Bitcoin

Will BTC Fall To $53,600?

Published

3 months agoon

By

admin

Bitcoin prices are volatile, recently dropping from the peak of over $73,000 in March to the current spot levels. Analysts are turning to historical data for insights with mounting selling pressure and some investors being concerned about potential short-term losses. This historical analysis is crucial in determining whether we’ve reached a market top or if this is just a temporary pause before the trend resumes.

Will The Depth Of This Correction Depend On This?

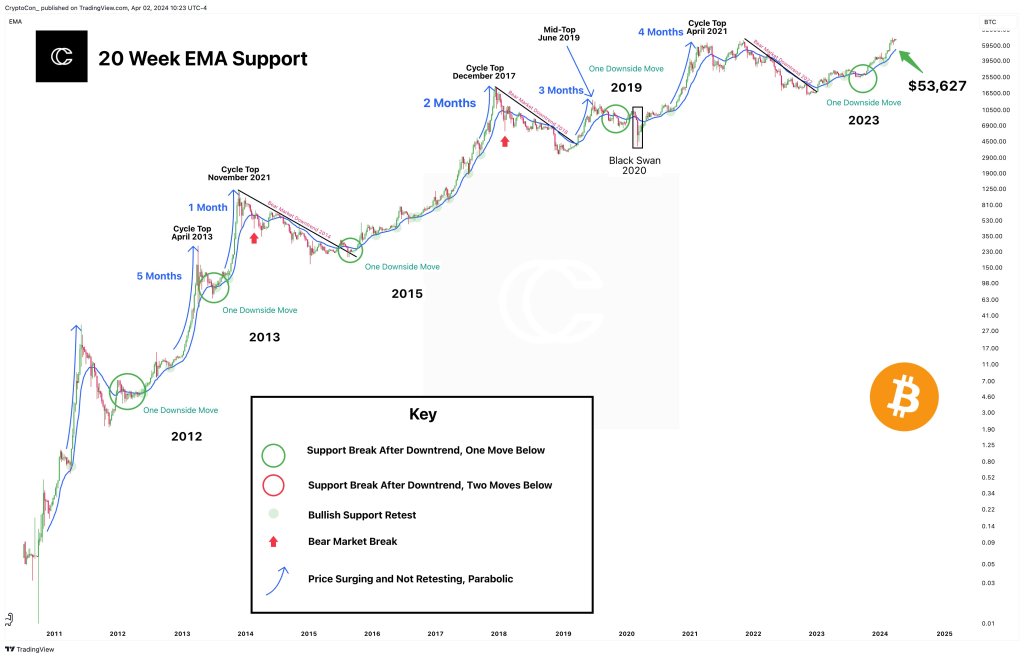

In a post on X, one analyst said the depth of the current correction will largely depend on whether Bitcoin is “parabolic” or not. Whenever an asset registers “parabolic” prices, it means valuation has increased sharply, and, at some level, analysts think it is unsustainable.

In that case, prices tend to cool off later, but after key resistance levels and even all-time highs have been broken. If this is the case, then the current cool-off could suggest the formation of a potential “first cycle top” at the March 2024 all-time high of $73,800.

This formation will be similar to those seen in April 2013 and 2021.

However, in another scenario, traders should expect a different arrangement, assuming the recent price growth wasn’t unsustainable or parabolic. Assuming this is the case, Bitcoin will likely continue bleeding and revisit established support levels.

The analyst predicts a possible correction to as low as the $53,600 support in the coming sessions. This retracement, the analyst continues, will allow the formation of a “smoother curve like 2016 – 2017.”

The Influence Of Bitcoin Halving

Aside from this assessment, another analyst is roping in the concept of the Bitcoin pre-halving cycle. Usually, and looking at historical formations, prices tend to collapse leading up to the halving event, which is set for the third week of April.

In a post on X, the analyst said the current rejection and the failure of bulls to push prices higher suggest that the coin might consolidate between $60,000 and $70,000 in the coming weeks.

Bitcoin continues under pressure and will likely register even more losses in the days ahead. Based on the daily chart formation, BTC prices are trending below the middle BB. Notably, it is finding strong rejection from the $71,700 zone.

Even though the uptrend remains, buyers will only be in control should prices rise, reversing current losses, preferably with increasing participation levels.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Bitcoin

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Published

19 mins agoon

July 8, 2024By

admin

Recent data shows that the Bitcoin mining difficulty is on the decline and has hit its lowest since May. This is significant considering what this could mean for the Bitcoin ecosystem, specifically Bitcoin’s price.

Bitcoin Mining Difficulty Drops To 79.5 T

Data from CoinWarz shows that Bitcoin mining difficulty has dropped to 79.5 T at block 851,204 and hasn’t changed in the last 24 hours. This mining difficulty has continued to fall for a while, with further data from CoinWarz showing that it is down 5% in the last seven and 30 days.

Bitcoin mining difficulty refers to how hard it is for miners to mine a new block on the Bitcoin network. The difficulty usually reduces when there is less computational power on the power and increases when miners are mining faster than the block average time of ten minutes. The recent drop in mining difficulty suggests that more miners are leaving the Bitcoin network.

This is most likely due to the effects of the Bitcoin halving, which cut miners’ rewards in half. This has reduced the revenue from their mining operations, with many miners struggling to stay afloat, especially with increased competition. Bitcoin’s price action since the halving has also not helped, as the drop in the flagship crypto’s price has also affected their income.

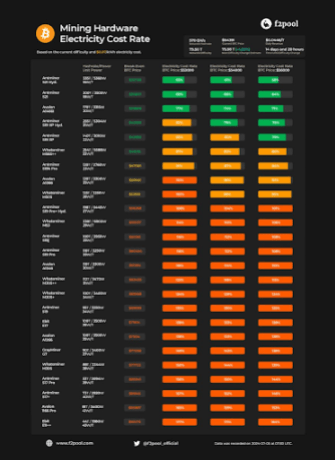

Bitcoin miner f2pool recently highlighted the profitability of various categories of miners at Bitcoin’s current price. The mining firm noted that only ASICs with a Unit Power of 26 W/T or less can make a profit at Bitcoin’s current price range.

Crypto analyst James Van Straten also recently highlighted how “weak and inefficient miners” continue to be purged from the Bitcoin network. He claimed that the recent drop in mining difficulty shows that miner capitulation is closer to ending. Due to the low profitability that miners have faced since the halving, some have had to offload a significant amount of their Bitcoin reserves to meet operational costs, and others have had to exit the Bitcoin ecosystem entirely.

What This Means For Bitcoin’s Price

The decline in mining difficulty suggests that miner capitulation might be ending soon, which is a positive for Bitcoin’s price considering the selling pressure these miners have put on it. Bitcoinist reported that Bitcoin miners sold over 30,000 BTC ($2 billion) last month, which ultimately caused the flagship crypto to experience significant price crashes.

Crypto expert Willy Woo also attributed Bitcoin’s tepid price action to these miners and mentioned that the flagship crypto will only recover when the “weak miners die and hash rate recovers.” He stated that Bitcoin would have to shed weak hands for this to happen, with inefficient miners going into bankruptcy while other mines are forced to buy more efficient hardware.

Source link

24/7 Cryptocurrency News

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

Published

1 hour agoon

July 8, 2024By

adminThe price of Bitcoin (BTC)e is yet to wriggle off from its bearish sentiment. It has doubled down on its selloffs from the past week.

BTC Trading Volume Records 94% Surge

At the time of this writing, Bitcoin was trading at $55,677.54 with a 2.34% drop in the last 24 hours. This has been the trend with the cryptocurrency in the last few weeks.

Markedly, this downtrend has been since the German government began to transfer Bitcoin to cryptocurrency exchanges, in addition to Mt.Gox repayment of its customers. The frequent offloads are an indication that Bitcoin investors including wallets that have stayed dormant for several years, are beginning to exit their positions, both short and long.

On the flip side, Bitcoin trading volume is moving upward. According to CoinMarketCap, Bitcoin’s trading volume has shot up by approximately 94.66% within the last 24 hours. Currently, BTC has hit a trading volume of $38,838,830,710. This suggests that investors are still showing interest in the coin amidst a broad market downturn. It reflects the change in market dynamics on the upside. This suggest that the market may be heading towards a bullish sentiment and probably hit a new all-time-high (ATH) as earlier projected.

For now, the selling pressure is still mounting. According to QCP Capital analysts, Bitcoin prices are continuing “to chop violently on very thin liquidity.”

Bitcoin Liquidation Continues With Mt.Gox And the German Government

More Bitcoin are still leaving the German government wallet, triggering more selling pressure. In the early hours of Monday, the German government dumped BTC to crypto market maker Cumberland DRW and Flow Traders, including crypto exchanges Coinbase, Bitstamp, and Kraken and other wallet addresses. This time around, almost 5,000 BTC were sent out by the German government.

The transfer to Cumberland DRW was made in two transactions. Markedly, the first one was a transfer of 0.001, likely a test transfer to follow with large transfers in the future. The total Bitcoin transfer to the crypto market maker summed up to 133.723 BTC worth nearly $7.63 million.

Just before publishing this story, the government moved another 2,300 BTC in its ongoing liquidations. It is believed that the German government still has as much as 32,488 BTC with an estimated worth of $1.855 billion

Similarly, Bitstamp is working on hastening the Mt.Gox repayment process. The exchange has a 60-day window to distribute tokens but aims to compensate investors much sooner. When this Bitcoin hit the market, the trajectory of Bitcoin is bound to change but the direction remains uncertain.

Read More: Bitcoin Miner Bitfarms Appoints New CEO Amid Riot Takeover Bid

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Published

9 hours agoon

July 8, 2024By

admin

The Ethereum-based BUIDL fund from the leading asset manager BlackRock has gulped over $5 million in assets over the past week despite the ongoing market turbulence.

Market analytics resource IntoTheBlock (ITB) revealed this in a recent disclosure, stressing that the fund has commanded considerable interest among investors.

While the crypto market struggles, BlackRock’s $BUIDL fund, operating on the Ethereum network, continues to attract new investors.

The fund requires a minimum entry of $5 million, and its total assets have now reached $491 million. pic.twitter.com/Bl19tVVxbW

— IntoTheBlock (@intotheblock) July 8, 2024

Launched in March on Ethereum, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) marks the company’s first tokenized fund. It allows qualified investors to procure yields in U.S. dollars by subscribing through the fintech company Securitize.

Notably, two months after the fund’s launch, Securitize secured a $47 million funding round from multiple investors, including BlackRock.

The BUIDL fund allocates investments into U.S. Treasury bills, cash, and repurchase agreements. This enables investors to generate yield while maintaining their holdings as tokens on the blockchain. Despite a correlation with the crypto industry, the fund has maintained a positive path amid the ongoing market turmoil.

According to data sourced by ITB, BUIDL now boasts $491 million in assets under management (AUM) amid a sustained growth trajectory. This feat comes as the broader global crypto market lost $290 billion in July, with Bitcoin (BTC) collapsing below $57,000.

On-chain data shows that BUIDL’s AUM stood at $486.46 million as of July 2. Interestingly, this figure has since increased to $491.83 million, recent data confirms. The growth rate indicates an addition of $5.37 million in the last week despite the bearish atmosphere.

With this bullish performance, BUIDL has maintained its position as the largest blockchain-based money market fund. Notably, BUIDL surpassed the BENJI fund from Franklin Templeton to become the largest money market fund in May, when its AUM soared to $375 million.

1/ Blackrock’s BUIDL has surpassed Franklin Templeton’s BENJI (FOBXX) in AUM and became the largest On-Chain Money Market Fund

– BUIDL has grown 36.5% MoM from $274M to $375M

– BENJI only grew 2.1% MoM from $360M to $368M pic.twitter.com/zcMzThfAAh— Tom Wan (@tomwanhh) April 30, 2024

As such, BUIDL has recorded inflows totaling $116.83 million. Meanwhile, BENJI has only seen $33.97 million in capital inflows within the same period.

Source link

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Pepe Price Analysis Reveals Bullish Strength As Bitcoin Plummets

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

✓ Share: