Bitcoin mining

Marathon Uses Bitcoin Mining To Heat Town of 11,000 in Finland

Published

1 week agoon

By

admin

Today, Marathon Digital Holdings, Inc. (NASDAQ: MARA), a leader in Bitcoin mining, has launched an innovative pilot project to recycle heat generated from Bitcoin mining to warm a community in Finland. The 2-megawatt data center, energized at the end of May, is located in the Satakunta region, home to 11,000 residents.

JUST IN: Marathon is now warming a town of over 11,000 in Finland using heat from #Bitcoin mining 🤯 🇫🇮

— Bitcoin Magazine (@BitcoinMagazine) June 20, 2024

“This pilot project in Finland is a critical step forward in our strategy to expand globally and innovate sustainably,” said Fred Thiel, Marathon’s chairman and CEO. “We are not just producing digital assets; we are heating homes and integrating sustainable practices into our business model. We believe that this kind of innovation can drive the advancement of the digital asset compute industry and further strengthen Marathon’s leading position in the field.”

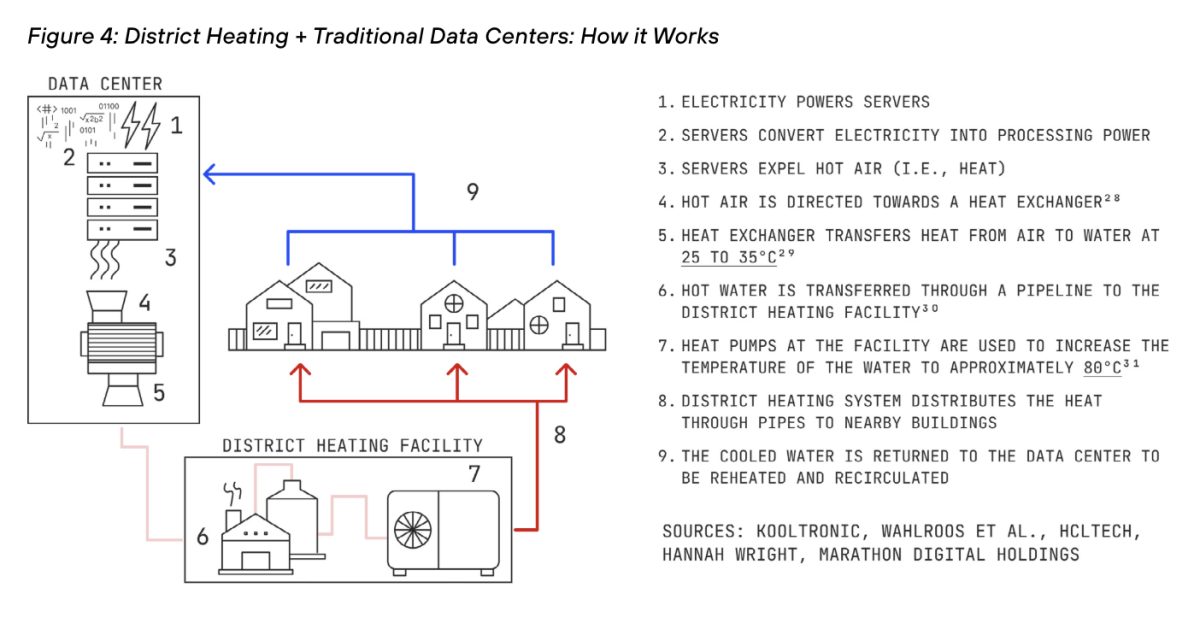

The initiative marks Marathon’s first district heating project and its debut in Europe. District heating involves centrally heating water and distributing it through underground pipes to heat local buildings. Finland, known for its clean energy mix, relies heavily on biomass for district heating. By utilizing heat from digital asset data centers, the project aims to reduce carbon emissions and operating costs.

Marathon's ASIC Heating Setup

“Europe’s colder climate has given rise to an extensive network of district heating systems that provide warmth to millions of residents,” Marathon stated in its new Heating with Hashes report, published in full below. “This same climate has attracted a different industry – data centers – which benefit from reduced energy consumption and infrastructure costs associated with the cooler temperatures. The share of electricity consumed by data centers in the EU is at least double the global average, with data centers accounting for around 3% of the EU’s electricity consumption compared, to 1.0-1.5% globally. These energy-intensive facilities generate 3 significant amounts of heat, creating a unique opportunity for strategic partnerships with district heating systems.”

“One industry needs heat, while the other generates plenty of it,” Marathon continued in the report. “Instead of wasting the abundant heat produced by data centers, it could be recycled to meet heating demand. This innovation transforms an unwanted byproduct of data centers into a valuable resource for district heating systems, reducing costs and waste for everyone involved while reducing the need for inefficient, carbon-emitting heat sources.”

Marathon's Heating with Hashes Report

The project is part of Marathon’s broader commitment to sustainability, expanding its footprint to twelve sites across four continents. According to Future Market Insights Inc, the district heating market is projected to grow from $198 billion to $340 billion by 2033, offering significant growth opportunities. By recycling heat, Marathon aims to enhance its sustainability portfolio and explore new revenue streams, aligning with its goal of achieving zero-cost power for digital asset computing.

“Following the success of our pilot project in Utah, where we demonstrated that it is both economically viable and environmentally beneficial to use landfill gas for digital asset compute, we have continued to experiment with innovative ways that our operations can add value beyond securing distributed ledgers, like Bitcoin’s,” stated Adam Swick, Marathon’s chief growth officer. “This pilot project in Finland is our first attempt to convert the heat that we produce as a byproduct of our operations into a valuable resource for a local community. We look forward to gathering more data from this project as we look for additional ways to leverage digital asset compute to build a more sustainable future.”

For more information about Marathon’s sustainability initiatives, visit their website here. Those interested in reading Marathon’s full Heating with Hashes report can do so below:

Source link

You may like

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

Biden Administration

Trump’s Appeal to Bitcoin Miners Is a Wakeup Call for Crypto to Stay Apolitical

Published

3 weeks agoon

June 12, 2024By

admin

Many see it as frankly embarrassing to be buddying up with any politician, putting aside Trump’s Napoleonic sized ego. Bitcoin writer and privacy advocate L0la L33tz, for one, wrote a whole essay about the subject, arguing that politicians cannot be trusted, that Trump failed to deliver on many of his previous campaign promises, and that Bitcoin doesn’t really even need political support.

Source link

Bitcoin

Bitcoin Mining Difficulty Hits New Record High With 5% Rise

Published

7 months agoon

November 26, 2023By

admin

The Bitcoin mining difficulty has witnessed another increase in 2023, bringing the metric to a new all-time high. The Bitcoin “difficulty” is a vital aspect of the network that controls the rate at which new blocks are added to the blockchain at a given time.

Bitcoin Mining Difficulty Surges To A New High Of 67.96T

According to data from BTC Blockchain Explorer, the Bitcoin network experienced a significant adjustment at block height 818,496. This caused the blockchain’s difficulty to soar by 5.07%, reaching a new all-time high of 67.96 T.

The mining difficulty is an essential feature that measures how much power is required to verify transaction blocks on the Bitcoin blockchain. An increase in mining difficulty value suggests higher demand for the Bitcoin network, while a lower difficulty value implies that there are fewer miners on the network.

Bitcoin mining difficulty ushered in a mining difficulty adjustment at block height 818496. The mining difficulty was raised by 5.07% to 67.96 T, continuing to hit a record high. The current average hashrate of the entire network is 504.80 EH/s. https://t.co/vgAkEgyDOf

— Wu Blockchain (@WuBlockchain) November 26, 2023

It is worth noting that the metric has been on an upward trend in the past few weeks. In fact, the recent mining difficulty value represents the sixth consecutive increase in the last six adjustments.

Interestingly, the new mining difficulty value surpassed the early projections for the blockchain. Initially, the Bitcoin mining difficulty was only expected to increase by about 3.8% to 67.14 T in the latest adjustment.

The network hash rate, which measures the total computing power for mining BTC, has also increased. According to BTC Blockchain Explorer, the current average hash rate for the Bitcoin network is 504.8 EH/s, a 3.76% increase from a previous hash rate of 486.5 EH/s.

Some of the factors contributing to the increasing Bitcoin mining difficulty are BTC’s recent price performance, the recent surge in network activity, and the spike in transaction fees. And as the metric continues to rise, it appears that miners will continue to face the challenge of maintaining profitability.

BTC Price Overview

As of this writing, Bitcoin is valued at $37,510, reflecting a 0.6% price increase in the past day. While the premier cryptocurrency seems to be drifting away from the $38,000 price mark, it has managed to maintain most of its profit on the weekly timeframe.

According to data from CoinGecko, the Bitcoin price has swelled by more than 2.7% in the past seven days. Meanwhile, the market leader has registered a 10% increase in the past month, emphasizing its strong performance in November.

Bitcoin remains the largest cryptocurrency in the sector, with a market capitalization of over $733 billion.

Bitcoin price drifts away from $38,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Source link

Asia

Kazakh crypto miners plead with president to cut energy prices

Published

9 months agoon

October 3, 2023By

admin

Local crypto-mining operators in Kazakhstan — the world’s third-largest market in terms of Bitcoin mining hash rate — are complaining about high energy prices to the country’s president.

According to local media, eight major cryptocurrency mining operators signed an open letter to President Kassym-Jomart Tokayev. The list includes BCD Company, TT TECH Limited, KZ Systems, AI Solutions, Green Power Solution, VerCom and Kinur Invest.

Related: Kazakhstan establishes regulatory agency to implement CBDC

The letter states that the Kazakh crypto mining industry is in a “very distressful situation” because of high energy prices for miners. According to the text:

“As of today, all major industry players have suspended their activities and plan to completely cease their business in the Republic of Kazakhstan by the end of the year.”

The executives who signed the letter believe that the situation with prices derails the government’s efforts to regulate the crypto industry in general and mining in particular. According to the letter, the problem is a consequence of the decision to raise taxes on energy for crypto miners. Because of the taxes, the country has already lost its position among crypto mining leaders like the United States, Russia and China, and the industry stands on the brink of extinction. The letter claims:

“If the government does not take urgent measures, the digital mining industry in the Republic of Kazakhstan will cease to exist.”

The country introduced taxes on digital mining on Jan. 1, 2022, based on electricity consumption by mining entities. The law emerged amid growing national frustration with crypto miners’ undertaxed usage of the national power grid.

Even at the highest mark, 1 kilowatt hour (kWh) of taxed electricity in Kazakhstan costs miners around $0.067, significantly lower than the average of $0.12 per kWh before any taxes in the United States. According to the data from the Kazakh government, it received around 3.07 billion tenges ($7 million) in tax payments from crypto mining entities in 2022.

Source link

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

XRP Price May Soar Past $6, Here’s Why

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs