AI

Trader Updates Outlook on Shiba Inu Rival That’s Exploded Over 1,200% in a Month, Predicts Rally for Fetch.ai

Published

7 months agoon

By

admin

A widely followed crypto analyst is updating his outlook on one red-hot Solana (SOL)-based memecoin.

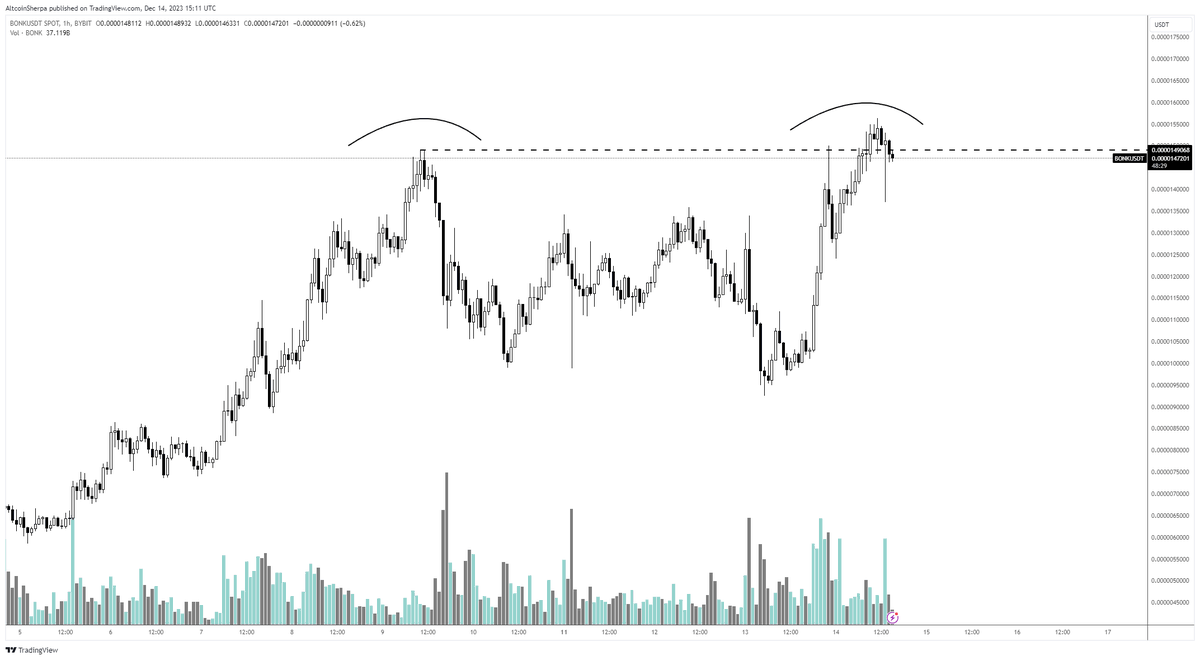

Pseudonymous crypto strategist Altcoin Sherpa tells his 201,400 followers on the social media platform X that Shiba Inu (SHIB) rival Bonk (BONK) could still have more upside potential after a massive rally.

“BONK: bulk of move probably over, but I think this could also just continue. In short, I have no idea and it’s extremely hard to ever predict these memes. I don’t think you should short this thing right now though, even if it is in a good area for pullback.”

Looking at the trader’s chart, BONK was retesting a key level Thursday at $0.0000147 after a dip down. However, BONK later soared and is trading for $0.00002864 at time of writing, more than 1,219% from its November 15th close at $0.00000217.

Next up, the trader says that artificial intelligence (AI)-focused altcoin Fetch.ai (FET) could move another leg up after flipping a resistance level at $0.60 into support and nearing a key level at $0.77.

“FET: current level is interesting, but I am still not going to be buying around here. I’m still looking for my main AI play for this cycle to be honest. I have other bags and narratives packed but not this one (yet). $0.90 seems likely in the mid-term to be honest.”

FET is trading for $0.72 at time of writing, up 9.2% in the last 24 hours.

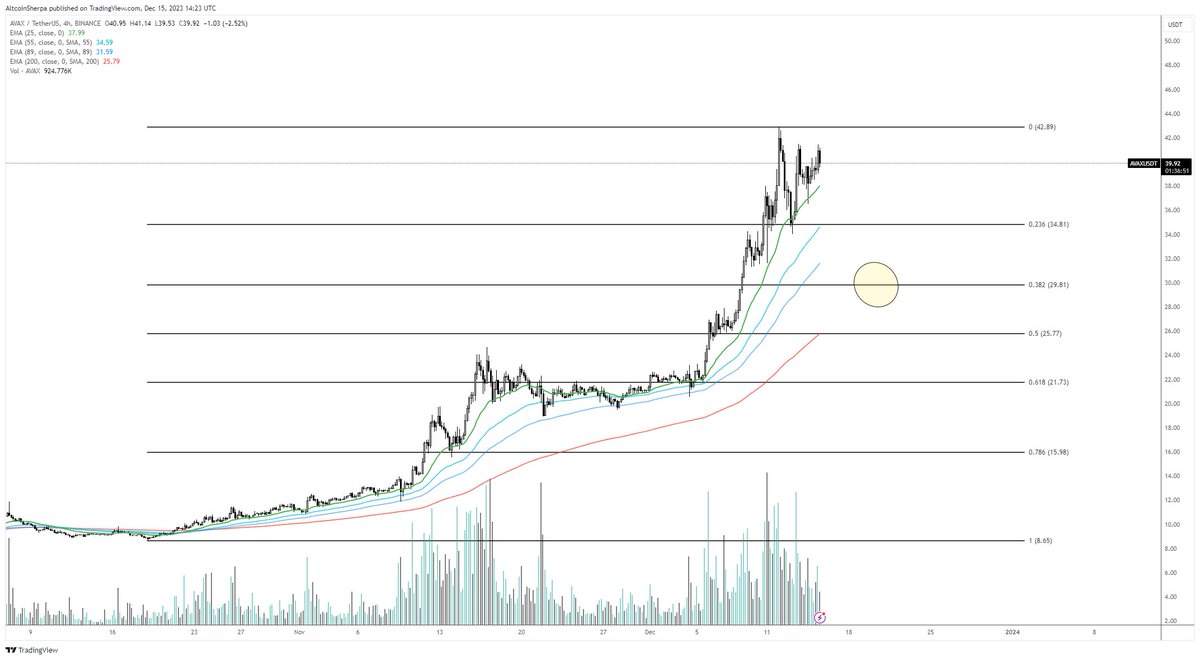

Lastly, the trader says that Ethereum (ETH) competitor Avalanche (AVAX) may dip down to $30 based on Fibonacci retracement levels and the 200-day exponential moving average (EMA).

“AVAX: the 200 EMA on the four-hour will get tapped eventually. I don’t know when but I would be patient. Look for $30 and lower eventually if this is the mid-term top. I have a spot bag of AVAX that I plan to keep holding for a while.”

AVAX is trading for $39.54 at time of writing, up slightly in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

AI

Holiday lull doesn’t slow crypto funding as Sentient scores $85m, Lombard raises $16m

Published

2 days agoon

July 7, 2024By

admin

The past week saw relatively low crypto funding activity, primarily due to the July Fourth holiday in the U.S.

Despite the holiday lull, several notable funding activities showcased the ever-growing interest in the potential of web3 innovations.

Sentient, $85 million

Sentient, an artificial intelligence (AI) research organization, collected an impressive $85 million in seed funding.

Founders Fund, Pantera Capital, and Framework Ventures led the effort, with participation from an extensive list of investors, including Ethereal Ventures, Robot Ventures, and Delphi Ventures.

Sentient seeks to foster an open AGI economy for AI developers by creating platforms and protocols that enable open-source AI innovation.

This funding round highlights the increasing demand for decentralized AI solutions that promote collaboration and monetization for developers.

Lombard, $16 million

Lombard, a startup dedicated to integrating Bitcoin (BTC) into the decentralized finance (defi) space, successfully raised $16 million in its seed round.

Led by Polychain Capital, the round also saw investments from BabylonChain, dao5, Franklin Templeton, and several others.

Lombard’s flagship product, LBTC, offers a liquid and yield-bearing representation of Bitcoin, allowing users to participate in defi activities like lending and trading while holding Bitcoin.

This innovation aims to unlock Bitcoin’s liquidity and inject it into the decentralized finance ecosystem, potentially driving growth in both sectors.

OpenLedger, $8 million

Another big winner in this week’s VC activity was web3 AI firm OpenLedger, which attracted $8 million in seed funding to build its permissionless, data-focused infrastructure for AI development.

Polychain Capital and Borderless Capital led the funding round, with contributions from Finality Capital and Hashkey Capital, among others.

The project aims to improve AI model performance by decentralizing data pipelines, with plans to launch its infrastructure on the mainnet in the upcoming quarter.

Mamori.xyz, $5 million

The rather quiet week also saw Mamori.xyz, an automated blockchain value extraction system, raising $5 million in seed funding.

Led by Blockchain Capital, the round included investments from Velocity.Capital and Web3.com. Notable angel investors such as Antonio Viggiano, Shujia Liang, and Grigore Rosu also participated.

Mamori.xyz focuses on addressing security challenges in the web3 space, leveraging machine learning to create a pathfinder for blockchain security.

Trever, $2.6 million

Wrapping up our VC roundup is Trever, an institutional operating system provider for digital assets. The startup secured €2.4 million ($2.6 million) in seed funding.

The round was co-led by TX Ventures CH and Market One Capital LUX, with additional investments from Blockchain Founders Capital DE and Dr. Alex von Frankenberg.

Trever’s software offers infrastructure for financial institutions to manage digital assets, catering to banks, brokers, and funds. With clients across the DACH region, Trever is looking to expand its reach throughout Europe, providing software solutions for the digital asset market.

Source link

AI

How Bitdeer is navigating Bitcoin mining and AI integration

Published

4 days agoon

July 4, 2024By

admin

Bitcoin mining company Bitdeer is integrating high-performance computing and AI technologies while prioritizing transparency and vertical integration to revolutionize the mining industry.

With U.S. presidential candidate Donald Trump’s ambitious plans to mine all future Bitcoin in the U.S., Bitcoin mining has become a pivotal element in his bid for the presidency. Talks of crypto and Bitcoin mining are dominating political campaigns and procedures.

The marriage of Bitcoin mining with cutting-edge technologies like Artificial Intelligence (AI) and high-performance computing (HPC) is reshaping the industry. Publicly traded miners are exploring these technologies to diversify revenue streams and ensure sustainable growth.

Bitdeer, a Singapore-headquartered Bitcoin mining company, has emerged as a standout in this competitive field. According to a recent Cantor report, Bitdeer is poised to become one of the largest miners globally, with plans to add 1,079MW of power to its data centers — enough to power nearly 900,000 homes or one large nuclear power plant. This expansion underscores Bitdeer’s ambition to become one of the biggest data centers in the world.

In an interview with crypto.news, Jeff LaBerge, Head of Capital Market & Strategic Initiatives at Bitdeer, gave insights into the company’s innovative practices and strategic initiatives.

Managing conflicts of interest

LaBerge emphasized the importance of transparency when asked about potential conflicts of interest, especially with AI companies buying more and more mining companies.

AI companies purchasing Bitcoin mining equipment can lead to transparency flaws, as using these AI technologies in mining operations obscures ownership, use cases and control structures, complicating financials and potentially facilitating illicit activities.

“We believe that keeping our contracts and terms specific and transparent allows us to manage potential conflicts of interest,” LaBerge said. “Each of our hosting customers has a detailed contract that explicitly states the amount of electricity they are contracted to draw and the payment terms associated with that power.”

To ensure this transparency, Bitdeer independently manages and operates mining rigs for both self-mining and hosting services, monitoring each rig’s status to ensure accurate logs of utilization, hash rate, and power consumption.

Proprietary vs. Hosted Mining

Bitdeer employs proprietary mining methods to boost efficiency and profitability. By utilizing various services in Bitcoin mining, Bitdeer can optimize resource allocation and reduce risks related to market volatility.

“Our diversified verticals in the Bitcoin mining segment, i.e. self-mining, cloud hashrate and hosting, allow us to mitigate volatility and facilitate growth during different cycles of the market,” LaBerge noted.

This diversification enables Bitdeer to maintain strong margins across various market cycles by leveraging different aspects of its operations.

Bitdeer aims to revolutionize the mining market with its highly efficient rigs, promising substantial energy savings—crucial for cutting miners’ largest costs. Its “SEAMLINER” technology roadmap shows its commitment to transparency, crucial for narrowing the crypto mining industry’s information gap.

Highlighting the advantages of vertical integration in rig design, LaBerge pointed out that Bitdeer produces the most efficient rigs on the market, which provides significant energy savings. “As a rig manufacturer, we have become the only truly vertically integrated public miner. This gives us a significant CapEx advantage over our competitors,” he said.

AI implementation and R&D Focus

Contrary to the assumption of increased operational costs due to AI, LaBerge clarified that Bitdeer had not implemented AI as an enabling technology at their sites. Instead, the company focuses on improving the efficiency of computing hardware.

“We have not implemented AI as an enabling technology in our sites. Bitdeer is committed to improving the efficiency of the computing hardware used in our data centers and available on the merchant market,” he said. “25% of employees are dedicated to R&D efforts, focused on chip design. We will continue to invest in R&D as part of our core strategy as a vertically integrated technology company for blockchain and high-performance computing.”

Nvidia’s computing capability

Leveraging Nvidia’s computing capability, LaBerge emphasized Bitdeer’s transition to High-Performance Computing (HPC) data centers, backed by its cloud computing and data center development expertise.

Bitdeer’s use of Nvidia’s computing capabilities enhances their competitive edge. With over 2 gigawatts of contracted power, Bitdeer is well-positioned to capitalize on the burgeoning market opportunities ahead.

“Becoming the first preferred cloud service provider in Asia by NVIDIA in Q4 2023 is a testament to this expertise and capabilities in this space,” LaBerge said.

Source link

AI

Imperial College London launches new lab, backed by £1 million from the IOTA Foundation

Published

5 days agoon

July 4, 2024By

admin

The facility is advancing bias-free AI algorithms, circularity in industrial robots and electric vehicles, battery product passports, predictive analytic tools for detecting pollution off-shoring, and more.

The IOTA Foundation just announced the inauguration of a new research facility, the Imperial IOTA Infrastructures Lab (I3-Lab), at Imperial College London.

The lab is well-positioned to lead research thanks to a generous £1 million endowment from the IOTA Foundation and additional funding from Imperial College London.

The facility aims to advance bias-free AI algorithms, circularity in industrial robots and electric vehicles, battery product passports, and predictive analytics for detecting pollution off-shoring.

Their approach will accelerate the application of scientific discoveries into practical solutions, focusing particularly on advancing Distributed Ledger Technology (DLT) within Web3 applications and digital economies.

Central to its mission, the I3-Lab will integrate DLT into the circular economy framework, hosting an incubator for sustainable business models and digital tools based on servitization. These initiatives aim to foster resource-efficient economic growth and promote shared access to goods and services.

The lab’s purpose

The lab is led by Dr. William Sanders and comprises a team of 25, including PhD students and senior researchers, collaborating closely with IOTA’s Applied Research Team.

The laboratory is dedicated to addressing worldwide issues such as climate change by developing advanced technological solutions. It also establishes a model for cooperative research where academia and industry intersect.

The lab has secured grants for pioneering projects like Autofair and iCircular3, which target bias-free AI algorithms and enhance circularity in industrial sectors, respectively.

Source link

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Taiwan is not in a CBDC rush as central bank lacks timetable

Will SHIB Price Reclaim $0.00003 Mark By July End?

The power of play: Web2 games need web3 stickiness

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs