Altcoins

Will Celestia (TIA) Hit $130? Analyst Makes Bold Prediction

Published

4 weeks agoon

By

admin

Celestia (TIA), a red-hot cryptocurrency in the modular blockchain space, has experienced a rollercoaster ride in recent weeks. After reaching a peak of nearly $16, TIA underwent a correction, plummeting to $7.5 according to CoinMarketCap data.

However, the token has displayed remarkable resilience, bouncing back to $11.50 and showcasing strong trading volume – a sign that investors haven’t abandoned ship.

Celestia’s Rebound And Investor Optimism

The past 24 hours have been particularly kind to Celestia. The token price surged by a significant 6.20%, indicating a shift in investor sentiment towards optimism. This bullish momentum is further bolstered by analyst predictions and market psychology.

TIA’s price action reveals a struggle between bullish and bearish forces. While the Fear & Greed Index sits at 72 (“Greed”) and price predictions lean bullish, the current price of $11.70 remains significantly lower than its February 10th, 2024 ATH of $20.85.

This signals a potential continuation of the downtrend. However, a key technical detail to note is the price staying above the cycle low of $7.61. This could indicate the beginning of a price recovery, but further technical analysis is necessary to confirm this.

Some 46 cryptocurrency exchanges, including Binance and KuCoin, allow traders to trade Celestia. Celestia changed hands for $549.60 million in the previous day.

TIA is currently trading at $11.7. Chart: TradingView

Celestia: Long-Term Potential And A Bullish Breakout

Crypto analyst CryptoBullet has offered a long-term perspective on Celestia’s trajectory, focusing on its one-week chart. The analyst predicts a consolidation phase where TIA will likely trade below its previous high of $20 for an extended period.

I think #TIA will consolidate below the $20 high for quite a while (maybe it will print a giant Symmetric Triangle, who knows)

In my opinion, only after this re-accumulation $TIA will be ready to go much higher 📈

🎯 Macro target 1 – $70

🎯 Macro target… pic.twitter.com/xiFzY3CQEc— CryptoBullet (@CryptoBullet1) April 18, 2024

This consolidation could potentially form a bullish “Symmetric Triangle” pattern, a technical indicator often seen before significant price breakouts. CryptoBullet believes that after this consolidation and re-accumulation period,

TIA will experience a substantial rise, with ambitious macro price targets set at a staggering $70 and even $130. While these targets are lofty, they highlight the analyst’s belief in Celestia’s long-term potential.

Celestia’s Underlying Value Proposition

The recent bullish sentiment surrounding Celestia isn’t solely driven by speculation. Celestia is a modular data availability network, a foundational technology that underpins the scalability and security of blockchains.

By offering a secure platform for developers to launch their own blockchains, Celestia positions itself as a crucial piece of infrastructure in the burgeoning blockchain ecosystem. This underlying value proposition, coupled with the recent positive market forces, is propelling Celestia into the spotlight.

Will TIA Reach $130?

While predicting specific price points like $130 is inherently difficult in the volatile cryptocurrency market, Celestia’s future trajectory remains intriguing. Bullish sentiment and a Greed market mood suggest potential for price appreciation.

However, the significant drop from its all-time high and the unknown influence of future news and developments necessitate caution. Technical analysis using indicators and monitoring upcoming events can provide more clarity on Celestia’s price direction.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Altcoins

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Published

1 week agoon

May 9, 2024By

admin

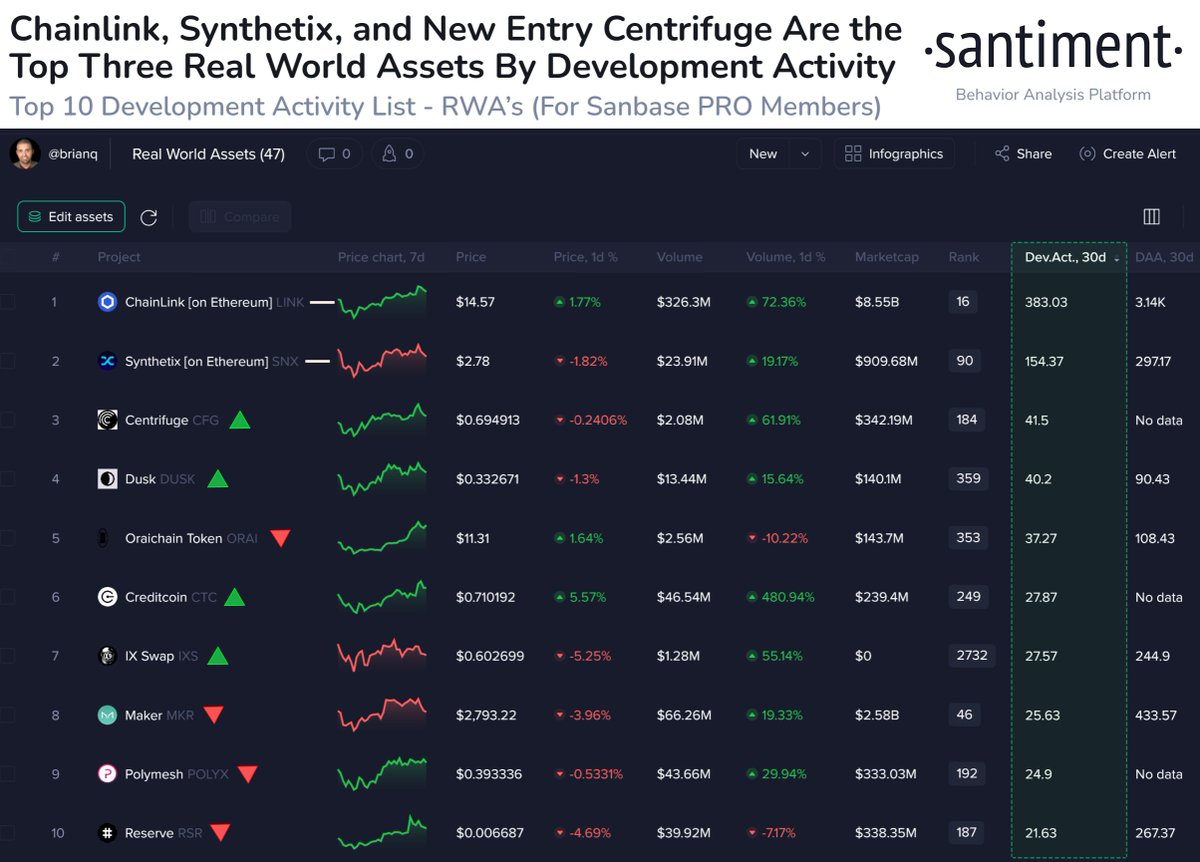

Blockchain analytics platform Santiment says one Ethereum (ETH)-based altcoin project is leading in the real-world asset (RWA) sector based on development activity.

Santiment says that blockchain oracle Chainlink (LINK) is seeing the greatest amount of daily activity on the development hosting platform GitHub.

LINK Is seeing more than two times the amount of development activity compared to the second most active blockchain project, Synthetix (SNX), a decentralized finance (DeFi) crypto that allows synthetic asset creation on Ethereum.

“Here are crypto’s top real-world assets by development. This list is compiled by counting any non-redundant GitHub activity, and averaging this daily activity over the past 30 days. Chainlink currently produces 2.49x more daily activity than the next most active project, Synthetix, in the RWA sector.”

Santiment’s ranking list is as follows: 1. Chainlink 2. Synthetix.io 3. Centrifuge (CFG) 4. Dusk (DUSK) 5. Oraichain (ORAI) 6. Creditcoin (CTC) 7. IX Swap (IXS) 8. Maker (MKR) 9. Polymesh Network (POLYX) 10. Reserve Rights (RSR).

Santiment also says that the native asset of decentralized oracle protocol Tellor (TRB) is outperforming most other digital assets so far this month.

“Tellor is one of the top performing assets thus far in May, exactly doubling in market cap since the calendar month turned. Whale transactions and address activity have both seen sudden spikes, which are suggesting potential TRB profit takes.”

Tellor is trading for $111.64 at time of writing, up 16% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Published

1 week agoon

May 8, 2024By

admin

The hacker who looted the crypto exchange Poloniex has started moving Ethereum (ETH) to the mixing service Tornado Cash, according to the digital asset de-anonymizing platform Arkham.

Arkham notes the hacker moved 1126.1 ETH worth more than $3.4 million into Tornado Cash across a series of 20 transactions on Monday and Tuesday.

They represent the exploiter’s first moves into the controversial Ethereum-based crypto mixer, which helps users conceal their digital assets.

The hacker raided Poloniex in early November, stealing $56 million worth of ETH, $48 million worth of Tron (TRX) and $18 million worth of Bitcoin (BTC), as well as smaller amounts of other crypto assets.

The exchange, which is owned by Tron founder Justin Sun, offered a 5% white hat bounty that went unaccepted. and the hacker still holds $181.47 million worth of crypto in their primary address, according to Arkham.

Justin Sun-affiliated projects have endured a prolific string of attacks in the past several months: In September, hackers exploited the Sun-linked exchange giant HTX for approximately 4,999 Ethereum worth $7.9 million, according to the blockchain security firm PeckShield.

Then in November, hackers hit HTX and Heco Bridge, another Sun-linked project that’s used to move funds between Ethereum and energy-saving blockchain Heco Chain, for a combined $100 million, according to cybersecurity firm Cyvers.

And in January, hackers once again struck HTX, hitting the exchange with a distributed denial of service (DDoS) attack that caused a brief outage.

A DDoS attack is a malicious attempt by bad actors to flood the target website with traffic to overwhelm the site’s infrastructure.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Published

1 week agoon

May 8, 2024By

admin

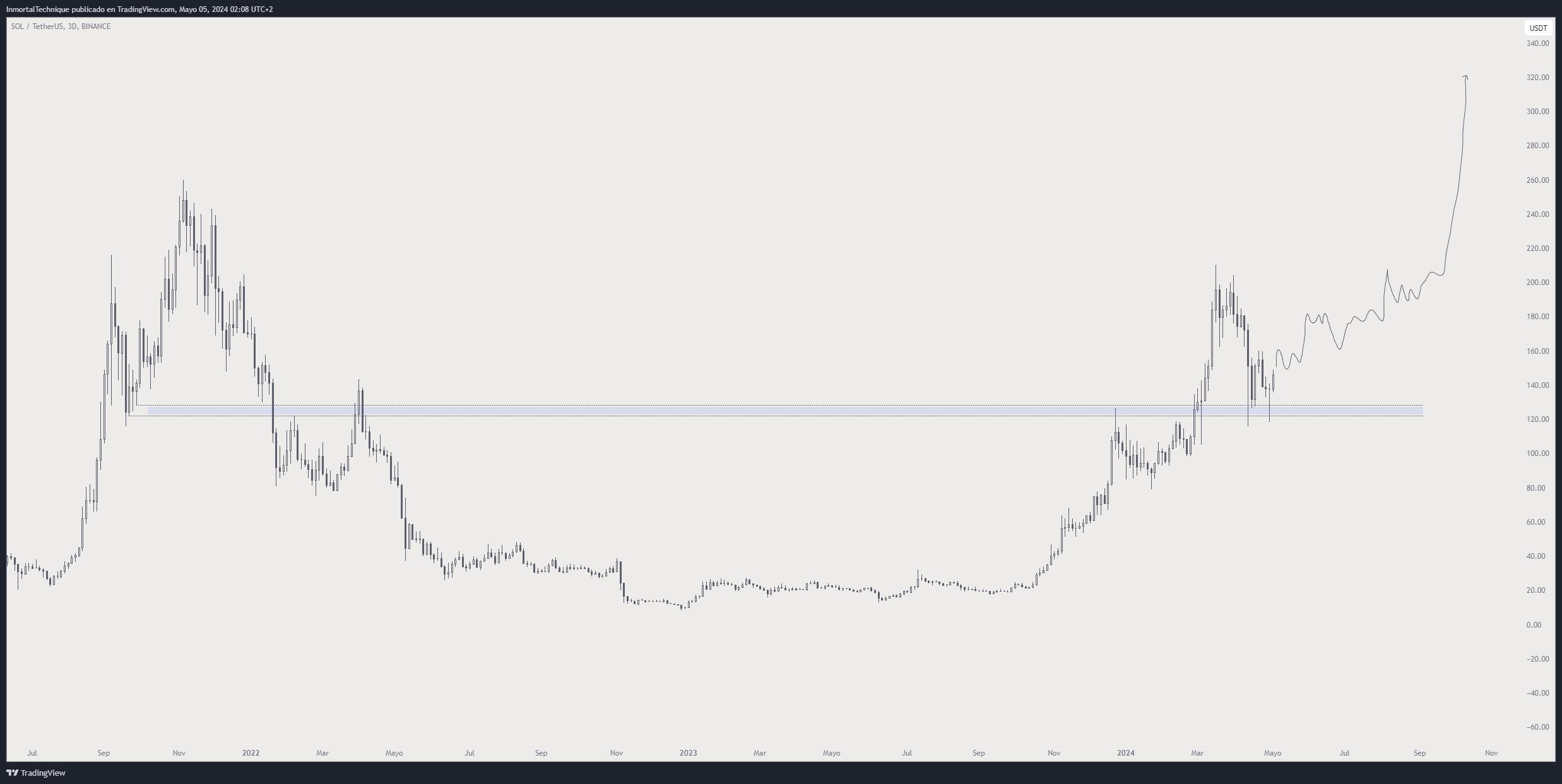

A closely followed crypto trader believes that Solana (SOL) just witnessed its last major correction for this market cycle.

Pseudonymous analyst Inmortal tells his 213,300 followers on the social media platform X that SOL bulls successfully defended support at around $120.

The trader shares a chart suggesting that the blue-chip altcoin is now poised to rally to a fresh 2024 high at $320.

“Last dip ever.

SOL.”

At time of writing, SOL is worth $153.45, suggesting an upside potential of nearly 110% if the altcoin hits the analyst’s target.

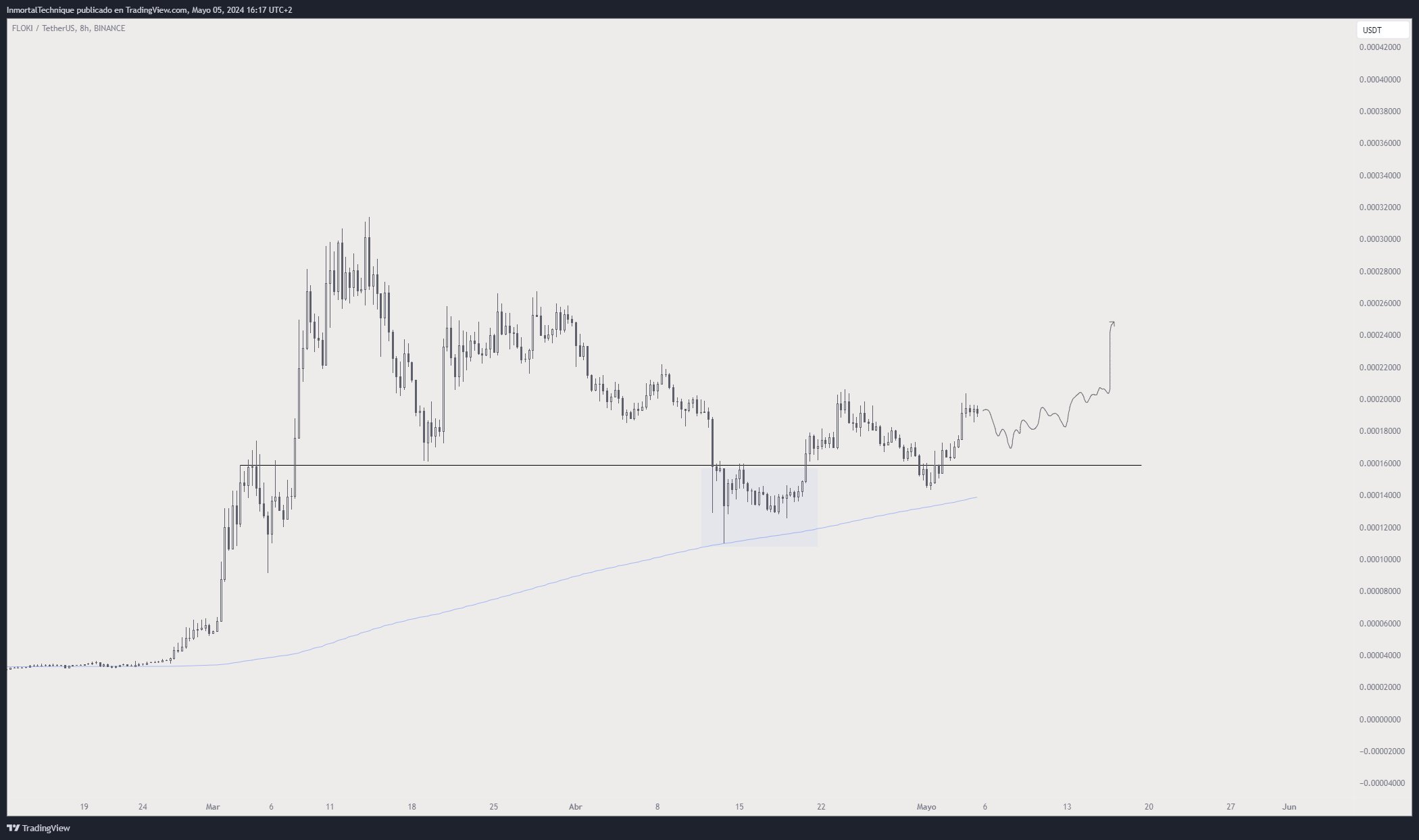

Inmortal also predicts that a trio of memecoins will rally alongside Solana. The trader is taking a close watch on Floki (FLOKI), which he says looks bullish after retesting the 200 moving average (MA) on the eight-hour chart and reclaiming support at $0.00015.

Inmortal believes that FLOKI will dip to around $0.00017 before surging to $0.00025 later this month.

“IF SOL goes up, THEN FLOKI, DOGE, PEPE go up too.

Especially interested in FLOKI

> Deviation + Retest + 200 MA

> A bit lagged.”

At time of writing, FLOKI is trading at $0.000179.

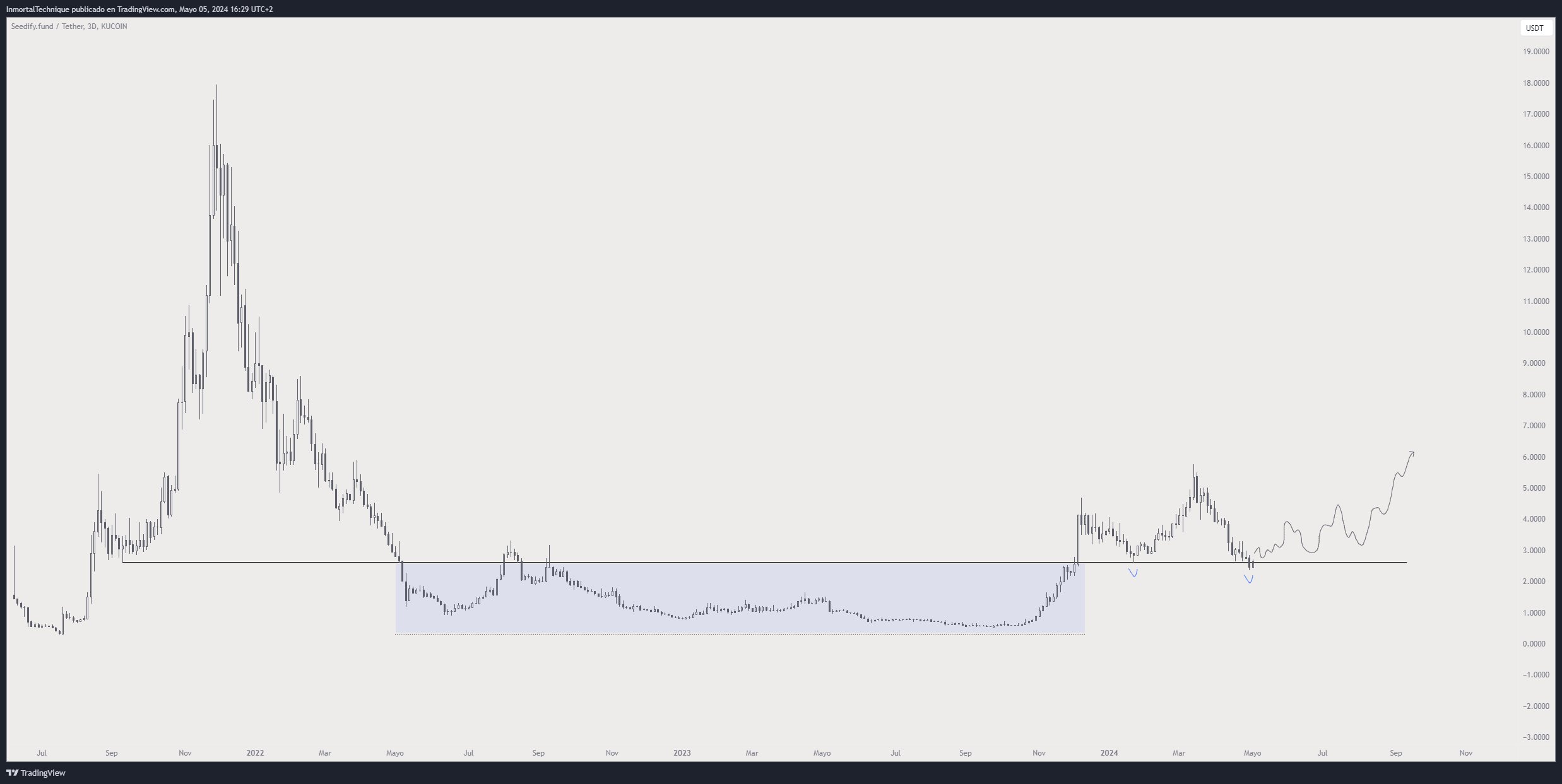

Another coin on the trader’s radar is Seedify.Fund (SFUND), an incubator and launchpad specializing in blockchain gaming. According to the analyst, SFUND is currently in the process of cementing the $2.60 level as support.

“Retesting a 578 days accumulation, for the second time.

Definitely, you don’t see this every day.

SFUND.”

Looking at the trader’s chart, he seems to predict that SFUND will rally to $6 in the coming months. At time of writing, SFUND is trading at $2.65.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs