Altcoins

Lekker Capital CIO Spotlights Prime Opportunity

Published

4 days agoon

By

admin

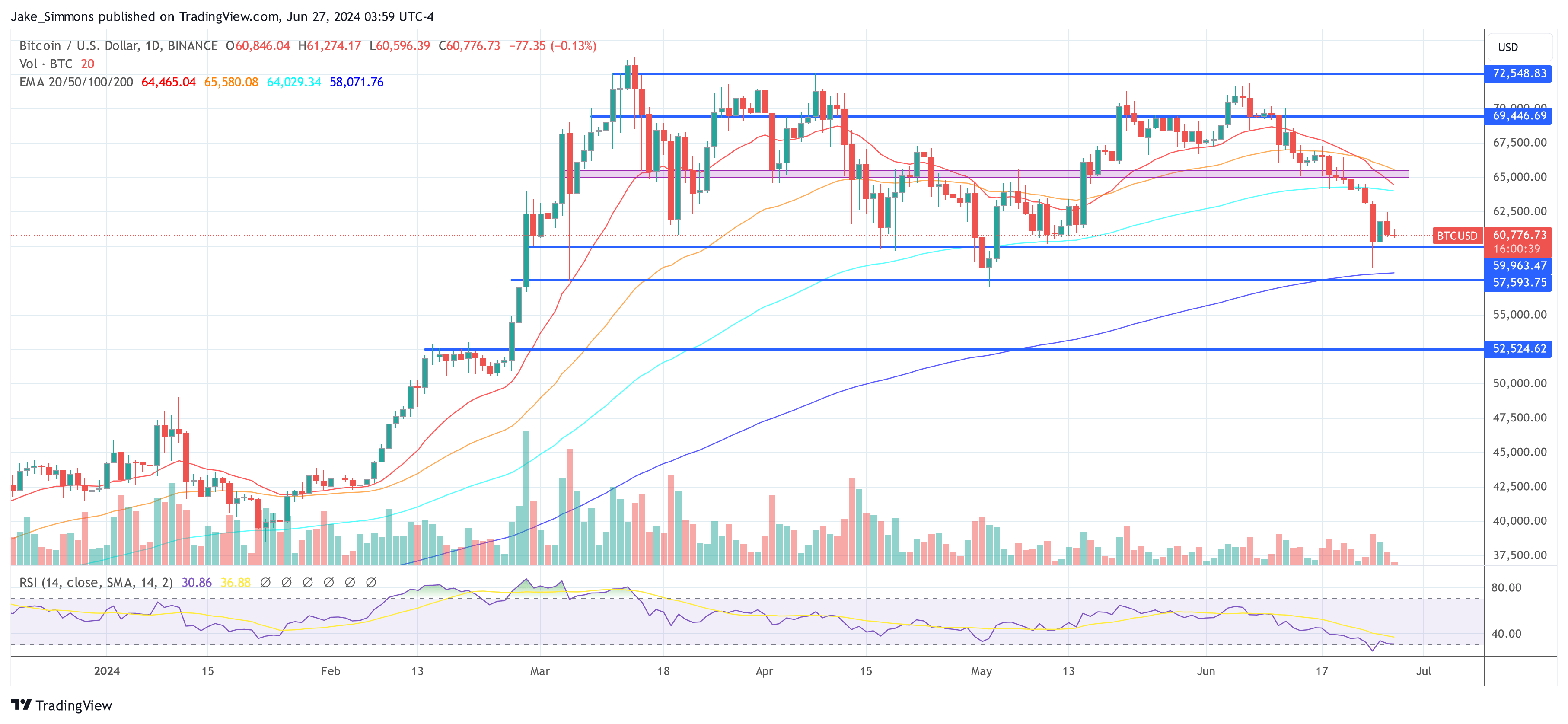

Quinn Thompson, Chief Investment Officer (CIO) at Lekker Capital, articulated a strong buy signal for cryptocurrencies amidst a landscape fraught with bearish sentiment. In a statement released through the social media platform X, Thompson described the present market conditions as “one of the most obvious and attractive crypto buying opportunities of recent memory.”

Lekker Capital, which has carved a niche in trading cryptocurrencies based on macroeconomic cues, provides an analysis that contrasts sharply with the prevailing market mood. Thompson’s commentary comes at a time when the broader crypto community appears enmeshed in pessimism. He expressed concern over the current trend where it’s become fashionable among crypto investors to adopt a bearish stance. “In all of my 5 years in crypto, I have never seen it be so ‘cool’ amongst crypto native investors as it is right now to be bearish,” Thompson noted, reflecting on the cyclical nature of market sentiments.

Related Reading

Thompson pointed to the reactive nature of the market, particularly surrounding major events like ETF launches. He revisited the aftermath of the US spot Bitcoin ETF launch, which contrary to the bullish anticipation, saw Bitcoin’s price plunge from $49,000 to $38,000, marking a steep 22% decline in just 12 days. This event, he argued, should serve as a cautionary tale about the market’s tendency to move against consensus expectations.

Addressing the most recent market dynamics, Thompson highlighted the significant impact of the sell-off that dampened the spirits of market participants, discouraging the usual strategies of buying the dip with leveraged positions. “It’s clear this most recent selloff has finally stung market participants given the lack of leveraged long dip buying,” he observed.

This scenario, according to him, sets the stage for a market correction that typically follows a pattern of initial slow recovery, stabilization, and then a rapid upward movement once a catalytic event occurs. He recalled the BTC ETF leak in October as a “buy the news” event that realigned market sentiment.

Furthermore, Thompson discussed the forward-looking nature of financial markets, emphasizing that the crypto market is no exception. He believes that the market has already adjusted to past events such as the Mt. Gox saga and Bitcoin sell-offs from the US and German governments. “The key thing to remember here is markets are forward looking. Citing the Mt. Gox or US and German government supply overhangs is old news – the market has priced this in. Fear and capitulation invokes an irrational near-sightedness,” the Lekker Capital CIO remarked.

Related Reading

Looking ahead, he underscored several macro and microeconomic developments poised to influence the market. “On the macro front, these include a November election and additional Fed liquidity. On the micro front, they are the ETH ETF, Circle IPO, and improved BTC miner profitability thanks to AI,” he explained. These factors are expected to reduce selling pressure (e.g. Bitcoin miners) and invigorate market sentiment.

Delving deeper into market technicals, Thompson pointed out that several key indicators are at cycle lows, which historically precede upward movements. He noted, “BTC and ETH CME basis, alt open interest as a percentage of total, and macro relative value all sit at cycle lows while stablecoin supply is finally growing again.” This combination of factors, according to Thompson, signals a potential market bottom forming.

In a bold closing prediction, Thompson projected significant rallies for major cryptocurrencies in the near future. “Personally, I think ETH will reach $7,000 and BTC will make its first attempt at $100,000 by the election in November,” he stated confidently.

At press time, BTC traded at $60,766.

Featured image from Shutterstock, chart from TradingView.com

Source link

You may like

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Altcoins

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Published

4 hours agoon

July 1, 2024By

admin

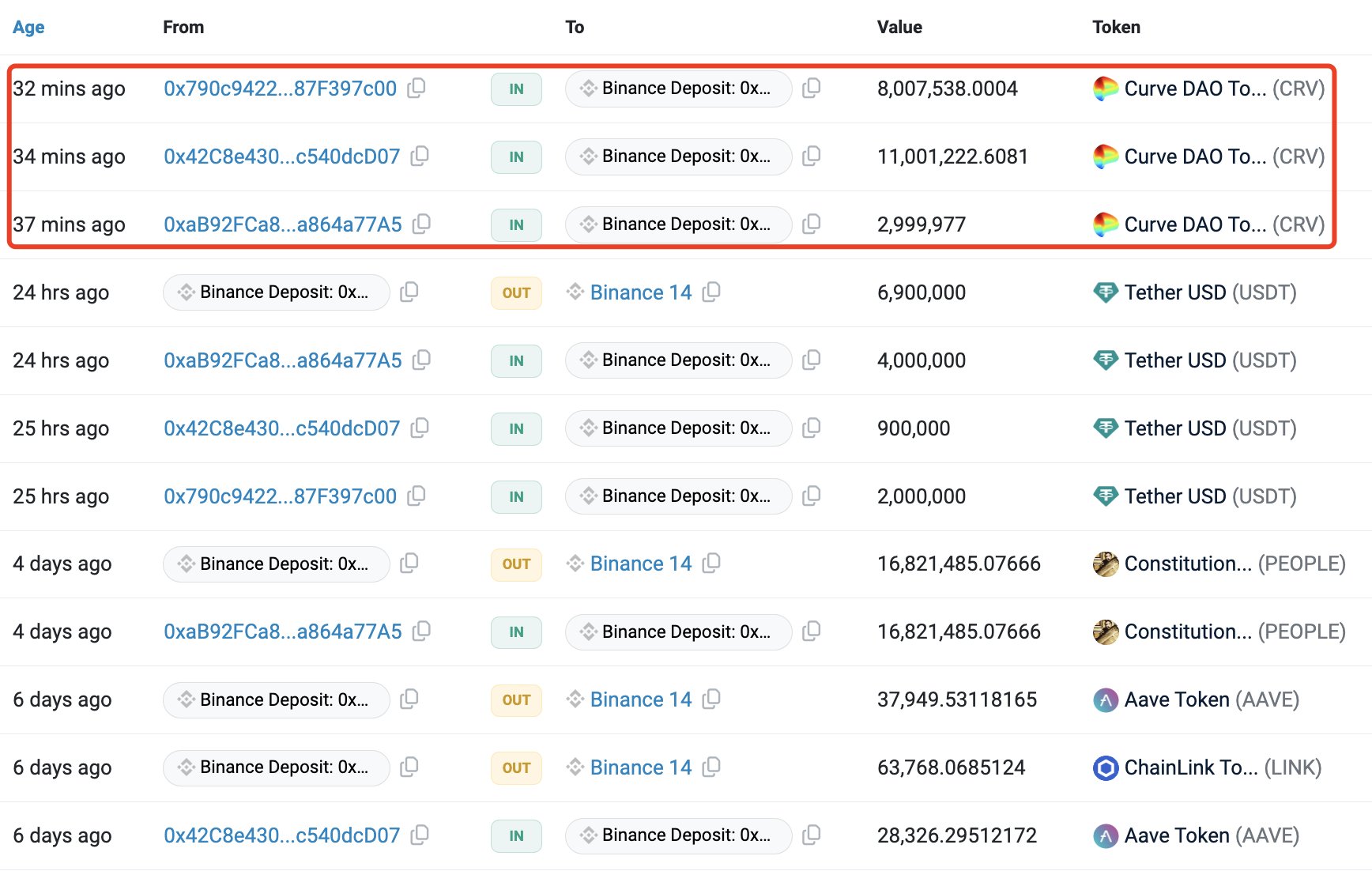

CRV, the native token of stablecoin lending platform CurveDAO, is close to all-time lows again as the ecosystem attempts a recovery from a large liquidation event this month.

Blockchain tracking firm Lookonchain reports that a whale deposited over $6 million worth of CRV to Binance, presumably to sell at a loss.

“The 22 million CRV was bought after the CRV liquidation, with a buying price of ~$0.33.

Selling now will result in a loss of ~$1 million.”

On June 13th, Curve founder Michael Egorov announced that all of his loans, reportedly worth roughly $156 million, were liquidated. He also said that he sold millions of CRV tokens in an organized transaction to one of the partners of crypto asset investment firm NextGen Digital Venture.

“The amount of CRV liquidations was very large for the market to handle in half an hour (1/3 of circulating supply or so), so to prevent any bad debt, I sold 30 million of my not yet vested CRV to @Christianeth on June 13th . Those 30 million CRV are being received by him in chunks by mid-August.

If you see CRV transactions from my wallet to christian2022.eth, they are related to that deal…”

On the same day of Egorov’s liquidation, CRV dropped to an all-time low of $0.239. Currently, CRV is trading at $0.28 and is now 98.3% down from its all-time high of $15.37.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Massive Altseason on the Horizon As Altcoins Gear Up for 2017-Style Expansion, According to Analyst

Published

20 hours agoon

June 30, 2024By

admin

An analyst who continues to build a following with timely crypto market calls believes that the stage is set for altcoins to witness a big burst to the upside.

Pseudonymous analyst TechDev tells his 461,900 followers on the social media platform X that he’s looking at the two-week chart of OTHERS, which tracks the market capitalization of all crypto excluding the 10 largest digital assets and stablecoins.

According to the analyst, OTHERS appears to be mirroring its setup in 2017 just before the altcoin market witnessed a parabolic surge.

“Accumulation –>Markup –> Expansion…

Not one bearish idea I’ve seen passes a start-of-2017 backtest. Every idea is a guess. I suggest not stating them as fact without backtesting a quick scroll to the left.”

Looking at the trader’s chart, he seems to suggest that OTHERS is gearing up for an expansion phase similar to what happened about seven years ago after respecting the 0.382 Fibonacci level. The chart also suggests that the relative strength index (RSI) momentum indicator is about to print a bullish higher low at its diagonal support.

To support his bullish stance on altcoins, TechDev looks at the Bitcoin dominance (BTC.D) index, which tracks how much of the total crypto market cap belongs to BTC. The analyst shares a chart suggesting that BTC.D is about to go on a downtrend as it flashes a bearish divergence, indicating that Bitcoin is losing momentum against altcoins.

A bearish BTC.D implies that altcoins are about to outperform Bitcoin.

Says TechDev,

“The crypto market in two charts.

BTC is bullishly consolidating at its prior all-time high.

As a massive altseason is on the horizon.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Voger Design/Sensvector

Source link

Altcoins

Decentralized Oracle Network Chainlink Leads ERC-20 Projects in Terms of Recent Development Activity: Santiment

Published

2 days agoon

June 29, 2024By

admin

The decentralized oracle network Chainlink (LINK) leads all ERC-20 projects in terms of recent development activity, according to new data published by the crypto analytics platform Santiment.

Santiment notes that Chainlink registered 560.6 notable GitHub events in the past 30 days.

Status (SNT) was second, clocking 385.97 events.

Status aims to offer users a secure messaging app, crypto wallet and web3 browser via an open-source, peer-to-peer protocol and end-to-end encryption.

Ethereum (ETH) itself was third on Santiment’s list, registering 314 notable events.

The analytics firm notes that it doesn’t count routine updates and utilizes a “better methodology” to collect data for GitHub events based on a “backtested process.”

Santiment has previously said that heavy development activity centered around a crypto project indicates developers believe in the protocol. Development activity also suggests that the project is less likely to be an exit scam.

LINK is trading at $14.04 at time of writing. The 17th-ranked crypto asset by market cap is down more than 2% in the past 24 hours.

SNT is trading at $0.0264 at time of writing. The 395th-ranked crypto asset by market cap is down more than 1% in the past day.

ETH is trading at $3,385 and is down more than 2% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs