Ether

Ethereum, Explained. Household names such as Samsung… | by Blockchain.com | @blockchain | Nov, 2022

Published

1 year agoon

By

admin

Household names such as Samsung, Amazon, and Microsoft are now using Ethereum, but what exactly makes Ethereum so attractive to investors, entrepreneurs, artists and corporations?

As the second biggest cryptocurrency after Bitcoin, Ethereum is known as “the mother of decentralized applications.”

This article covers everything you need to know about Ethereum basics, what makes Ethereum different from Bitcoin, smart contracts and use-cases, and how to get started with this new and exciting technology.

What is Ethereum?

Ethereum is a decentralized blockchain technology that’s not owned or regulated by a third party such as a government or central bank.

Ethereum is used for building decentralized apps (dApps), holding and transacting cryptocurrency and other digital assets, and creating new cryptocurrencies.

Ethereum’s native cryptocurrency, called ether (abbreviated to ETH), powers Ethereum. Imagine ETH as the fuel and Ethereum as the engine.

How does Ethereum work?

The Ethereum network is like a large, powerful, decentralized computer.

Through computer code it can complete almost any task if it has enough time, processing power and instructions.

This means a varied range of applications can be built on its blockchain, making Ethereum the rails on which many blockchain-based projects run.

How do Ethereum and Bitcoin compare?

The basic similarities between Bitcoin and Ethereum are:

- They’re not owned or regulated by a third party such as a central bank.

- They both use blockchain technology to record and store transaction details.

- They both have digital currencies (BTC and ETH) that can be stored in cryptocurrency wallets.

However, the main differences are:

- Use case. Ethereum was created as a platform to facilitate smart contracts and dApps. Bitcoin was created as a currency alternative.

- Supply. Ethereum has no limits on its total supply amount and instead uses its own supply and demand economics to define its scarcity. Bitcoin has a fixed total supply of 21 million.

- How it works. Ethereum uses a proof-of-stake consensus algorithm, which means that users can earn rewards by holding ETH in their wallets and staking, or pledging, them to validate transactions. Bitcoin runs on a proof-of-work consensus algorithm, which involves people dedicating computing power to validate transactions (called mining).

Who created Ethereum?

Ethereum was originally proposed by Russian-Canadian programmer, Vitalik Buterin.

In 2013 Buterin released a whitepaper which described a blockchain network that allows developers to create their own dApps.

As a co-founder of Bitcoin magazine, Buterin was already an active member of the crypto community prior to developing Ethereum, and naturally, the network promised to go beyond what the Bitcoin network could offer.

From the development of the whitepaper, many other co-founders joined his vision, including Gavin Wood and Charles Hoskinson.

Today, Ethereum is run by hundreds of thousands of developers located around the world and is constantly evolving.

The most recent example in its evolution is the “Ethereum Merge,” transitioning Ethereum from a proof of work to a proof of stake consensus mechanism.

As proof of stake does not rely on high amounts of computer processing power, the move to proof of stake is said to reduce Ethereum’s energy consumption by approximately 99.95%.

What can you do with Ethereum?

Beyond using ETH like money or a store of value, most of what can be built on Ethereum is through dApps.

A dApp is an application which is run on a decentralized peer-to-peer network as opposed to an app which is run on centralized servers (like Uber or Twitter).

This permissionless nature means that builders can experiment freely without input from a central authority.

Here are some examples:

1. DeFi (Decentralized finance)

Decentralized finance is an umbrella term given to financial services and products like lending, borrowing, and earning interest, that can be accessed on public blockchains without the permission of a third party such as a bank.

Find out more about the basics of DeFi on the Blockchain.com Podcast.

2. NFTs (Non-fungible token)

An NFT is a digital asset stored on a blockchain, that is unique and impossible to replicate.

While other blockchains have implemented their own version of NFTs, the first ever NFT was built on the Ethereum blockchain.

NFTs can represent anything from digital art to in-game items and even real-world assets like land or houses.

Find out more about NFTs on our podcast.

3. DAOs

DAOs are decentralized autonomous organizations. Instead of having a CEO in place, DAOs are collectively owned.

How the organization works and how funds are spent are baked into the Ethereum blockchain through the use of smart contracts.

Find out more about DAOs on our Crypto Basics podcast episode

4. Other cryptocurrencies

You can create your own cryptocurrencies that can be purchased with ETH on the Ethereum blockchain.

There are different guidelines or standards to follow in order to create a token on Ethereum to ensure they are compatible with online Exchanges such as the Blockchain.com Exchange.

The ERC-20 standard is the most popular standard.

Examples of other cryptocurrencies built on Ethereum are Tether and USDC, the two largest stablecoins in the crypto market.

Transacting on the Ethereum network

Here’s a simple breakdown of what happens when someone wants to send Ether using blockchain technology.

- Every Ethereum transaction made, along with the sender’s public key, is recorded in a public list called the blockchain. Each facilitated transaction will charge the sender a ‘gas fee’.

- The main mechanism by which Ethereum transactions are confirmed and validated is called “proof of stake”. A proof of stake mechanism means that anyone who wants to add new blocks to the chain must stake (offer up) at least 32 ETH and run specialized validator software.

- Participants are then selected at random to add blocks to the blockchain in return for the gas fee as payment. The full public list is then distributed to every computer that is connected to the Ethereum network.

Re-cap: What are gas fees?

Ethereum “gas” is the fee that’s applied to carry out a transaction or execute a smart contract on the Ethereum blockchain.

The “gas fee” is priced at fractions of ETH and the amount depends on the supply and demand of the network at the time of the transaction.

Re-cap: What is proof of stake?

The recent Ethereum Merge refers to developers changing Ethereum’s consensus mechanism from proof of work to proof of stake to ensure every transaction and new block added on the network is valid.

How can you build on Ethereum?

Every node (computer participating on the Ethereum network) holds a copy of the Ethereum Virtual Machine (EVM).

The EVM is a piece of software that acts like a decentralized “computer” that has the ability to execute millions of projects through the use of “smart contracts”.

What is a smart contract?

A smart contract is a self-executing contract in which the terms of an agreement between two or more parties are written as lines of code, which are baked into the blockchain.

A traditional contract is often slow, relies on trust and often physical record keeping.

Since smart contracts exist in a public ledger, they are distributed throughout the blockchain network so the terms of the agreement cannot be tampered with or changed.

Smart contracts are like digital “if-then” statements which can be synced with external databases — if a condition of the contract is met then the agreement is approved.

For example:

What industries use Ethereum smart contracts?

Insurance

AXA insurance used smart contracts to automatically pay out flight delay insurance claims. They applied a smart contract to air traffic databases, and when a delay is detected, the smart contract will automatically pay the relevant customers.

Supply chain

Grocery stores such as Walmart have implemented smart contracts to track the end-to-end journey of items. This offers more transparency across product sources as well as quickly highlighting identifying missing products.

Real estate

Seattle-based company SMARTRealty introduced smart contracts to record information such as monthly payment amount, duration of a contract and contract auto-renew, into the blockchain.

What’s the future of Ethereum?

In 1989, British scientist Tim Berners-Lee created the open-source and free-to-use World Wide Web (WWW), making it possible for the internet to evolve as fast as it has. Buterin upheld this spirit in writing the Ethereum whitepaper.

In 2021, Berners-Lee sold the original source code for the WWW as an NFT on the Ethereum blockchain, and the symbolic baton was passed.

Beyond offering a new revenue stream for creators and laying the technical foundations for start-up developers, Ethereums’ role in creating a version of the internet that gives ownership back to the user is pivotal.

And after a highly successful Ethereum Merge proving the network’s resistance, a new chapter in Ethereum’s history has just started.

If you’re excited about Ethereum, you can purchase ETH today on Blockchain.com using the Blockchain.com Wallet.

Ethereum staking is now available on the Blockchain.com Wallet. You can learn more about staking here.

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Altcoins

Is Ethereum Back? Record 267,000 New Users Spark Speculation

Published

2 weeks agoon

May 3, 2024By

admin

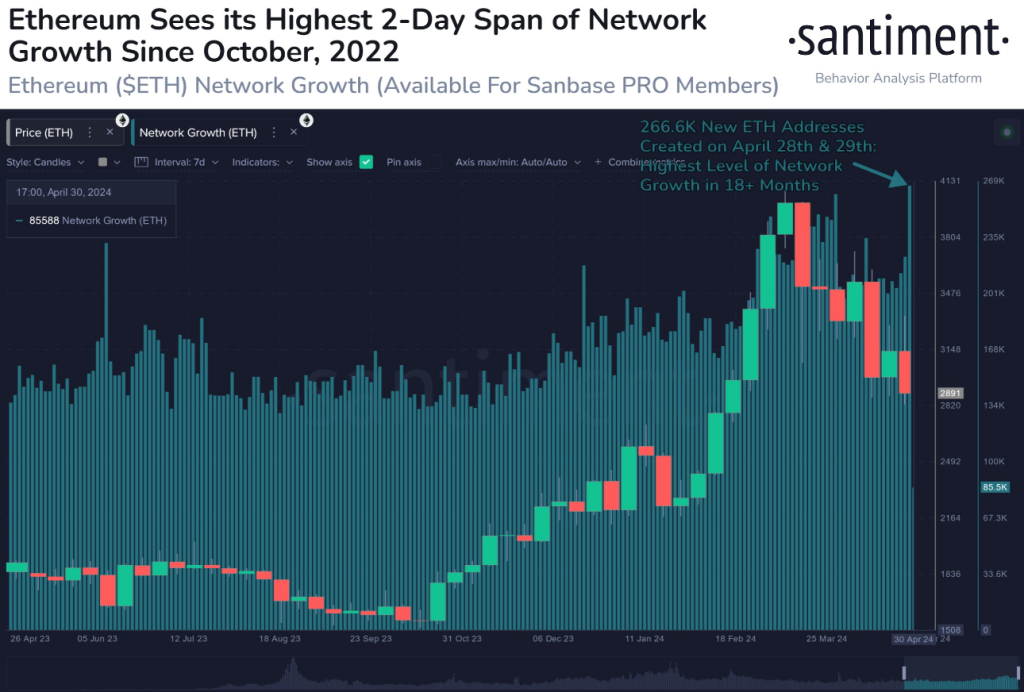

The winds of change are swirling around Ethereum, the world’s second-largest cryptocurrency. Despite a recent price dip, the network has witnessed a surge in new user activity, sparking a wave of optimism. However, the outsized influence of large holders, known as whales, continues to cast a long shadow.

New Wallets Open For Business

Data from blockchain analytics firm Santiment reveals a surge in new Ethereum wallets, with a record-breaking 267,000 created on April 28th and 29th. This influx marks the highest two-day increase since October 2022 and suggests a potential resurgence of interest in the Ethereum network.

📈 #Ethereum saw a milestone as April came to an end. 266.6K new wallets were created on April 28th and 29th, the highest 2-day stretch of network growth since October 8th and 9th, 2022. It is a strong that $ETH continues expanding despite dipping prices. https://t.co/SN6xqc3JXV pic.twitter.com/KDcjhY30y5

— Santiment (@santimentfeed) May 1, 2024

This trend defies the current market downturn, with many cryptocurrencies experiencing significant price drops. Analysts speculate that the rise in new wallets could be fueled by several factors, including:

- Anticipation of future growth: Investors may be looking towards upcoming Ethereum upgrades that promise improved scalability and security, betting on the network’s long-term potential.

- Bargain hunters: The recent price dip might be seen as an attractive entry point for new investors seeking a discount on Ethereum.

On Minnows And Whales

While the number of new users is encouraging, a closer look at Ethereum’s address distribution reveals a stark disparity in holdings. According to CoinMarketCap, a staggering 97% of Ethereum addresses hold between $0 and $1,000 worth of the cryptocurrency. This signifies a large pool of small-scale investors, often referred to as “minnows.”

However, the real power lies with a select few. Whale tracking platform Clank estimates that whales, representing only 0.10% of all Ethereum addresses, control a whopping 41% of the total circulating supply. This translates to an average holding of nearly 10 million ETH per whale, valued at a staggering $3.7 million.

Ether market cap currently at $362 billion. Chart: TradingView.com

Holding Steady: A Vote Of Confidence?

Despite the recent price decline, Ethereum appears to be weathering the storm better than the broader crypto market. In fact, Ether is up more than 30% year-to-date (YTD) from an opening price of about $2,282.

As of today, Ethereum sits at $3,014, with a total market capitalization of $362 billion. Notably, the market experienced an average decline of 8.75% over the last week, highlighting Ethereum’s relative resilience.

Source: CoinMarketCap

Furthermore, data suggests that a majority of Ethereum investors (74%) are long-term holders, demonstrating a strong belief in the project’s future. This “hodling” mentality indicates a commitment to maintaining their Ethereum positions for the long haul, even in the face of short-term market fluctuations.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

blockchain technologies

Consensys Takes Legal Action Against SEC to Safeguard U.S. Ethereum Community – Blockchain News, Opinion, TV and Jobs

Published

3 weeks agoon

April 29, 2024By

admin

In a bold move to protect the interests of the U.S. Ethereum community, Consensys has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC). This legal action comes in response to the SEC’s looming regulatory stance on ether, which threatens to classify it as a security. Such a classification could not only disrupt digital asset trading but also impede the nation’s utilization of Ethereum and analogous blockchain technologies.

The ramifications of this regulatory shift extend far beyond the realm of cryptocurrency trading. They pose a significant threat to the proliferation of innovative products and technologies, potentially jeopardizing numerous job opportunities within the United States. Recognizing the gravity of the situation, Consensys has taken proactive measures to halt what it perceives as an overreach of regulatory authority by the SEC.

“We are compelled to take this necessary step to defend against the SEC’s unlawful power grab,” stated a spokesperson from Consensys. The litigation brought forth by Consensys underscores several pivotal realities that underscore the importance of maintaining a conducive regulatory environment for blockchain innovation.

As the legal battle unfolds, stakeholders within the Ethereum community and the broader blockchain industry await the outcome with bated breath, cognizant of the profound implications it could have on the future landscape of digital innovation and economic growth in the United States.

The ongoing debate surrounding the classification of cryptocurrencies as either securities or commodities holds significant implications for their regulation, trading, and legal oversight. This distinction is crucial as it determines how and by whom cryptocurrencies are regulated within the United States.

Securities, such as stocks, bonds, and derivatives, represent a claim on the issuer and are subject to regulation by the Securities and Exchange Commission (SEC). In contrast, commodities, including agricultural products and precious metals, are physical goods traded on exchanges and regulated by the Commodity Futures Trading Commission (CFTC).

The implications of categorizing cryptocurrencies as securities or commodities are profound. If classified as securities, cryptocurrency issuers and exchanges must navigate stringent regulatory requirements, often requiring licenses from securities regulators. This can present significant challenges for the crypto industry, prompting efforts to ensure compliance with securities laws, often through decentralization strategies.

Decentralization is a key tactic employed by cryptocurrency projects to mitigate the risk of being classified as securities. By minimizing centralized control and involving decentralized autonomous organizations (DAOs) in governance, projects aim to demonstrate that their tokens are not solely reliant on the efforts of a third party, as mandated by the “Howey test.”

The consequences of misclassification are significant. Exchanges may refrain from listing cryptocurrencies to avoid fines for listing unregistered securities, while issuers could face legal action from regulatory authorities. Recent legal cases, such as the SEC’s lawsuit against Kik, underscore the potential repercussions for projects that fail to comply with securities regulations.

On the other hand, the CFTC has asserted that certain cryptocurrencies, like bitcoin and ether, are commodities and subject to regulation under the Commodity Exchange Act. This determination emphasizes the interchangeable nature of cryptocurrencies on exchanges, akin to traditional commodities.

The regulatory landscape for cryptocurrencies remains complex and dynamic, with ongoing efforts by lawmakers to clarify the classification and regulation of digital assets. Proposed legislation, such as the Responsible Financial Innovation Act, aims to provide clarity on the distinction between securities and commodities within the crypto space.

SEC Chair Gary Gensler has signaled the agency’s intention to oversee crypto assets, stating that “most crypto tokens are securities.” However, the formal classification of specific cryptocurrencies, such as ether, remains contentious, with the SEC yet to provide a definitive stance.

As regulatory discussions continue, the crypto community and industry stakeholders await further guidance and clarity on the classification and regulation of digital assets within the United States. The outcome of these deliberations will shape the future regulatory landscape and influence the development and adoption of cryptocurrencies in the years to come.

Source link

Altcoins

Ancient Ethereum Whale With Over 12,000 ETH Creates Noise

Published

1 month agoon

April 8, 2024By

admin

The Ethereum market is buzzing after a long-dormant “whale” – a major investor holding a vast amount of cryptocurrency – resurfaced and transferred a significant amount of ETH to the Kraken exchange. This move has sparked speculation about a potential price drop, but wider market trends suggest a more complex picture.

On-chain analytics firm Spot On Chain has disclosed that the investor, who participated in Ethereum’s Initial Coin Offering (ICO) in 2014, recently deposited 1,069 ETH, valued at roughly $3.56 million, to Kraken.

Traditionally, deposits to exchanges are seen as a sign of intent to sell, potentially putting downward pressure on the price of ETH.

This whale’s activity is particularly noteworthy because of their participation in the Ethereum ICO. Back in 2014, they acquired 12,566 ETH at a meager $0.30 per token. The recent transfer represents just a fraction of their holdings, but the sale price – over $3,300 per ETH – signifies a massive profit for the early investor.

An #Ethereum #ICO participant returned after 1.12 years to deposit 1,069 $ETH ($3.56M) to #Kraken at $3,329 3 hours ago.

The whale received 12,566 $ETH at #Ethereum Genesis in Jul 2015, at an ICO price of ~$0.31,

And then distributed the $ETH across 12 wallets in 2017, of which… pic.twitter.com/Lid1hItGik

— Spot On Chain (@spotonchain) April 6, 2024

Ethereum Market Shows Signs Of Accumulation

While the whale’s move might suggest a potential sell-off, on-chain data reveals a broader trend that could offset its impact. According to IntoTheBlock, a blockchain analytics company, the past quarter witnessed a significant outflow of ETH from cryptocurrency exchanges, totaling a staggering $4 billion.

This movement suggests that many investors are accumulating ETH, potentially anticipating future price increases.

Ether market cap currently at $409 billion. Chart: TradingView.com

Dencun Upgrade Fuels Ethereum Network Activity

The news comes on the heels of Ethereum’s successful Dencun upgrade, implemented in March 2024. The upgrade aimed to address the network’s scalability issues, specifically targeting high transaction fees and slow processing times.

Early signs appear positive, with IntoTheBlock reporting a surge in activity on the main optimistic rollups (Layer 2 scaling solutions) following the upgrade.

Weekly transaction volume reached highs of 32 million, indicating increased network usage. While gas prices have risen recently, they were initially significantly lower on many Layer 2 solutions after the upgrade.

Market Uncertainty Remains

The combined effect of the whale’s sale, the wider accumulation trend, and the Dencun upgrade’s impact on network activity make it difficult to predict the short-term direction of the Ethereum market.

While the whale’s sale could trigger a price dip, the broader accumulation trend suggests underlying bullish sentiment. The Dencun upgrade’s success in reducing transaction fees and increasing network usage could further bolster investor confidence.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs