BTC

Is There Such a Thing as a Bullish Rate Hike? – Blockchain News, Opinion, TV and Jobs

Published

2 years agoon

By

admin

By Ben Small, Analyst at the publicly listed digital asset broker GlobalBlock

The crypto market has started the second half of this week on the front foot on the back of the latest interest rate decision in the US.

Despite starting the week under plenty of pressure in the build-up to the decision, a sea of green is showing across digital assets since.

BTC rebounded back above the $23.840k mark placing the market leader comfortably within its higher ranges of the last 6 weeks. ETH has jumped by as much as 13% since the announcement hitting $1.729k, a level it has struggled to break since early June too. DeFi tokens have also responded strongly, with Aave establishing its price above the $92 mark (almost a 40% rise in the month of June) and Uniswap climbing by 21%.

You could argue this show of optimism reflects the view among investors that a more aggressive plan of action from the Federal Reserve was expected, particularly given the amount of political pressure that is building on governments to tackle inflation (not that the two should be linked!).

So will crypto assets manage to maintain this momentum?

Eyes will now be turning towards any economic data that could conflict with the Fed’s targets. Not only does the FOMC have to be willing to seriously harm growth prospects in the states, but also come to terms with the realities of a looming recession and a jobs market under serious pressure.

The US’ latest GDP release will be keenly watched as well as the initial jobless claim data due this afternoon. It will be interesting to see how Germany’s inflation readings also come out today given Russia’s latest power play forcing gas prices to sky rocket in Europe.

UK crypto news: Law commission pushes for a specific property category for crypto

Advisors to investors up and down the country will have been campaigning for this push for a long time. The constant battle of trying to fit innovative digital products into traditional categories has proven ineffective at best.

The proposal to create a distinct label under personal property law would certainly make their lives easier and could make the process of regulating digital much more efficient too. It will be interesting to see what kind of feedback is provided by the wider industry on these proposals and most importantly how the government responds.

Source link

You may like

Ethereum Price Reclaims 100 SMA But Bulls Still Lack Strength To Clear Hurdles

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Bitcoin

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

Published

22 hours agoon

May 5, 2024By

admin

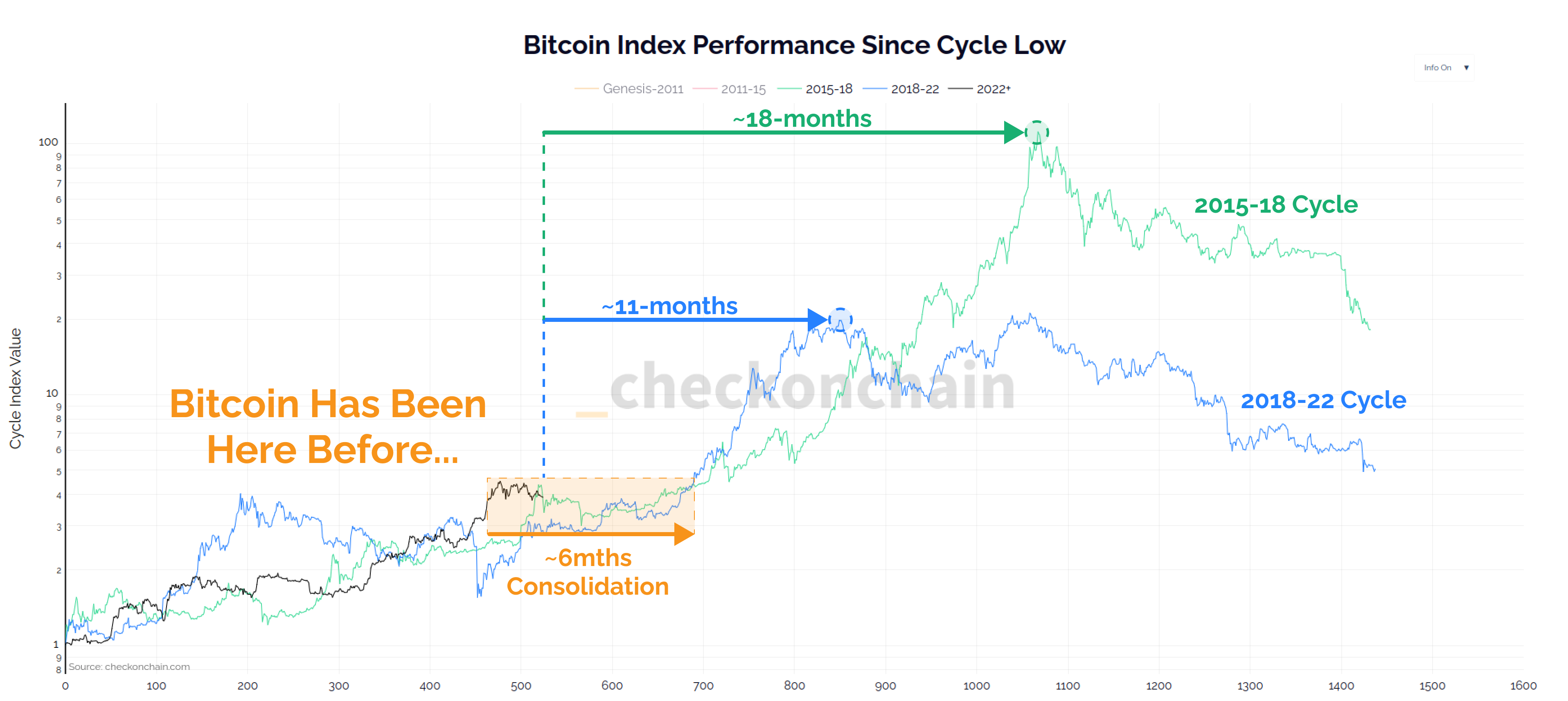

Prominent on-chain analyst Checkmate is updating his outlook on Bitcoin’s (BTC) current market cycle and says that a parabolic move to the upside is likely in sight.

The pseudonymous analyst tells his 90,000 followers on the social media platform X that based on previous cycles, Bitcoin is most likely in for about six months of “chopsolidation” – or a choppy period of consolidation with no real trend shift.

After six months, Checkmate says that six months to a year’s worth of parabolic moves could be in store, based on historical precedence.

“Bitcoin history tends to rhyme, and thus far, this cycle is no different.

The song sung during the last two cycles paints around six-months of chopsolidation ahead of us, followed by 6-12 months of parabolic advance.”

While some are speculating that Bitcoin’s bull run may have already seen its top, Checkmate says such a scenario would be a major break from the “norm” of BTC’s past market cycles.

“If we measure from the cycle high, we see the same chorus.

Establishing a bull market top here would no question be a major break from the Bitcoin norm. It could for sure happen, but we must dig deeper to investigate…

April so far has seen prices drop by over $8,250 MoM (month over month)

I’m expecting text messages from the sidelines saying ‘Hey man, what’s up with Bitcoin, it’s down a lot, I hope you sold it?’”

Checkmate isolates every year in which a Bitcoin halving takes place, and notes that corrections like the one BTC has had since March are par for the course. The analyst also notes that the end of halving years tend to be quite bullish for Bitcoin.

“If we isolate Bitcoin halving years only (2012, 2016, 2020, 2024) we can see MoM performance via table and chart.

MoM corrections of this magnitude are the norm, not the exception, and the end of the year is usually pretty powerful (as per first charts).”

At time of writing, Bitcoin is worth $63,433.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Crypto research platform 10x Research recently noted that the Bitcoin Relative Strength has jumped to 40%. In line with this, they provided insights into what major moves the flagship crypto might make soon enough.

What Next For Bitcoin?

In their newsletter titled “Fake Dip?” 10x Research drew the crypto community’s attention to the fact that Bitcoin has historically experienced potential rallies whenever its relative strength index (RSI) drops to 40%. As such, there is the possibility that BTC could again rally following its recent decline.

The research platform warned that a “line in the sand” at the $62,000 mark could keep the flagship crypto from rallying. However, Bitcoin has already broken above that level, which could mean there is still a bullish sentiment around the crypto token.

Meanwhile, the research hinted that BTC would need a catalyst to enjoy a sustained rally. They highlighted four bullish events that helped Bitcoin enjoy a parabolic run soon after breaking a vital support level. These events included Treasury Secretary Janet Yellen’s bid for uncapped deposit insurance, BlackRock’s application for a Spot Bitcoin ETF, Franklin Templeton also filing for a Spot Bitcoin ETF, and when US Core PCE dropped below 3.0%.

This echoes the sentiment of Andrey Stoychev, Head of Prime Brokerage at Nexo, who previously mentioned that Bitcoin would need a catalyst to make a significant move to the upside. He predicts that Bitcoin will only continue to trade around the $67,000 range without this catalyst.

10x Research didn’t sound optimistic about BTC enjoying a sustained rally, as their trend model indicates that the flagship crypto is in a downtrend. Despite that, they are not ruling out the possibility of BTC experiencing a bullish reversal. The research firm also revealed that they would look to buy the dip if Bitcoin drops significantly or rallies from here.

BTC Still Destined To Hit New Highs

Crypto analyst Mikybull Crypto recently suggested that Bitcoin will still hit new highs. He stated that Bitcoin’s current price action is meant to create “more fear across the market and then bottom for upward continuation.” Crypto analyst Ali Martinez also recently suggested that the bull run was far from over, bearing in mind that Bitcoin consolidated around this period in the last two bull runs.

He claimed that BTC might be over 500 days away from hitting its market top for this cycle. As to how BTC could rise, Martinez mentioned that it could hit a new all-time high (ATH) of $92,190 if it breaches the resistance level of $69,150. It is also worth noting that crypto analyst PlanB stated that Bitcoin hitting $100,000 this year is “inevitable.”

At the time of writing, BTC is trading at around at around $63,500, up over 7% in the last 24 hours, according to data from CoinMarketCap.

BTC price recovers above $63,000 | Source: BTCUSD on Tradingview.com

Featured image from BBC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Bitcoin

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Published

1 day agoon

May 4, 2024By

admin

Bitcoin is now at a critical junction, which many determine its price trajectory for the rest of the year. The crypto has managed to return into $60,000 territory after dropping down to $56,000 for the first time since April. Some analysts are of the notion that the Bitcoin bulls haven’t actually started on their momentum yet, with many expecting a surge above $74,000 in the coming weeks.

According to a crypto analyst, impulse waves formed by Bitcoin over the past 1.5 years are indicating that the price of Bitcoin will soon jump to between $90,000 and $100,000.

Bitcoin To $90,000

A crypto analyst known pseudonymously as TechDev recently shared a Bitcoin price outlook on social media platform X with over 448,000 followers. Interestingly, his analysis is based on Elliot impulse waves, a technical analysis tool that has become extremely popular among crypto analysts when forecasting Bitcoin’s price.

According to the BTC/US Dollar 2D timeframe shared by the analyst, Bitcoin has been forming impulse waves on an uptrend since May 2023. The chart indicated that the recent correction since Bitcoin reached an all-time high of $73,780 is the fourth impulse wave formation, which is generally known to be a corrective wave. Interestingly, the asset is now at a critical junction after bouncing up at $56,800.

As noted by the analyst, Bitcoin is set to form its fifth (bullish) impulse wave and go parabolic in the coming months. The first price target is around $90,000 to $100,000 in the short term. The second price target is around the projected peak of the fifth impulse wave, which sits just below $150,000.

TechDev’s analysis is based on a similar five-impulse wave formation in the 2020 to 2021 bull market cycle. A similar fourth impulse wave correction during this period saw Bitcoin falling from $41,000 to $29,000 in early 2021. However, a rebound led to the formation of a fifth (bullish) impulse wave, pushing the price of Bitcoin to its former all-time high.

The impulsive structure of the last 1.5 years says 90-100K is next. $BTC pic.twitter.com/jboA0rQ3Qs

— TechDev (@TechDev_52) May 3, 2024

What’s Next For Bitcoin Price?

At the time of writing, Bitcoin is trading at $63,275 and up by 6% in the past 24 hours. Since the launch of Spot Bitcoin ETFs in the US, Grayscale’s GBTC recorded its first day of inflow, totaling $63 million on May 3. Investors are hopeful and speculating how this might kickstart a new bull run for the cryptocurrency.

According to an analyst, Bitcoin has successfully defended a correction below the 21-day exponential moving average (EMA). The next step is crossing above resistance around $63,488.

BTC bulls push price toward $64,000 | Source: BTCUSD on Tradingview.com

Featured image from The TechBullion, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Ethereum Price Reclaims 100 SMA But Bulls Still Lack Strength To Clear Hurdles

Crypto Trader Says Three Altcoins Are His Golden Tickets, Flips Bullish on One Memecoin With ‘Monster’ Chart

XRP Holders Stack Coins Despite Price Dip: Bullish Signal?

Spot Bitcoin ETF Token Presale Crosses $200,000 – Blockchain News, Opinion, TV and Jobs

Employee at Billion-Dollar Bank Arrested, Accused of Stealing $44,000 From Account of Deceased Customer

Analyst Reveals Why It’s Time To Get Back Into ADA

Six to Twelve Months of ‘Parabolic Advance’ on the Horizon for Bitcoin, According to On-Chain Analyst

10x Research Reveals Next Steps From Here

New Global Currency Designed To Ditch US Dollar, Avert Sanctions Emerging As BRICS Leaders Prepare To Meet: Report

Analyst Says Bitcoin Price Is Headed To $90,000, Here’s Why

Venture Capitalists Funnel Nearly $2,500,000,000 Into Crypto in Q1 of 2024: Galaxy Research

Injective (INJ) Price In Danger If It Falls To Crucial Support Level: Analyst

Bitcoin and Other Cryptos Set To Begin ‘Slow Grind Higher,’ Says Arthur Hayes – Here Are His Top Altcoin Picks

Daily Active Addresses Hit 514,000 As DOT Price Surges 7%

Announces $1,000,000 Creator and Community Member Grants & Bybit IDO – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs