cryptocurrency

The Ethereum merge: what you need to know | by Blockchain.com | @blockchain | Aug, 2022

Published

2 years agoon

By

admin

You may have seen the Ethereum token, known as ether or ETH, rally as of late.

One big reason for this rally? The upcoming Ethereum merge.

What is the Ethereum (ETH) merge?

The ETH merge refers to developers changing Ethereum’s consensus mechanism, the process the blockchain uses to ensure every transaction and new block added on the network is valid. Ethereum will move from an energy-intensive proof-of-work consensus mechanism to a more energy-efficient proof-of-stake one.

To find out more about Ethereum check out

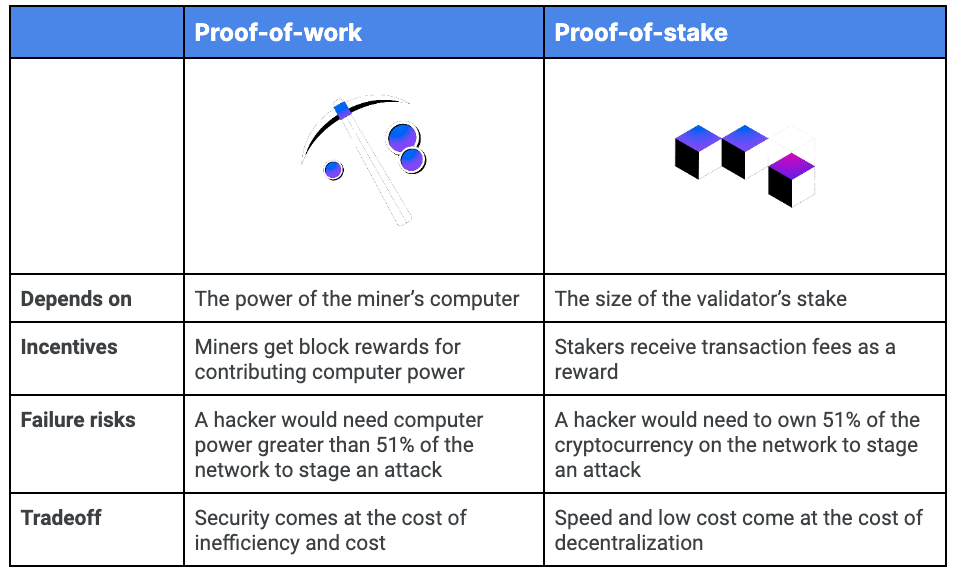

What is the difference between proof-of-work and proof-of-stake?

Proof-of-work and proof-of-stake are the two major consensus mechanisms that cryptocurrencies use to validate transactions on the blockchain.

Proof of work blockchains are verified by miners (networks of computers that help with the creation of new bitcoin).

Miners use large amounts of computer processing power in a race to solve a mathematical puzzle. As a result, the miner who solves the puzzle the quickest earns cryptocurrency as a reward, and newly verified transactions get added to the blockchain.

Alternatively, proof of stake blockchains have a network of “validators” who “stake” (put up) their own crypto to verify transactions and add them to the blockchain.

Instead of the block rewards received by proof of work miners, stakers earn a share of fees for transactions. As opposed to contributing vast amounts of computer processing power, validators stake their crypto.

What impact will moving to proof-of-stake have?

The merge to proof-of-stake will reduce Ethereum’s energy consumption by approximately 99.95%. The merge will make Ethereum more efficient and scalable.

It will also mean more competition for the project as many Ethereum competitors run on proof of stake technology.

What impact will the merge have on price?

While it’s impossible to tell the future, one effect of the merge should be to make Ethereum more cost effective. This may attract users to the ecosystem.

When is the Merge happening?

Source link

You may like

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

crypto hack

Indian police crack down on $200,000 ‘Max Crypto’ ponzi scheme

Published

20 hours agoon

June 28, 2024By

admin

A resident of Mangalore, Karnataka, has been arrested for defrauding over 50 people in a cryptocurrency ponzi scheme.

According to a local report, law enforcement in Hyderabad has arrested Kunjathbail Mujib Sayyad for operating the “Max Crypto trading” ponzi.

The investigation was originally initiated in late 2022. Back then, victims alleged that Sayyad, along with other accomplices, promised lucrative returns on investments.

The scam operated via an Android application dubbed the MAX App. The scheme promised returns within 150 days from investment.

Users were also offered a two percent commission for every new investor they brought in. The commission would be higher for bigger numbers.

Owners of the scheme claimed to be connected with big cryptocurrency traders. Further, they misled investors, stating that they were headquartered in Ajman in the United Arab Emirates.

The group held local events to promote their scheme. However, the scam operated completely online, without having any physical offices in India.

According to the victims, the scheme initially paid out returns in U.S. dollars. This is a common tactic leveraged by fraudsters to gain credibility.

The scam managed to draw in small-time investors and daily wagers hoping to see their investments multiply. However, the company, along with its app, disappeared within the first 50 days of launch.

In total, the scheme managed to accumulate INR 1.66 crore, worth approximately $200,000, from 52 victims.

The case was originally registered by local police after multiple complaints and was later directed towards the Economic Offences Wing of the Cyberabad police.

Sayyad is currently facing charges under Section 420 of the Indian Penal Code for cheating and dishonestly inducing the delivery of property. Additionally, he is charged under Section 406 for criminal breach of trust, which involves misappropriating property entrusted to him, along with charges under Section 120B for being part of a criminal conspiracy.

His accomplices remain at large at the time of writing.

Scams of these sorts are quite common in developing nations like India. Scammers tend to leverage the general populace’s lack of understanding and the hype around cryptocurrencies.

Earlier this month, India’s Enforcement Directorate (ED) froze the $180 million worth of assets from an investment group alleged to be a similar Ponzi scheme.

Prior to that, the watchdog filed charges against 299 entities for operating a fraudulent scheme operating as a cryptocurrency mining investment firm.

Source link

Akash Network (AKT) price was up 12% on Thursday as the cryptocurrency ranked second behind Book of Meme (BOME) as the top gainers.

While BOME leads top 100 gainers by market cap with a 24-hour gain of over 14%, AKT traded to highs of $3.45. The AI related token led other coins in this category, with only Render (RNDR) and The Graph (GRT) in the green among top AI and Big Data cryptocurrencies.

SingularityNET, Fetch.ai and Ocean Protocol, which are headed for a merger under the Artificial Superintelligence Alliance (ASI), were all dumping more than 10% at the time of writing.

The all-time high for AKT was $8.07 reached in April 2021.

However, while in the current market cycle, the cryptocurrency peaked at $6.22 on March 10, 2024. A surge amid Upbit listing in April saw AKT break to above $6.03 before paring gains.

Akash Network price up amid RenAIssance Hackathon

The broader crypto market was up just 1% to about $2.29 trillion, but Akash Network appeared to defy this with its double-digit gain.

As well as the announcement that Crypto.com now supports AKT staking with up to 19% in rewards, positive vibes around Akash Network may have come from another major network related event.

On June 25, the Akash team revealed a collaboration with Flock, a platform for decentralized training of AI models.

With FLock.io, AKT holders can participate in an open and collaborative ecosystem, contributing to training of models, for on-chain rewards. Users can also contribute data and other computing resources to earn AKT.

The RenAIssance Hackathon offers rewards in AKT, USDC and native FLock token FML. Top 3 models in the hackathon will earn 400 USDC and $400 worth of AKT for the winner; 300 USDC plus $300 worth of AKT will go to the runner up and 200 USDC plus $200 in AKT for the third-place model.

Participants also stand to win 200 USDC and $200 worth of AKT for winning validators.

Source link

cryptocurrency

Turkey’s parliament passes crypto bill with prison terms and fines up to $182k

Published

2 days agoon

June 27, 2024By

admin

The Turkish parliament passed a crypto bill regulating crypto use, with fines ranging from $7,500 to $182,600 and prison terms of three to five years for violations.

Turkish legislators approved the crypto bill introduced by ruling party chairman Abdullah Güler, which includes fines of up to $182,600 and imprisonment of up to five years for violations, as first reported by crypto.news Türkiye.

The bill has now been sent to Turkish President Recep Tayyip Erdoğan for approval. If approved, the decision will be published in the Official Gazette by the end of the week, bringing the bill into effect.

Under the new bill, crypto exchanges that wish to operate legally in the country must be licensed by the Capital Markets Board, Turkey’s financial regulatory and supervisory agency. Unauthorized crypto platforms offering trading services could face prison sentences of three to five years.

Crypto providers will also be responsible for implementing and reporting measures such as seizures and other legal enforcement actions. Additionally, crypto platforms must ensure that customer fund transfers — including deposits and withdrawals — are accessible and traceable by legal authorities.

Although not included in the bill, a transaction tax of 0.04% may be levied on investors’ crypto trades, though it is unclear when and how this will be regulated.

Turkey has been considering crypto regulation since 2021, after the Financial Action Task Force (FATF) included the country in its “grey list” for failing to supervise its banking, real estate, and other sectors vulnerable to money laundering practices.

In November 2023, Turkey’s Treasury and Finance Minister Mehmet Şimşek said that the country was finally introducing crypto legislation. Speaking to the nation’s planning and budget commission, he noted that Turkey has met 39 of the 40 FATF standards and was in the “final stage” of compliance.

In early 2024, Şimşek emphasized that the upcoming regulations aim to mitigate the risks associated with crypto trading and protect retail investors. Key aspects of these regulations allegedly include legal definitions of crucial crypto-related terms such as “crypto assets,” “crypto wallets,” and “crypto asset service providers.”

Source link

Book of Meme sees gains as Pepe Unchained ICO raises $1 million

Coinbase Won’t Support Upcoming AI Token Merger Between Fetch.ai, Ocean Protocol and SingularityNET

BTC Back To $60K Amid ETF Outflows, Top Cryptos Prices Fall

21Shares files spot Solana ETF with SEC

Google Releases Supercharged Version of Flagship AI Model Gemini

Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

CleanSpark’s acquisition of GRIID reiterates CLSK as a Buy

Treasury and IRS Finalize Broker Rule, Defers DeFi Decision

U.S. Treasury Issues Crypto Tax Regime For 2025, Delays Rules for Non-Custodians

Lido and Rocket Pool tokens tank after SEC sues Consensys

Consensys Responds to SEC Lawsuit Over MetaMask

BREAKING: 21Shares Joins Race To Launch Spot Solana ETF

Supreme Court Decision Overturns Chevron: A Victory for Judicial Authority and Bitcoin

ADA short positions spike; experts double down on Dogecoin, Angry Pepe Fork

Crypto Airdrops To Watch Out For in July

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs