Ethereum

Lisk DAO to decide what to do with 25% of LSK supply

Published

1 week agoon

By

admin

The Lisk community will soon have to decide whether it should burn 100 million LSK tokens as its first major vote for a newly-formed decentralized organization.

Starting September 27, the Lisk community will have seven days to vote on whether to burn 100 million LSK tokens, which represents 25% of the total LSK supply or allocate these tokens for community incentives until 2033.

In a press release shared with crypto.news, the Lisk team says this will be the “first major vote” of the newly-formed decentralized autonomous organization Lisk DAO, which recently migrated to the Optimism Superchain to lower access to the network’s products across the Ethereum ecosystem.

If the community votes to burn the tokens, the total LSK supply will decrease to 300 million tokens from the current 400 million mark. Conversely, if the community chooses to allocate the tokens, they will be vested into the Lisk DAO Fund from 2027 – 2033 to enable the community to “drive initiatives, support growth campaigns, and finance innovative projects over the next decade,” according to the press release.

Lisk’s chief project officer, Dominic Schwenter, emphasized that the Onchain Foundation (formerly Lisk Foundation) will not participate in the vote “to ensure a fair and community-focused decision-making process.”

Launched back in 2016, Lisk first unveiled its migration plans in late 2023. The team said at the time in a blog post that the decision was driven by the necessity “to upgrade” the Lisk ecosystem and make the network, which was initially designed as a layer-1 chain, to be more “cost-effective for users and developers.”

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

ETH

Experts Eye Ethereum ETF Launch By Mid-July, Predict Price Rally

Published

2 days agoon

July 3, 2024By

admin

The crypto industry is on the verge of a potentially significant development as key figures in the sector hint at the imminent approval of a spot Ethereum ETF in the United States, possibly triggering a notable price rally for ETH.

Nate Geraci, president of The ETF Store, shared insights into the expected timeline for the launch of the first spot Ethereum ETF.

According to Geraci, current forecasts by Bloomberg predict a mid-July launch. He detailed the procedural timeline via X, stating, “Wen spot eth ETF? BBG sticking w/ mid-July. Amended S-1s due July 8th. Potential final S-1s by July 12th. Would theoretically mean launch week of July 15th.”

In parallel, Steve Kurz, head of asset management at Galaxy Digital, confirmed to Bloomberg on July 2 that the U.S. Securities and Exchange Commission (SEC) might greenlight a spot Ethereum ETF before the month’s end.

Related Reading

Kurz emphasized the extensive groundwork laid in collaboration with the SEC, drawing parallels between the proposed Ethereum ETF and Galaxy’s existing spot Bitcoin ETF (BTCO), created with Invesco. Kurz expressed confidence in their preparedness, remarking, “We know the plumbing, we know the process… The SEC is engaged.”

Bloomberg ETF analyst Eric Balchunas also chimed in, aligning with the mid-July expectations. He highlighted the SEC’s recent instructions to Ethereum ETF issuers for amending their S-1 registration forms by July 8, suggesting possible further amendments. Notably, the SEC approved rule changes under 19-b4 in May, facilitating the listing and trading of such funds, though the issuance of funds remained pending final approvals.

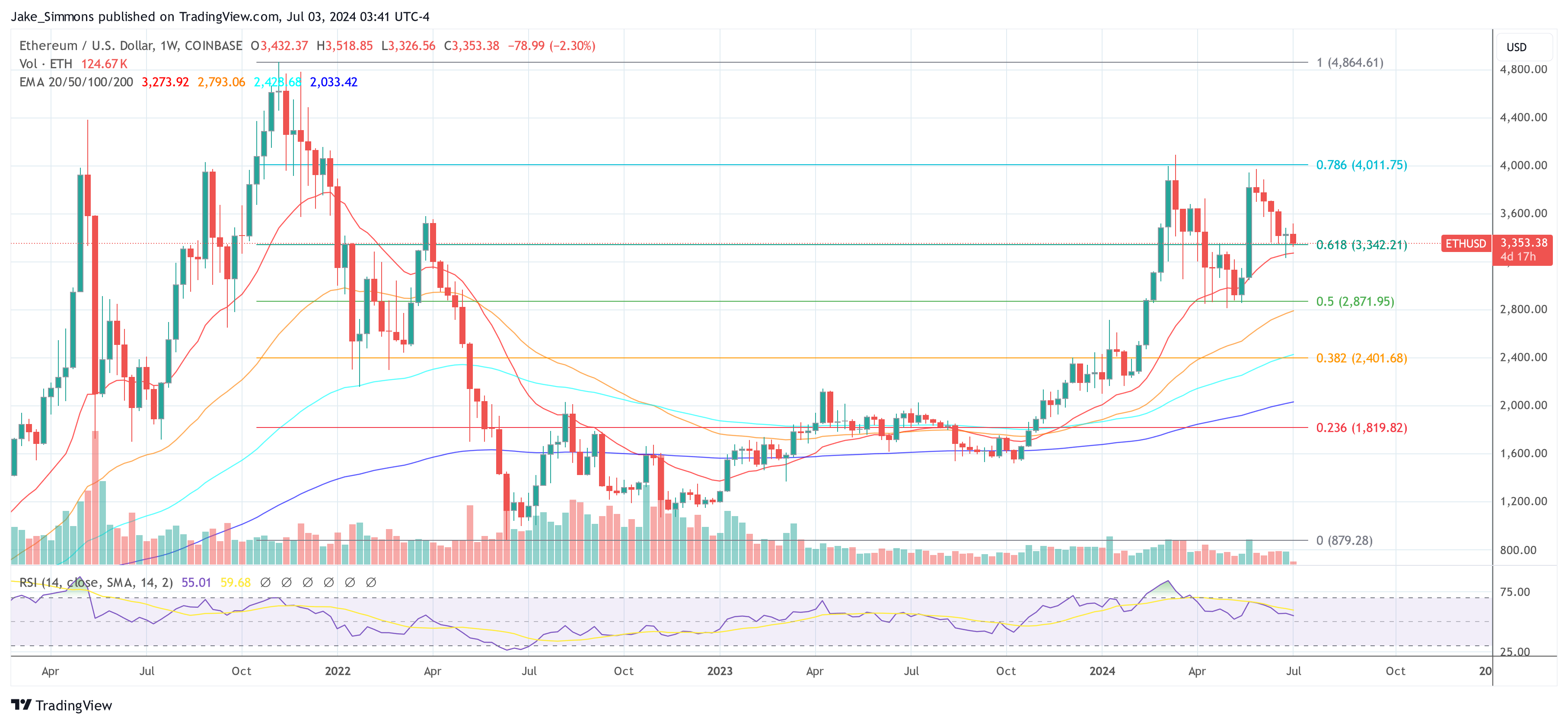

Ethereum Price Holds Above Key Support

The anticipation of these approvals appears to be having a stabilizing effect on Ethereum prices. Crypto analyst IncomeSharks, commenting on Ethereum’s current price trajectory via X, noted optimism for a near-term breakout, stating, “ETH – Looking more optimistic for a Q3 breakout. Liking the chances of a run towards $4,000 this or next month.” According to the chart shared by him, ETH price needs to hold the region of $3,300 to $3,350 in order to rally to $4,000.

Supporting this sentiment, Cold Blooded Shiller highlighted the crucial need for Ethereum to demonstrate momentum at the current price levels, specifically around the $3,400 mark, as a key indicator for a potential high-time-frame impulse.

Related Reading

“ETH is still in a fine position but it really needs to start showing some momentum soon. LTF divergences around this $3400 low are probably where I take one stab at trying to capture any HTF impulse away from the consolidation,” he remarked via X.

Adding historical perspective, analyst Jelle (@CryptoJelleNL) compared the current market phase to Ethereum’s long consolidation in 2016-2017 before its massive rally, urging persistence and optimism: “In 2016-2017, ETH consolidated for 50+ weeks before rallying nearly 12000 percent. Today, people are giving up after less than 20 weeks, with ETH ETFs right around the corner. Stick to the plan boys. The best is yet to come.”

At press time, ETH traded at $3,353.

Featured image created with DALL·E, chart from TradingView.com

Source link

crypto

Ethereum (ETH) Products See Largest Institutional Outflows Since August 2022: CoinShares

Published

4 days agoon

July 1, 2024By

admin

Digital assets manager CoinShares says that institutional crypto products sustained outflows last week for the third week in a row.

In its latest Digital Asset Fund Flows report, CoinShares says digital asset investment products suffered $30 million in outflows last week.

“Digital asset investment products saw a third consecutive week of outflows totaling US$30m, with last week indicating a significant stemming of the outflows. In contrast to prior weeks, most providers saw minor inflows, although this was offset by incumbent Grayscale seeing US$153m outflows.”

Despite overall outflows, the US, Brazil and Australian regions saw $43 million, $7.6 million and $3 million in inflows, respectively.

“Negative sentiment pervaded Germany, Hong Kong, Canada and Switzerland with outflows of US$29m, US$23m, US$14m and US$13m respectively.”

While the leading crypto by market cap Bitcoin (BTC), multi-asset investment vehicles, Solana (SOL) and Litecoin (LTC) brought in $18 million, $10 million, $1.6 million and $1.4 million in inflows, Ethereum (ETH) had one of its worst weeks in years.

“Ethereum saw the largest outflows since August 2022, totaling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.”

Chainlink (LINK) and XRP also brought in $0.6 million and $0.3 million, respectively.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/phive/Sensvector

Source link

C-Buzz

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Published

4 days agoon

July 1, 2024By

adminJul 1, 2024 18:56 UTC

| Updated:

Jul 1, 2024 at 18:56 UTC

By Raghav Sawhney

Starting off with positivity, it looks like ETH ETFs may start trading by July 4th (Which is now delayed by the SEC).

We’re on the edge of a significant breakthrough: the approval of the first spot Ethereum ETFs by the U.S. SEC.

As speculation mounts, here’s a deep dive into the implications of this approval, exploring the background, recent developments, market implications, expert analysis, and more. This comprehensive overview may help in understanding where ETH ETFs currently stand.

What is Ethereum and what happened with Bitcoin ETF Approvals?

Ethereum is the second-largest cryptocurrency by market capitalisation, and has been a cornerstone of the blockchain ecosystem since its launch in 2015.

Unlike Bitcoin, which primarily serves as a digital currency, Ethereum supports smart contracts and decentralised applications (dApps), making it a versatile platform for innovation.

The journey of Bitcoin ETFs began with multiple rejections by the SEC, primarily due to concerns over market manipulation and insufficient regulatory oversight. However, in October 2021, ProShares’ Bitcoin Strategy ETF became the first Bitcoin futures ETF to gain approval, paving the way for further crypto investment products.

The first spot Bitcoin ETF was approved in January 2024 after a decade of regulatory hurdles which paved the way for the potential acceptance of Ethereum ETFs.

Recent Developments

One of the most compelling narratives of the Ethereum ETF is its impact on investors. The ETF structure provides several advantages, including ease of access, as investors can purchase Ethereum ETFs through traditional brokerage accounts. Additionally, ETFs offer enhanced protection, because regulatory oversight by the SEC ensures higher standards of security, keeping investor scepticism at bay.

Eight major asset managers, including BlackRock, VanEck, Franklin Templeton, and Grayscale Investments, have filed for spot Ether ETFs. The SEC has already approved the listing of these ETFs on major exchanges like Nasdaq, CBOE, and NYSE. The final approval of S-1 forms, which detail the fund’s structure, management, and investment strategy, is all that remains.

On May 23rd, the SEC approved 19b-4 applications from these firms, allowing them to issue spot Ether ETFs.

“After careful review, the Commission finds that the Proposals are consistent with the Exchange Act and rules and regulations thereunder applicable to a national securities exchange.” SEC Chair Gensler.

Now 2 months later we are at the stage where S-1 filings may be approved by July 4th with Grayscale holding about 3 million ETH.

The Process Unveiled

- 19b-4s (Exchange Rule Changes) Imagine exchanges like the NYSE or Nasdaq wanting to list a brand-new product: Ethereum ETFs. To do this, they must file a 19b-4 form with the SEC. This filing asks for permission to change rules or introduce new products, essentially allowing the exchange to list these Ethereum-based ETFs.

- S-1s (Registration Statements) The S-1 is a deep dive into the ETF’s blueprint. It outlines everything from the fund’s management to how it plans to mirror Ethereum’s performance. This registration is critical as it provides potential investors with all the necessary information about the ETF.

- The SEC’s Decision-Making Process Both the 19b-4s and S-1s must be approved by the SEC for the ETFs to be legally sold. The SEC usually has 45 days to make a decision on the 19b-4 filings, extendable to 240 days. Approval of these filings means the ETFs can be listed, but without S-1 approval, they can’t be sold to investors.

- Potential for Delay Even with 19b-4 approval, the SEC can “slow play” the S-1 approval. This means they could take longer to review and approve the registration statements, allowing them more time to evaluate market conditions and the specific structures of these ETFs without outright denying the applications.

So what now?

The approval of Ethereum ETFs is expected to have significant market implications:

Price Movements: Previous data shows that the approval of Bitcoin ETFs led to a substantial increase in Bitcoin’s price. Similarly, Ethereum is expected to experience heightened price volatility. For instance, Ethereum rose 2% on the news and was trading at $3,900 as of press time.

Future Outlook: Bullish patterns, the potential approval of spot Ethereum ETFs, and historically favourable conditions during “Uptober” could drive Ethereum to new all-time highs by the end of 2024.

Market Predictions: Analysts are buzzing with excitement, predicting a potential 30% surge in Ethereum’s value within the first month of ETF trading. If Ethereum can smash through the psychological barrier of $4,000 and conquer the R2 Fibonacci pivot at $4,230, the sky’s the limit. With market sentiment on the upswing, we could see a swift rebound above $3,500, paving the way for Ethereum to reach new, unprecedented highs.

On 20 May 2024, Bloomberg ETF analysts Eric Balchunas and James Seyffart significantly increased their estimated odds of SEC approval for spot ETH ETFs from 25% to 75%. This change was brought on by emerging rumours suggesting that the SEC might be reconsidering its stance, driven by political considerations.

On the other hand a well-known crypto analyst, Pentoshi remains skeptical on the projected highs for the ETH after the ETFs roll out.

Technical Analysis: Ethereum has broken out of a falling wedge pattern, with significant resistance expected between $4,000 and $4,230 and strong support near $3,000, aligned with the 200-day EMA.

Data and Dashboards

Market data from CoinMarketCap and Glassnode indicate a surge in trading volumes and active addresses, suggesting growing investor interest and market participation.

(Data as taken on 28th June )

Price movements of Ethereum show significant spikes around major news events.

Charts also show a substantial influx of institutional investments into Ethereum-related products, with a notable increase in Grayscale’s Ethereum Trust holdings.

Projects, Protocols and the People

Ethereum’s ecosystem hosts numerous key projects and protocols, including Uniswap, Aave, and Chainlink. These projects are poised to benefit from the increased attention and investment resulting from Ethereum ETF approvals.

For instance, Uniswap’s daily trading volume saw a 15% increase following the news.

Users:

– Active Wallets: The number of active Ethereum wallets has surged to over 70 million, with daily transaction volumes exceeding 1.2 million.

– Transaction Volume: Ethereum’s transaction volume has consistently grown, reaching new highs of $15 billion daily, driven by DeFi and NFT activities.

The crypto community is geared up for the Pros and Cons that come with ETF approvals. Community members on Crypto-twitter have been largely positive, reflecting excitement and bullish sentiment on this topic.

A Brief?

Approval of Ethereum ETFs could lead to increased mainstream adoption of Ethereum, providing a regulated and safer investment environment. Just like there are pros and Cons for everything, the SEC’s approval of Ethereum ETFs may represent a watershed moment for the cryptocurrency market.

With increased institutional participation, ETH ETFs will improve market liquidity and provide the means for a robust regulatory framework. Ethereum is set to achieve new milestones. Conversely, delays or denials could reflect the SEC’s ongoing concerns about the stability and security of cryptocurrency investments.

Raghav Sawhney

Raghav is a significant contributer who uses his knowledge, skills and experience towards development & growth of the organisation in an efficient and effective manner.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs