accomplices remain at large at the time of writing.

Scams of these sorts are quite common in developing nations like India. Scammers tend to leverage the general populace’s lack of understanding and the hype around cryptocurrencies.

Earlier this month, India’s Enforcement Directorate (ED) froze the $180 million worth of assets from an investment group alleged to be a similar Ponzi scheme.

Prior to that, the watchdog filed charges against 299 entities for operating a fraudulent scheme operating as a cryptocurrency mining investment firm.

Source link

You may like

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

crypto hack

Crypto Platform UwU Lend Offers $5M to Catch Hacker

Published

2 weeks agoon

June 13, 2024By

admin

UwU Lend has put up a $5 million bounty in ETH for anyone who can apprehend the hacker behind the recent heists.

This move comes after the efforts to get the hacker to release the stolen funds proved futile.

UwU Lend Offers $5M to Catch Hacker

UwU Lend, a decentralized lending protocol, is offering a $5 million bounty in Ethereum for ‘the first person to identify and locate’ the hacker who has been carrying out attacks lately. In the announcement made through Input Data Message (IDM) on Ethereum, there is no demand for the recovery of funds or facing the criminal charges.

This bounty comes after unsuccessful talks with the hacker where UwU Lend proposed to give the hacker 20% of the stolen funds if the rest 80% would be returned. The hacker did not follow the offer that was made to him/her, and therefore UwU Lend had to step up its actions.

Source: IDM

On Monday, the exploiter utilized a flash loan attack to hack UwU Lend, and the platform lost $20 million. Another raid occurred on Thursday, resulting in the loss of another $3.7 million. According to blockchain security experts, the same person is behind both attacks.

Previous Offers and Deadlines

UwU Lend at first tried to settle the dispute without involving the police by offering the exploiter a deal. If the hacker decided to return 80% of the stolen amount, he would be allowed to retain the 20% and be let off the hook.

This offer was extended with a deadline of Wednesday, 1 p.m. ET (17:As at 00:00 UTC, which was the agreed time to shut down the system, the hacker did not do so.

By Thursday, UwU Lend informed that the repayment period has been over and, therefore, the protocol had to think about other options which resulted in the creation of the $5 million bounty.

Repeated Exploits and Security Concerns

The first incident on June 10 was a flash loan attack that manipulated price oracles of sUSD stablecoin which left the platform to lose $20 million. After this, UwU Lend came out and said that the problem has been noted and fixed. However, another attack on June 13 resulting in a loss of $3.7 million, showed that the security issues had not been fully addressed. Both of these attacks have caused concerns in the DeFi industry on the effectiveness of security measures that have been put into place in decentralized platforms.

Due to its connection with Michael Patryn, also known as Omar Dhanani and 0xSifu, co-founder of the collapsed cryptocurrency exchange QuadrigaCX, UwU Lend has attracted criticism. This background has compounded the problem of rebuilding user trust in the wake of the exploits.

We have made an offer to the hacker and are awaiting a response. The protocol will remained paused until the investigation has concluded. Thank you for your patience during this time.

List of approximate assets and values taken listed below.

— UwU Lend (@UwU_Lend) June 11, 2024

The experts advise the application to utilise better real-time tracking and stronger security measures to reduce the risk to the users’ valuables. However, in light of the recent breaches, UwU Lend has ensured its clients that their funds are secure and that all the losses incurred will be recovered at the earliest.

The company has also thanked security firms such as Hypernative Labs for their timely notifications that allowed the company to act quickly to minimize the effects of the exploits. UwU Lend has also ceased and is slowly bringing back its markets, and working on getting back to normalcy.

Read Also: Bitcoin Book Spurs US Bill to Abolish Federal Reserve

Kelvin is a distinguished writer specializing in crypto and finance, backed by a Bachelor’s in Actuarial Science. Recognized for incisive analysis and insightful content, he has an adept command of English and excels at thorough research and timely delivery.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

UwU Lend Protocol by Frog Nation’s Ex-CFO 0xSifu Drained of $19.3M

Published

3 weeks agoon

June 10, 2024By

admin

The decentralized finance (DeFi) lending protocol UwU Lend has been compromised, leading to a substantial loss of approximately $19.3 million in digital assets.

This event is the latest in a long series of incidents that have raised further questions on the security of DeFi platforms.

UwU Lend Protocol Drained of $19.3M

As per the reports from the leading blockchain security companies such as Arkham and Cyver, the attack was a swift one where the hacker made three transactions within six minutes.

According to Arkham, the lending protocol UwU Lend launched by Frog Nation’s former CFO 0xSifu is suspected to have been attacked. The protocol may have loopholes, and $19.3 million of funds have been abnormally outflowed. The project is a fork of Aave and supports the lending of…

— Wu Blockchain (@WuBlockchain) June 10, 2024

The security breach was first detected by Cyvers on their X platform, raising an alarm for UwU Lend on the activities that resulted in the unauthorized transfer of funds.

“The UwU lending contract was hacked and the attacker was able to steal substantial sums of funds from the liquidity pools, ” said Meir Dolev, co-founder of Cyvers.

The stolen funds, which included the major cryptocurrencies such as WBTC and stablecoins, were quickly liquidated on the Uniswap exchange, making it difficult for the stolen assets to be tracked.

Security Measures and Industry Reaction

This exploit is a part of a growing concern within the crypto space as DeFi platforms continue to fall victim to hacks. This has led to a reassessment of the security measures that are in place within the crypto space due to the repeated occurrence of these incidents.

Some of the measures that experts recommend include proper real-time monitoring and adoption of tight security measures to protect users’ assets.

In addition, the incident highlights the necessity of the DeFi platforms’ interaction with their users to share the information promptly when such actions take place for the purpose of credibility.

Hacks Preceding the UwU Lend Hack

The UwU Lend hack is another attack in the crypto world this year alongside other hacks such as the one that occurred at DMM Bitcoin, a Japanese cryptocurrency exchange.

The DMM Bitcoin exchange was hacked last week, and the exchange has stated that it will buy more than 4,500 BTC to compensate the affected users.

These back to back incidents point to the fact that there are still weaknesses in the cryptocurenncy exchanges and DeFi platforms and the need for stronger measures to address the issue.

Read Also: 3 Hot Meme Coin Presales to Watch After Missing Out on GameStop

Kelvin is a distinguished writer specializing in crypto and finance, backed by a Bachelor’s in Actuarial Science. Recognized for incisive analysis and insightful content, he has an adept command of English and excels at thorough research and timely delivery.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

crypto hack

Fake NFT Project Hack? CTO Vanishes After Stealing 94 SOL

Published

3 months agoon

April 4, 2024By

admin

A new rug pull alert sounded on Tuesday after crypto detective ZachXBT unveiled on-chain details of an alleged hack suffered by an NFT project last month. The project’s CTO announced that a response was in the works but ultimately vanished as criticism grew.

Nuddies NFT, A Hack Or Rug Pull?

On-chain sleuth ZachXBT revealed the alleged misuse of funds by the CTO of NFT project Nuddies NFT. In a now-deleted post, its CTO Kyle explained that the project was “derugged from its previous founder” and built differently from other NFT projects.

A short investigation into how @kyledegods faked a hack and stole SOL from his project @NuddiesNFT before spending it on NFTs and lying to holders about how devastated he was about the incident.

On March 3, 2024 Kyle made a post in his Discord server claiming his wallets had… pic.twitter.com/4ne6dtVyA5

— ZachXBT (@zachxbt) April 2, 2024

According to the crypto detective, Kyle faked a hack that seemingly stole the project’s funds. On March 3, the alleged culprit posted on the Nuddies NFT Discord server, informing us of the hack.

The post affirmed that Kyle’s Mac was hacked despite “not clicking in any malicious link.” The CTO concluded that a “zombie process” was on his computer for an undetermined period.

This “mini-program” gave control of the computer to “the hacker.” Through the TeamViewer app the attacker gained access to the project and Kyle’s wallets. The post further explained that 90 SOL, approximately $17,000 at today’s price, were taken from the Nuddies NFT creator wallet.

Moreover, the hacker allegedly took control of Kyle’s Discord and stole 150 SOL, worth around $28,300, from his wallets. At the time, he claimed to be “mentally destroyed” by the loss of the project’s treasury money.

SOL is trading at $188.43 in the 3-day chart. Source: SOLUSDT on Tradingview.com

Nonetheless, the on-chain data compiled by ZachXBT tells a different story. Per the crypto detective’s post, the CTO allegedly lied to the holders and stole the 94 SOL, worth $12,000, when the incident occurred.

The post reveals that the funds were transferred during that day from the Nuddies Royalty Wallet to an exchange deposit at 8:20 UTC. The on-chain investigator claims that a destination transaction was found using time analysis. The transaction to one of Kyle’s wallets accounted for 3.42 ETH, around $11,700, at 8:21 UTC.

The ETH was seemingly used to buy two NFTs: DeGods 2921 and y00t 10991. The DeGod NFT was used as the CTO’s profile picture on X until yesterday.

CTO Answers The Accusations, Then Vanishes

The accusations didn’t go unnoticed by the suspect, who posted on his X account that he was “preparing the answer” with a wink face emoji. After changing his profile picture, Kyle answered some users’ questions about his credibility, to which he replied that his “conscience is clear.”

Now-deleted post from Nuddies' CTO Kyle. Source: X

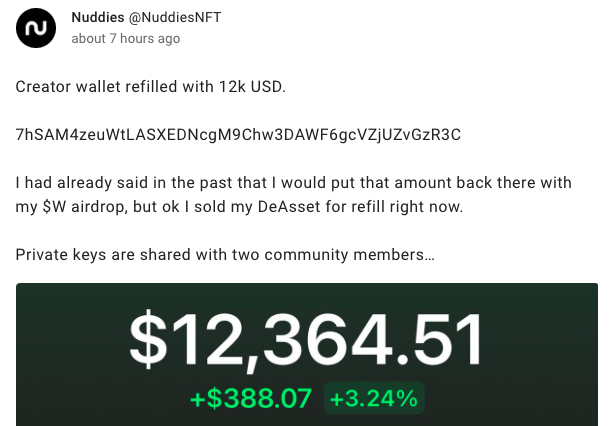

In the early hours of Wednesday, Nuddies NFT account shared a now-deleted post informing that the creator wallet was “refilled with 12k USD.” In the post, Kyle reassured that his previous claims of intending to refill the wallet were authentic.

The CTO also claimed he was “waiting for his $W airdrop” to fulfill his promise instead of selling his DeAsset. Additionally, he “stepped out” of the project after giving the access keys to two community members.

Recovered excerpt from the deleted Nuddies NFT post. Source: X

However, the story doesn’t end there. Kyle and Nuddies NFT’s account were deleted a couple of hours after the post. The Nuddies website seems not to be working, as reported by an X user.

The project’s future is unsure as one of the community members to whom Kyle gave the access keys was unaware of the situation. Juiceddd, an NFT artist, is one of the two people in charge of the project.

The artist explained that he was responsible for redrawing the entire Nuddies collection while adding “70+ new traits.” Moreover, Juiceddd stated that he “woke up this morning to being the owner of everything.” The artist is contemplating giving his perspective on the incident as he considers that it is generally the artist who “gets fucked” in these situations.

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Popcat up over 90%, as SHIB and DOGE see price declines

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: