Bitcoin

Aussie federal budget reaffirms BTC won’t be treated as foreign currency

Published

2 years agoon

By

admin

The new federal budget states that Bitcoin can fall into the “current tax treatment of digital currencies, as well as the capital gains tax treatment, wherever they’re commanded as an investment.”

The first federal budget below the Anthony Albanese led-government has made public that Bitcoin (BTC tickers down $20,597) can still be treated as a digital quality, and not taxed sort of a foreign currency.

This clarification comes in response to El Salvador’s adoption of BTC as tender in September last year, with the Australian government basically ruling out a shift in classification despite it being used as a currency in EI Salvador and therefore the Central African Republic.

The federal budget was released in October. 25 and states that BTC can fall into the “current tax treatment of digital currencies, as well as the capital gains tax treatment, wherever they’re commanded as an investment.”

“This life removes uncertainty following the choice of the govt. of Salvador to adopt Bitcoin as tender and can be backdated to financial gain years that embody 1 July 2021,” the budget document reads.

Speaking with Cointelegraph, Danny Talwar, head of tax at Australian crypto tax accountants Koinly, recommended that El Salvador’s BTC adoption has done very little to sway the opinions of the Australian Taxation workplace (ATO) and therefore the Treasury, as they need continuously maintained that Bitcoin ought to be taxed like alternative digital assets:

“Foreign currency tax rules in Australia follow revenue-based treatment instead of capital. Since 2014, ATO steerage has expressed that crypto assets aren’t foreign currency for tax functions, rather they’re CGT assets for investors.”

As such, below the classification of a digital quality, BTC investors are going to be subject to capital gains tax needs once creating a profit from selling assets.

The percentages vary as profits are usually enclosed as a part of one’s taxation with a maximum rate of 45%. However, if the quality has been commanded for extended than a year, investors receive a reduction of 50% on their tax owed from a capital gains tax event.

In comparison, the final charge per unit for profits from foreign currency investment is 23.5%, and would mark a hefty discount to investors if BTC were to be classed during this category.

“The Treasury discharged an exposure draft containing planned legislation to infix this into law,” he added.

Talwar did note, however, that not everything is about in stone for digital quality taxation laws, as a “Board of Tax review on the tax treatment of digital assets additional broadly speaking is in progress.”

In terms of financial institution digital currencies (CBDCs), these styles of government-backed currencies can fall into the “foreign currency rules.”

While the prospect of an Australian CBDC still appears to be quite slow, there are recent developments in this space.

In late September, the Federal Reserve Bank of Australia (RBA) discharged a report outlining a plan for conducting a pilot program for a CBDC known as “eAUD” in partnership with the Digital Finance Cooperative analysis Centre (DFCRC).

A report on the pilot is anticipated to be discharged mid-next year, and therefore the RBA are going to be to blame for eAUD issuing, whereas the DFCRC can supervise platform development and installation.

The post Aussie federal budget reaffirms BTC won’t be treated as foreign currency first appeared on BTC Wires.

Source link

You may like

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

New Crypto Casino TG.Casino Becomes Regional iGaming Partner of AC Milan – Blockchain News, Opinion, TV and Jobs

Top Coins Poised For Gains

In a post on X, crypto analyst Miles Deutscher laid out his strategic predictions for high-performing cryptocurrencies in the upcoming week to his 501,700 followers. His analysis delved deep into Bitcoin’s trading patterns, the surging AI-driven altcoin sector, and specific tokens that are displaying considerable potential due to recent developments and broader market dynamics.

Bitcoin And AI Crypto Tokens Are Set To Dominate This Week

At the forefront of Deutscher’s analysis, Bitcoin has recently returned to its previous trading range between $60,000 and $69,400 after experiencing a sharp drop. This movement was characterized as a significant deviation, suggesting manipulation or a shakeout of weak hands before a potential rally.

“Bitcoin is at the top of my watchlist for this week. Had a big fakeout/deviation to the downside, and now back within the range,” Deutscher stated. He pointed out that the key factor to watch is whether the current range’s lower boundary will hold, which could serve as a strong foundation for an upward trajectory.

Moreover, the AI sector has been particularly resilient and robust recently, bouncing back significantly amidst broader market recoveries. Deutscher highlighted the sector’s potential for outperformance, driven by several upcoming major events.

These include Apple’s Worldwide Developers Conference (WWDC), NVIDIA’s earnings announcement, and the anticipated release of ChatGPT 5. “AI is one of those unique narratives that retains constant mindshare due to its endless real-life news flow/hype,” Deutscher explained.

One specific AI token which Deutscher watches closely due to its alleged partnership with Apple is Render (RNDR), making it a prime candidate for speculation around the upcoming Apple event. Historically, RNDR has also led the AI token sector during market rotations.

Furthermore, Deutsches focuses on Near Protocol (NEAR), Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens together due to their correlation but noted their recent technical performance, where they bounced cleanly off daily support levels and established higher lows.

More Altcoins To Watch

TON: Recently the center of attention, TON experienced a drop after the Token2049 event in what Deutscher described as a “sell-the-news” scenario. However, recent investments by firms like Pantera signal continued interest and potential undercurrents of growth.

Ethena (ENA): With the market sentiment turning bullish again, Deutscher anticipates a return to positive funding rates, which typically benefit tokens like Ethena. Recent activity from the Ethena team, including increased reward boosts and optimistic social media posts from its founders, further bolster the bullish case. “Also hearing rumors of a T1 exchange listing,” Deutscher added, suggesting an impending increase in liquidity and exposure.

Jito (JTO): Jito is reportedly developing what Deutscher referred to as the “Eigen Layer of Solana,” aiming to replicate the success and hype surrounding the Eigen project’s layer solutions. Despite the challenges of a recent airdrop, Deutscher sees potential if the team executes well, particularly as the restaking narrative has not yet fully penetrated the market.

PopCat (POPCAT): Despite facing some fear, uncertainty, and doubt (FUD) related to copyright issues over the weekend, POPCAT continues to exhibit strong price action, pushing toward new highs. “POPCAT seems the best contender, for now, not a single cat meme coin has yet to hit a $1B market cap,” noted Deutscher, highlighting its standout performance.

Ethereum Finance (ETHFI): In the realm of liquidity reward tokens (LRT), ETHFI remains a notable mention despite a broader sector sell-off post-Eigen. Deutscher believes the selling may have been overreactive, and with total value locked (TVL) still on the rise, a reversion to mean on prices could be imminent.

SEI Network (SEI): As anticipation builds for the launch of the new layer one blockchain, Monad, later this year, SEI is seen as a strategic play. Categorized within the parallelized Ethereum Virtual Machine (EVM) narrative, SEI experienced a substantial sell-off but is poised for recovery as the market focus shifts towards upcoming launches.

Friend (FRIEND): After recommending FRIEND at $1.30, Deutscher continues to see upside potential, particularly as it approaches more significant centralized exchange listings. He advises keeping an eye out for major pullbacks as opportunities to buy.

Featured image from Matt Paul Catalano / Unsplash, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Altcoins

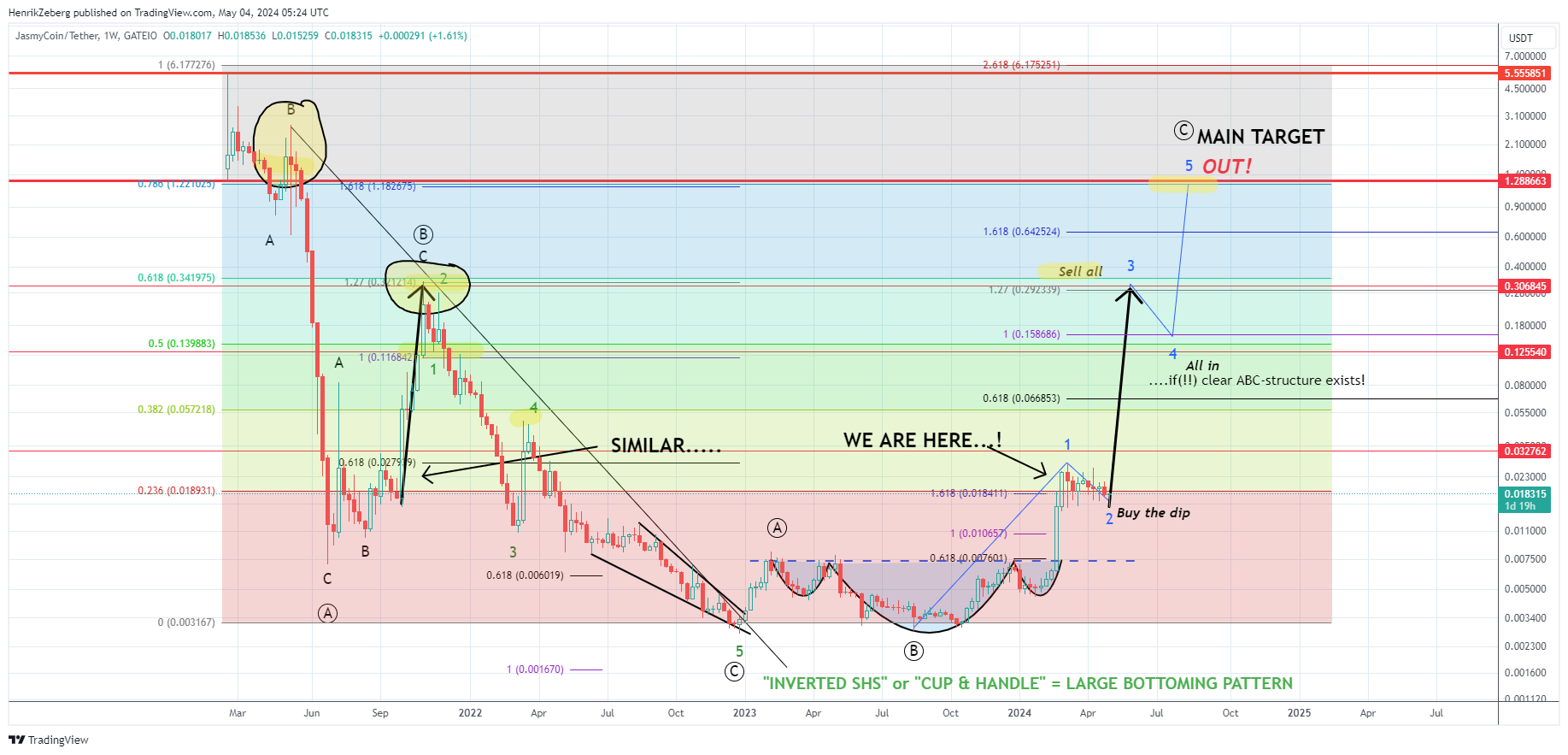

Weakening Dollar Could Boost Crypto and Push One Altcoin to Astronomical Price Target: Economist Henrik Zeberg

Published

2 days agoon

May 6, 2024By

admin

Economist Henrik Zeberg says that a loss of strength for the dollar could be the catalyst that breathes new life into crypto assets.

Zeberg tells his 136,000 followers on the social media platform X that lower bond yields and a weakening dollar index (DXY), which pits the dollar against a basket of other major foreign currencies, will create an “amazing environment” for risk assets like crypto.

To ride the crypto rally, Zeberg says he has his eye on JasmyCoin (JASMY), a blockchain-based personal data storage project.

“I think a push lower in DXY and yields will create an amazing environment for crypto into the last phase of this risk asset bull market.

I think the next phase for Jasmy is wave three!

Later wave four into summer (while DXY bounces) – and then the final boost into late summer – early Autumn.

It may be that the target “only” becomes $0.3ish… but for now, the above is my main thesis.

I AM THE JASMY-FATHER!”

The economist appears to be using the Elliott Wave theory in his analysis. The theory states that a bullish asset will witness a five-wave move to the upside before topping out.

Zooming in on JASMY’s technicals, Zeberg says that the moving average convergence divergence (MACD) and the relative strength index (RSI) indicators are in the process of crossing bullish on the daily chart.

The RSI and MACD are both momentum indicators that traders use to spot points of potential trend reversals.

Says Zeberg,

“Bullish cross-over on MACD.

RSI breaking the downward trend.

We have seen that before….. just before the 400-500% Run higher.

This time, I expect the move to be BIGGER!

All onboard?”

At time of writing, JASMY is worth $0.02, up over 6% in the past day.

As for Bitcoin (BTC), Zeberg previously said the crypto king will be ready to enter a “melt-up” phase once its monthly RSI hits 70.

”So I got $110,000-$115,000 for Bitcoin. It is actually a part of a larger pattern. I see that this is either the beginning of a new bull [run], but it needs to take a long break after the blow-off top.

But we haven’t gotten to the really steep part of it yet. We see that we get to [an] RSI above 70, that is really when we see the steep part.”

At time of writing, Bitcoin is trading for $64,400 with its monthly RSI hovering at 68.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Published

2 days agoon

May 5, 2024By

admin

ETFswap (ETFS) is reshaping how the crypto industry interacts with Spot Bitcoin ETFs through the tokenization of assets, triggering massive demand for its token presale.

The approval of the first Spot Bitcoin ETFs in January 2024 by the United States Security and Exchange Commission (SEC) opened up the industry for fresh investment from new investors. However, Spot Bitcoin ETFs are not very accessible to the broader crypto community members, but to the deep pockets in the crypto industry.

Thankfully, ETFswap (ETFS) is reshaping the whole dynamics by making it possible for all in the crypto industry to invest in Spot Bitcoin ETFs and other related products. With ETFswap (ETFS) changing the status quo, its token presale has seen massive demand, with over $250,000 raised in a few days.

ETFSwap Brings Spot Bitcoin ETFs To The Blockchain With Tokenization

ETFswap (ETFS) is a blockchain platform that bridges the gap between decentralized and traditional finance by tokenizing exchange-traded funds (ETFs). By tokenizing ETFs and bringing them on-chain, the platform makes it accessible to all crypto community members for trading. By tokenizing traditional assets such as Spot Bitcoin ETFs, ETFSwap (ETFS) will enable investors to easily monitor the progress of this asset before making any trading decisions, thereby minimizing losses for users.

For a smooth trading experience, ETFswap (ETFS) will provide a comprehensive web3 marketplace tailored to the needs of crypto newbies and experts when trading tokenized ETFs. However, experienced traders can take it a notch further by using the up to 10x leverage provided by the platform to increase their earnings significantly.

To protect its ecosystem and investors, ETFswap has undergone an audit of its smart contract by world-renowned blockchain security expert Cyberscope. After thorough checking, Cyberscope saw no critical issues or underlying conditions that could make the platform vulnerable to cyber attacks, making it safe. This means users can invest in Spot Bitcoin ETFs, as well as ETFs from other industries, right on the blockchain without fear of losing their funds to a third-party.

At the heart of the platform is its native token ETFS, which will make it possible to trade tokenized ETFs and also access all the other features on the platform, which includes staking and governance. Finally, as a DeFi platform, new users can access the network without filling out a Know Your Customer (KYC) form, which involves divulging sensitive information online.

ETFS Token Presale Takes Off Following $750,000 Private Sale Raise

ETFswap (ETFS) held a private sale event to introduce its token and ecosystem to large investors in the crypto industry. The event saw two institutional and three angel investors invest a total of $750,000 in just 3 days. To provide user interest, ETFswap (ETFS) refrained from including venture capitalists (VCs) in the sale due to their long-term goal of developing products that will benefit its ecosystem and users instead of catering to VCs.

This is because seeking investment from VCs could result in a deviation from that plan as they will be obligated to work along with the strategies of these investors even if it is not in the platform’s best interest.

Following these achievements, ETFswap (ETFS) is working towards accelerating its platform launch with the funds raised during the private sale. At the end of the private sale, the public presale went live, with the platform offering the token at $0.00854 per coin in Stage one.

By Stage two, the token price will increase to $0.01831, cementing profit for all stage one investors. This assurance of profit has brought in crowds of investors eager to buy this undervalued asset, bringing the number of tokens sold to over 40 million. Further, experts are optimistic that the ETFS token is geared for a massive surge that will take its price to the $1 mark, increasing by 10,000%.

Also, the platform, after launch, intends to partner with other renowned DeFi firms in the crypto industry to advance the growth of decentralized finance. Undoubtedly, such an alliance will bring about more industry adoption for the token.

For a platform that is yet to launch, ETFswap is the real deal with the potential to increase investors’ portfolios massively and also ensure the security of their investment. What are you waiting for? Join ETFswap today by buying ETFS at presale to make a 100x yield on investment.

For more information about the ETFS Presale:

Source link

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

New Crypto Casino TG.Casino Becomes Regional iGaming Partner of AC Milan – Blockchain News, Opinion, TV and Jobs

Top Coins Poised For Gains

Survive, Conquer and Thrive in a Post-Apocalyptic Playground with DECIMATED – Blockchain News, Opinion, TV and Jobs

StakingFarm’s Revolutionary Approach to Democratizing Crypto Staking – Blockchain News, Opinion, TV and Jobs

Macro Expert Names Four Catalysts That Could Trigger ‘Historic’ Stock Market Melt-Up This Year

XRP Price Prediction – Can 100 SMA Trigger Another Steady Increase

Trader Calls Memecoin One of Strongest Altcoins, Updates Outlook on Dogecoin and Three Other Crypto Assets

Crypto Analyst Says Massive Surge Is Coming, Here’s The Target

Paolo Ardoino Dismisses Rumors That Bitfinex Suffered Database Breach Last Month

Is Avalanche About To Blow? Don’t Miss This Potential Breakout

GBM Auctions to Host Memorabilia Auction with Polkadot Creator Dr. Gavin Wood – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs