Coins

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Published

3 days agoon

By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

In a move to bolster support for cryptocurrency-friendly politicians in the United States, crypto investment firm Multicoin Capital on Friday announced a matching campaign for donations made to the Sentinel Action Fund.

Kyle Samani, managing partner at Multicoin Capital, revealed the initiative in a detailed Twitter (aka X) thread, emphasizing the importance of political engagement in shaping the future of cryptocurrency regulation.

The campaign, set to run for 10 days, will see Multicoin Capital matching all donations made in Solana (SOL) tokens to the Sentinel Action Fund, up to a total of $1 million.

“We’re doing this because we realize that political engagement matters, and it starts with supporting the candidates who believe America needs to remain free for innovation,” Samani stated.

The Sentinel Action Fund, a political action committee (PAC), focuses on electing crypto-friendly candidates to the U.S. Senate. Under the leadership of Jessica Anderson, the PAC is backing conservative candidates who support responsible crypto innovation in America.

Samani highlighted the endorsement of Senator Bill Hagerty, a known champion of crypto innovation.

“We can’t win without [get out the vote] efforts, and Sentinel Action Fund is literally laying the groundwork for a pro-crypto Senate—they are on the ground in swing states to boost turnout for pro-crypto candidates,” said Hagerty, according to Samani’s tweet thread.

The initiative comes at a crucial time for the cryptocurrency industry, with Samani claiming that “it’s clear that our industry’s future is at stake, and that we need to do everything in our power to elect pro-crypto candidates that will see sensible legislation brought to the floor.”

To facilitate donations, Multicoin Capital has partnered with Dialect to implement a donation “Blink” system, using a recently added Solana network feature, allowing for direct contributions from Twitter using Backpack wallets, with Phantom wallet support expected in the near future.

“When you make your donation here on X, the Blink will provide all the information that is needed for FEC compliance purposes,” Samani explained.

The matching campaign aims to amplify the impact of individual contributions.

“If you make a contribution in SOL during this period, we’ll double the impact of your contribution with our match,” Samani stated, directing potential donors to the Sentinel website. Samani also expressed gratitude to the Solana community for rapidly developing the technology to support this initiative.

“This wasn’t possible three days ago, but several contributors across teams worked day and night to make it happen,” he noted.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Coins

This Week In Coins: Bitcoin’s Bad Week Sinks the Crypto Fleet

Published

3 days agoon

July 6, 2024By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

After ten years, the Mt. Gox bankruptcy’s Bitcoin distributions have officially begun—and the crypto market is spooked.

On Friday, the price of Bitcoin collapsed as low as $53,898, its lowest price since February, according to CoinGecko. That’s a 27% drop from its all-time high of $73,700 registered in March, and the largest pullback from a local high since the asset’s bottom at $15,500 in November 2022.

Though Bitcoin’s price fell swiftly after the exchange revealed it was initiating distributions, on-chain data suggests that the pullback was far more driven by narrative than by the event itself.

“Mt. Gox wallets continue to hold in total 138,985 BTC ($7.52B),” tweeted blockchain data platform Arkham Intelligence on Friday. That means just 2,701 BTC had actually left the exchange’s wallets for repayments—and only a fraction of those coins may have been sold by recipients.

UPDATE: Mt. Gox moving $2.71B BTC

In the past 8 hours, Mt. Gox wallets moved 47,229 BTC ($2.71B) from the cold wallet 1HeHL.

2701.8 BTC ($148.4M) was moved out of Mt. Gox wallets with 1544.7 BTC ($84.9M) sent to Bitbank through Gox address 1PKGG, and 1157.1 BTC ($63.6M) sent to… pic.twitter.com/sJEuJB7GwC

— Arkham (@ArkhamIntel) July 5, 2024

Indeed, the bearish narrative surrounding Mt. Gox has proven so overpowering that even altcoins completely unrelated to the exchange are collapsing.

While BTC has slightly recovered to $56,372—a 7% drop over seven days—Ethereum has slid way down and closed out the week at $2,989 for an 12% weekly drop. That’s despite a counter-bullish narrative for the asset surrounding Ethereum spot ETFs that could go live next week, affirming that Mt. Gox and Germany’s Bitcoin are the top concerns in crypto right now.

The top 10 cryptocurrencies by market cap, excluding stablecoins, all ended the week in the red.

So what is holding up? Solana, apparently, down only 4% this week—and is actually up a modest 3% over the past 24 hours. The asset is potentially next to get the digital asset ETF treatment, with industry watchers suggesting it could happen after the U.S. federal election when crypto’s arch-nemesis Gary Gensler may lose his position at the SEC.

Speaking of the election, Solana-based political meme coins went on a rollercoaster this week around speculation of President Joe Biden potentially being replaced as the Democratic Party nominee.

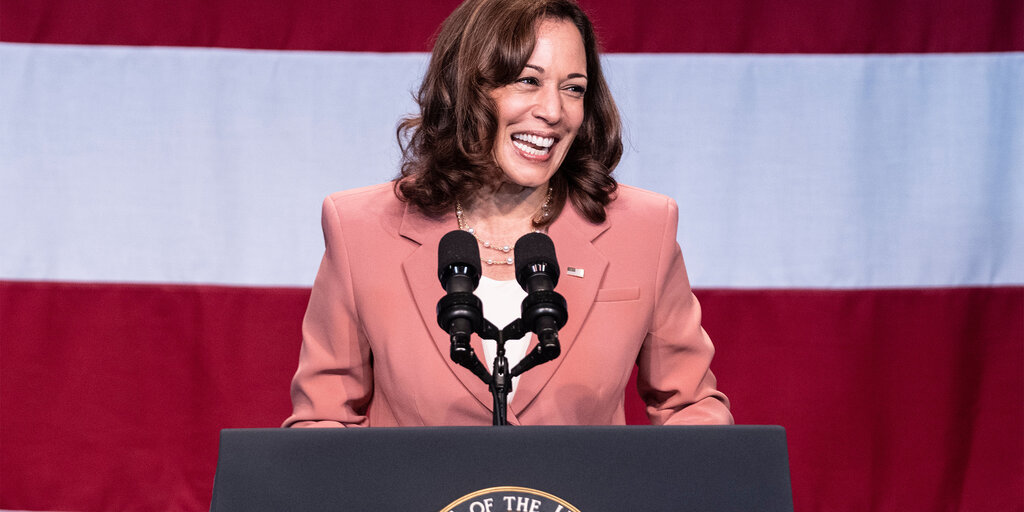

The Jeo Boden (BODEN) meme coin fell 43% on the week, partially recovering after Biden promised not to drop out of the race. Regardless, Kamala Horris (KAMA)—the coin based on his Vice President—is still up 326% as crypto bettors briefly favored Kamala Harris to replace Joe Biden. The president flipped his vice president yesterday.

The lasting appeal of meme coins has also, sadly, been leveraged by scammers. Earlier this week, the $SMASH token—a meme coin inspired by UFC star Khamzat Chimaev—dumped to zero immediately after the fighter promoted it over social media, with on-chain footprints pointing to an orchestrated pump and dump.

Edited by Ryan Ozawa.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

If crypto investors are any measure, Kamala Harris will replace President Joe Biden if he drops out.

Yes, the coconuts are continuing to fall from the tree for Biden following his disastrous performance at last week’s presidential debate, with confidence faltering in his ability to beat Donald Trump in the November general election. And nowhere is it more nutty than in crypto land.

On the burgeoning prediction market Polymarket, Harris’s chances of becoming the nominee surged today from 7% to a peak of 31% at midday. President Joe Biden was still the frontrunner at 58%, with Michelle Obama at 7% and California Gov. Gavin Newsom at 3%.

There is around $75.6 million worth of bets on the line for that poll.

For what it’s worth, in a separate poll on Polymarket, Biden’s likelihood of dropping out increased today to 45%, a 10% gain. The odds have fluctuated within 10 points since a high call of 50% on June 29, two days after the debate.

Meanwhile, $KAMA, which has become the Solana meme coin of choice to represent the vice president, saw a nice 127% pump today up to $0.00843 at 2:00 Pacific Time, according to CoinGecko, where the coin has an $8 million market cap. DexScreener shows that 1,171 unique wallets trade the coin. By comparison, $NOOSUM, a Newsom’s tribute coin with a $2.7 million market cap, was up 21.9% to $0.0043.

It almost goes without saying that $BODEN, Solana’s favorite Biden coin, continued to fall 70% since last week and was hovering at around a nickel, according to CoinGecko—a mere fraction of $TREMP, the Donald Trump coin, which is trading at around $0.55.

Meme coins are fueled entirely by memetic energy, of course, are extremely volatile, and frequently drop to zero. If you are looking for something that will retain at least some value, there is the Kamala Harris proof coin from the Hamilton Collection, or the Future 47th, 1st Woman President coin on eBay. Either one can always come in handy for a coin toss.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

This Week In Coins: Bitcoin Price Cools, Solana Soars on ETFs, and BODEN Tanks Amid Debate

Published

1 week agoon

June 30, 2024By

admin

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

The crypto market’s bearish slide in June began showing signs of recovery this week, as bullish news revived investor interest across a variety of altcoins.

Chief among those coins is Solana (SOL)—one of the biggest cryptocurrencies after Bitcoin (BTC) and Ethereum (ETH).

The latter assets were down another 5% and 3% respectively over the past week, with another old-school Bitcoin whale deciding to take profits while the market is up. By contrast, SOL leaped by an impressive 6% this week to over $142 thanks to VanEck pitching the first-ever application for a U.S.-based Solana ETF.

VanEck’s logic was simple: If regulators consider Ethereum a commodity worthy of an ETF, then surely Solana also ticks all necessary boxes as well. It’s a prevalent bullish thesis for altcoin investors, eager for a taste of the Wall Street inflows that Bitcoin ETFs enjoyed earlier this year. And 21Shares followed up with its own Solana ETF filing on Friday, continuing the buzz.

Riding the same excitement, alternative runner-up smart contract platforms including Cardano (ADA), Avalanche (AVAX) and Polkadot (DOT) also rose approximately 5.5%, 11%, and 7% respectively.

Meanwhile, the Telegram-linked Toncoin (TON) recovered some of its gains from earlier this month following a steep correction last week, rising over 5% in the last seven days. It has now successfully eclipsed Dogecoin as the 9th largest crypto by market cap.

Another coin to see market-defying gains this week was Kaspa (KAS)—a top 25 crypto by market cap that exploded 23% this week after Marathon Digital announced that it was mining the cryptocurrency. The miner has now produced $15 million worth of KAS since September 2023, with its dedicated ASICs generating 95% gross profits on its efforts in some cases.

Blast (BLAST) was a major focus for traders this week, as the token tied to the Ethereum layer-2 network finally launched alongside a sizable airdrop that put $354 million into the wallets of users—though there was some initial disappointment among the Crypto Twitter chatter amid expectations of larger bags for early supporters.

Still, the airdrop indeed enriched many users, and BLAST started to bounce back after significant selloffs. It’s currently down 29% from this week’s peak, at a price of nearly $0.021, giving it a market cap around $360 million.

Perhaps most volatile this week, however, were the political meme coins. Following what was widely viewed as a disappointing debate performance from President Joe Biden, the Solana-based “Jeo Boden” (BODEN) token tanked 52% in a single day—alongside Biden’s re-election odds, at least per crypto bettors.

Donald Trump, who many crypto advocates viewed as the victor of the debate despite his persistent falsehoods, also saw his “Doland Tremp” (TREMP) token plunge late Thursday into Friday—though it’s still up 13% on the week.

Edited by Andrew Hayward

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs