Cryptocurrency Market News

Rug Pull Rumors Swirl As Token Takes A 45% Hit

Published

8 months agoon

By

admin

Recent data analysis reveals a significant decline in the performance of YFI, the native token of the Yearn Finance platform. In a dramatic overnight development, the native token of the Yearn Finance ecosystem witnessed a staggering 40% plunge.

This downturn in YFI’s performance prompts a closer examination of the intricate dynamics within the decentralized financial landscape. The abrupt and substantial drop has ignited a wave of speculation within the community, with some expressing concerns about the possibility of an exit scam.

Much of its recent profits was wiped by the slump. Investors quickly sold off their holdings in YFI in response to the wider selloff that had shook the cryptocurrency market as a whole, which caused a sudden shift in value.

Yearn Finance Suffers An Apparent Exit Scam

As users seek to navigate and capitalize on the potential returns of the crypto market, the fluctuations in YFI’s value underscore the inherent volatility and complexity of DeFi environments.

Specifically, YFI plummeted from $15,450 to $8,950 within a mere 24-hour period. This sharp and rapid descent represents a substantial loss of $6,510 in the value of YFI.

The price of YFI has seen a noteworthy rising trend during the last seven days. The asset was trading at almost $9,000 just a week ago. But it quickly gained momentum and by Friday, it had reached its highest price point in more than a year—above the $15,000 level.

JUST IN: Yearn finance ( $YFI ), one of the biggest platforms in the DeFi ecosystem, has just plummeted over -45% in an apparent exit scam by insiders.

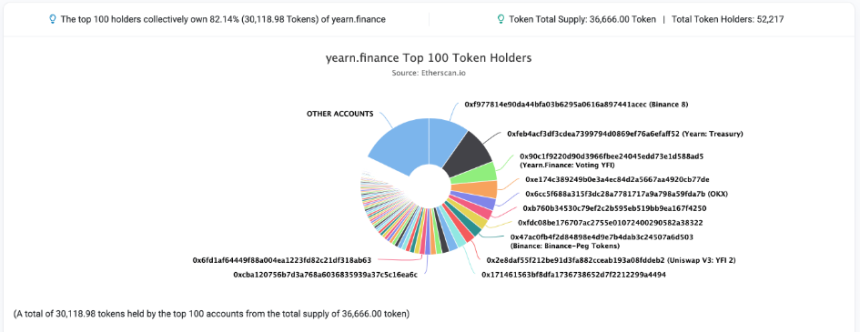

Nearly half of the entire supply for YFI is held by 10 wallets, and over $250 million in market value has vanished in minutes pic.twitter.com/pMqonBcgux

— WhaleWire (@WhaleWire) November 18, 2023

In a matter of hours, the market capitalization experienced a significant decline, with almost $250 million disappearing. The market cap plummeted from $525 million to $275 million. It is once again seeing an upward trend; however, investor sentiment has been negatively impacted by the abrupt decline.

The recent sell-off has incited a weekend characterized by fear, uncertaintly and doubt (FUD) among members of the cryptocurrency community.

According to certain users on X (formerly known as Twitter), there are assertions made regarding the distribution of the token supply, suggesting that 50% of the tokens were held within 10 wallets under the supervision of engineers.

It appears that Yearn Finance $YFI was rugpulled

One of the biggest DeFi platforms plummeted over -50% in an exit scam by insiders

Approx half of the entire supply for YFI is held by ~10 wallets. Over $250 million in market value has vanished in a few hours pic.twitter.com/Y1TbtlkltC

— Solid 堅固 (@SolidTradesz) November 18, 2023

Nevertheless, according to data from Etherscan, it is indicated that a portion of these holders could potentially be wallets associated with cryptocurrency exchanges.

The rollercoaster ride in YFI’s market hasn’t just been a wild descent; it’s been a game-changer for crypto traders riding the waves of this digital asset’s fortune.

Source: Etherscan

Crypto Holders Lose Nearly $5 Million

According to insights from derivative market tracker, CoinGlass, the recent nosedive in YFI has left crypto enthusiasts nursing a whopping $4.99 million in losses through liquidations.

Those traders who wagered on YFI’s upward trajectory found themselves taking the most substantial hit in the aftermath of the digital asset’s dramatic crash. It’s not just numbers on a chart; it’s a tale of high-stakes bets and unforeseen twists in the ever-unpredictable world of crypto trading.

Zooming in on the details, according to CoinGlass data, the brunt of the blow in the near $5 million total liquidations is borne by long positions, tallying up to a substantial $3.5 million in losses.

YFI market cap at $309 million on the weekend chart: TradingView.com

The majority of these traders find themselves navigating the aftermath on platforms such as the giant Binance, alongside participants from Bybit and OKX.

It’s a vivid snapshot into the crypto battleground, where the casualties of this market turbulence are felt by those who took bullish positions, and the ripples extend across some of the most prominent exchanges in the digital arena.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Markus Spiske/Unsplash

Source link

You may like

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

Altcoins

20% Price Drop Follows $87 Million Spending Outrage

Published

9 hours agoon

July 5, 2024By

admin

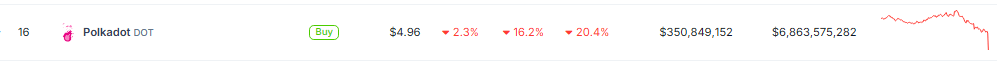

The winds of change are swirling around Polkadot (DOT). After a month-long slump that mirrored a broader cryptocurrency market downturn, DOT finds itself at a critical juncture.

Technical indicators hint at a bullish reversal, with some analysts predicting a significant price surge for the interoperable blockchain darling. However, a recent spending spree by the Polkadot Foundation has cast a shadow of doubt, leaving the community divided.

Falling Wedge Hints At Breakout, Analysts Eye $9 Target

As technical analysis presents a potentially hopeful picture, DOT holders’ hope wavers. On the daily chart, a “falling wedge” pattern—historically a bullish indication—has been observed. This pattern suggests a price squeeze between converging trendlines, often culminating in a sharp breakout.

Related Reading

Renowned analyst Jonathan Carter pinpoints $6.50 as the key resistance level. A decisive break above this point could trigger a surge in buying pressure, propelling DOT towards his projected profit targets of $7.75 and even $9.00.

Polkadot forming falling wedge on daily timeframe💁♂️

Key resistance at $6.5 – need to break for bullish structure☝️

Consider setting profit targets at $7.75 and $9.00 levels🎯 pic.twitter.com/OwPVFaPZyD

— Jonathan Carter (@JohncyCrypto) July 3, 2024

The falling wedge pattern and increasing trading volume suggest a potential breakout is imminent. A successful breach of the $6.50 resistance could signal a significant shift in market sentiment, paving the way for a substantial price increase.

Buoying this optimism is the Relative Strength Index (RSI), currently hovering around 48.65. This neutral level indicates that DOT is neither overbought nor oversold, leaving room for further upward momentum.

Polkadot Foundation’s Spending Spree

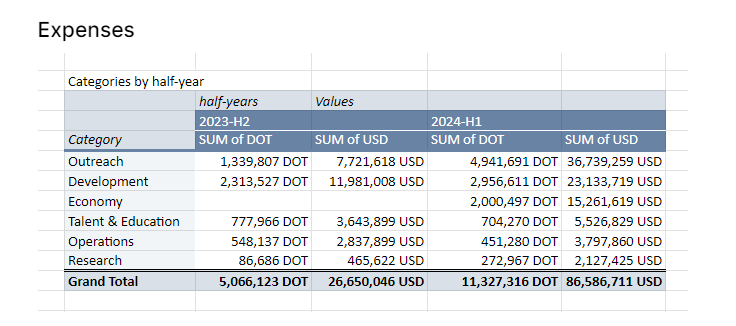

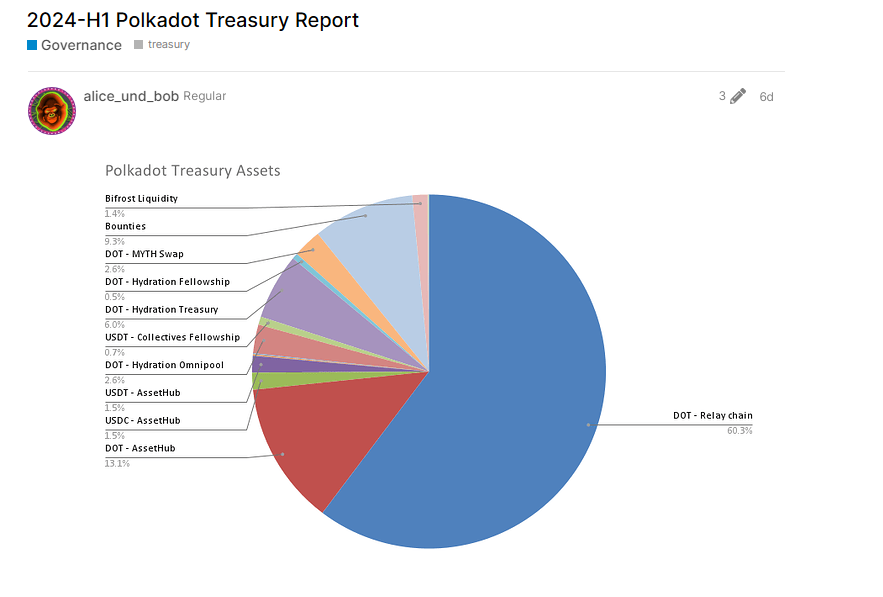

However, a recent spending spree by the Polkadot Foundation has injected a dose of skepticism into the bullish narrative. Earlier this year, the Foundation burned through a staggering $87 million, leaving its coffers with a significantly reduced balance.

The breakdown reveals $36.7 million allocated for advertising and events, $15 million for trading platform incentives, and $23 million for development. While the Foundation maintains these investments are crucial for boosting network visibility and adoption, community members are not convinced.

Many point out that despite the hefty spending, Polkadot continues to lag behind competitors like Ethereum and Solana in key metrics like network activity, developer engagement, and total value locked (TVL).

Related Reading

The spending seems excessive, especially considering the lack of tangible results, some community members on the Polkadot forum said. The blockchain needs to see a better return on investment before the Foundation throws more money at marketing campaigns, they said.

Will Spending Concerns Spook Investors?

The coming days will be crucial for DOT. If the technical indicators hold true and the price breaks above $6.50, a significant rally could be in the cards.

However, the community’s concerns about the Foundation’s spending habits cannot be ignored. If these concerns translate into a broader sell-off, the potential breakout might fizzle.

Featured image from Shutterstock, chart from TradingView

Source link

Circle

Circle Awarded Europe’s First Stablecoin License Under New MiCA Crypto Rules

Published

4 days agoon

July 2, 2024By

admin

Cryptocurrency firm Circle has achieved a significant milestone by securing registration as an electronic money institution (EMI) in France. This move grants Circle a crucial license to operate as a compliant stablecoin issuer under the European Union’s rigorous crypto laws.

Circle Breakthrough

According to a CNBC report, the approved license positions Circle as the first global stablecoin issuer to achieve compliance with the European Union’s regulatory framework known as Markets in Crypto-Assets (MiCA).

This framework, considered a cornerstone in the EU’s approach to governing cryptocurrencies, sets out comprehensive rules and obligations for crypto companies to ensure investor protection and safeguard against market manipulation.

Related Reading

Circle’s acceptance into the MiCA regulatory framework means that both its USDC and Euro Coin (EURC) tokens can now be issued within the European Union while meeting the stablecoin regulatory obligations outlined by MiCA.

Additionally, Circle is opening up its Circle Mint service, enabling businesses to mint and redeem Circle stablecoins, to customers in France.

Expressing his satisfaction with the achievement, Jeremy Allaire, co-founder and CEO of Circle, emphasized the company’s longstanding commitment to building compliant and well-regulated infrastructure for stablecoins. He stated:

Our adherence to MiCA, which represents one of the most comprehensive crypto regulatory regimes in the world, is a huge milestone in bringing digital currency into mainstream scale and acceptance.

European Stablecoin Adoption

The EU’s MiCA law, which officially came into effect in May 2023, introduced the world’s first comprehensive regulatory framework for cryptocurrency operations.

Last week, provisions specifically governing stablecoins were approved, imposing stringent measures on trading volume limitations for certain stablecoins, particularly those denominated in US dollars.

As a registered EMI in France, Circle can now extend its services, including the minting and redemption of USDC through Circle Mint, not only to customers in France but also to individuals and businesses across the European Union.

This is made possible by the concept of “passporting” outlined in MiCA, which allows crypto businesses to offer services in one EU country and expand into other markets within the bloc.

Related Reading

While Circle’s achievement is commendable, it should be noted that additional obligations under MiCA about crypto asset service providers will become applicable by December 30, 2024. Crypto companies will then have until July 2026 to ensure full compliance with MiCA’s requirements.

Since its launch in September 2018 by Circle and crypto exchange Coinbase, USDC has gained significant traction and now holds the position of the second-largest stablecoin globally.

According to CoinGecko data, USDC’s circulation amounts to $32.4 billion, trailing only Tether’s USDT, which holds the title of the world’s largest stablecoin with a circulation of $112.7 billion.

Featured image from Shutterstock, chart from TradingView.com

Source link

Bitcoin

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Published

4 days agoon

July 1, 2024By

admin

Bitcoin has long been a hallmark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend trading, once a notorious breeding ground for volatility, has been especially significant in the cryptocurrency landscape.

However, a recent report by Kaiko reveals a not so rosy picture – BTC weekend trading volumes have plunged to historic lows, potentially marking a new era dominated by institutional weekday warriors.

Related Reading

Bitcoin Trading Activity Takes A Nap

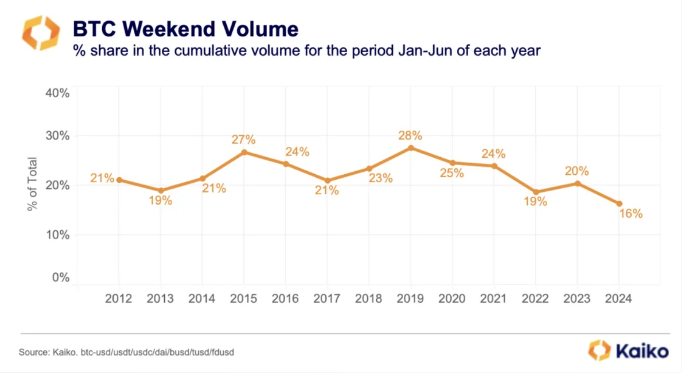

Kaiko’s data is straightforward: Bitcoin weekend trading activity has shrunk dramatically, dropping from a high of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the highly anticipated launch of spot Bitcoin ETFs in the US. These exchange-traded funds, mirroring the behavior of stocks, can only be traded during traditional market hours.

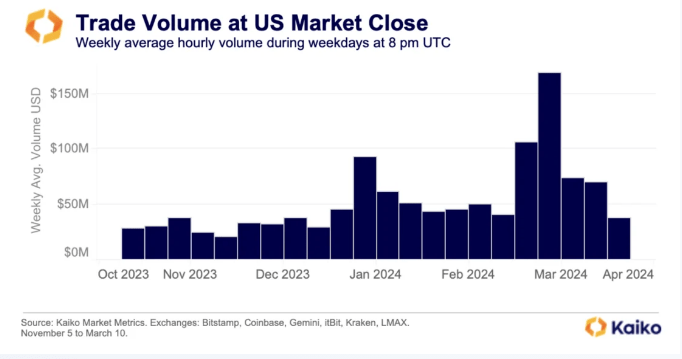

The influence of institutional investors, who tend to favor these regulated products, is evident. The report highlights a surge in Bitcoin trading activity during the “benchmark fixing window” – the final hour of US stock market trading. This suggests institutions are shaping new trading patterns, prioritizing weekdays over the once-active weekends.

Beyond Weekends: A Multifaceted Market Transformation

The decline in weekend activity isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank in March 2023 is another contributing factor. These institutions provided 24/7 infrastructure that enabled market makers to constantly place buy and sell orders. Their absence has created a void in weekend liquidity, further dampening trading activity.

However, the changing landscape isn’t all doom and gloom. The report offers a glimmer of hope for investors seeking stability. The reduced weekend volatility could make Bitcoin a more predictable asset, potentially attracting a new wave of institutional interest. Additionally, the historical trend suggests July could be a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters On The Horizon?

While the weekend trading scene may be quieting down, the coming weeks look to be somewhat turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and potentially impact Bitcoin’s dominance.

Related Reading

The Road Ahead

The dwindling weekend trading activity signifies a potential paradigm shift in the Bitcoin market. While the once-volatile weekends may become a relic of the past, the coming months promise to be eventful.

Institutional investors are now in the spotlight, shaping new trading patterns and potentially ushering in an era of greater stability. However, this month could still introduce significant volatility, keeping investors on the edge of their seats.

Featured image from Inc. Magazine, chart from TradingView

Source link

Multicoin Capital To Fund Crypto-Friendly US Candidates In Solana

Multicoin to Match Up to $1 Million in Solana Donations to Pro-Crypto Candidates

Multicoin Capital pledges up to $1m to pro-crypto Senate candidates

MATIC Price Crash: Reaching A Two Year Low

Multicoin Pledges up to $1M for Pro-Crypto Senate Candidates

Crypto heists near $1.4b in first half of 2024: TRM Labs

FTX Founder Sam Bankman-Fried’s Family Accused Of $100M Illicit Political Donation

Bitcoin Price Falls as Mt Gox Starts Repayments

20% Price Drop Follows $87 Million Spending Outrage

More than 10 years since the collapse of Mt. Gox, users confirm reimbursements

Leading Telecom Company Taiwan Mobile Gets Crypto Exchange License

Here Are Price Targets for Bitcoin, Solana, and Render, According to Analyst Jason Pizzino

Bitcoin price plunges below $55k as Mt. Gox announces repayments

Jasmy Sheds 20% Amid Bitcoin Sell-Off

Are they a good thing?

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs