Markets

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

Published

4 days agoon

By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

The Mt. Gox bankruptcy estate has transferred billions of dollars worth of Bitcoin (BTC) to an unidentified wallet, further exacerbating concerns on declining crypto prices.

Data from blockchain analytics firm Arkham Intelligence shows a cold storage wallet belonging to Mt. Gox has transferred 47,228 BTC, worth roughly $2.71 billion, according to a Thursday post on X, formerly Twitter.

It follows several test transactions conducted on Wednesday by the estate, valued at less than $27 over three separate transactions, according to blockchain data also provided by Arkham.

Repayments from Mt. Gox are expected to commence this month after extensive preparations for fund distribution. The defunct exchange will disburse approximately 142,000 BTC and 143,000 Bitcoin Cash.

The development marks a step towards resolving the decade-long wait for 127,000 creditors affected by the 2014 collapse of the former Japanese crypto exchange.

Several headwinds continue to dampen investor sentiment, including tensions arising from the recent transfer of Bitcoin by the German government, which began transferring seized assets to its own wallet six months ago.

Rising interest rates, inflation, and global economic instability also present uncertainty, Decrypt was previously told.

The German government seized nearly 50,000 BTC from the operators of the illegal streaming site Movie2k.to in 2020. The Bitcoin, initially worth around $2 billion, was confiscated as part of an investigation into the site’s activities, which included distributing pirated films and laundering the proceeds.

Roughly 1,300 BTC, worth $75.5 million, were sent to several exchanges, including Bitstamp, Coinbase, and Kraken, on Wednesday, adding to concerns that prices could be headed lower.

“It would need to be a massive July for Bitcoin’s price to resist the sheer weight of supply flooding into the market from Mt. Gox and the German government,” Pav Hundal, lead market analyst at crypto exchange Swyftx, told Decrypt. “This could be how we get as low as $50,000.”

Bitcoin’s price has dropped 9.5% since the beginning of the week, dipping from $62,000 on Monday to $56,700 on Wednesday. The asset is changing hands for a little over $56,900, CoinGecko data shows.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

Markets

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

Published

5 hours agoon

July 8, 2024By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

The German government continued to move Bitcoin from its holdings to crypto exchanges Monday morning, transferring BTC worth over $28 million to Coinbase and Bitstamp.

Addresses linked to the German government by crypto analytics firm Arkham moved 250 BTC each to Coinbase and Bitstamp. A further 500 BTC worth $28 million was also sent to an unidentified address.

Per an Arkham Intelligence dashboard, the German government’s Bitcoin holdings amount to 38,826 BTC seized as a result of criminal cases, worth over $2.23 billion at current prices. The bulk of its holdings were seized in January as the result of a piracy sting, when Bitcoin was trading at around $46,000.

In recent days, the German government has been offloading its Bitcoin through crypto exchanges, prompting the price of Bitcoin to plunge to lows of under $55,000 and wreaking havoc on the wider crypto markets. At time of publication, the price of Bitcoin has recovered to around $57,590, trading flat on the day.

Over the weekend, an independent Member of the Bundestag, Joana Cotar, accused the German government of having “no strategy” for dealing with Bitcoin, arguing that, “I’m not at all sure whether the government was or is aware of the consequences of its sales.”

Others have seized the opportunity presented by Germany’s Bitcoin sales, with controversial Tron founder Justin Sun making a public offer to buy the German government’s remaining BTC holdings in order to “minimize the impact on the market.”

Bitcoin selling pressure

Analysts told Decrypt that selling pressure on Bitcoin would be unlikely to decrease in the coming days, with Germany’s sell-off over the past week compounded by the transfer of funds from the bankruptcy estate of defunct crypto exchange Mt. Gox.

Mt. Gox users are awaiting restitution of up to $7.7 billion in funds lost due to a hack more than 10 years ago, with repayments expected to kick off in July.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Markets

German Government Sill Holds 39,826 BTC, Blockchain Data Show

Published

9 hours agoon

July 8, 2024By

admin

“Foolishly, the German Government has transferred more than $390 million worth of BTC to exchanges over the past few weeks to be sold for fiat currency. From a geopolitical perspective, it is a strategic blunder for any nation-state to sell bitcoin holdings for fiat currency given that they can simply print the latter out of thin air,” the July 5 edition of the Blockware Intelligence newsletter said.

Source link

cryptocurrency

Top cryptocurrencies to watch this week: BTC, LTC, TRX

Published

1 day agoon

July 7, 2024By

admin

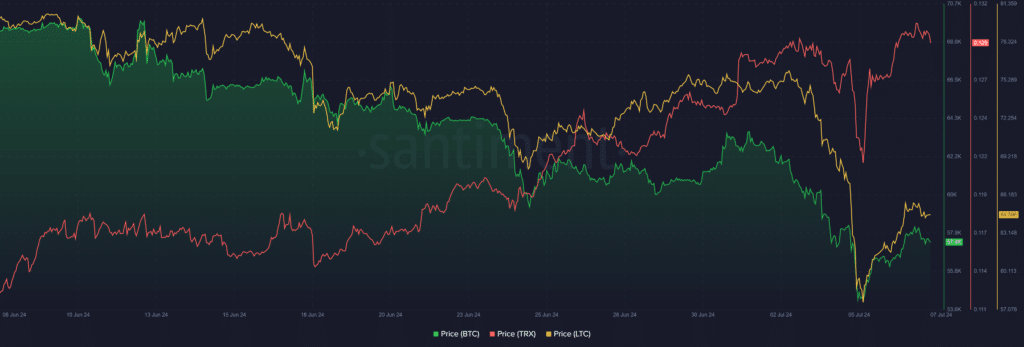

The first week of July introduced bearish pressure, leading to massive losses in the crypto market. Bitcoin (BTC) led the downtrend, as it consistently recorded lower lows amid sustained selling pressure.

Notably, the rest of the market experienced similar losses. Consequently, the global crypto market cap lost $140 billion, as it dropped further to $2.11 trillion, its lowest level since late February. While most assets remained down, a few witnessed remarkable recoveries.

Here are our top picks for cryptocurrencies to watch this week following their noteworthy performances during the downtrend last week:

Bitcoin drops to 5-month low

Bitcoin’s start to the week was mildly bullish following a consolidation phase two weeks back. However, bearish pressure emerged as the leading crypto asset maintained a divergence from U.S. equities, currently in their bullish stage.

BTC was subjected to its toughest bearish selling pressure this year, as bankrupt exchange Mt. Gox began creditor repayments, the German government distributed thousands of BTC tokens, new holders began selling off their assets and miners showed signs of capitulation.

Last week alone, Bitcoin gave up multiple psychological thresholds from $63,000 to $58,000. The asset slumped to a 5-month low of $53,485 on July 5 but immediately rebounded from this position. Despite the mild recovery, BTC ended last week with a 4.5% drop, slightly above $58,000.

At press time, the asset has again forfeited the $58,000 threshold amid an additional 1.13% drop. Nonetheless, it has maintained a position above the lower Bollinger Band ($56,347). Bitcoin’s hopes of a full recovery hinge on its ability to reclaim the 20-day SMA ($61,509) and the upper Bollinger Band ($66,676).

LTC slumps 12%

Litecoin (LTC) was one of the numerous victims of last week’s market collapse. The asset showed resilience at the start of the week, largely consolidating from June 30 to July 2.

However, as pressure mounted, LTC recorded three consecutive intraday losses from July 3 to 5, dropping 18.6% within this period. When the market staged a mild rebound on July 6, LTC gained 5.72% but closed the week with a 12.7% loss.

Litecoin’s MACD line crossed below the Signal line on July 4, confirming the bearish momentum.

With both lines currently sloping downward, this suggests the bearish momentum is increasing. LTC needs to decisively close above Fib. 0.236 ($64.60) to mount a formidable defense against any more declines this week.

TRX bucks the trend, hits 4-month high

Tron (TRX) was one of the few assets that bucked the overall bearish trend last week.

TRX started the week with an indecisive bearing, but eventually increased 3.5% over four days to $0.12997 on July 3, looking to recover the $0.13 territory. The last time Tron saw this level was on March 13.

The retest of the $0.13 region coincided with the widespread drop in the market. Tron crashed 6.7% to a low of $0.12117 on July 5, but immediately rebounded.

A recovery push on July 6 helped it reclaim the bullish momentum, leading to a four-month high of $0.13028. Tron closed last week with a 3.5% increase.

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Is Ethereum Becoming Scarcer than Bitcoin on Exchanges?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs