crypto

Self-Custody, Explained. Self-custody is the idea that an… | by Blockchain.com | @blockchain | Jan, 2023

Published

1 year agoon

By

admin

Self-custody is the idea that an individual should be able to safeguard the private key to their crypto wallet without relying on a custodian to do it for them.

This allows individuals to protect and control their assets instead of needing the assistance of a third party intermediary.

While self-custody does grant the user complete autonomy over their funds, the flip side of this is that it also forces them to take complete responsibility for the security of their holdings.

In fact, over the past decade, an estimated 4 million bitcoins have been unnecessarily lost due to user error.

Why would anybody want to deal with this instead of just using a custodial wallet?

Read on to learn more about the promise of self-custody.

What is a self custody wallet?

When you self-custody your crypto, this means that you store your crypto at a digital address or a “wallet” that is totally controlled by you. These “wallets” may be referred to self custody wallets, non-custodial wallets, or self hosted wallets.

A self-custody wallet is a cryptocurrency wallet where only the holder possesses and controls the private key to that wallet.

Private keys are a vital part of the cryptocurrency ecosystem, as they are used to sign and verify transactions on the blockchain.

When individuals have control over their private keys, they can access and manage their cryptocurrency holdings without relying on a third party, such as an exchange or online wallet service.

There are several types of self-custody wallets, including:

- Hardware wallets. Physical devices store private keys offline, making them more secure against hacking attempts.

- Software wallets. Digital wallets can be installed on a computer or mobile device.

- Paper wallets. Physical documents that contain private keys can be stored in a safe place.

Self-custody wallets offer many benefits, including increased security, greater control over one’s assets, and the ability to manage cryptocurrency holdings without relying on a third party.

However, it is crucial for individuals to carefully manage their private keys and to follow best practices for securing their self-custody wallet.

Benefits of self-custody

Self-custody offers some distinct advantages, and we’ve already touched briefly on some of them, such as security and control.

- Censorship resistant. Holding crypto in a non-custodial wallet means that those assets cannot be frozen or confiscated by a third party. In countries with capital controls or targeted discrimination, self-custody becomes a technology of empowerment.

- Increased security. Non-custodial wallets offer increased security compared to custodial wallets, as the individual controls their private keys. Their keys are not stored on a central server that could be hacked or subject to other vulnerabilities like counterparty risk.

- Expanded access. Self-custody can be particularly liberating for unbanked individuals, who may not have access to traditional financial services such as bank accounts and payment cards. With self-custody, these individuals can still use cryptocurrency to store, send, and receive funds, even if they don’t have access to traditional financial services.

- Greater control. With self-custody, the individual has complete control over their own funds and can manage them as they see fit. This is in contrast to custodial wallets, where the funds are managed by a third party, and the individual may not have as much control over their use.

- Decentralization. Non-custodial wallets are often associated with decentralization, allowing individuals to hold and manage their own assets without relying on a central authority. This aligns with the decentralized nature of many cryptocurrencies and can help to promote a more equitable and transparent financial system.

- Privacy. Non-custodial wallets can offer greater privacy, as they often do not require individuals to provide personal information. This can be especially important for those who are concerned about the potential for their data to be misused.

Self-custody offers numerous benefits for those looking to securely and privately manage their cryptocurrency holdings.

Drawbacks of self-custody

There are a few potential drawbacks to self-custody that you’ll need to carefully consider to ensure you’re comfortable with the level of responsibility and complexity involved.

- Responsibility. With self-custody, you’ll be responsible for safeguarding your assets and personal information. This can be challenging, but we’ve put together some great resources for managing your data.

- Complexity. Self-custody can involve a greater degree of complexity compared to using a custodial service. For example, an individual may need to set up and manage their own hardware or software wallet, which can be time-consuming and require specific technical knowledge.

- Limited functionality. Self-custody wallets may offer only some of the features and functionality of custodial wallets, such as quickly buying and selling cryptocurrency or accessing advanced trading features.

Your keys, your crypto

While self-custody can involve a greater degree of responsibility and complexity, it is a powerful way for you to take control of your own assets and to participate in cryptocurrency and decentralized finance.

We believe in self-custody; so strongly, in fact, that we’ve created the only crypto app with a custodial and non-custodial wallet in the same place. This means you can purchase crypto using fiat currency, then self-custody that crypto in the same place, without having to switch between apps.

Create your Blockchain.com Account today.

Further reading:

If you enjoyed this article and want to learn more about self-custody and DeFi, check out these articles:

Self-Custody FAQs

Are self-custodial wallets secure?

Yes, one of the biggest benefits of non-custodial wallets is their security. However, they are susceptible to human errors. If you self custody your crypto, you are fully responsible for retaining your private key and seed phrase.

For example, here at Blockchain.com, 95% of all funds are stored in offline cold wallets which are distributed across the world in facilities that specialize in physically securing valuable items.

While we’re proud of the security we provide, the fact is that even if a non-custodial wallet provider was compromised, as long as you had your private key and seed phrase, your assets would be safe.

Will one wallet work for all coins?

Not all wallets work for all assets. The Blockchain.com Wallet handles assets across multiple blockchains, so you will see private key wallets for BTC, ETH, and dozens of other cryptocurrencies.

Important Note

This information is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax or financial advice from a professional advisor.

The purchase of crypto entails risk. The value of crypto can fluctuate and capital involved in a crypto transaction is subject to market volatility and loss.

Digital currencies are not bank deposits, are not legal tender, and are not backed by the government. Blockchain.com’s products and services are not subject to any governmental or government-backed deposit protection schemes.

Legislative and regulatory changes or actions in any jurisdiction in which Blockchain.com’s customers are located may adversely affect the use, transfer, exchange, and value of digital currencies.

Source link

You may like

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

crypto

Ethereum (ETH) Products See Largest Institutional Outflows Since August 2022: CoinShares

Published

1 day agoon

July 1, 2024By

admin

Digital assets manager CoinShares says that institutional crypto products sustained outflows last week for the third week in a row.

In its latest Digital Asset Fund Flows report, CoinShares says digital asset investment products suffered $30 million in outflows last week.

“Digital asset investment products saw a third consecutive week of outflows totaling US$30m, with last week indicating a significant stemming of the outflows. In contrast to prior weeks, most providers saw minor inflows, although this was offset by incumbent Grayscale seeing US$153m outflows.”

Despite overall outflows, the US, Brazil and Australian regions saw $43 million, $7.6 million and $3 million in inflows, respectively.

“Negative sentiment pervaded Germany, Hong Kong, Canada and Switzerland with outflows of US$29m, US$23m, US$14m and US$13m respectively.”

While the leading crypto by market cap Bitcoin (BTC), multi-asset investment vehicles, Solana (SOL) and Litecoin (LTC) brought in $18 million, $10 million, $1.6 million and $1.4 million in inflows, Ethereum (ETH) had one of its worst weeks in years.

“Ethereum saw the largest outflows since August 2022, totaling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.”

Chainlink (LINK) and XRP also brought in $0.6 million and $0.3 million, respectively.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/phive/Sensvector

Source link

Bitcoin

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Published

2 days agoon

July 1, 2024By

admin

Bitcoin has long been a hallmark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend trading, once a notorious breeding ground for volatility, has been especially significant in the cryptocurrency landscape.

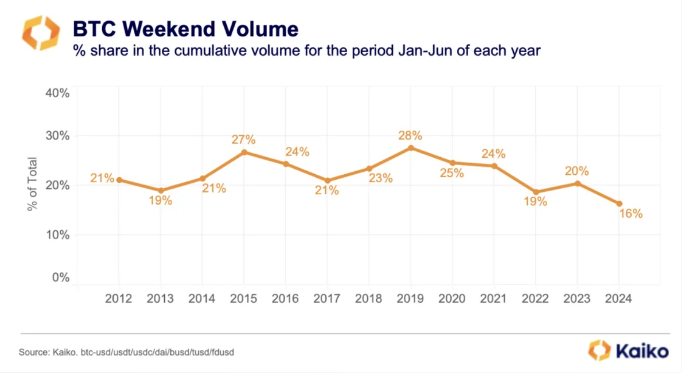

However, a recent report by Kaiko reveals a not so rosy picture – BTC weekend trading volumes have plunged to historic lows, potentially marking a new era dominated by institutional weekday warriors.

Related Reading

Bitcoin Trading Activity Takes A Nap

Kaiko’s data is straightforward: Bitcoin weekend trading activity has shrunk dramatically, dropping from a high of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the highly anticipated launch of spot Bitcoin ETFs in the US. These exchange-traded funds, mirroring the behavior of stocks, can only be traded during traditional market hours.

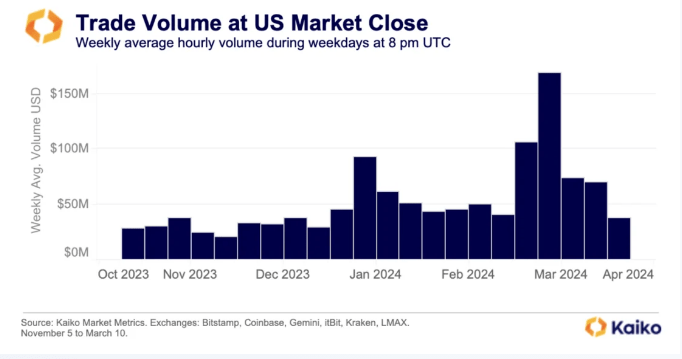

The influence of institutional investors, who tend to favor these regulated products, is evident. The report highlights a surge in Bitcoin trading activity during the “benchmark fixing window” – the final hour of US stock market trading. This suggests institutions are shaping new trading patterns, prioritizing weekdays over the once-active weekends.

Beyond Weekends: A Multifaceted Market Transformation

The decline in weekend activity isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank in March 2023 is another contributing factor. These institutions provided 24/7 infrastructure that enabled market makers to constantly place buy and sell orders. Their absence has created a void in weekend liquidity, further dampening trading activity.

However, the changing landscape isn’t all doom and gloom. The report offers a glimmer of hope for investors seeking stability. The reduced weekend volatility could make Bitcoin a more predictable asset, potentially attracting a new wave of institutional interest. Additionally, the historical trend suggests July could be a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters On The Horizon?

While the weekend trading scene may be quieting down, the coming weeks look to be somewhat turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and potentially impact Bitcoin’s dominance.

Related Reading

The Road Ahead

The dwindling weekend trading activity signifies a potential paradigm shift in the Bitcoin market. While the once-volatile weekends may become a relic of the past, the coming months promise to be eventful.

Institutional investors are now in the spotlight, shaping new trading patterns and potentially ushering in an era of greater stability. However, this month could still introduce significant volatility, keeping investors on the edge of their seats.

Featured image from Inc. Magazine, chart from TradingView

Source link

Bitcoin

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Published

3 days agoon

June 30, 2024By

adminJune was much rougher for Bitcoin than many expected at the beginning of the month. This is because the price of Bitcoin virtually declined throughout the month, leaving many investors, especially short-term holders, disappointed.

Related Reading

However, despite the price decline, on-chain data suggests that Bitcoin adoption is growing. New data shows the number of new Bitcoin addresses being created has surged to the highest level in two months. This growth suggests the long-term prospects for Bitcoin remain strong.

New BTC Addresses Surge To 2-Month High

Despite the price slump, the network is exhibiting a promising trend that signals future growth for the world’s largest cryptocurrency. According to Glassnode chart data initially shared on social media platform X by crypto analyst Ali Martinez, new BTC wallet addresses have risen steadily over the past week to reach 352,124, their highest level since April.

Interestingly, the chart shows that the recent uptick in new addresses contrasts with a larger decrease in the creation of new addresses since November 2023. This new increase points to an influx of new users entering the crypto space. As more people adopt Bitcoin, demand will inevitably grow, which is a catalyst for price surges down the line.

Furthermore, Martinez suggested that the uptick in new addresses is from retail investors making a comeback. While institutional investors often drive major market moves, retail interest is crucial for Bitcoin’s mainstream adoption.

Retail #Bitcoin investors are making a comeback! The number of new $BTC addresses on the network surged to 352,124, marking the highest level since April. pic.twitter.com/GFOHnsokz0

— Ali (@ali_charts) June 29, 2024

A major part of the increase in new addresses can be attributed to recent adoption in the Brazilian market. Nubank, Brazil’s biggest neobank, recently announced plans to integrate Bitcoin’s lightning network into its services. As the largest fintech bank in Latin America, this integration could potentially expose a significant portion of its 100 million customers to the digital asset.

What’s Next For Bitcoin?

At the time of writing, Bitcoin was trading at $61,446. The leading digital asset has lost over 10% of its market cap in a 30-day time frame and the bulls are struggling to break above $61,000. This downtrend could be attributed to a selloff by miners and many long-term holders. Specifically, around 40,000 BTC were sold by long-term holders in June.

Bear markets are temporary. Bull runs will return. It’s just a matter of when, not if. With the second half of the year now approaching, time can only tell how the price of Bitcoin unfolds. Of course, new wallet addresses don’t directly impact price, but they are a leading indicator of growing Bitcoin adoption.

Related Reading

This adoption and demand, coupled with a recent decrease in the number of new Bitcoins entering the market, points to an increase in the price of Bitcoin in July.

Featured image from CNBC, chart from TradingView

Source link

Reasons Why Bitcoin Falls To $60K After A Weekend Pump

Taliban jailed 8 traders for holding and using crypto

Solana Struggles to Rise Amid Bitcoin Price Uncertainty

Developing in Web 3.0 Is on the Cusp of a Breakthrough

Digital Shovel Sues RK Mission Critical for Patent Infringement on Bitcoin Mining Containers

crypto will get positive regulation ‘no matter who wins’ election

Toncoin (TON) v Cardano (ADA): On-chain Data Show Gains

Crypto Markets Like Their Odds With Kamala Harris

How Financial Surveillance Threatens Our Democracies: Part 2

CleanSpark’s amped hashrate mined 445 Bitcoin in June

Ripple and Coinbase Use Binance Win to Contest SEC Claims

DCG, Top Executives Renew Push to Get New York AG’s Civil Fraud Suit Dropped

Introducing Satoshi Summer Camp: A Bitcoin Adventure for Families

US judge approves expedited schedule for Consensys suit against SEC

2 Cryptocurrencies To Buy Boosting Into Top 10

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs