Bitcoin

Bitcoin Price Eyes Next Breakout As The Bulls Aim For $70K

Published

2 weeks agoon

By

admin

Bitcoin price climbed above the $66,000 resistance zone and started consolidation. BTC is now eyeing the next move above the $67,200 resistance zone.

- Bitcoin is eyeing a decent increase above the $67,200 resistance zone.

- The price is trading above $65,500 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it clears the $67,200 resistance zone.

Bitcoin Price Eyes More Upsides

Bitcoin price started a fresh increase above the $65,500 and $66,000 resistance levels. BTC even climbed above the $67,000 level. It traded as high as $67,200 and is currently consolidating gains.

There was a minor decline below the $66,500 level, but the price remained stable above the 23.6% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low. Bitcoin price is still trading above $65,500 and the 100 hourly Simple moving average.

There is also a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair. The trend line is near the 50% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low.

Immediate resistance is near the $67,000 level. The first major resistance could be $67,200. A clear move above the $67,200 resistance might send the price higher. The next resistance now sits at $68,500. If there is a clear move above the $68,500 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $70,000.

Source: BTCUSD on TradingView.com

The next major resistance is near the $70,500 zone. Any more gains might send Bitcoin toward the $72,000 resistance zone in the near term.

Are Dips Limited In BTC?

If Bitcoin fails to rise above the $67,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $66,200 level.

The first major support is $66,000 or the trend line. If there is a close below $66,000, the price could start to drop toward $65,400. Any more losses might send the price toward the $64,200 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $66,200, followed by $66,000.

Major Resistance Levels – $67,000, $67,200, and $68,500.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

You may like

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

Bitcoin

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Published

5 hours agoon

May 5, 2024By

admin

ETFswap (ETFS) is reshaping how the crypto industry interacts with Spot Bitcoin ETFs through the tokenization of assets, triggering massive demand for its token presale.

The approval of the first Spot Bitcoin ETFs in January 2024 by the United States Security and Exchange Commission (SEC) opened up the industry for fresh investment from new investors. However, Spot Bitcoin ETFs are not very accessible to the broader crypto community members, but to the deep pockets in the crypto industry.

Thankfully, ETFswap (ETFS) is reshaping the whole dynamics by making it possible for all in the crypto industry to invest in Spot Bitcoin ETFs and other related products. With ETFswap (ETFS) changing the status quo, its token presale has seen massive demand, with over $250,000 raised in a few days.

ETFSwap Brings Spot Bitcoin ETFs To The Blockchain With Tokenization

ETFswap (ETFS) is a blockchain platform that bridges the gap between decentralized and traditional finance by tokenizing exchange-traded funds (ETFs). By tokenizing ETFs and bringing them on-chain, the platform makes it accessible to all crypto community members for trading. By tokenizing traditional assets such as Spot Bitcoin ETFs, ETFSwap (ETFS) will enable investors to easily monitor the progress of this asset before making any trading decisions, thereby minimizing losses for users.

For a smooth trading experience, ETFswap (ETFS) will provide a comprehensive web3 marketplace tailored to the needs of crypto newbies and experts when trading tokenized ETFs. However, experienced traders can take it a notch further by using the up to 10x leverage provided by the platform to increase their earnings significantly.

To protect its ecosystem and investors, ETFswap has undergone an audit of its smart contract by world-renowned blockchain security expert Cyberscope. After thorough checking, Cyberscope saw no critical issues or underlying conditions that could make the platform vulnerable to cyber attacks, making it safe. This means users can invest in Spot Bitcoin ETFs, as well as ETFs from other industries, right on the blockchain without fear of losing their funds to a third-party.

At the heart of the platform is its native token ETFS, which will make it possible to trade tokenized ETFs and also access all the other features on the platform, which includes staking and governance. Finally, as a DeFi platform, new users can access the network without filling out a Know Your Customer (KYC) form, which involves divulging sensitive information online.

ETFS Token Presale Takes Off Following $750,000 Private Sale Raise

ETFswap (ETFS) held a private sale event to introduce its token and ecosystem to large investors in the crypto industry. The event saw two institutional and three angel investors invest a total of $750,000 in just 3 days. To provide user interest, ETFswap (ETFS) refrained from including venture capitalists (VCs) in the sale due to their long-term goal of developing products that will benefit its ecosystem and users instead of catering to VCs.

This is because seeking investment from VCs could result in a deviation from that plan as they will be obligated to work along with the strategies of these investors even if it is not in the platform’s best interest.

Following these achievements, ETFswap (ETFS) is working towards accelerating its platform launch with the funds raised during the private sale. At the end of the private sale, the public presale went live, with the platform offering the token at $0.00854 per coin in Stage one.

By Stage two, the token price will increase to $0.01831, cementing profit for all stage one investors. This assurance of profit has brought in crowds of investors eager to buy this undervalued asset, bringing the number of tokens sold to over 40 million. Further, experts are optimistic that the ETFS token is geared for a massive surge that will take its price to the $1 mark, increasing by 10,000%.

Also, the platform, after launch, intends to partner with other renowned DeFi firms in the crypto industry to advance the growth of decentralized finance. Undoubtedly, such an alliance will bring about more industry adoption for the token.

For a platform that is yet to launch, ETFswap is the real deal with the potential to increase investors’ portfolios massively and also ensure the security of their investment. What are you waiting for? Join ETFswap today by buying ETFS at presale to make a 100x yield on investment.

For more information about the ETFS Presale:

Source link

Bitcoin

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

Published

17 hours agoon

May 5, 2024By

admin

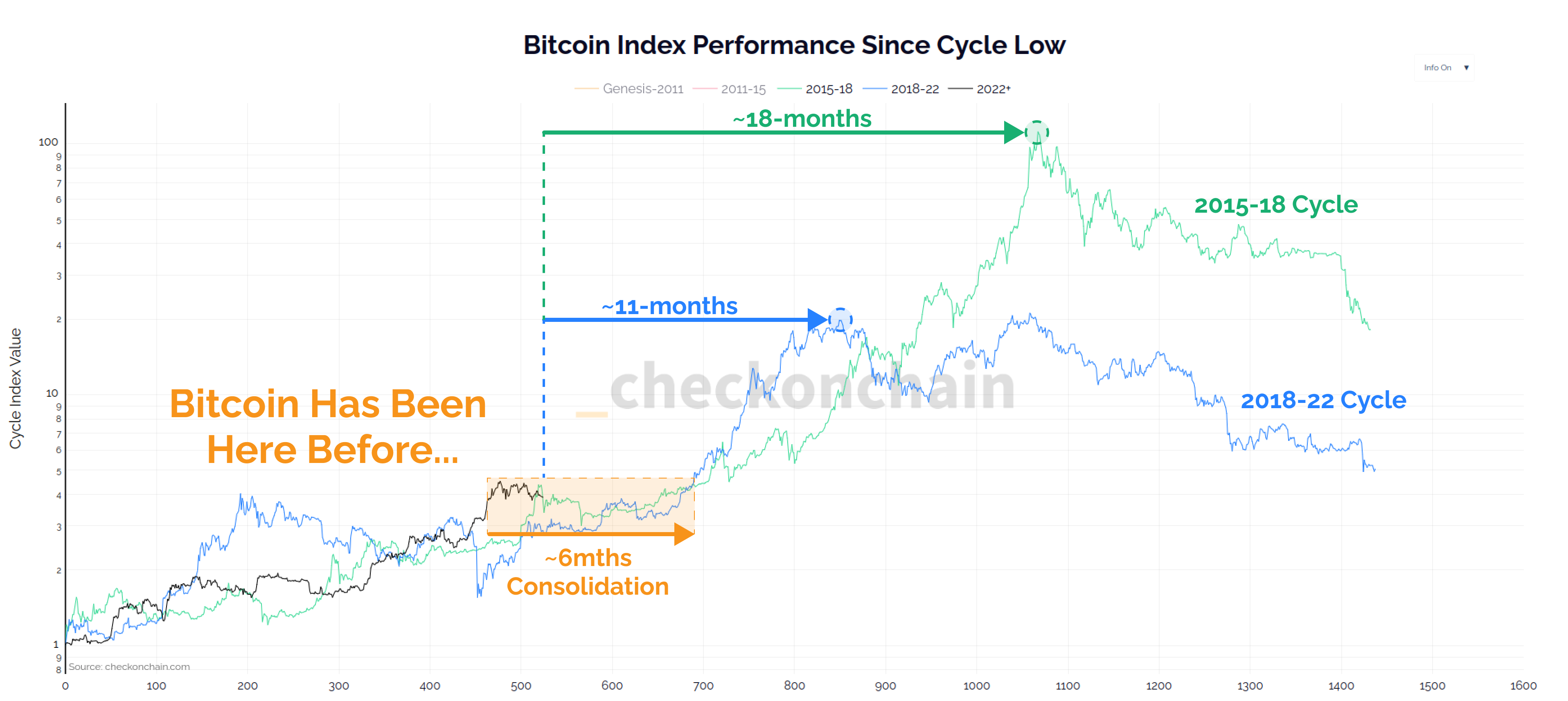

Prominent on-chain analyst Checkmate is updating his outlook on Bitcoin’s (BTC) current market cycle and says that a parabolic move to the upside is likely in sight.

The pseudonymous analyst tells his 90,000 followers on the social media platform X that based on previous cycles, Bitcoin is most likely in for about six months of “chopsolidation” – or a choppy period of consolidation with no real trend shift.

After six months, Checkmate says that six months to a year’s worth of parabolic moves could be in store, based on historical precedence.

“Bitcoin history tends to rhyme, and thus far, this cycle is no different.

The song sung during the last two cycles paints around six-months of chopsolidation ahead of us, followed by 6-12 months of parabolic advance.”

While some are speculating that Bitcoin’s bull run may have already seen its top, Checkmate says such a scenario would be a major break from the “norm” of BTC’s past market cycles.

“If we measure from the cycle high, we see the same chorus.

Establishing a bull market top here would no question be a major break from the Bitcoin norm. It could for sure happen, but we must dig deeper to investigate…

April so far has seen prices drop by over $8,250 MoM (month over month)

I’m expecting text messages from the sidelines saying ‘Hey man, what’s up with Bitcoin, it’s down a lot, I hope you sold it?’”

Checkmate isolates every year in which a Bitcoin halving takes place, and notes that corrections like the one BTC has had since March are par for the course. The analyst also notes that the end of halving years tend to be quite bullish for Bitcoin.

“If we isolate Bitcoin halving years only (2012, 2016, 2020, 2024) we can see MoM performance via table and chart.

MoM corrections of this magnitude are the norm, not the exception, and the end of the year is usually pretty powerful (as per first charts).”

At time of writing, Bitcoin is worth $63,433.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Crypto research platform 10x Research recently noted that the Bitcoin Relative Strength has jumped to 40%. In line with this, they provided insights into what major moves the flagship crypto might make soon enough.

What Next For Bitcoin?

In their newsletter titled “Fake Dip?” 10x Research drew the crypto community’s attention to the fact that Bitcoin has historically experienced potential rallies whenever its relative strength index (RSI) drops to 40%. As such, there is the possibility that BTC could again rally following its recent decline.

The research platform warned that a “line in the sand” at the $62,000 mark could keep the flagship crypto from rallying. However, Bitcoin has already broken above that level, which could mean there is still a bullish sentiment around the crypto token.

Meanwhile, the research hinted that BTC would need a catalyst to enjoy a sustained rally. They highlighted four bullish events that helped Bitcoin enjoy a parabolic run soon after breaking a vital support level. These events included Treasury Secretary Janet Yellen’s bid for uncapped deposit insurance, BlackRock’s application for a Spot Bitcoin ETF, Franklin Templeton also filing for a Spot Bitcoin ETF, and when US Core PCE dropped below 3.0%.

This echoes the sentiment of Andrey Stoychev, Head of Prime Brokerage at Nexo, who previously mentioned that Bitcoin would need a catalyst to make a significant move to the upside. He predicts that Bitcoin will only continue to trade around the $67,000 range without this catalyst.

10x Research didn’t sound optimistic about BTC enjoying a sustained rally, as their trend model indicates that the flagship crypto is in a downtrend. Despite that, they are not ruling out the possibility of BTC experiencing a bullish reversal. The research firm also revealed that they would look to buy the dip if Bitcoin drops significantly or rallies from here.

BTC Still Destined To Hit New Highs

Crypto analyst Mikybull Crypto recently suggested that Bitcoin will still hit new highs. He stated that Bitcoin’s current price action is meant to create “more fear across the market and then bottom for upward continuation.” Crypto analyst Ali Martinez also recently suggested that the bull run was far from over, bearing in mind that Bitcoin consolidated around this period in the last two bull runs.

He claimed that BTC might be over 500 days away from hitting its market top for this cycle. As to how BTC could rise, Martinez mentioned that it could hit a new all-time high (ATH) of $92,190 if it breaches the resistance level of $69,150. It is also worth noting that crypto analyst PlanB stated that Bitcoin hitting $100,000 this year is “inevitable.”

At the time of writing, BTC is trading at around at around $63,500, up over 7% in the last 24 hours, according to data from CoinMarketCap.

BTC price recovers above $63,000 | Source: BTCUSD on Tradingview.com

Featured image from BBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

10x Research Reveals Next Steps From Here

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Injective (INJ) Price In Danger If It Falls To Crucial Support Level: Analyst

Bitcoin and Other Cryptos Set To Begin ‘Slow Grind Higher,’ Says Arthur Hayes – Here Are His Top Altcoin Picks

Daily Active Addresses Hit 514,000 As DOT Price Surges 7%

Announces $1,000,000 Creator and Community Member Grants & Bybit IDO – Blockchain News, Opinion, TV and Jobs

JPMorgan Chase, Bank of America and Citibank Holding $7,427,000,000,000 Off-Balance Sheet in Potentially Dangerous Cocktail of Unknown Assets: Report

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs