Opinion

The Emerging Bitcoin Modular Ecosystem

Published

2 weeks agoon

By

admin

What’s modularity anyway?

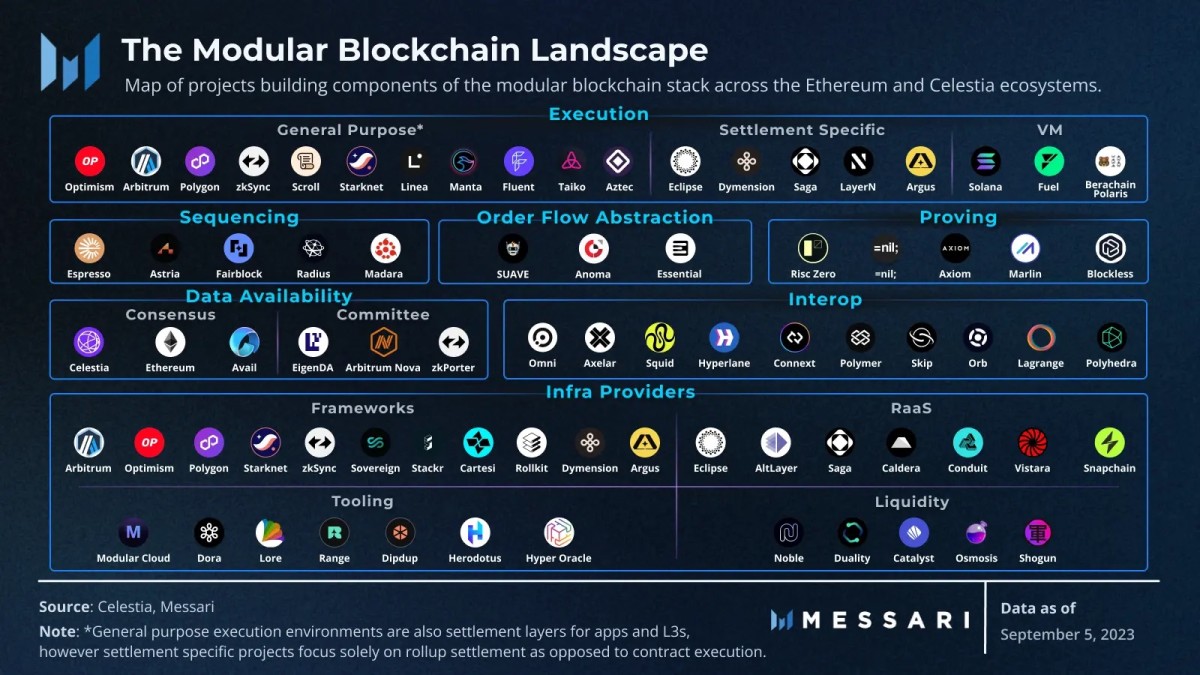

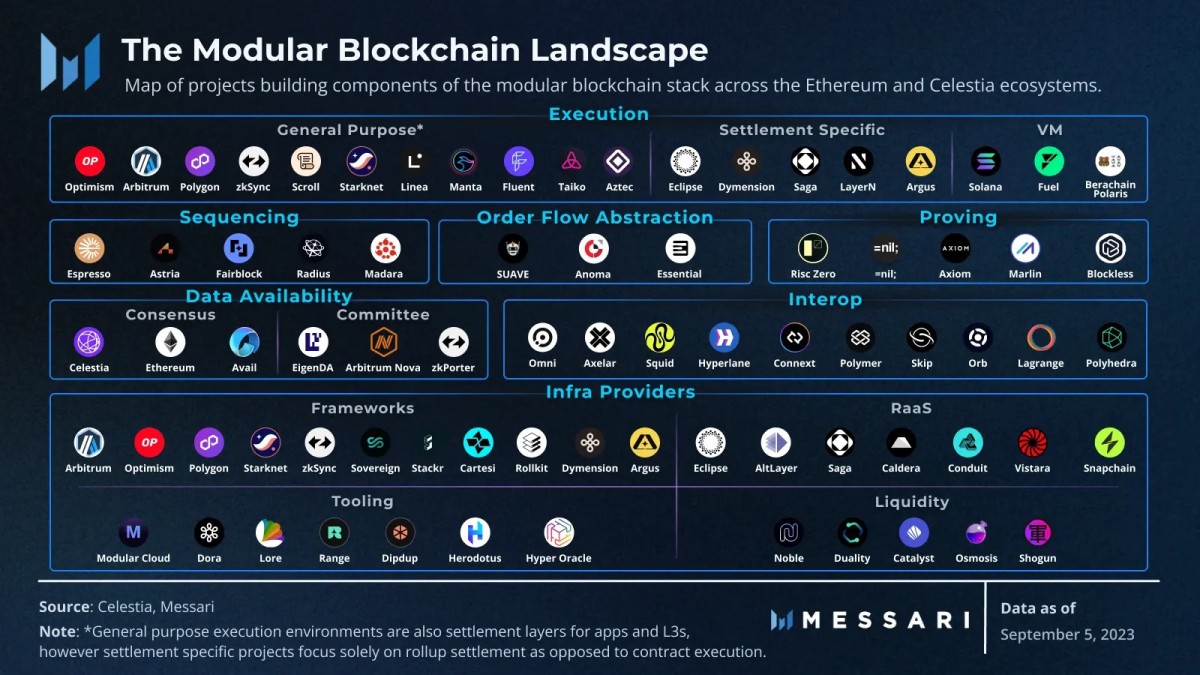

Modularity is the result of a curious experiment playing out in Ethereum as a reaction to the poor scaling properties of blockchains. To address this bottleneck, developers have taken the radical approach of auctioning off core functions of the main chain to… other blockchains.

Centered around rollup technology, this modular transformation has completely redefined how products and services are built on top of Ethereum. Breaking apart every element of the stack allows different architectures to be designed according to their use cases. Understandably this has led to a proliferation of… blockchains.

I kid you not. Everyone is getting hilariously rich selling blockchains, again.

While each new consensus protocol offers novel and interesting scaling opportunities, they also introduce a weird coordination problem. If users become dispersed across different networks, how is the economy made more efficient? How can we synchronize everyone across this distribution? Maybe one more… blockchain?

It’s turtles all the way down.

This fragmentation of the ecosystem has had a few obvious consequences. For one, users are siloed and trapped between intermediaries. While rollups have compelling trust-minimization properties, the inefficiency created by the transfer in and out of those systems creates unreasonable costs for users. It also exposes them to more risky options like bridges and centralized services.

For developers, the absence of interoperability across platforms creates friction and fosters a competitive rather than collaborative environment. Every other day a new protocol is created for new and existing teams to compete over with yet another copy of the same applications. In many cases, teams are opting to “bet on themselves”, spinning off into their own ecosystem (read: blockchain). It’s crucial to emphasize the appeal of this model, which allows for the customization and optimization of diverse components for each application. This flexible architecture empowers anyone to contribute their unique frameworks and inspire new designs. The possibilities are endless!

Unfortunately, those incentives have resulted in the fragmentation of the network effect. If nothing that’s built fits together, users will consolidate towards only a handful of competing networks. As a result, economic activity becomes concentrated into fewer permissioned systems.

This brand of modularity has brought people further from the goal when it shouldn’t. Using different interfaces to interact with the consensus protocol is a perfectly valid idea. However, Ethereum’s strategy proves problematic; it regards interoperability more as an optional feature than a foundational design principle. As long as Ethereum continues to pursue scalability by multiplying blockchains, the debate will persist, providing ample opportunities for competitors to exploit these divisions and encourage discord. Divide and conquer.

Bitcoin’s opportunity

On Bitcoin, a different architecture is emerging that favors a fundamentally different design. Using Lightning as the interoperability backbone, developers are slowly coalescing towards a technology stack much closer to Bitcoin’s peer-to-peer model.

Rather than attempt to replicate global shared states, protocols like Cashu or Fedimint are optimizing for local and permissionless interactions. Financial services can now be deployed across different economic hubs and remain connected through the Lightning Network.

Liquidity providers, atomic bridges, and ecash mints. A novel financial network all sharing the same settlement layer.

Nostr’s arrival provides the social abstraction that ties it all together. A social network based on similar principles as Bitcoin, it provides a simple set of rules engineered to maximize interoperability. By avoiding being prescriptive about the functions it enables, Nostr is unleashing a Cambrian explosion of open innovation.

Today, different projects are beginning to explore ways to facilitate Bitcoin commerce by making Nostr a native component of the Bitcoin user experience. The public key infrastructure underlying the protocol is a natural match for wallets and other payment applications, allowing them to communicate with each other and securely exchange messages. This communication layer can connect users with others and various services made available through the network. Standards like Nostr Wallet Connect are creating new opportunities for Bitcoin applications to interface with Nostr’s growing ecosystem.

A case study

Projects like Mutiny perfectly embody the differences in this Bitcoin modular vision. Users can simultaneously connect with services like Nostr Relays, Fedimint federations, and Lightning Service Providers (LSPs). Each of these grants access to a growing number of features and applications. Using Nostr as a discovery service, we are empowered to leverage our social network to identify and natively access applications and services endorsed by our peers. This web-of-trust introduces an interesting alternative to so-called trustless systems. Participants can begin relying on market incentives to engage in more efficient exchanges that aren’t encumbered by the tradeoffs required of more decentralized systems.

Eventually, marketplaces will emerge for liquidity providers, ecash mints, lenders, and coinjoin coordinators to advertise their services through Nostr. Decentralized order books projects Civkit could seamlessly integrate with Mutiny and allow users to engage in peer-to-peer trades. Every integration is designed around permissionless participation so that users can maintain full sovereignty over their interactions.

Platforms vs. protocols

Bitcoin’s modular story is not without its own risks. Fundamental pieces of the puzzle such as LSPs involve significant capital requirements that will create economies of scale between competing providers. The growth of ecash mints may be hindered by regulatory concerns and operator fraud. Nostr relays have already shown centralization tendencies and it remains unclear how the network topology will play out.

The success of this approach rests on market optionality and it is essential that the barriers to entry into these businesses remain low. A number of different efforts are being deployed to that end. For example, multiple Lightning companies are currently collaborating on a specification that would allow any market actors to implement their own LSP.

It’s probably too early to forecast how any of those architectures and protocols will evolve. As both worlds continue to collide, it’s likely that rollups find their place within the Bitcoin ecosystem. Application specific designs such as exchange rollups or zkCoins do not require global state and could perhaps be made to be interoperable with Lightning.

The tension between both methods is somewhat reminiscent of the early days of the internet. Commercial interest may favor platforms that allow them to capture portions of the network effect in order to monetize it. It could take longer for more open and permissionless protocols to truly get off the ground. The internet provides a cautionary tale with regards to the consolidation of services and applications into gatekeeping walled gardens. Hopefully, the current Bitcoin development path resolves into a future that prioritizes interoperability and permissionless access over financial silos.

Source link

You may like

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

At home, the issue that I know, will present as the second word is bill, it might be medical bill, it might be housing bill, it might be gas bill. It’s all about, you know, the challenge, post-COVID, of coming out and finding a way, with lots of industries no longer being here, a path ahead. And that’s why I come back to people like the software developers, those were kind of my roots. That was my first experience with crypto when a bunch of Senators went to the floor and said, “we’re going to sock these developers for $50 billion worth of taxes.” And I said, “wait a minute, how did the software developers suddenly acquire expertise in tax collection,” and we waylaid. So the big challenge of our time is to listen. And I can tell you right now, the supreme supreme opportunity is to focus on these economic issues, and make better use of scarce resources.

Source link

Culture

Bitcoin's Trump Card: Dividing Is The Wrong Move

Published

12 hours agoon

June 26, 2024By

admin

Ever since Donald Trump became more vocal in support of Bitcoin heading into this year’s Presidential campaign, I’ve been sitting with a wide range of emotions and concerns.

Outside of Bitcoin, as a left-leaning voter and vocal critic of Donald Trump, I have deep concerns with such an ego-centric, narcissistic character assuming power in the oval office again, not to mention the damage this could do to issues I deeply care about in the U.S. including a woman’s right to choose, reproductive rights, immigration, global affairs, and beyond.

I came into Bitcoin and began writing, running the Progressive Bitcoiner, and advocating for Bitcoin to those outside of the right leaning/libertarian bubble because I had great concerns about Bitcoin being perceived as “right wing” or politically polarizing. It’s open source code, digital peer-to-peer cash, not belonging to any one ideology or political party. I believe in its importance to radically improve our world, and the lives of millions and billions of people. Already from the left, campaigns like Greenpeace USA, Elizabeth Warren’s anti-crypto army, and beyond assume Bitcoin to be a haven for criminals and terrorists, climate denying fossil fuel tycoons, and only for the wealthy and wall street. Despite advances in data showing Bitcoin is one of the most, if not the most, sustainable industries on the planet, it’s growing list of human rights use-cases and more, appealing to progressives and the left about Bitcoin (yes Bitcoin specifically, not crypto) continues to be an uphill battle. What should we expect after years of Bitcoin’s loudest voices promoting various right leaning ideologies, encouraging books like the Bitcoin Standard, various right wing lifestyle maximalism tropes including carnivore diets, traditional family values, skepticism of science and climate science, and beyond.

The Trump campaign, and Bitcoiners openly donating to, engaging with, and stanning for Trump makes my job a lot harder. Metaphorically, we went from going fishing (regarding steady bitcoin adoption) to throwing a grenade in the water, without the slightest pause for how this may affect the bigger picture.

The reality is, post 2016 with the election of Donald Trump, and the doubling down of Hillary and the Democratic party calling his supports a “basket of deplorables,” (yes I’m quite critical of the left too!) our political polarization has skyrocketed, leaving most to feel politically homeless (some studies suggesting between 70 million to 100 million Americans).

The left has been corrupted by purity culture. If your view, means to an end, etc. has not been approved by The Left Regime (or you are not well versed on dozens of leftist philosophers and the latest theories), you’re out! Trump and bitcoiners aside, this is also why it’s so hard to get them to engage on bitcoin, because it’s not what their tribe uses, it’s right wing money (according to them).

The right has been overtaken by Trump and a party of valueless debauchery. Conservatives/republicans used to be values driven with actually policy and ideas, which I could agree or disagree with. Now it’s just complete chaos fueled and led by Trump, who has no political philosophy or value system, just ego.

Bitcoin should be a tool to cut through this noise. A tool that any ideology in this case can find useful and valuable. Instead, I’m deeply concerned the narrative may very well latch on to Trump-ism for the next several years, and beyond. Am I ultimately concerned about Bitcoin, its code, usefulness, use-cases, and beyond? Not for this Trump/political reason, no not necessarily (I do have concerns about regulatory capture via ETF’s, mining centralization, lack of privacy and better tools for bitcoin’s peer-to-peer use, etc…but that’s a chat for another time).

I just simply think it’s a bad move for bitcoiners to put all their eggs in the Trump basket, or any political basket for that matter. There’s severe reputational risk, slow down of adoption in the U.S. for those (especially on the left) that will see this as “Trump’s thing” or “right wing” and further this narrative, and the politicians who will respond by doubling down on narratives they continue to try to push against Bitcoin.

For Bitcoin’s social layer, I think it’s in the best interest to continue educating on bitcoin, advocating for grassroots adoption at the individual/community level, holding politicians accountable when they try to overstep (like Elizabeth Warren wanting to institute a backdoor ban on self-custody…no, we’re not going to let that fly, much less how that’s blatantly unconstitutional), and not desperately clinging to politicians’ words on the campaign trail, no matter who they are, that are purely pandering for votes, regardless of what may happen once they are in office (or what they can actually do, versus the legislative and judiciary branches).

As for me, an independent voter, I care deeply about Bitcoin, it’s long-term success, and seeing as many people as possible around the world use and benefit from this revolutionary money and technology. Both for Bitcoin, and for reasons beyond Bitcoin and into my values I stated above, I cannot in good conscience support Donald Trump. You don’t have to vote for Donald Trump to support, learn about or use Bitcoin, or contribute to the Bitcoin ecosystem.

Whether you agree or disagree with me, my hope is that among a growing chorus of Trump supporters from the Bitcoin community, those on the outside looking in may see that not all of us are on the same page, and that Bitcoin is for anyone regardless of your political party or who you plan to vote for come November.

This is a guest post by Trey Walsh. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

It feels like this year is going by at the speed of light, doesn’t it? I can hardly believe that it’s already June. Everyone is in vacation mode and ready to relax by the pool and forget the daily grind of work and taking care of a family.

I completely understand the sentiment. Who doesn’t want to stop thinking about wallet-crushing inflation, high interest rates, credit card debt, and the sense that whatever you do you can’t advance in life? It almost feels like this whole system is rigged against you right?

Well, it is, to be honest, but that’s a story for another time. The powers that be who want you fat, happy, and stupid have largely succeeded in that mission. Now that they have succeeded in dumbing down the populace, they literally can do whatever the hell they want and get away with it with impunity.

The thing is their hubris has gotten the best of them. The Federal Reserve and its zero interest rate policy (ZIRP) royally screwed things up to the detriment of the American people and the federal government.

Before the pandemic of 2020, the government had a hard time keeping the inflation rate around its 2 percent benchmark. Certain economic factors such as improved technology, a declining birth rate, baby boomer retirement, and globalization made it where inflation was trending down over time.

The Federal Reserve, in their infinite wisdom and constantly worried about deflation, kept cutting interest rates to spur borrowing and lending in the American economy, which worked for a time until we got to 2008 and the Great Financial Crisis (GFC).

The increased borrowing and lending overheated the housing market and almost took down the global economy, but luckily we had the “mighty” government to step in a fix a problem they helped create. That being said you would think they would have learned their lesson and got their fiscal house in order.

It’s the government, of course not! They did nothing of the sort, what they did do is keep going on their spending binge through the 2020 pandemic. It didn’t matter what political party was in office, the spending kept going up and up.

Did you know that former President Trump added $8.4 trillion to the national debt while he was in office and President Biden is not faring much better with total debt looking to clock in around the $7.9-$8 trillion mark? Needless to say, the government is broke and is living on borrowed time.

Whoever “wins” the election will be the captain of a sinking ship. Medicare and Social Security are broken and completely unaffordable but politicians don’t dare tell the millions of Americans who “paid” into their entire working lives that there is no pot of money set aside for them and that it was just an elaborate tax scheme to fund the government.

You are NOT entitled to receive social security “benefits”, I hope you know that by now. If the government told you f**k you, you ain’t getting Social Security or Medicare, there isn’t a damn thing you could do about it. There are no lawsuits that you could file to compel the government to give you your money back or elect the “right” congressman to fix things. Once the government taxes your paycheck, that money is GONE forever.

You can’t trust the government to keep its end of the bargain or not to debase the currency and destroy your quality of life. With a government like this, why would you trust them with anything? Self-custody of assets is going to determine the winners and losers over the next 5-10 years.

Storm Clouds Gathering

I don’t know about you but I have this unsettling feeling that we are on the precipice of something major. It is going to be a paradigm shift for the whole world. If you look out over the horizon you can see all the pieces falling into place. Just take a look at what is going on:

The United States government is $34 trillion in debt with no end in sight.

Israel bombing the Iranian military in Syria

BRICS expansion and de-dollarization ongoing

Global birthrate under replacement levels

All across the globe there is open hostility or simmering tensions about to blow out in the open. I’m not sure if this is how the world felt pre-WW2 but it sure feels like the world is coming apart at the seams. With all this going on, how can you trust the current dollar-based system to protect your hard-earned wealth?

Nothing New Under The Sun

If you have large amounts of dollars in the bank, your wealth is at risk. The banks can confiscate or severely restrict your access to your money, especially during a bank run or some other unforeseen crisis. This is exactly what happened in 2013 during the Eurozone crisis.

During this time Cyprus’ two largest banks were in trouble and need of a bailout from the European Union. The Cypriot government was desperate and the EU knew it, so in classic mob fashion, they insisted on the bank conducting a bail-in using customer funds!!

It doesn’t get any worse than this people. According to a 2018 survey, 55 percent of households who were over the $100k threshold in deposits experienced direct financial loss, and 28 percent experienced a bail-in of deposits.

If you think it can’t happen to you, think again. I bet the Cypriots thought it couldn’t happen to them yet it did. Now is not the time to be complacent and think that everything is fine. If you are a Bitcoiner you understand the world we live in right now.

This is why self-custody of your assets, principally Bitcoin is a must if you want to survive the economic armageddon with your wealth intact.

Self Custody Is The Best Tool For Economic Freedom

Satoshi created Bitcoin and gave us the monetary policy that we need to change the trajectory of humanity from endless fiat wars and a dystopian surveillance state to a bright orange future where human potential can flourish.

In addition to creating a just and fair monetary system, Satoshi gave us the ability to self-custody our wealth without the need for a middleman such as a bank. A simple Bitcoin wallet address and your private key are all you need to secure your wealth from confiscation by a malicious third party. This is truly revolutionary, I mean this is a true 1776 moment in history that was fired back on Jan 3, 2009.

Self-custody gives you the ability to move across borders with your wealth and start over in a new place if push comes to shove. You can’t do that with gold, you can’t do that with silver, you can’t do that with your 401k or the brand new shiny Bitcoin ETFs.

Not your keys, not your coin is the mantra that should be drilled into the head of every single new person coming into Bitcoin. Trusting a custodian to hodl your Bitcoin wealth is just as risky as keeping money in the bank.

There is so much educational material and Bitcoiners willing to help people new to Bitcoin that quite frankly it is unacceptable to have anyone holding any amount of Bitcoin on an exchange. If a majority of Bitcoin holders are keeping their coins on an exchange or purchasing a Bitcoin ETF instead of the real deal, what are we even doing here? It’s self-custody or bust. This is the mission at hand. Are you ready anon?

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

BTC Hashrate decline spurs interest in altcoins: APORK, RNDR, APT emerge

Cardano Price Expected To Hit $40 Next Per Crypto Analysts

Web3 Game Con: The World’s Largest Web3 Game Show Debuts at ABS2024 in Taipei

German Government Moves Millions in Bitcoin to Exchanges

Notcoin surges 10% amid token burn and $4.2m incentive plan

Robert Kiyosaki Decodes Bitcoin’s “Banana Zone”, Contrasts with Fiat Currency

Ron Wyden on FISA Reform and Crypto

Latin America's Largest Fintech Bank Integrates Bitcoin Lightning Payments Via Lightspark

bitter pills in crypto mass adoption?

Solana and Cardano Lead Top 10 Crypto Rebound

This Historical Ethereum Top Signal Is Yet To Appear This Cycle

Bitcoin's Trump Card: Dividing Is The Wrong Move

Florida lawmaker pitches ‘Bitcoin for Taxes’ bill

SEC Chair Says Approval Is Going Smoothly

Bitcoin on Cusp of ‘Top Heavy’ Zone As New Phase Begins, According to On-Chain Analyst – Here’s What He Means

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs