Arbitrum

Is The Ethereum Winter Over? L2 Exploding, ETH Futures ETF Launches

Published

9 months agoon

By

admin

After sinking roughly 30% from 2023 highs, Ethereum appears to be bouncing off from the pits of the crypto winter. Looking at candlestick arrangements in the daily and weekly charts, the coin has primary support at around $1,500 and is firm, bouncing off with decent trading volume.

At spot rates, ETH is up approximately 3% following positive developments sparked by the increasing adoption of its layer-2 scaling solution and the recent news that VanEck, a player managing billions of assets, is preparing to launch an Ethereum derivatives product.

Ethereum Layer-2 Solutions Exploding

Taking to X on September 28, Alex Masmej, the founder of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to such an extent that it no “longer makes sense to build on other platforms.”

The development and deployment of Ethereum layer-2 solutions took center stage following network congestion, which forced gas fees to spike to record highs in the last bull run.

Developers have responded to the network co-founder Vitalik Buterin’s urging. The expert believes they are quickly constructing and deploying safe, universal platforms that have gained widespread popularity.

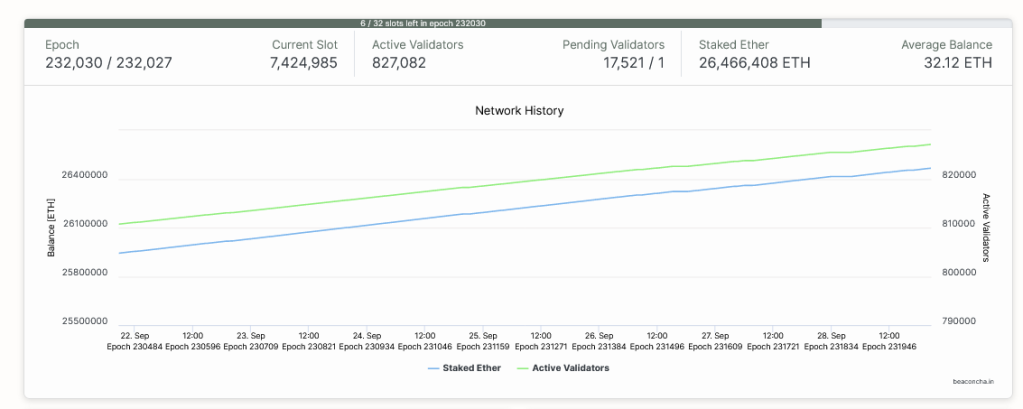

Layer-2 platforms bundle transactions off-chain before confirming them on-chain, allowing for faster and more cost-effective operations while benefiting from the security of Ethereum. As of September 28, there were over 827,000 validators whose job is to confirm transactions and ensure that the network is secure, thanks in part to their geographic distribution.

Most layer-2 solutions use optimistic rollups, including Arbitrum, Base, and OP Mainnet. However, Masmej also said that once ZK rollups, which utilize zero-knowledge proofs to validate transactions without revealing sensitive data, are available, it will end the scalability trilemma, further boosting the capabilities of layer-2 solutions.

In the founder’s assessment, high throughput options, including Solana, will be a hedge. At the same time, Cosmos, which drives blockchain interoperability, will act as a long-term source of inspiration. Meanwhile, Ethereum will continue to flourish as Layer-2 options gain traction.

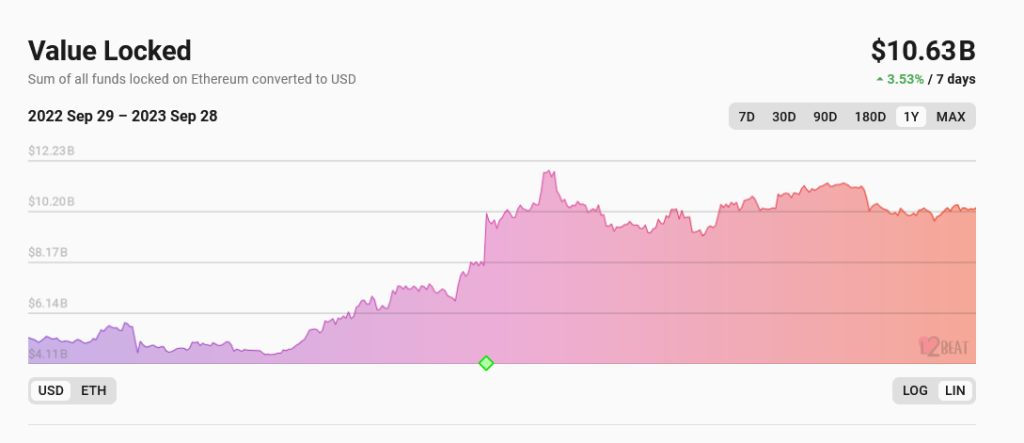

Rising TVL And ETH Complex Products Launching

According to l2Beat data, popular solutions like Arbitrum and Base, which offer faster and cheaper processing environments while remaining coupled with Ethereum and enjoying the pioneer network’s fast-move advantage, have larger total value locked (TVL). As of September 28, layer-2 platforms have a TVL of over $10.6 billion, more than Solana’s market cap, which stood at $8 billion, according to CoinMarketCap.

Beyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a global asset manager, is preparing to introduce its Ethereum futures exchange-traded fund (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) will invest in ETH futures contracts provided by exchanges approved by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being offered, the Ethereum derivative product will allow institutions to gain exposure, boosting liquidity.

Feature image from Canva, chart from TradingView

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Altcoins

DeFi Platform Hacked for at Least $1,900,000 and Possibly More on Ethereum and Arbitrum Blockchains

Published

3 months agoon

April 19, 2024By

admin

A decentralized finance (DeFI) protocol has been hacked to the tune of millions of dollars over the Ethereum (ETH) and Arbitrum (ARB) blockchains.

In a new announcement, cybersecurity firm Cyvers says that DeFi platform Hedgey Finance has been breached by bad actors who took at least $1.9 million worth of funds that were converted to the stablecoin Dai (DAI).

“Hedgey Finance has experienced a security breach with their Hedgey Token Claim Contract! Total loss is around $1.9 million. Attacker is funded by ChangeNOW_io. All stolen funds are swapped to DAI and transferred to an [external address].”

According to Hedgey Finance, users should be canceling active claims related to the Hedgey Token Claim Contract, which allows users to create token claims for recipients while having greater control over when claimed tokens are unlocked.

“Security Alert: We’re investigating an attack on the Hedgey Token Claim Contract. If you have created active claims, please cancel them using the ‘End Token Claim’ button. We are actively working with our auditors and team to understand the attack and stop any ongoing attack. We will share more information as we learn more.”

However, citing a since-deleted X post from Cyvers, on-chain analyst Colin Wu says that Hedgey suffered a significantly larger loss totaling over $44 million.

“According to Cyvers Alerts, the on-chain token infrastructure protocol Hedgey suffered an attack on the Arbitrum and lost about $42.8 million, and suffered the same attack on the Ethereum and lost about $1.9 million.

Hedgey’s official Twitter account issued a security alert, saying that it is investigating the attack on the contract.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Prince Zaleski/AtlasbyAtlas Studio

Source link

Altcoins

Trader Says He’s Still ‘Hugely Bullish’ on This Gaming Altcoin, Updates Outlook on Arbitrum and Render

Published

3 months agoon

April 12, 2024By

admin

A widely followed crypto strategist is remaining bullish on one gaming altcoin this market cycle.

Pseudonymous analyst Altcoin Sherpa tells his 214,300 followers on the social media platform X that Beam (BEAM) seems to have a lot more upside potential.

“BEAM: one of my bags. It’s just chilling the last several weeks. Still hugely bullish on this coin and it’s still an indexed bet on crypto gaming for this cycle. Going to just keep hodling, not a trade.”

Looking at the trader’s chart, he suggests Beam could rally to the key upside levels of $0.036 and $0.040.

Beam is trading for $0.031 at time of writing, up slightly in the last 24 hours.

Next up, the analyst says that Ethereum (ETH) layer-2 scaling solution Arbitrum (ARB) may decline more than 15% from the current value.

“ARB: nasty price moves. I think this one looks like it’s going to head to $1.20 or lower. I would like to see it consolidate and chill for a bit before forming a bottom. But the 200-day exponential moving average (EMA) getting lost is not great and this might near retrace the entire move.”

Arbitrum is trading for $1.42 at time of writing, down more than 2% in the last 24 hours.

Lastly, the analyst says Render (RNDR), a project related to Graphics Processing Units (GPUs), could decline nearly 17% from the current value based on Fibonacci retracement levels.

“RNDR: you can now fib out the entire range and wait for the .382 and .50 fibs. Strong coins like RNDR probably bounce a bit lower, aiming for the $7.50 level. Still bullish on this one though for 2024.”

Render is trading for $9.03 at time of writing, down more than 1% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Top Analyst Says Ethereum Rival Looks Turbo Bullish, Updates Outlook on Arbitrum and Solana-Based Memecoin

Published

3 months agoon

March 28, 2024By

admin

A top trader who accurately called Bitcoin’s (BTC) floor price during the 2018 bear market says one Ethereum (ETH) challenger looks extremely bullish.

Pseudonymous analyst Bluntz tells his 251,100 followers on the social media platform X that he expects the native asset of the layer-1 protocol Near (NEAR) to rally to a level last seen in May 2022.

According to the analyst, NEAR appears to be in the midst of a five-wave surge that could see the altcoin soaring close to $10 in a matter of days.

“NEAR looks turbo bullish here IMO (in my opinion), clear ABC down from the highs, spent all weekend accumulating and now breaking out.

Should be one of the first to make new highs IMO.”

Bluntz uses the Elliott Wave theory to predict the future price action of crypto assets. According to the theory, a bullish asset tends to witness a five-wave rally after completing an ABC corrective move.

At time of writing, NEAR is worth $7.60, an increase of over 3% in the past day.

The trader is also keeping a close watch on the Ethereum scaling solution Arbitrum (ARB). Bluntz says ARB is flashing multiple bullish reversal signals on the daily chart.

“ARB not only looks like a nice clear as day ABC down but there’s also a daily bullish divergence now on that daily close print.

ETH beta about to get some love again IMO.”

Traders often watch out for assets that give off a bullish divergence reading. It suggests that a bullish reversal is in sight as the asset gains momentum despite the price trending down or sideways.

At time of writing, ARB is worth $1.70.

Bluntz says he’s also expecting rallies for the Solana (SOL)-based meme token Slerf (SLERF).

“Initial hype and first pullback on SLEF looks over. Took a punt now it’s cooled off.”

At time of writing, SLERF is worth $0.767, up over 17% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs