News

Proof-Of-Stake On Bitcoin? Discussing Botanix’s Spiderchains

Published

4 weeks agoon

By

admin

In a recent interview with Bitcoin Magazine, Shinobi sat down with Willem Schroé from Botanix Labs to discuss the progress and vision behind Spiderchains, an innovative scaling solution soon to be released to the public. Despite the flurry of attention surrounding other layer solutions like BitVM and rollups, the team at Botanix has been steadily laying out the groundwork for a distributed network capable of supporting 10,000 nodes, leveraging a unique combination of multisig and proof-of-stake (PoS) mechanisms.

Design Overview

Schroé describes Spiderchains as a decentralized network of multisigs, similar in concept to the Lightning Network but using a different architecture. “If you start with this idea of a multisig, but then think bigger…you will generate one multisig, a bigger multisig, then a frost multisig of 100 random members.”

This decentralized network of multisigs forms the backbone of Spiderchain, ensuring the security of the assets deposited to the platform. Spiderchain uses the Ethereum Virtual Machine (EVM) as an execution environment and secures it using a novel PoS mechanism, enhancing the network’s security and decentralization. The design aims to address issues commonly associated with other layer 2 solutions, particularly those on Ethereum, which often suffer from centralization and security vulnerabilities. The architecture of Spiderchain prioritizes decentralization and security through its unique integration of multisig and PoS mechanisms.

Combining Proof of Stake and Proof of Work

Building a PoS consensus layer on top of Bitcoin’s proof of work (PoW) system addresses many issues inherent in pure PoS systems. Willem, once a “proof of work maximalist,” explained the benefits of this hybrid approach. The combination of PoS and PoW also solves security concerns related to randomization and finality. This integration allows Spiderchain to inherit the finality of Bitcoin, further strengthening its security model.

By using Bitcoin’s block hash for randomization, Spiderchain ensures a secure and reliable method for selecting validators, thus enhancing the overall stability and security of the network. Schroé pointed out that this unique approach resolves many of the centralization and security issues that typically plague pure PoS systems.

Security and Forward Security

One of the standout features of Spiderchain is its forward security, a concept borrowed from encryption. Forward security means that even if a key is compromised, it cannot be used to decrypt previous transactions, enhancing the overall security framework of the network. This feature ensures that historical transaction data remains secure even if future keys are exposed. The protocol achieves this by frequently rotating keys and using unique keys for each transaction, preventing any single point of failure from compromising the entire chain’s security.

“When you think about the roadmaps of different rollups, at some point for upgradability, you’ll have to introduce a time delay. But even with a time delay, let’s say you have a two-week time delay or a 30-day time delay, after those 30 days, an attacker still knows exactly that he’ll be able to steal the funds. With forward security, that’s a big unknown.”

This approach not only protects past transactions but also bolsters trust in the network’s resilience against potential attacks.

Slashing and Capital Efficiency

Spiderchain also implements slashing rules to penalize malicious stakers, further securing the network. This robust mechanism ensures that any malicious actions are promptly and effectively addressed. Moreover, the design of provides capital efficiency and decentralized ownership. Unlike other layer 2 solutions that rely on a single smart contract with a large amount of funds, Spiderchain distributes the risk across multiple multisigs. “You no longer have that honeypot, you also have suddenly like decentralized ownership. There’s no single party that can own that whole thing,” Schroé emphasized. This design also allows for greater participation and security, making it a significant improvement over existing models.

Progress and Vision

Willem acknowledged the complexity of building on Bitcoin, even with recent advancements. He emphasized Botanix Labs’ dedication to the project and their focus on moving from white paper concepts to a fully functional product. “There’s a lot to be built. It’s not easy to actually build to go from that white paper to actually to a working product. And so we’ve been heads down, we’ve been building,” he explained.

Looking ahead, Willem shared the exciting news that the federated sidechain of Spiderchain is expected to go live soon. “We’ve implemented the bigger Frost Multisigs, we’ve built the initial federation. We will start with a federated sidechain and basically build out from there.” he announced.

Botanix’s Spiderchain has been live on testnet since November and has already processed over one million transactions.

Source link

You may like

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

Donation

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

Published

1 hour agoon

July 5, 2024By

admin

Multicoin Capital, one of the biggest crypto-focused investment firms in the United States, announced plans to pledge up to $1 million to support pro-crypto candidates.

Multicoin plans to donate to the conservative super political action committee (PAC) Sentinel Action Fund to support four Senate candidates: Sam Brown in Nevada, David McCormick in Pennsylvania, Bernie Moreno in Ohio, and Tim Sheehy in Montana.

Multicoin plans to support Senate candidates who take a positive stance toward crypto.

All four of these candidates are Republican.

Sentinel and Solana (SOL)

Sentinel’s crypto donation drive will be the catalyst for all of Multicoin’s contributions. According to Sentinel, Multicoin will match 100% of Solana (SOL) token donations sent to the PAC from now until July 14.

Gemini is hosting the group’s crypto donations portal and accepting various tokens, including SOL. The Winklevoss twins, Gemini’s founders, have been very vocal in their support of Presidential nominee Donald Trump and have donated to his cause.

Sentinel is conservatively minded and Multicoin tries to stay bipartisan, even though they are very vocal about their support for pro-crypto candidates.

“We’re doing this because we realize that political engagement matters, and it starts with supporting the candidates who believe America needs to remain free for innovation,” said Multicoin Managing Partner Kyle Saman on their support of the four candidates.

America-first crypto

Multicoin wants to support candidates that support America-first crypto mining and pro-crypto mining legislation. The four candidates have expressed a positive stance towards crypto in their campaigns, making them ideal funding recipients.

Kyle Samani and Tushar Jain are the funds leaders and have supported pro-crypto candidates on a bipartisan basis, even though their most recent support only involves Republican candidates.

Multicoin identified Sentinel as a great partner for these funds as the specific candidates in question are pro-crypto, regardless of their political party.

The four Republicans supported by Sentinel and now Multicoin received “A” ratings from Stand With Crypto.

Other political funding

On June 26, Fairshake PAC announced plans to spend over $100 million in the general election to back pro-crypto lawmakers. Fairshake achieved significant victories in recent congressional primaries, proving that pro-crypto stances can help sway electoral decisions.

Fairshake was created to support candidates who are favorable to the crypto industry.

Sentinel and Fairshak PACs usually support campaigns that could potentially help the Republicans gain control of the Senate. A change in Senate control could impact the balance of power in agency appointments — like the SEC — and other important areas where crypto companies engage with the federal government.

Source link

Donations

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Published

3 hours agoon

July 5, 2024By

admin

These candidates’ opponents aren’t uniformly critical of cryptocurrency on the level of Elizabeth Warren, the Massachusetts senator despised by the crypto industry for her rhetoric of hosting an “anti-crypto army.” Three of the four are rated as “neutral” or better by Stand With Crypto, though Ohio Senator Sherrod Brown touts an “F.”

Source link

Crypto scam

Crypto heists near $1.4b in first half of 2024: TRM Labs

Published

4 hours agoon

July 5, 2024By

admin

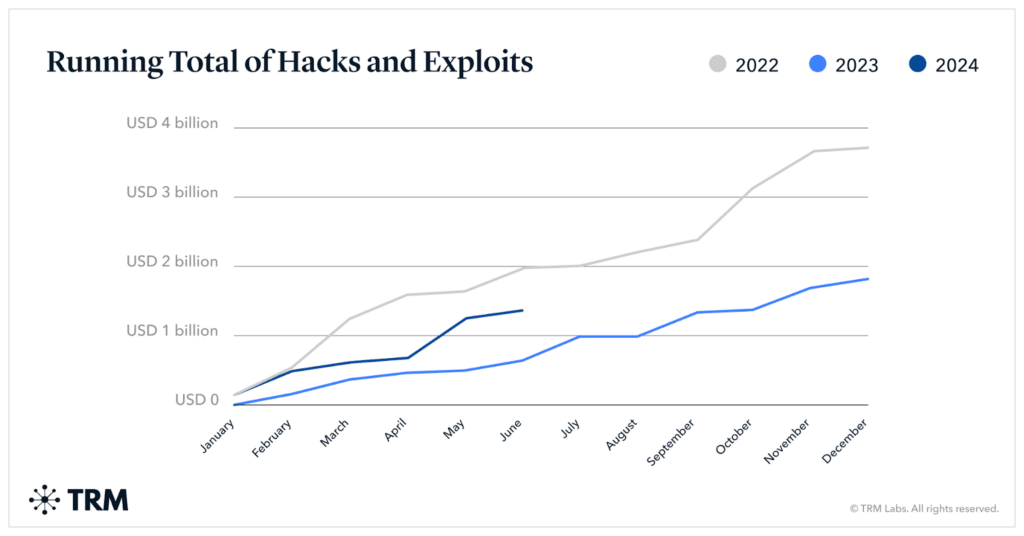

Cybercrime in the crypto sector has soared in the first half of 2024, with hackers stealing nearly $1.38 billion, nearly doubling last year’s figures.

Cybercriminals have pilfered a staggering $1.38 billion from crypto investors in the first half of 2024, nearly doubling the $657 million stolen during the same period in 2023, according to data compiled by blockchain forensic firm TRM Labs.

Consistent with 2023 trends, a handful of major breaches have dominated this year’s thefts, with the top five incidents accounting for 70% of the total haul, analysts say. The most significant attack to date occurred in May when DMM Bitcoin, a Japanese crypto exchange, suffered a hacker attack, losing over 4,500 BTC valued at over $300 million at the time.

While the nature of the hack remains unclear, TRM Labs attributes “stolen private keys or address poisoning” to potential attack vectors. “Private key and seed phrase compromises remain a top attack vector in 2024, alongside smart contract exploits and flash loan attacks,” the analysts say.

The New York-headquartered firm notes that the first six months of 2024 have seen higher theft volumes each month than the corresponding months in 2023, “with the median hack 150% larger.” Despite this surge, the analysts say thefts from hacks and exploits are a “third below the same period in 2022, which remains a record year.”

In the meantime, data from Scam Sniffer indicates that phishing scammers made over $300 million across EVM chains by targeting around 260,000 victims, marking a 6.44% increase compared to 2023. According to researchers, around $58 million worth of crypto was drained from 20 victims alone, with one victim losing $11 million, becoming the second-largest theft victim in crypto history.

Source link

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs