Bitcoin

What can be done about crypto scam ads?

Published

4 days agoon

By

admin

Crypto scam ads promising wild riches have appeared on Facebook for years, yet there seems to be little progress in stopping them once and for all.

With every passing week, the number of audacious crypto scam ads online — and the unsuspecting victims losing eye-watering sums of money — continues to grow.

And to make matters worse, they’re often found on the social networks we trust the most, Facebook and X among them.

Both tech giants are losing in the battle to protect their users from fraudsters attempting to entice them with too-good-to-be-true crypto investments.

Many of these bogus ads mimic official news sites and contain false quotes from celebrities in an attempt to generate a sheen of credibility.

And while they are rapidly taken down after being reported, it’s like a game of Whac-A-Mole, with dozens more subsequently popping up in their place.

But how big of a problem is this, and what can social networks do to eradicate scam ads once and for all?

Lawsuits galore

High-profile individuals are fed up with their names and pictures being used in scam ads — prompting some to take legal action against the sites they appear on.

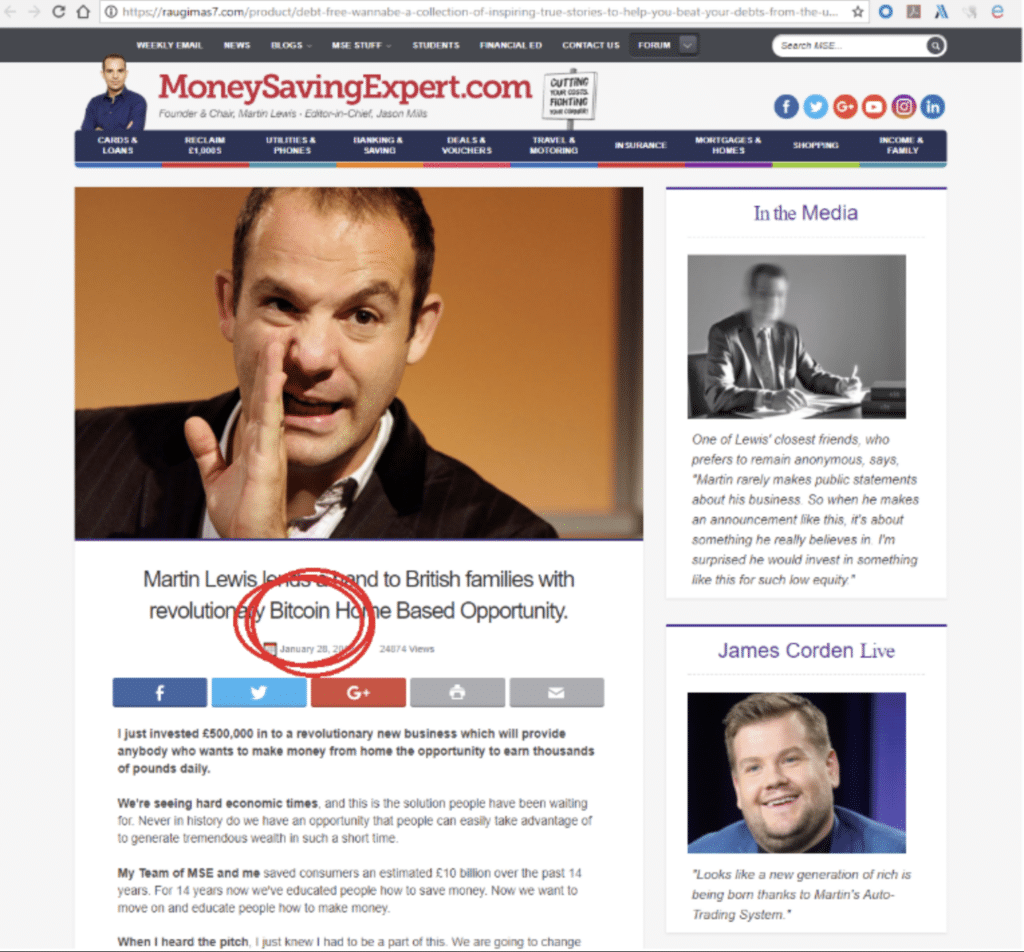

One of the first to head to the courts was Martin Lewis, a British journalist who is known as “Money Saving Expert” for his personal finance tips.

Given how he has long been a trusted voice on money matters, it’s easy to see how someone could be drawn into a bogus ad touting a once-in-a-lifetime opportunity.

Back in April 2018, he sued Facebook for defamation with a goal of pressuring the company into stepping up its efforts in preventing these ads from appearing.

By January 2019, Lewis had reached a settlement that included a $3.8 million donation to a new, independent project tasked with clamping down on scams.

This was certainly a step in the right direction. But more than five years on, Facebook users around the world are still being bombarded with these dangerous pages.

In a sign that history is repeating itself, an Australian billionaire has now been given the green light to sue Meta, amid claims Facebook has also profited from these adverts.

Andrew Forrest has alleged that thousands of people ended up losing millions of dollars after over 1,000 ads were plastered on the social network last year.

A common defense used by U.S. internet companies is Section 230 of the Communications Decency Act, which states it cannot be liable for content released by third parties. But Meta’s efforts to dismiss the case on this basis were rejected by a judge.

How is this happening?

BBC News recently wrote a deep dive into these scam ads, noting that its branding had often been used by criminals.

It explained that scammers are able to dupe Facebook’s detection systems by launching ads that appear to be going to a legitimate source, then quickly redirecting users.

The company says it’s now taking action to stop fraudsters using this technique.

Scam ads have also become much more prolific on X since Elon Musk’s takeover — and at times, has even rendered the site borderline unusable.

But this particular social network has a distinct problem of its own: malicious actors managing to take over the accounts of people with millions of followers.

Just last week, 50 Cent revealed that his X profile and website had been taken over by hackers to promote a crypto pump-and-dump scam — with the rapper stressing he had nothing to do with the project.

“Whoever did this made $3,000,000 in 30 minutes,” he claimed on Instagram.

Put together, it doesn’t seem like there’s been much success in making crypto scam ads a thing of the past.

That’s a big problem for the crypto industry in particular as it attempts to win round the public and shake off its image of being a “Wild West.”

So… what can be done about all of this?

Well, regulators might need to step up more.

In the U.K, one policy that’s being considered could see social networks face a fine of 10% of their global annual revenue if they fail to protect users. That could make them sit up and take notice.

And while artificial intelligence is widely being used to create these bogus ads, AI tools could also play a valuable role in tracking them down before they gain traction.

Meta’s previously said that scam ads are increasingly sophisticated, and it has ensured that fake ads can be easily reported by any of its users. Meanwhile, X says its teams “work around the clock to safeguard the platform.”

Unfortunately though, this is likely to be a problem that gets worse before it gets better.

Source link

You may like

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Published

41 mins agoon

July 1, 2024By

admin

Bitcoin has long been a hallmark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend trading, once a notorious breeding ground for volatility, has been especially significant in the cryptocurrency landscape.

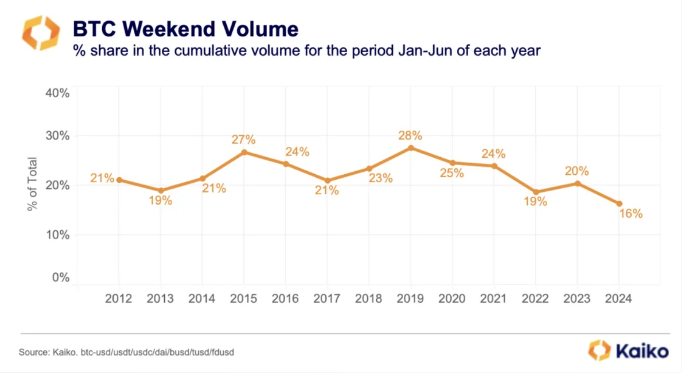

However, a recent report by Kaiko reveals a not so rosy picture – BTC weekend trading volumes have plunged to historic lows, potentially marking a new era dominated by institutional weekday warriors.

Related Reading

Bitcoin Trading Activity Takes A Nap

Kaiko’s data is straightforward: Bitcoin weekend trading activity has shrunk dramatically, dropping from a high of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the highly anticipated launch of spot Bitcoin ETFs in the US. These exchange-traded funds, mirroring the behavior of stocks, can only be traded during traditional market hours.

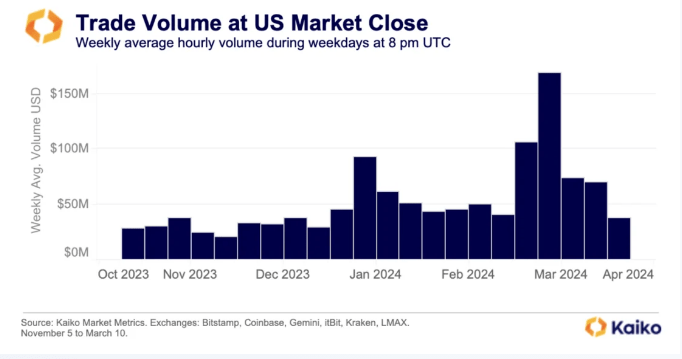

The influence of institutional investors, who tend to favor these regulated products, is evident. The report highlights a surge in Bitcoin trading activity during the “benchmark fixing window” – the final hour of US stock market trading. This suggests institutions are shaping new trading patterns, prioritizing weekdays over the once-active weekends.

Beyond Weekends: A Multifaceted Market Transformation

The decline in weekend activity isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Bank in March 2023 is another contributing factor. These institutions provided 24/7 infrastructure that enabled market makers to constantly place buy and sell orders. Their absence has created a void in weekend liquidity, further dampening trading activity.

However, the changing landscape isn’t all doom and gloom. The report offers a glimmer of hope for investors seeking stability. The reduced weekend volatility could make Bitcoin a more predictable asset, potentially attracting a new wave of institutional interest. Additionally, the historical trend suggests July could be a positive month for Bitcoin, with price increases observed in seven out of the past 11 Julys.

Jitters On The Horizon?

While the weekend trading scene may be quieting down, the coming weeks look to be somewhat turbulent for the crypto market. The potential approval of Ethereum ETFs could further fuel institutional involvement and potentially impact Bitcoin’s dominance.

Related Reading

The Road Ahead

The dwindling weekend trading activity signifies a potential paradigm shift in the Bitcoin market. While the once-volatile weekends may become a relic of the past, the coming months promise to be eventful.

Institutional investors are now in the spotlight, shaping new trading patterns and potentially ushering in an era of greater stability. However, this month could still introduce significant volatility, keeping investors on the edge of their seats.

Featured image from Inc. Magazine, chart from TradingView

Source link

Bitcoin

Bitcoin ATM installations reach 38k, below the all-time high

Published

7 hours agoon

July 1, 2024By

admin

The global Bitcoin ATM market has seen significant growth. There are now over 38,000 Bitcoin ATMs worldwide, up from just over 10,000 in October 2020 and down by 2,000 from its all-time high (ATH) of nearly 40,000 in December 2022.

According to data available on Coin ATM Radar, the global tally of installed Bitcoin ATMs stands at 38,279 as of the latest count.

This expansion is driven by factors such as accessibility and ease of use, profitability for operators who earn transaction fees above the Bitcoin spot price, and favorable regulatory environments in many countries that support setup and expansion.

Additionally, Bitcoin ATMs provide enhanced privacy and security, allowing users to transact without divulging personal information and enabling direct deposits into digital wallets.

Despite their advantages, the industry faces challenges. Many operators lack the necessary experience, financial backing, or business acumen required for success, compounded by regulatory uncertainties in certain regions.

To address these issues, industry leaders emphasize the importance of public education on the benefits of cryptocurrencies and the need for reliable customer support. Building greater understanding and trust among users could encourage broader adoption of Bitcoin ATMs and digital assets.

As demand grows for convenient and secure cryptocurrency transactions, the Bitcoin ATM market is poised for further expansion. Strategic approaches and supportive regulatory frameworks could propel this industry into a pivotal role in the global adoption of digital assets.

Bitcoin holds steady at $60k

Bitcoin’s (BTC) price trajectory in 2024 has been marked by significant volatility and a bullish momentum. March saw Bitcoin achieving a new all-time high, surpassing $69,000 and briefly touching $73,000 before undergoing a correction.

This surge was driven by pivotal events this year: regulators approved the first spot Bitcoin ETFs in January, and April’s halving event reduced the block reward from 6.25 BTC to 3.125 BTC.

Experts anticipate a new growth cycle in the crypto market, potentially peaking between 2024 and 2025, in line with the four-year market cycle theory.

However, external factors such as global developments and regulatory changes could also influence Bitcoin’s price trajectory. Despite ongoing scrutiny of Bitcoin’s long-term prospects, its historical resilience suggests the possibility of a rebound.

Analysts maintain optimism regarding Bitcoin’s future price movements, with some forecasting it could surpass $80,000 in the coming years.

Over the past 60 days, the Bitcoin price has risen by 7.3%, climbing from approximately $57,000 to its current level of $61,532.

Source link

Bitcoin

Bitcoin Remains Bullish As New BTC Addresses Surge To New 2-Month Highs

Published

17 hours agoon

June 30, 2024By

adminJune was much rougher for Bitcoin than many expected at the beginning of the month. This is because the price of Bitcoin virtually declined throughout the month, leaving many investors, especially short-term holders, disappointed.

Related Reading

However, despite the price decline, on-chain data suggests that Bitcoin adoption is growing. New data shows the number of new Bitcoin addresses being created has surged to the highest level in two months. This growth suggests the long-term prospects for Bitcoin remain strong.

New BTC Addresses Surge To 2-Month High

Despite the price slump, the network is exhibiting a promising trend that signals future growth for the world’s largest cryptocurrency. According to Glassnode chart data initially shared on social media platform X by crypto analyst Ali Martinez, new BTC wallet addresses have risen steadily over the past week to reach 352,124, their highest level since April.

Interestingly, the chart shows that the recent uptick in new addresses contrasts with a larger decrease in the creation of new addresses since November 2023. This new increase points to an influx of new users entering the crypto space. As more people adopt Bitcoin, demand will inevitably grow, which is a catalyst for price surges down the line.

Furthermore, Martinez suggested that the uptick in new addresses is from retail investors making a comeback. While institutional investors often drive major market moves, retail interest is crucial for Bitcoin’s mainstream adoption.

Retail #Bitcoin investors are making a comeback! The number of new $BTC addresses on the network surged to 352,124, marking the highest level since April. pic.twitter.com/GFOHnsokz0

— Ali (@ali_charts) June 29, 2024

A major part of the increase in new addresses can be attributed to recent adoption in the Brazilian market. Nubank, Brazil’s biggest neobank, recently announced plans to integrate Bitcoin’s lightning network into its services. As the largest fintech bank in Latin America, this integration could potentially expose a significant portion of its 100 million customers to the digital asset.

What’s Next For Bitcoin?

At the time of writing, Bitcoin was trading at $61,446. The leading digital asset has lost over 10% of its market cap in a 30-day time frame and the bulls are struggling to break above $61,000. This downtrend could be attributed to a selloff by miners and many long-term holders. Specifically, around 40,000 BTC were sold by long-term holders in June.

Bear markets are temporary. Bull runs will return. It’s just a matter of when, not if. With the second half of the year now approaching, time can only tell how the price of Bitcoin unfolds. Of course, new wallet addresses don’t directly impact price, but they are a leading indicator of growing Bitcoin adoption.

Related Reading

This adoption and demand, coupled with a recent decrease in the number of new Bitcoins entering the market, points to an increase in the price of Bitcoin in July.

Featured image from CNBC, chart from TradingView

Source link

Bitcoin Weekend Trading Volumes Plunge To Record Lows

Exclusive: Savl’s COO on new frontiers of KYC

Binance Warns Of Delisting These Tokens, Price Drop Ahead?

Top cryptocurrencies to watch this week: MOG, KAS, FET

CurveDAO (CRV) Nears All-Time Low Following Whale Deposit to Binance: On-Chain Data

Japanese Tech Giant Sony Enters Crypto Exchange Business With This Acquisition

Bitcoin ATM installations reach 38k, below the all-time high

Mark Cuban and ChatGPT Predicts Best Pick

This Week in Crypto Games: Dr. Disrespect Dumped, Pixelverse and Catizen Tokens, Notcoin ‘Fresh Start’

June sales drop 47% but there are more buyers and sellers

Toncoin Whales Just Started Buying This Coin; Is $10 Next?

SEC Sues Consensys Over MetaMask Staking, Broker Allegations

Cryptocurrency after the European Union’s MiCA regulation

Charles Hoskinson Flags Major Ongoing AI Censorship Trend

Catch up on Render and BNB price spike; enhance wallets with top analyst pick

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs