Altcoin

NEAR Hits New High Since 2022

Published

7 months agoon

By

admin

The past two months have been a green flag for the broader crypto market in the run-up to the festive season. Although the hype has since cooled down, a few outliers continue to follow the upward trend. NEAR is one of those tokens that aren’t showing signs of cooling down.

According to Coingecko, the token is up nearly 8% in the daily, with the biggest jump being at 23% in the weekly timeframe. With this price ascent, NEAR just reached a new high of $2.81. The token hit its all-time high of $20.42 in January 2022.

The token’s market capitalization has likewise ballooned significantly, currently priced around $2.8 billion. Several on-chain integrations power this new wave of bullishness for NEAR.

NEAR: Monolithic And Modular?

Recently, eyes are on NEAR as it continues to improve its systems. According to a Medium article last week, the protocol is implementing more changes to become what they call “a monolithic going modular” blockchain.

“In a monolithic blockchain, all four functions are executed by the same set of nodes. This has some benefits, such as high security, easier deployment, and potentially improved utility for users thanks to the ability to specialize the entire network,” the Medium article said.

Although the NEAR team says that the token is a monolothic chain, its implementation of sharding do not overwhelm individual validators. However, this isn’t enough for users as both users and developers quickly realized that publishing on Ethereum becomes an expensive ordeal.

But NEAR DA aims to change that.

NEAR market cap currently at $2.839 billion. Chart: TradingView.com

NEAR DA (“DA” meaning data availability) will give rollup operators access to NEAR’s storage capacity.

“NEAR runs four shards with roughly 16MB throughput a second. Assuming 100 bytes per transaction, you can store quite a significant amount of your data on NEAR at a fraction of the cost of publishing to NEAR,” the article explained.

As of writing, only a handful of rollups are using NEAR DA; namely Caldera, Fluent, and Movement Labs. Once this capability is in the hands of commercial users and other rollup operators, NEAR will be able to increase exposure to other investors.

Meanwhile, according to Artemis data, there has been a significant increase in network activity on the NEAR blockchain since the beginning of the month.

The data source claims that there has been a 975% increase in the daily count of unique wallet addresses sending on-chain transactions on the network.

Source: Artemis

How Does This Affect NEAR’s Price?

As of now, the token is on its way to break through $2.90 price ceiling. However, it seems that the January 2022 high of $20.42 will be a tough nut to crack as the bears mount a strong defense. But the advent of strong on-chain development along with good market conditions will bring more bullishness in the short to medium-term.

For now, investors and traders should brace for a possible correction towards $2.25 once the hype starts to settle down.

Featured images from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Meme coins are enjoying their time in the green while Bitcoin (BTC), which experienced a downturn this week, has climbed 3% in 24-hour trading.

BONK, WIF, BRETT, and PEPE have all surged over 15% amid a broader meme coin rally. Let’s take a look at each.

Bonk

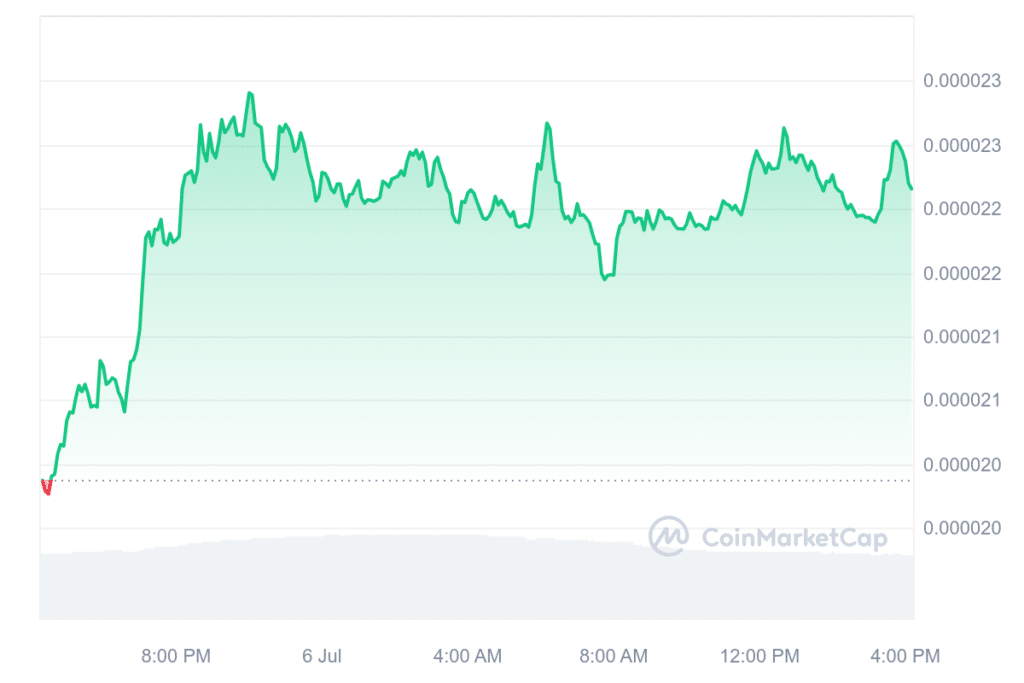

At the time of writing, Solana-based meme coin Bonk (BONK) was still up 12% in the last 24 hours.

The leading dog-themed Solana coin was trading at $0.000022 per data from CoinMarketCap (CMC). In the same time frame, its trading volume saw a drop of 1%, hovering around $319.5 million, suggesting traders could be holding on to their BONK tokens and expecting a further jump in price.

Moreover, BONK’s market cap was standing at $1.52 billion, marking it as the 50th largest cryptocurrency per CMC. Despite the latest price surge, the dog-themed meme coin is still down 52% from its all-time high of 0.000047, which it reached on March 4.

Dogwifhat

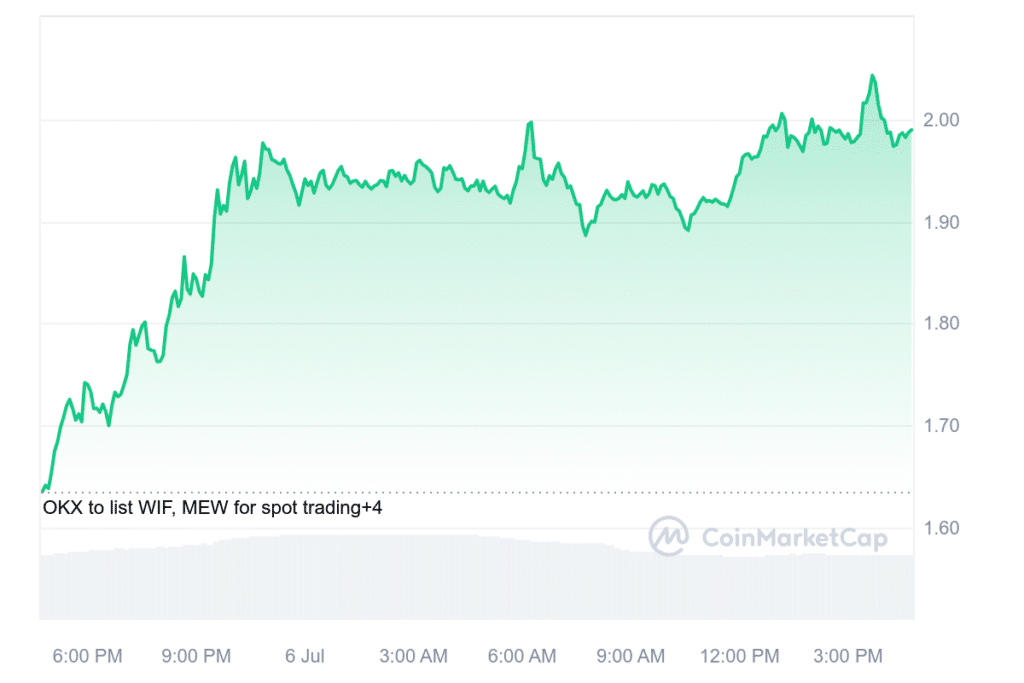

Dogwifhat has also seen a greater jump of 22%, currently trading at $1.99 as of press time. The 41st largest cryptocurrency in terms of market cap had a daily trading volume of $580 million per CMC.

At the time of publication, WIF’s market cap stood at $1.98 billion, holding the rank of 41st largest crypto asset. The canine-themed meme coin (also a Solana-based coin) is still down 60% from its all-time high of $4.85 attained on March 31.

Brett

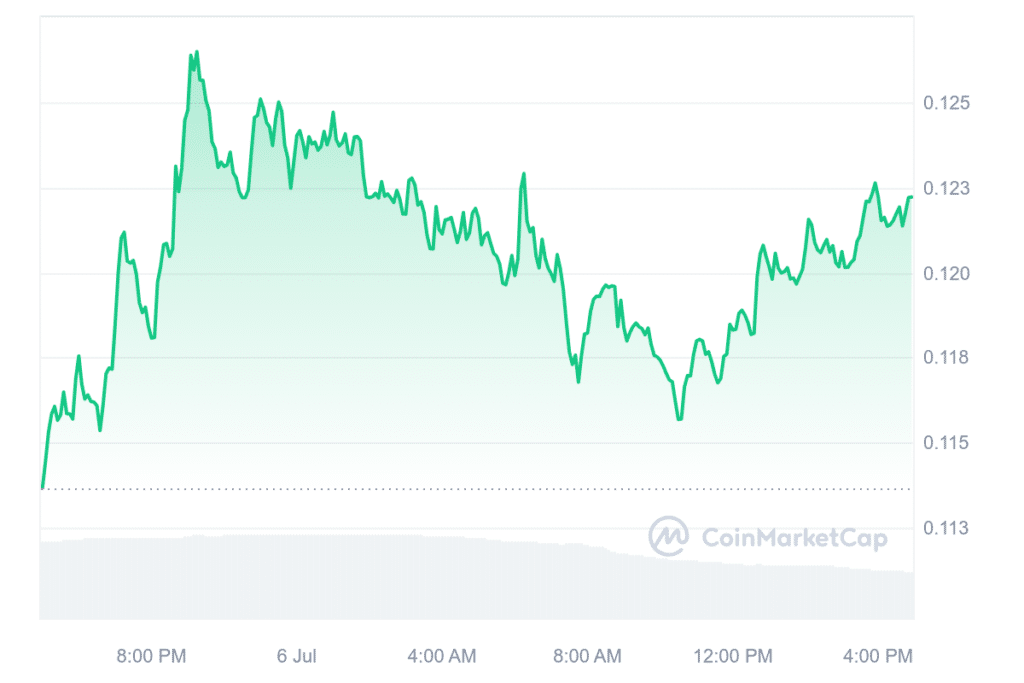

BRETT, the meme coin launched four months ago, was still up 8%, trading at $0.12, according to CoinMarketCap (CMC).

During the same period, the meme coin — inspired by a character from illustrator Matt Furie’s “Boy’s Club” comic — had a daily trading volume of $42.7 million, down 29%.

Additionally, the crypto asset’s market cap rose to $1.13 billion, making it the 58th largest cryptocurrency, according to CMC.

Pepe

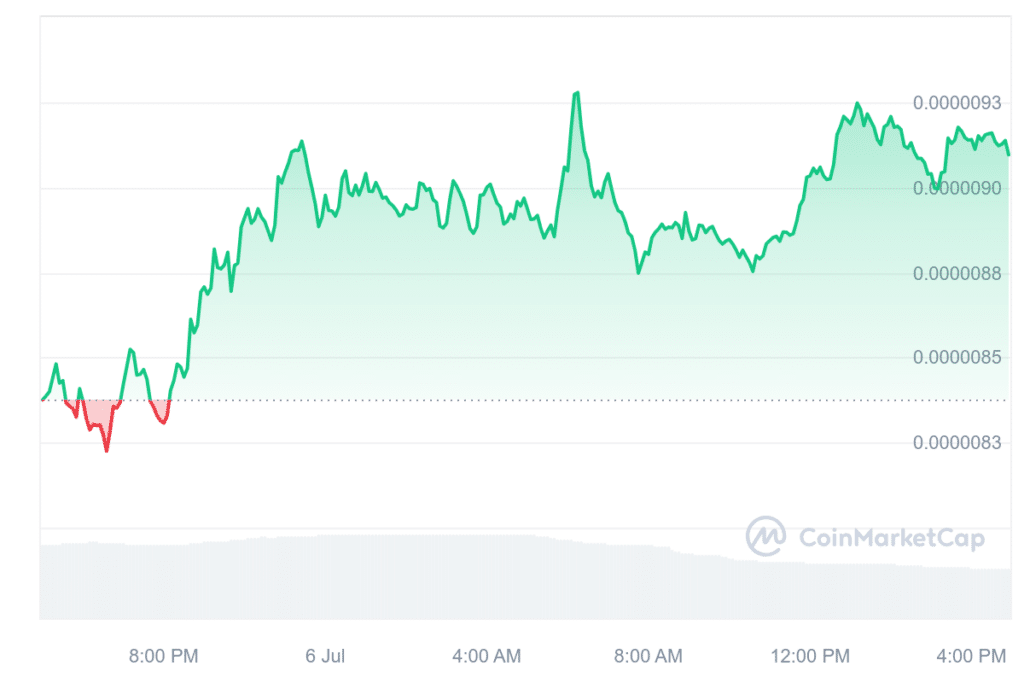

PEPE, an Ethereum-based meme coin, was also up 8.6% over the past day and exchanging hands at $0.0000090.

In the same timeframe, the daily trading volume of crypto assets hovered around $908 million, down over 32% per CMC. Meanwhile, its market cap had jumped by 8%, and it now stands at $3.8 billion.

The general surge in all these meme coins follows a rise in the largest crypto asset by market cap, Bitcoin, which had risen by 3% over the past day to $56,713 on Saturday. Its 24-hour lows and highs were recorded as $54,839 and $56,856, respectively.

Bitcoin’s dominance is currently 53.64%, a decrease of 0.31% over the day, reflecting a notable jump in altcoin market activity. Meanwhile, the global crypto market cap has risen by 3.2%, bringing its total market cap to $2.08 trillion.

The big jump in the meme coin market is often linked to Bitcoin’s performance due to its influence on the broader cryptocurrency market.

When Bitcoin performs well, it often leads to increased investor confidence and interest in alternative coins (altcoins), including meme coins. This phenomenon can create a positive feedback loop, where rising prices attract more investors, further driving up prices.

Source link

Akash Network (AKT) price was up 12% on Thursday as the cryptocurrency ranked second behind Book of Meme (BOME) as the top gainers.

While BOME leads top 100 gainers by market cap with a 24-hour gain of over 14%, AKT traded to highs of $3.45. The AI related token led other coins in this category, with only Render (RNDR) and The Graph (GRT) in the green among top AI and Big Data cryptocurrencies.

SingularityNET, Fetch.ai and Ocean Protocol, which are headed for a merger under the Artificial Superintelligence Alliance (ASI), were all dumping more than 10% at the time of writing.

The all-time high for AKT was $8.07 reached in April 2021.

However, while in the current market cycle, the cryptocurrency peaked at $6.22 on March 10, 2024. A surge amid Upbit listing in April saw AKT break to above $6.03 before paring gains.

Akash Network price up amid RenAIssance Hackathon

The broader crypto market was up just 1% to about $2.29 trillion, but Akash Network appeared to defy this with its double-digit gain.

As well as the announcement that Crypto.com now supports AKT staking with up to 19% in rewards, positive vibes around Akash Network may have come from another major network related event.

On June 25, the Akash team revealed a collaboration with Flock, a platform for decentralized training of AI models.

With FLock.io, AKT holders can participate in an open and collaborative ecosystem, contributing to training of models, for on-chain rewards. Users can also contribute data and other computing resources to earn AKT.

The RenAIssance Hackathon offers rewards in AKT, USDC and native FLock token FML. Top 3 models in the hackathon will earn 400 USDC and $400 worth of AKT for the winner; 300 USDC plus $300 worth of AKT will go to the runner up and 200 USDC plus $200 in AKT for the third-place model.

Participants also stand to win 200 USDC and $200 worth of AKT for winning validators.

Source link

Altcoin

Crypto sees over $300 million in liquidations as Bitcoin, altcoins plummet

Published

2 weeks agoon

June 25, 2024By

admin

Bitcoin price broke below $61,000 on Monday as bearish pressure intensified, and the market has seen over $320 million in total liquidations in 24 hours as a result.

With bulls unable to hold key price levels as BTC traded lower, today’s dip sees buyers staring at a potential dip to the psychologically important $60,000 level.

The bloodbath is also visible across the altcoin market as Ethereum failed to hold above the $3,300 level. Meanwhile, Solana, BNB and XRP all shed significant chunks of recent gains. Uniswap and Maker, down 12% and 9% in the past 24 hours, are the biggest losers among the top 50 coins by market.

Liquidations hit over $320 million in past 24 hours

As Bitcoin slumped past $62,000 on Monday, total liquidations across the crypto market moved past $300 million.

With BTC below $61k and looking likely to extend losses, the annihilation of leveraged longs increased to over $324 million. More than $286 million are long positions, while $36 million are shorts.

According to data from Coinglass, nearly $132 million of the liquidations are for Bitcoin.

Longs account for the vast majority of the rekt traders at nearly $122 million in 24 hours while liquidated short positions account for about $9.9 million. Per the market data, over $95 million of the liquidated longs have come in the past 12 hours.

Overall, more than 85,440 traders have been liquidated in the past 24 hours. The largest single liquidation order within this period as of 12:30 pm ET on June 24 occurred on Binance – a $15.36 million burn on the BTC/USDT pair.

Why did Bitcoin price fall sharply today?

On June 24, the trustee of the bankrupt crypto exchange Mt. Gox announced that the long-awaited repayments for creditors will start in July. With over $9 billion in BTC with the defunct exchange and earmarked for distribution, investor reaction to the news was swift and biting.

Bitcoin price tumbled more than 5% after the news, breaking past support levels as fears of a potential sell-off pressure struck the market. The downward pressure also comes amid recent selling by a wallet linked to the German government.

Earlier this year, German police seized close to 50,000 BTC worth around $2.1 billion at the time.

Bitcoin’s gains over the past months meant the total value of the coins reached over $3 billion. But data from Arkham Intelligence shows the wallet has recently sold off a significant number of BTC, likely contributing to the selling.

Miners have also sold quite a chunk, with IntoTheBlock data showing about 30,000 BTC sold post-halving.

Source link

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

What’s the best new crypto in 2024?

Bitcoin Mining Difficulty Crashes 5% To Lowest Level In 3 Months, What Happens Next?

Bitcoin (BTC) Price, Volume Contrasts In Fight For Rebound

The German Government Is Selling More Bitcoin – $28 Million Moves to Exchanges

BC.GAME Announces the Partnership with Leicester City and New $BC Token!

Justin Sun Says TRON Team Designing New Gas-Free Stablecoin Transfer Solution

Mt. Gox is a ‘thorn in Bitcoin’s side,’ analyst says

XRP Eyes Recovery Amid Massive Accumulation, What’s Next?

Germany Moves Another $28 Million in Bitcoin to Bitstamp, Coinbase

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

BlackRock’s BUIDL adds over $5m in a week despite market turbulence

Binance To Delist All Spot Pairs Of These Major Crypto

German Government Sill Holds 39,826 BTC, Blockchain Data Show

HIVE Digital stock rallies over 9% as Bitcoin miner bolsters crypto reserves to 2.5k BTC

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

Block News Media Live Stream

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

BNM DAO Token Airdrop

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs