News

Ripple’s Big Court Win Nonetheless Muddied Waters on Whether XRP Is a Security Deserving Tougher Regulation

Published

5 days agoon

By

admin

In a near-vacuum of legal and regulatory clarity for crypto, district judges’ opinions on whether a given token is a security or not – which determines the level of regulation – can vary from court to court.

Source link

You may like

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Donations

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Published

1 hour agoon

July 5, 2024By

admin

These candidates’ opponents aren’t uniformly critical of cryptocurrency on the level of Elizabeth Warren, the Massachusetts senator despised by the crypto industry for her rhetoric of hosting an “anti-crypto army.” Three of the four are rated as “neutral” or better by Stand With Crypto, though Ohio Senator Sherrod Brown touts an “F.”

Source link

Crypto scam

Crypto heists near $1.4b in first half of 2024: TRM Labs

Published

2 hours agoon

July 5, 2024By

admin

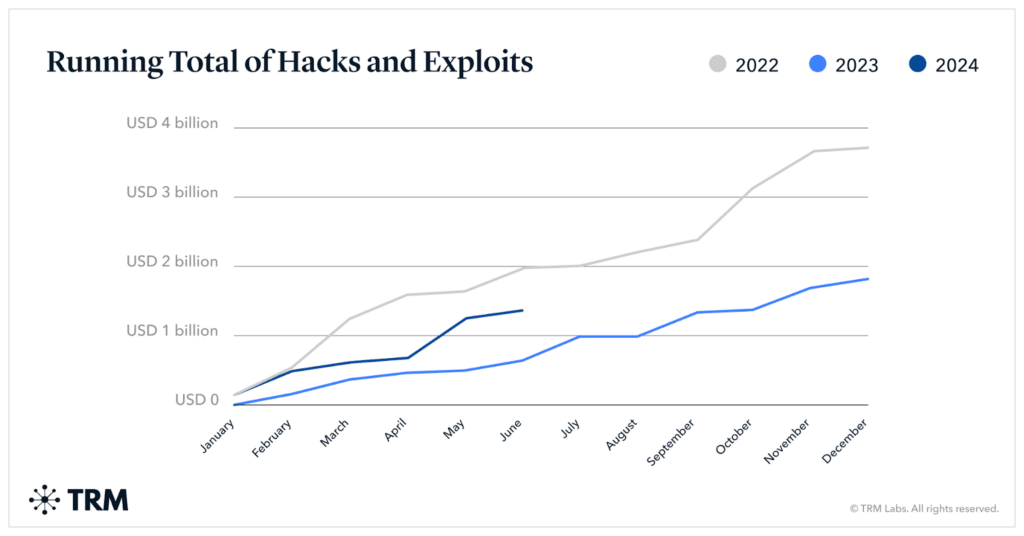

Cybercrime in the crypto sector has soared in the first half of 2024, with hackers stealing nearly $1.38 billion, nearly doubling last year’s figures.

Cybercriminals have pilfered a staggering $1.38 billion from crypto investors in the first half of 2024, nearly doubling the $657 million stolen during the same period in 2023, according to data compiled by blockchain forensic firm TRM Labs.

Consistent with 2023 trends, a handful of major breaches have dominated this year’s thefts, with the top five incidents accounting for 70% of the total haul, analysts say. The most significant attack to date occurred in May when DMM Bitcoin, a Japanese crypto exchange, suffered a hacker attack, losing over 4,500 BTC valued at over $300 million at the time.

While the nature of the hack remains unclear, TRM Labs attributes “stolen private keys or address poisoning” to potential attack vectors. “Private key and seed phrase compromises remain a top attack vector in 2024, alongside smart contract exploits and flash loan attacks,” the analysts say.

The New York-headquartered firm notes that the first six months of 2024 have seen higher theft volumes each month than the corresponding months in 2023, “with the median hack 150% larger.” Despite this surge, the analysts say thefts from hacks and exploits are a “third below the same period in 2022, which remains a record year.”

In the meantime, data from Scam Sniffer indicates that phishing scammers made over $300 million across EVM chains by targeting around 260,000 victims, marking a 6.44% increase compared to 2023. According to researchers, around $58 million worth of crypto was drained from 20 victims alone, with one victim losing $11 million, becoming the second-largest theft victim in crypto history.

Source link

Bitcoin price

Bitcoin Price Falls as Mt Gox Starts Repayments

Published

5 hours agoon

July 5, 2024By

admin

The Bitcoin price plunged this week, sinking below $55,000 for the first time since February as the now-defunct Mt Gox exchange began distributing billions in owed funds.

Mt Gox announced it has started repaying creditors, ending years of waiting stemming from its 2014 collapse. The Japan-based exchange will distribute approximately $9 billion worth of Bitcoin, Bitcoin cash, and fiat currency.

The news added heavy selling pressure on Bitcoin, which fell over 6% on Friday to trade near $54,000. The broader Bitcoin and crypto market shed over $170 billion in 24 hours amid the declines.

On Thursday evening, Mt Gox moved around 47,000 Bitcoin worth nearly $2.7 billion from cold storage wallets to a separate address. While intentions remain uncertain, the transfer fueled concerns creditors may sell portions of recovered coins.

The payouts come after protracted bankruptcy proceedings for Mt Gox, which suffered a massive hack in 2014 that resulted in 850,000 Bitcoin being lost. It was the largest crypto exchange at the time, handling 70% of all Bitcoin transactions.

The repayment of creditors marks a major step toward resolving Mt Gox’s decade-long insolvency case. However, the influx of previously lost coins threatens to shift supply and demand dynamics.

Some analysts estimate selling pressure from payouts could push Bitcoin’s price as low as $50,000 in the near term. Ongoing transfers from the German government have also weighed on the market.

However, others argue the amounts equate to a small fraction of daily Bitcoin trading volumes. They say most creditors are long-term investors unlikely to dump holdings en masse, limiting impacts.

Nonetheless, analysts widely expect significant volatility ahead between Mt Gox distributions and the start of German government sales in July.

Source link

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Mt. Gox Transfers $2.7 Billion in Bitcoin From Cold Storage Amid Market Rout

What’s Next For Ethereum (ETH) as Price Hovers $3,000?

Bitcoin’s quick dip below $57k forces beginners to capitulate, CryptoQuant says

$PRDT

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs