Bitcoin price

Rich Dad, Poor Dad Author Predicts Bitcoin to Hit $350,000

Published

3 weeks agoon

By

admin

Renowned personal finance author Robert Kiyosaki has predicted Bitcoin will reach $350,000 by August 25, 2024. The Rich Dad, Poor Dad writer has long been a Bitcoin bull, touting Bitcoin as hard money alternatives.

NEW: Rich Dad, Poor Dad author predicts #Bitcoin will reach $350,000 by August 2024.

Are you prepared? 🙌 pic.twitter.com/6Isr7UZUVT

— Bitcoin Magazine (@BitcoinMagazine) June 6, 2024

In a recent X post, Kiyosaki projected Bitcoin to hit $350,000 based on his lack of faith in U.S. leadership. He labelled President Biden, Treasury Secretary Janet Yellen, and Fed Chair Jerome Powell as “the 3 Stooges in real life” and said he was confident in their incompetence.

Kiyosaki advised buying more Bitcoin to protect against poor economic stewardship. He has frequently criticized the U.S. government’s stimulus spending and money-printing policies under Biden.

While a long-term Bitcoin believer, Kiyosaki’s $350,000 target within two months is an extremely bullish projection. For bitcoin to reach that price by August, it would need to surge over 380% from current levels near $71,000.

Still, the author sees potential for explosive Bitcoin growth ahead, calling his prediction “not a lie.” Kiyosaki endorsed Ark Invest’s $2.3 million long-term Bitcoin price forecast earlier this year.

The bold projection follows surging inflows into U.S. spot Bitcoin ETFs, which saw their second-highest daily haul ever on Tuesday at over $880 million.

Improving mainstream acceptance has buoyed Kiyosaki’s outlook. With major financial centres like Australia, the U.K., and the U.S. embracing spot bitcoin ETFs, confidence is rising.

While $350,000 by August appears overly optimistic, the author advocates Bitcoin’s potential as a hedge against what he views as unsound government policies. Kiyosaki urges investors to continue accumulating positions in Bitcoin.

Source link

You may like

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Bitcoin price

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Published

3 hours agoon

July 3, 2024By

admin

Solana price dropped by 0.4% in the last 24 hours to trade around $148 during European business hours on Wednesday. This small regression in price is overshadowed by the 8.3% surge in price Solana experienced in the past week, caused by the prospect of Solana ETF filings. Bitcoin, on the other hand, wiped off some of the gains it made over the weekend and dropped back down to $60,900.

Solana Price Analysis: 16% Gains in Sight If This Trendline Holds

Solana network has a lot going for it currently and its price action echoes the same. SOL price recently broke out from a falling channel and has been in an uptrend. The price action is trending at the 50-day and above the 200-day simple moving averages (SMA), depicting an asset that is slowly turning fully bullish.

Zooming out, the SOL price is currently in a descending channel, which is generally not a bullish chart pattern. However, if the 32% chance of a breakout to the upside happens, it is usually explosive and aggressive.

The SOL 14-day relative strength index (RSI) is trending just above the midpoint around 52 and also above its moving average (MA). This is bullish for the asset since there is a lot of upside room for movement. The journey to the overbought (OB) region will be characterized by increasing volume and bullish momentum. Solana’s 24-hour trading volume is already up by 41% per CoinGecko, revealing an increasing interest among investors.

According to these technical indicators, the Solana price prediction shows that the asset may rise by 16% in the coming days to touch $173 at the downward sloping trend line. Conversely, SOL may find support around $131 (200-day SMA) or $120.

Bitcoin price has been a great influence on Solana’s price, threatening to thwart any progress SOL price makes with its erratic movements. The price of Bitcoin dropped back to $60,900 over the past 2 days after rising to $63,794 in the weekend.

Fundamentally, Bitcoin still remains extremely bullish, but it won’t save the asset if the price breaks below $60,000. A fair value gap (FVG) of around $46,000 is currently the most worrying concern on the Bitcoin price chart. Price action usually corrects to fill these areas of market imbalance.

Solana ETF Filings Boost Investor Morale

Over the past week, the Solana ecosystem has been abuzz with news of VanEck and 21Shares filing for a Solana ETF with the U.S. SEC. This is the first ever Solana ETF and if it gets approval, the SOL price may rise to $1000 easily.

Solana joins Bitcoin and Ethereum in the list of ETFs filed with the SEC. The crypto community speculates whether there could be more ETF filings coming, with Cardano, XRP, Algorand, and Chainlink being at the top of the speculation list.

Bottom Line

Solana’s price prediction against Bitcoin reveals an intriguing dynamic as SOL’s resilience and ability to maintain investor interest amid Bitcoin’s price uncertainty become apparent.

Frequently Asked Questions (FAQs)

The approval of a Solana ETF is currently uncertain and does not have a set timeline. Recent discussions and applications, such as those by VanEck, have raised the possibility, but the U.S. Securities and Exchange Commission (SEC) has not made a definitive decision yet.

As of May, there were more than 455,000 tokens created on the Solana blockchain. This ecosystem includes a variety of token types, such as fungible tokens, non-fungible tokens (NFTs), and other types of digital assets used in various decentralized applications and financial services

According to available there are ovver 9,154,449 SOL holders.

Related Articles

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Published

15 hours agoon

July 2, 2024By

admin

On-chain data shows that selling pressure from Bitcoin miners has recently slowed down. This is significant considering the impact it could have on Bitcoin’s price heading into the third quarter of the year.

Bitcoin Miners’ Selling Pressure Has Significantly Declined

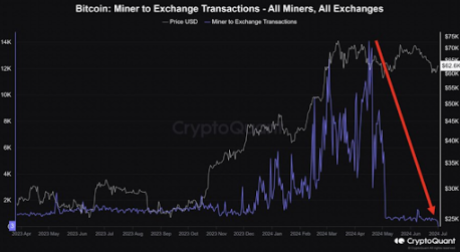

Referencing data from the on-chain analytics platform CryptoQuant, crypto analyst Crypto Dan noted that selling pressure from miners has significantly declined for two reasons. One is that the quantity of Bitcoin these miners sent to exchanges to sell has reduced drastically since May.

Related Reading

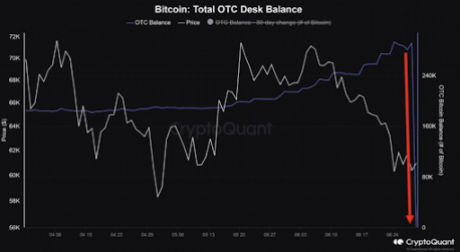

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for selling has been consumed, suggesting that someone recently bought up all the available Bitcoin supply from these miners. The volume of the OTC Desk is said to have piled up until June 29th, as there was no willing buyer to purchase these crypto tokens.

Bitcoin miners greatly contributed to the price crashes the flagship crypto suffered in June. Data from the market intelligence platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) throughout the month. This put significant selling pressure on Bitcoin, which caused it to drop below $60,000 at some point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue the bull run for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” to continue the upward rally for Bitcoin in this third quarter of the year.

Crypto analyst Willy Woo had also previously predicted that Bitcoin’s price would recover once miners capitulate. With that out of the way, Bitcoin could enjoy an upward trend this month and make massive moves to the upside.

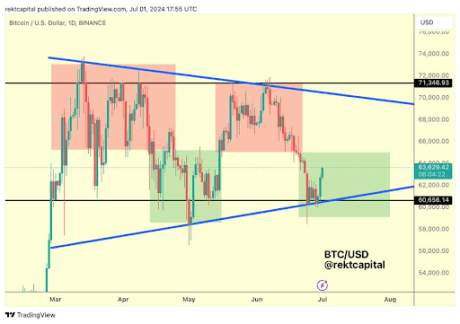

BTC’s Uptrend Has Begun

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) post that Bitcoin’s uptrend has begun. He claimed that the macro higher low has been confirmed, and Bitcoin is now rallying to the upside. He added that the flagship crypto is developing a macro bull flag, providing a bullish outlook for the crypto token.

Related Reading

In another X post, the crypto analyst remarked that the goal for Bitcoin following its strong start to July is to build a “foundation from which it will be able to springboard to the Range High area at $71,500 over time.”

Crypto analyst Michaël van de Poppe also suggested that Bitcoin’s downtrend is over and a bullish reversal was underway as the flagship crypto makes significant moves to the upside. He also mentioned that he believes that Bitcoin has bottomed out and has found support at $60,000, meaning a decline below that price level anytime soon was unlikely.

At the time of writing, Bitcoin is trading at around $62,900, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Altcoins

Lekker Capital CIO Spotlights Prime Opportunity

Published

6 days agoon

June 27, 2024By

admin

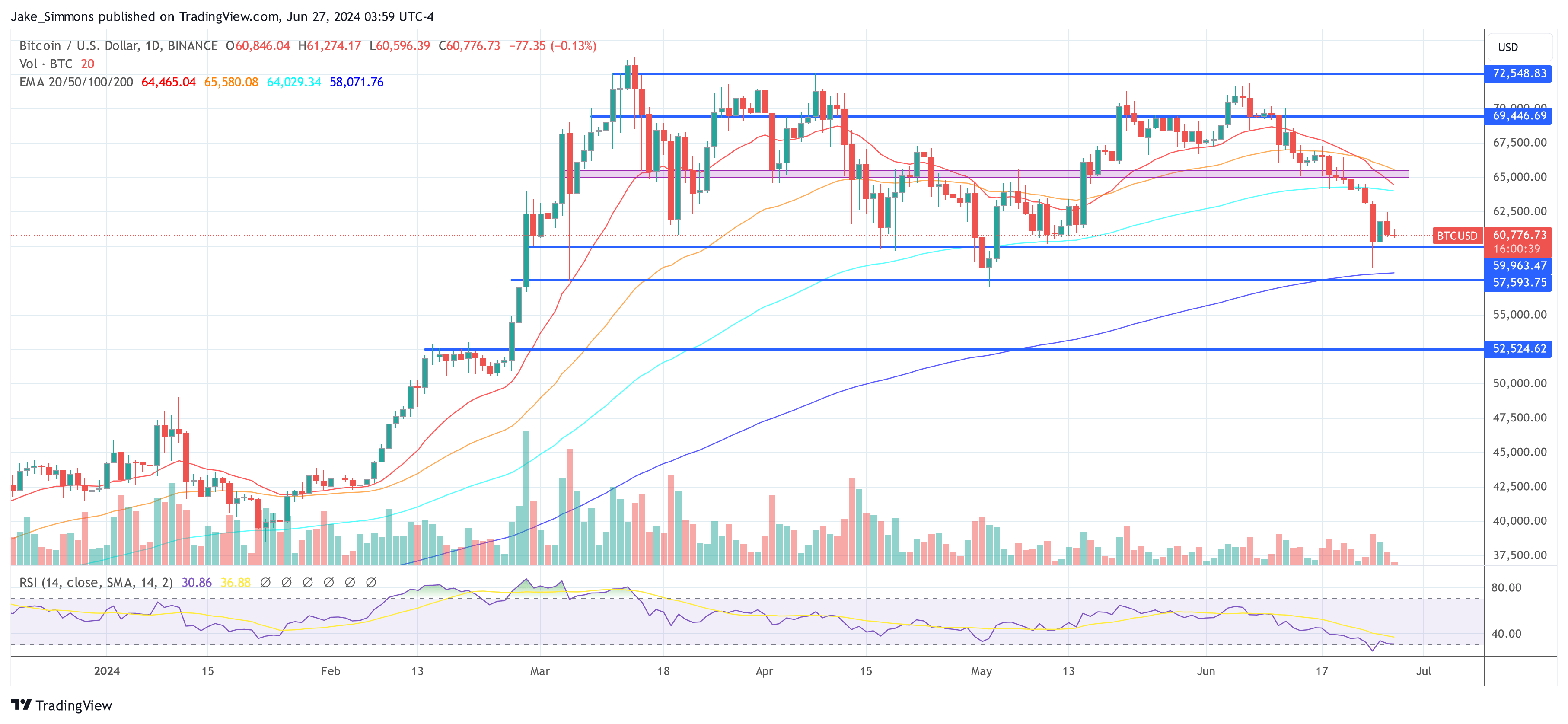

Quinn Thompson, Chief Investment Officer (CIO) at Lekker Capital, articulated a strong buy signal for cryptocurrencies amidst a landscape fraught with bearish sentiment. In a statement released through the social media platform X, Thompson described the present market conditions as “one of the most obvious and attractive crypto buying opportunities of recent memory.”

Lekker Capital, which has carved a niche in trading cryptocurrencies based on macroeconomic cues, provides an analysis that contrasts sharply with the prevailing market mood. Thompson’s commentary comes at a time when the broader crypto community appears enmeshed in pessimism. He expressed concern over the current trend where it’s become fashionable among crypto investors to adopt a bearish stance. “In all of my 5 years in crypto, I have never seen it be so ‘cool’ amongst crypto native investors as it is right now to be bearish,” Thompson noted, reflecting on the cyclical nature of market sentiments.

Related Reading

Thompson pointed to the reactive nature of the market, particularly surrounding major events like ETF launches. He revisited the aftermath of the US spot Bitcoin ETF launch, which contrary to the bullish anticipation, saw Bitcoin’s price plunge from $49,000 to $38,000, marking a steep 22% decline in just 12 days. This event, he argued, should serve as a cautionary tale about the market’s tendency to move against consensus expectations.

Addressing the most recent market dynamics, Thompson highlighted the significant impact of the sell-off that dampened the spirits of market participants, discouraging the usual strategies of buying the dip with leveraged positions. “It’s clear this most recent selloff has finally stung market participants given the lack of leveraged long dip buying,” he observed.

This scenario, according to him, sets the stage for a market correction that typically follows a pattern of initial slow recovery, stabilization, and then a rapid upward movement once a catalytic event occurs. He recalled the BTC ETF leak in October as a “buy the news” event that realigned market sentiment.

Furthermore, Thompson discussed the forward-looking nature of financial markets, emphasizing that the crypto market is no exception. He believes that the market has already adjusted to past events such as the Mt. Gox saga and Bitcoin sell-offs from the US and German governments. “The key thing to remember here is markets are forward looking. Citing the Mt. Gox or US and German government supply overhangs is old news – the market has priced this in. Fear and capitulation invokes an irrational near-sightedness,” the Lekker Capital CIO remarked.

Related Reading

Looking ahead, he underscored several macro and microeconomic developments poised to influence the market. “On the macro front, these include a November election and additional Fed liquidity. On the micro front, they are the ETH ETF, Circle IPO, and improved BTC miner profitability thanks to AI,” he explained. These factors are expected to reduce selling pressure (e.g. Bitcoin miners) and invigorate market sentiment.

Delving deeper into market technicals, Thompson pointed out that several key indicators are at cycle lows, which historically precede upward movements. He noted, “BTC and ETH CME basis, alt open interest as a percentage of total, and macro relative value all sit at cycle lows while stablecoin supply is finally growing again.” This combination of factors, according to Thompson, signals a potential market bottom forming.

In a bold closing prediction, Thompson projected significant rallies for major cryptocurrencies in the near future. “Personally, I think ETH will reach $7,000 and BTC will make its first attempt at $100,000 by the election in November,” he stated confidently.

At press time, BTC traded at $60,766.

Featured image from Shutterstock, chart from TradingView.com

Source link

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Miners Slow Down Selling In July, What This Could Mean For Price

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: