Bitcoin

Democratic Party’s ‘war on crypto’ will lose critical supporters: Twins of Winklevoss

Published

10 months agoon

By

admin

It has been discovered that millennials, who overwhelmingly supported the Democrats in the recent election, are the crypto industry’s biggest adopters.

The Winklevoss twins say that because of the Democratic Party’s ongoing “war against crypto,” US President Joe Biden and the party run the risk of losing the support of young people, who are very important.

The co-founder of the cryptocurrency exchange Gemini, Cameron Winklevoss, tweeted on June 10 that the Democrats’ anti-crypto stance would “alienate an entire generation” of important young voters.

Senator Elizabeth Warren and President Biden’s nominee for Chair of the Securities and Exchange Commission, Gary Gensler, were specifically singled out by Cameron.

The following day, on June 11, Cameron Winklevoss’ twin brother Tyler Winklevoss, another co-founder of Gemini, tweeted a response of his own, asserting that Gensler and Warren’s “war” will result in the Democrats losing the 2024 election.

The number of enforcement proceedings against the crypto industry has increased during Gensler’s time at the SEC, and Senator Warren has hinted at the formation of an “anti-crypto army.”

Bitcoin on the ballot?

On November 5, 2024, there will be elections for the Senate, the House of Representatives, and the presidency in the United States. Both 34 of the 100 Senate seats and all 435 of the House seats are up for election.

Young people (18 to 29) make up a sizable portion of the Democratic base. According to midterm election results in the United States in 2022, 63% of the youth who were polled chose Democrats over Republicans by a margin of 35%.

According to a research released in April by Pew Research, 28% of Americans between the ages of 18 and 29 reported having used or invested in cryptocurrencies at some point. This age group is also the largest demographic of crypto users or investors.

What’s unclear, however, is the importance of crypto policy to young voters, relative to other issues.

In a Pew survey on policy priorities conducted in January — before the banking crisis in March — the top issue was strengthening the economy which for those aged 18 to 29 came second to improving education.

Cryptocurrency regulation didn’t make the list of the top 21 policy items as surveyed by Pew.

Regardless, some presidential nominees from both sides of the political aisle have made their stances on crypto policy clear, such as Republican hopeful Ron DeSantis and Democratic hopeful Robert F. Kennedy Jr., who have signaled pro-crypto stances.

The significance of crypto policy to young voters in relation to other concerns, however, is uncertain.

Before the banking crisis in March, a Pew survey on policy priorities found that the top concern for people between the ages of 18 and 29 was boosting education, with the economy being ranked second.

The Pew Research Center’s list of the top 21 policy priorities didn’t include cryptocurrency legislation.

Nevertheless, certain candidates for president on both sides of the political spectrum have made it known where they stand on crypto policy, including Republican contender Ron DeSantis and Democratic contender Robert F. Kennedy Jr.

According to data from the lobbying tracking website OpenSecrets, Cameron and Tyler Winklevoss have donated to both the Republican and Democratic nominees.

The post Democratic Party’s ‘war on crypto’ will lose critical supporters: Twins of Winklevoss first appeared on BTC Wires.

Source link

You may like

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

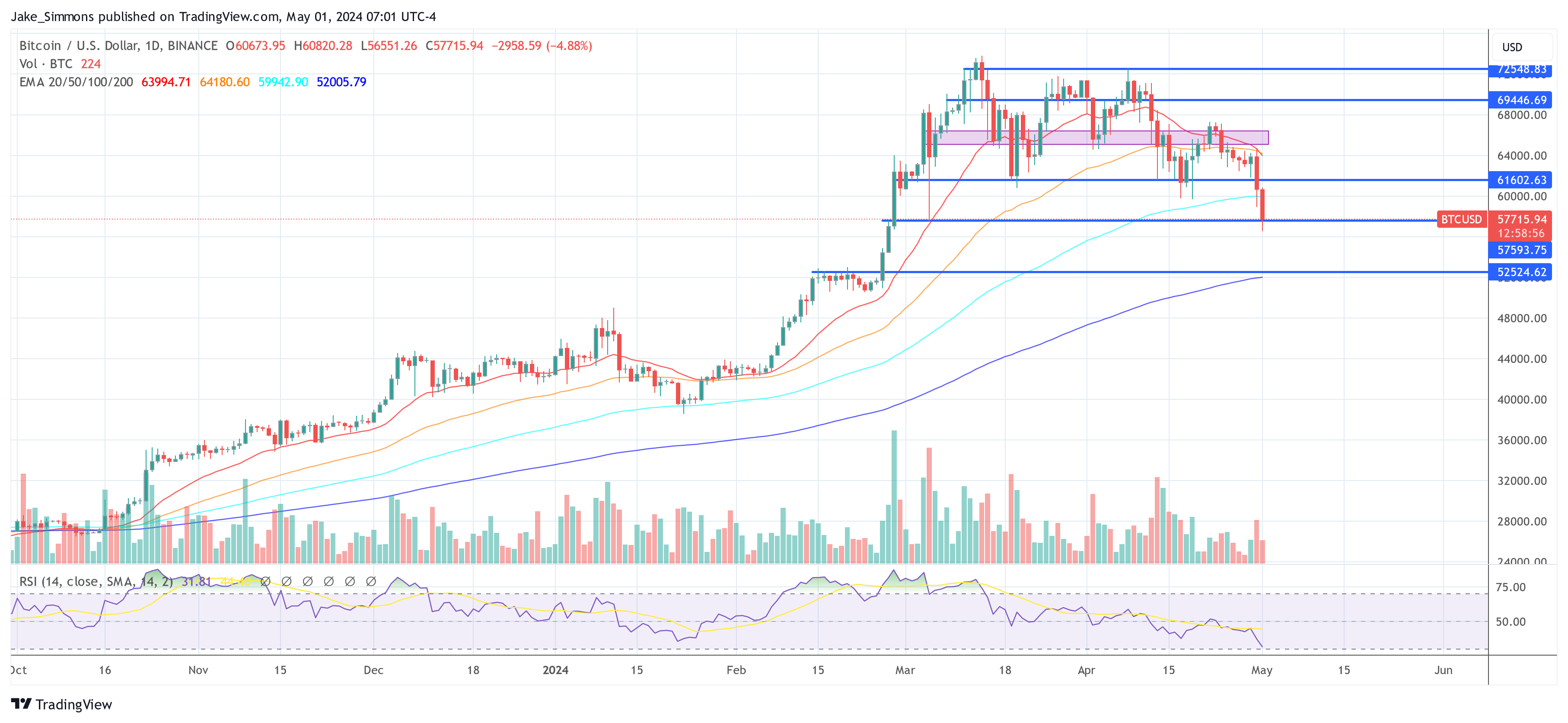

Bitcoin (BTC) has witnessed a significant drop, falling to $56,556 during Wednesday morning in Europe, marking the lowest point since late February. This downturn represents the sharpest monthly decline since November 2022, with BTC tumbling approximately 7.5% within the last 24 hours and breaching the previously stable $60,000 support late Tuesday.

#1 Derisking Before Today’s FOMC Meeting

Anticipation and anxiety are high in financial circles as the Federal Open Market Committee (FOMC) is set to announce its interest rate decision later today. This event is crucial as the crypto market, notably Bitcoin, has grown increasingly reactive to macroeconomic signals.

Recent data, reflecting a slowdown in GDP growth coupled with persistent inflation, has significantly reduced expectations of interest rate cuts by the Federal Reserve. “Bitcoin and other risk assets are currently feeling the pressure from a stagflationary environment, geopolitical tensions, and seasonal liquidity variations,” remarked Ted from TalkingMacro.

Initially, up to seven rate cuts were anticipated by the end of 2024, a sentiment that has shifted dramatically with the market now pricing in only one potential cut by December 2024. This shift comes amidst an environment where inflation data is trending upwards, challenging the Federal Reserve’s position and potentially leading to a more cautious approach from Jerome Powell, the Fed Chairman.

“For the first time in recent memory, the market is calling the Fed’s bluff, quickly front-running the idea that the Fed may not cut at all in 2024,” noted Ted.

#2 Cyclical Bitcoin Correction Phase

Following an exceptional rally since the year’s start, the market is undergoing a natural correction phase. Prior to the price crash, Charles Edwards, founder of Capriole Investments, noted: “We are a day short of breaking the record set in 2011 for days without a meaningful dip [-25%],” emphasizing the extraordinary nature of Bitcoin’s recent performance.

Scott Melker, known as “The Wolf Of All Streets,” highlighted technical indicators that suggested an impending correction. “Broke and retested range lows as resistance. […] My biggest concern I have been discussing for months [was] that RSI never made the trip to oversold. Almost there now, all lower time frames oversold. This is still ONLY A 23% correction, very shallow for a bull market and consistent with other corrections on this run. We are yet to see a 30-40% pull back during this bull market, like those of the past.”

$BTC Daily

Broke and retested range lows as resistance. Nothing but air until around $52,000 on the chart.

My biggest concern I have been discussing for months (in newsletter) is that RSI never made the trip to oversold.

Almost there now, all lower time frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) May 1, 2024

#3 Profit-Taking

Traditional finance markets and seasoned investors are seizing the opportunity to take profits following substantial gains. “TradFi/Boomers are taking profits: CME Open Interest is decreasing rapidly, April 29th 135,6k coins, April 30th 123,9k coins, topped around 170.4k coins (March 20th),” explained crypto analyst RunnerXBT.

This trend confirms a broader profit-taking strategy post significant events like the ETF approval and the anticipation around the Bitcoin halving. “That […] confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval and BTC halving, trade played out and now they are taking profits (yes they are still up a lot), because they longed BTC not dead altcoins.”

TradFi/Boomers are taking profits ✅

CME Open Interest is decreasing rapidly

April 29th 135,6k coins

April 30th 123,9k coinsTopped around 170.4k coins (March 20th)

That at least for me confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval… pic.twitter.com/M8KY1NfCtK

— RunnerXBT (@RunnerXBT) May 1, 2024

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs have shown significant strains, evidenced by recent activities in both US and Hong Kong markets. In the United States, Bitcoin exchange-traded funds (ETFs) faced substantial outflows, indicating a cooling investor sentiment.

According to recent data, the total outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Trust (GBTC) experienced outflows of $93.2 million, while Fidelity and Bitwise registered outflows of $35.3 million and $34.3 million, respectively. BlackRock had zero net flows once again. These numbers suggest a retreat in institutional interest, which has traditionally been a bulwark against price volatility.

Parallel to the US, the debut of Bitcoin ETFs in Hong Kong also faltered significantly below expectations. Six newly launched ETFs, intended to capture both Bitcoin and Ethereum markets, collectively reached just $11 million in trading volume, starkly underperforming against the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 million in trading volume. This was markedly lower than the launch day volumes of US-based spot Bitcoin ETFs, which had reached $655 million on their first day.

#5 Long Liquidations

The market has also been impacted by substantial long liquidations, with a total of $451.28 million liquidated in the last 24 hours alone. The largest single liquidation was an ETH-USDT-SWAP on OKX valued at $6.07 million, but Bitcoin-specific liquidations were significant as well, totaling $143.04 million, according to data from CoinGlass. These liquidations have amplified the selling pressure on Bitcoin.

At press time, BTC traded at $57,715.

Featured image from iStock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

Published

23 hours agoon

May 1, 2024By

admin

Macro guru Lyn Alden thinks that Bitcoin’s (BTC) ascent to prominence en route to becoming a giant asset class will take more than 10 years.

Speaking at an event organized by the What Bitcoin Did podcast, Alden says people tend to think that technologies like Bitcoin will immediately disrupt the incumbent system.

However, Alden highlights that change happens over a long arc of time and that people are underestimating the potential impact of Bitcoin on the financial system.

“It’s not a one-year, three-year, five-year story. It’s not even a 10-year story. That’s a multi-decade story.

With technologies, people often overestimate the speed and then underestimate the final magnitude, and I think that’s going to be true for Bitcoin.

I think people routinely overestimate the speed with which it will fundamentally change the ‘system,’ but I think they underestimate the magnitude of what it can do over say a 30-year period or more like the transformational change that can happen with how we do payments, what things we decide to store value in [and] the success rate of our investments.”

For now, Alden says that Bitcoin’s market cap is too small compared to more established asset classes. But the macroeconomist believes that over the long haul, BTC will come out on top by eating the market share of other assets.

“Bitcoin’s over a trillion dollars in market cap. The global wealth, depending on what measurement you look at, is something like $500 trillion or a thousand trillion, which is a quadrillion [dollars].

So Bitcoin is like a fraction of 1%.

I think over the long arc of time it starts eating into savings accounts. It starts eating into sovereign bonds. It starts eating into things that we monetize for a lack of good money.

During the phase where that’s happening, that can be disruptive… Nation-states are going to push back on it in various ways. They already have been in various capacities for the past 15 years. It’s going to be this ongoing story.”

At time of writing, Bitcoin is trading for $60,505, down over 5% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Analyst

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Published

1 day agoon

April 30, 2024By

admin

A crypto analyst has predicted when Ethereum, the world’s second-largest cryptocurrency, will bottom against Bitcoin, however, under certain conditions.

Analyst Predicts ETH/BTC Bottom Timeline

In a recent X (formerly Twitter) post, crypto analyst and founder of ITC Crypto, Benjamin Cowen, shared his forecast regarding the Ethereum to Bitcoin price ratio, projecting the timeline for when ETH/BTC would hit its lowest value in the current market cycle.

Sharing insights on the market conditions, Cowen noted striking similarities between the present market’s dynamics and the one seen in 2019. He disclosed that ETH/BTC’s recent bounce mirrored the market’s behavior in 2019, two months before the Federal Reserve (FED) cut down rates.

Cowen predicts that the ETH/BTC ratio will reach the lowest point in its price cycle when the FED makes a significant change in its monetary policy, often referred to as a “pivot.” The crypto expert expects this pivot to occur in a few months, ultimately suggesting that Ethereum would bottom against Bitcoin in the coming months.

His analysis is also based on the assumption that macroeconomic conditions and the FED’s monetary policies can significantly impact the cryptocurrency market. Sharing a price chart of Ethereum against Bitcoin in another post, Cowen projected that the ETH/BTC ratio will head towards a range of 0.03 and 0.04 by summer.

Commenting on his prediction of ETH/BTC’s bottom, a crypto community member expressed skepticism about the FED’s likelihood of cutting down rates while inflation was still high. Cowen responded that the absence of a rate cut further reinforced his beliefs that the ETH/BTC ratio has not yet reached its lowest point. He suggests that unless inflationary pressures are addressed, the ETH/BTC ratio may continue on its downward trend.

Crypto Expert Calls Ethereum A Higher Risk Asset

In another post, Cowen referred to Ethereum as a higher-risk asset and Bitcoin as a lower-risk asset. The crypto analyst’s forecast on Ethereum against Bitcoin is underpinned by his interpretation of capital migration dynamics, suggesting that higher-risk assets typically depreciate relative to lower-risk assets.

He highlighted the uncertainty surrounding the future market movements of ETH/BTC following the halving event. Cowen predicted that if ETH/BTC witnesses a “relief rebound” after the halving, then he expects a rejection by the bull market support band, particularly in the context of weekly closing prices, estimated to range between $0.053 to $0.054.

While acknowledging his past successes in predicting ETH/BTC price movements, Cowen highlighted that his predictions remain speculative, stating, “Just because I have been right so far about ETH/BTC does not mean I will continue being right.”

ETH bulls fail to hold $3,000 | Source: ETHUSDT on Tradingview.com

Featured image from Finbold, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Ethereum Price Revisits Key Support, Can Bears Take Over?

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

World of Dypians Offers Up to 1M $WOD and $225,000 in Premium Subscriptions via the BNB Chain Airdrop Alliance Program

DOT Price (Polkadot) Approaches Key Level: Should Traders Brace for Sharp Drop?

Ethereum and Altcoins Associated With ETH May Witness Rallies Sooner Than Expected, According to Santiment

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs