Bitcoin

Spot Bitcoin ETF Could Trigger a 155% BTC Explosion, According to CryptoQuant- Here’s the Timeline

Published

9 months agoon

By

admin

On-chain data provider CryptoQuant says that the approval of a spot Bitcoin (BTC) exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC) could boost the price of BTC by triple-digit percentage points.

In a new report, CryptoQuant says that billions of dollars would flow into the BTC market and consequently more than double Bitcoin’s price if the Wall Street firms that have applied to issue a spot Bitcoin ETF allocate a fraction of their assets under management (AUM) to the flagship digital asset.

Some of the financial giants seeking to issue a spot Bitcoin ETF include BlackRock, VanEck and Fidelity Investments.

“We could expect $155 Billion will flow into the Bitcoin market once these ETFs are approved. The total Assets Under Management of these companies are around $15.6 trillion. If they were to put 1% of their AUM into these Bitcoin ETFs, the total US dollar amount that would enter the Bitcoin market could be approximately $155 Billion…

The increase in the Bitcoin Market Capitalization we calculated above implies the market cap would increase between 82% and 165% from the current level and that Bitcoin price could reach between $50,000 and $73,000 as a result of these inflows of fresh money.”

Bitcoin is trading at $28,550 at time of writing and a jump to $73,000 would represent a 155% gain.

On when spot Bitcoin ETFs could be approved by the SEC, CryptoQuant says,

“Although these ETFs are not expected to be approved this year, the probability that they will be approved by the final deadline (March 2024) has been growing as a result of favorable court rulings for Grayscale (GBTC Fund) and XRP in the respective legal fight against the SEC.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE-3

Source link

You may like

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Published

51 mins agoon

July 8, 2024By

admin

The latest in blockchain tech upgrades, funding announcements and deals. For the period of July 5-10.

Source link

Bitcoin

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

Published

3 hours agoon

July 8, 2024By

admin

Today, a Republican National Committee panel approved a draft of its 2024 party platform, that strongly supports Bitcoin.

On page nine, the draft explicitly states, “We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their digital assets, and transact free from Government Surveillance and Control.”

JUST IN: 🇺🇸 Republican National Committee panel passes draft of party platform, pledging to "defend the right to mine #Bitcoin" and protect self custody. pic.twitter.com/CnH8nMOuUO

— Bitcoin Magazine (@BitcoinMagazine) July 8, 2024

Additionally, it promises to end what it calls the Democrats’ “unlawful and unAmerican Crypto crackdown” and opposes the creation of a Central Bank Digital Currency (CBDC). According to The Hill, the platform committee overwhelmingly approved the new draft and it will face a final vote on Tuesday.

This decision further marks a clear stance by the Republican party in favor of Bitcoin and cryptocurrency innovation, positioning itself against the current unwelcoming stance by the Biden Administration and Democrats.

The draft reflects the growing interest and advocacy for protecting and supporting Bitcoin within the party, aligning with broader trends of Bitcoin adoption and support among various Republican politicians. In May, Donald Trump said he “will ensure that the future of crypto and Bitcoin will be made in the USA.”

The full approved draft can be read here:

View the original article to see embedded media.

Source link

Bitcoin

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Published

5 hours agoon

July 8, 2024By

admin

Recent data shows that the Bitcoin mining difficulty is on the decline and has hit its lowest since May. This is significant considering what this could mean for the Bitcoin ecosystem, specifically Bitcoin’s price.

Bitcoin Mining Difficulty Drops To 79.5 T

Data from CoinWarz shows that Bitcoin mining difficulty has dropped to 79.5 T at block 851,204 and hasn’t changed in the last 24 hours. This mining difficulty has continued to fall for a while, with further data from CoinWarz showing that it is down 5% in the last seven and 30 days.

Bitcoin mining difficulty refers to how hard it is for miners to mine a new block on the Bitcoin network. The difficulty usually reduces when there is less computational power on the power and increases when miners are mining faster than the block average time of ten minutes. The recent drop in mining difficulty suggests that more miners are leaving the Bitcoin network.

This is most likely due to the effects of the Bitcoin halving, which cut miners’ rewards in half. This has reduced the revenue from their mining operations, with many miners struggling to stay afloat, especially with increased competition. Bitcoin’s price action since the halving has also not helped, as the drop in the flagship crypto’s price has also affected their income.

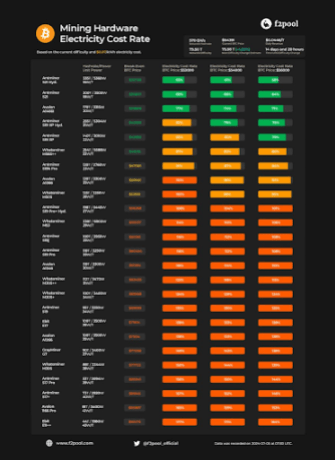

Bitcoin miner f2pool recently highlighted the profitability of various categories of miners at Bitcoin’s current price. The mining firm noted that only ASICs with a Unit Power of 26 W/T or less can make a profit at Bitcoin’s current price range.

Crypto analyst James Van Straten also recently highlighted how “weak and inefficient miners” continue to be purged from the Bitcoin network. He claimed that the recent drop in mining difficulty shows that miner capitulation is closer to ending. Due to the low profitability that miners have faced since the halving, some have had to offload a significant amount of their Bitcoin reserves to meet operational costs, and others have had to exit the Bitcoin ecosystem entirely.

What This Means For Bitcoin’s Price

The decline in mining difficulty suggests that miner capitulation might be ending soon, which is a positive for Bitcoin’s price considering the selling pressure these miners have put on it. Bitcoinist reported that Bitcoin miners sold over 30,000 BTC ($2 billion) last month, which ultimately caused the flagship crypto to experience significant price crashes.

Crypto expert Willy Woo also attributed Bitcoin’s tepid price action to these miners and mentioned that the flagship crypto will only recover when the “weak miners die and hash rate recovers.” He stated that Bitcoin would have to shed weak hands for this to happen, with inefficient miners going into bankruptcy while other mines are forced to buy more efficient hardware.

Source link

Grayscale Announces Distribution Date for ‘Mini’ Ethereum ETF Shares

Protocol Village: Hinkal, Instititutional-Grade Self-Custodial Protocol, Plans Launch of 'Shared Privacy'

Republican National Committee Endorses Pro-Bitcoin Platform in Party Draft

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs