crypto

Ledger Users Can Now Buy Crypto Directly Using PayPal

Published

11 months agoon

By

admin

PayPal has taken another step in its crypto mission following a team-up with hardware wallet provider Ledger. This time around, the payments giant is making it possible for users to purchase crypto directly without the need for extra verifications.

Ledger Live Integration With Paypal

On August 16, Ledger and PaPal announced an integration to make buying cryptocurrencies easier. This feature will allow users to purchase crypto using PayPal directly from the Ledger Live app.

Chairman and CEO Pascal Gauthier of Ledger made a statement about integrating Ledger Live with Paypal to make crypto transactions easier.

“Both PayPal and Ledger are focused on creating secure, seamless, and fast transactions no matter where you are in the world. PayPal,” Gauthier said. “We’re combining the uncompromising security of Ledger with PayPal’s leadership in protected payments technology to help facilitate a seamless platform for user crypto transactions.”

Ledger Live’s integration with Paypal currently offers four cryptocurrencies in the US, such as Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), and Litecoin (LTC), and this will allow US residents to be able to purchase these cryptocurrencies with their verified Paypal accounts with no extra verification required.

What makes this integration so interesting is that no “withdrawal” process needs to be initiated by a user. All the crypto purchases made through Paypal via Ledger Live are immediately sent to the user’s wallet, according to the announcement.

PYPL price drops to $59 | Source: PayPal Holdings, Inc. on Tradingview.com

Ledger Live’s integration with Paypal is indeed a significant step in the financial tech world, as the two giants share a similar vision of creating fast and seamless transactions on a universal scale.

Ledger is one of the most notable hardware wallet manufacturers, recording over 6 million Ledger Nano hardware wallet sales all around the world since 2016. Also, Ledger launched its Tradelink service in 2023 that will enable “off-exchange trading, enhanced security, distribution of risk, zero transaction fees, and a more efficient and faster trading” for institutional investors.

Paypal’s interest in the crypto world is by no means new. On August 7, Paypal made an announcement to launch its own Ethereum-based stablecoin called PYUSD.

However, nothing was said about PYUSD being listed as one of the coins that will be available on the Ledger Live just yet.

PYUSD’s launch has not been smooth either with regulators calling for more oversight following the launch. Last week, US congresswoman Maxine Waters called for federal oversight and enforcement of PayPal after launching the stablecoin.

PayPal also revealed plans to allow select customers to purchase cryptocurrencies such as Bitcoin and Ethereum using PYUSD. However, amid the new UK regulatory system that will come into play on October 8, Paypal plans to temporarily pause the buying of cryptocurrencies in the country from October 1 to resume crypto services in the Q1 of 2024.

Featured image from iStock, chart from Tradingview.com

Source link

You may like

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

Altcoins

Is Dogwifhat (WIF) Out? Price Tanks 15% On Whale Exodus

Published

2 days agoon

July 6, 2024By

admin

Dogwifhat, the once-high-flying Solana-based meme coin, suffered a brutal week, mirroring a broader crypto market correction and raising questions about the sustainability of the meme coin craze.

Related Reading

Meme Coin Mania Meets Market Mayhem

WIF, the token powering Dogwifhat, saw its price plummet 15% in just 24 hours. This dramatic drop erased all the gains from a recent rebound rally. The sell-off wasn’t isolated to Dogwifhat; the entire crypto market experienced a double-digit tumble, with major altcoins like Ethereum and Cardano feeling the heat.

Analysts point to a combination of factors behind the downturn, including renewed concerns about inflation and a recent sell-off by the German government and Mt. Gox, a defunct cryptocurrency exchange.

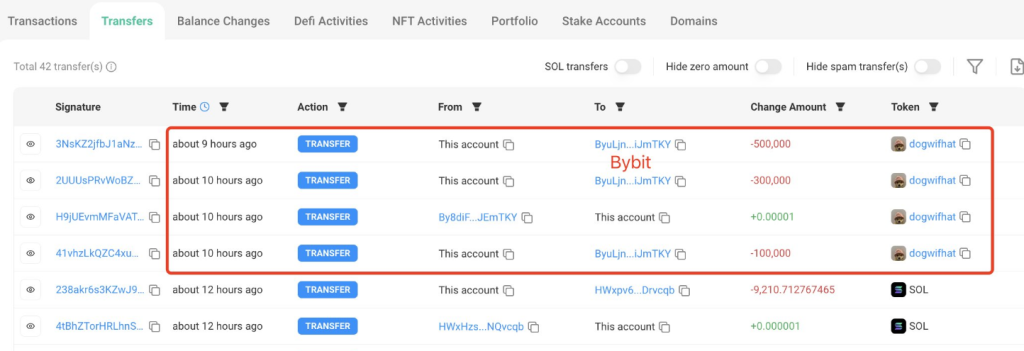

The price of $WIF dropped 15% as the market fell.

A whale deposited 900K $WIF($1.64M) to #Bybit 10 hours ago, leaving 974K $WIF($1.76M).https://t.co/qJwlxcWy15 pic.twitter.com/amIkvwKfNG

— Lookonchain (@lookonchain) July 4, 2024

The pain for Dogwifhat was further amplified by a whale of a different kind: a large investor. LookOnChain, a blockchain whale tracking agency, identified a major Solana whale dumping 900,000 WIF tokens in a series of transactions. This fire sale, amounting to roughly $1.64 million, undoubtedly contributed to the downward spiral.

Dogfight On Derivatives: Bulls Trampled, Bears Feast

While the Spot market witnessed a bloodbath, the WIF derivatives market displayed a curious mix of activity. Trading volume surged by a surprising 25%, propelling Dogwifhat to the coveted title of third most-demanded meme coin behind Dogecoin and Pepe Token. This surge in volume might suggest increased interest, but a closer look reveals a different story.

Lurking beneath the surface was a brutal battle between bullish and bearish investors. More than $3 million in WIF positions were liquidated in the last 24 hours. This liquidation primarily targeted long positions, meaning investors who bet on the price going up were forced to sell at a loss as the price plummeted.

While some might see the increased volume as a sign of potential revival, the liquidation figures paint a starker picture – many bulls got trampled by the bears feasting on the market downturn.

A Buying Opportunity Or A Boneheaded Move?

Despite the carnage, not everyone has lost faith in Dogwifhat. The plummeting price has attracted some opportunistic “Solana whales” who view the current price as an attractive entry point. This glimmer of hope hinges on the possibility that Dogwifhat can recapture its past glory.

Related Reading

In Q1 2024, Dogwifhat was a meme coin darling, riding the wave of the meme coin craze to a $4 billion market cap and a place in the top 30 global crypto rankings. However, the recent downturn serves as a stark reminder of the inherent volatility of meme coins, which often lack the utility or strong fundamentals of established cryptocurrencies.

The future of Dogwifhat remains uncertain. Whether it can claw its way back from the doghouse or fade into obscurity depends on several factors, including broader market trends, community support, and potential developments within the Dogwifhat ecosystem.

Featured image from Shutterstock, chart from TradingView

Source link

Altcoins

Solana-Based Memecoin Defies Market Downturn, Jumps Over 30% in 24 Hours Amid Listing on Multiple Exchanges

Published

3 days agoon

July 5, 2024By

admin

One Solana-based (SOL) meme asset is defying market doldrums and rallying after being listed on numerous crypto exchange platforms.

New data reveals that Billy (BILLY), a dog-themed memecoin built over Solana, has jumped over 30% during the last 24 hours after multiple crypto exchange platforms added support for it.

The crypto exchange platforms that listed Billy include Bittrue, Bitget, MEXC, and Gate.io, who all announced support for the meme asset earlier this week.

Billy is trading for $0.1659 at time of writing, a 36% gain during the last day. On June 26th, Billy was moving for just $0.0286.

Billy, which was launched earlier this year in June and features a picture of a puppy, is outpacing other prominent meme assets during the market’s current consolidation period, which has caused sharp decreases across the board.

Other dog-theme assets, such as dogwifhat (WIF), Shiba Inu (SHIB), Bonk (BONK), and Dogecoin (DOGE), are trading for $1.91, $0.000014, $0.000023, and $0.1046 at time of writing, respectively.

However, DOGE, WIF, SHIB, and BONK are all down between 30-40% during the last month while BILLY is up a staggering 150% during the same time frame.

According to data from blockchain tracker Dexscreener, Billy’s market cap is sitting at $161 million at time of writing while its 24-hour volume is at $24.6 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Quardia/Sensvector

Source link

Altcoins

20% Price Drop Follows $87 Million Spending Outrage

Published

3 days agoon

July 5, 2024By

admin

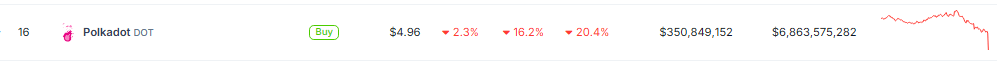

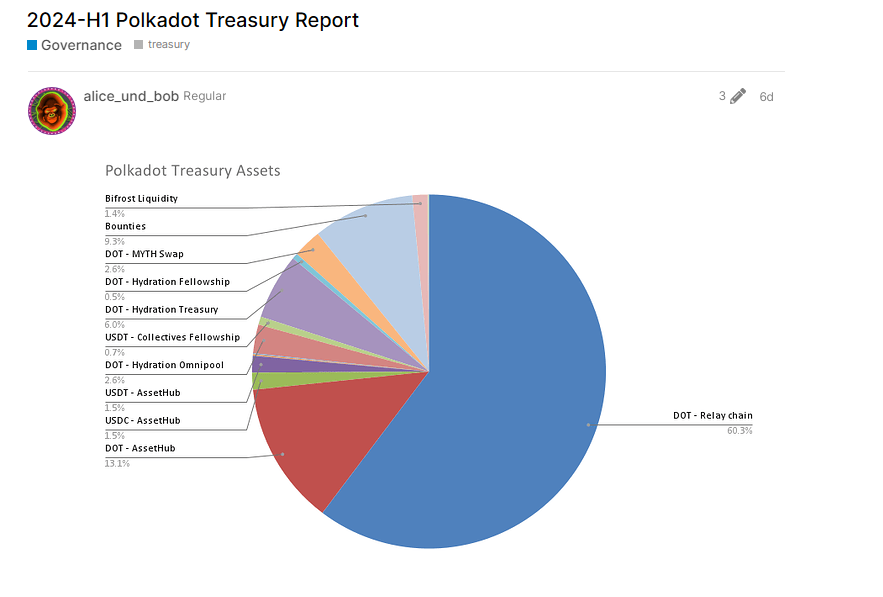

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

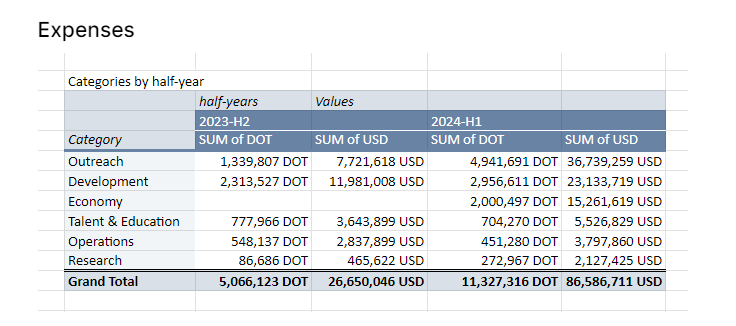

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs