bybit

Singapore Based Crypto Exchange Bybit Expands to Argentina

Published

2 years agoon

By

admin

Bybit, a Singapore-based cryptocurrency exchange, has proclaimed it’ll be increasing its operations to Argentina. The exchange needs to supply Argentinian voters another platform on which to interact, given the recognition that the cryptocurrency business is amusing in the country. The exchange will have an avid team to support Argentinian operations.

Bybit Lands in Argentina

The growth of the cryptocurrency business in Argentina has not gone unobserved by international firms. Bybit, a Singapore-based, top-ten crypto exchange by volume listed, has proclaimed that it’ll expand its dealing to support Argentinian customers directly.

To better come through this goal, the corporate can dedicate a team to attend to applicable needs and support its approaching Argentinian customers, permitting them to interact, purchase, and sell cryptocurrencies on Bybit’s platform. Also, the platform is accessible in Spanish, the language of the country.

Regarding this development, the exchange declared:

Taking under consideration the amount of penetration and also the rapid climb within the adoption of cryptocurrencies in Argentina, Bybit has created this call, that is because of the importance of the Argentinian market within the Spanish American region.

Due to all of this, Bybit considers it the proper time to expand its operations to the country, providing there’s a chance for onboarding users still unaccustomed to the cryptocurrency movement.

Argentinian Crypto Appeal

In recent years, Argentinians are obtaining nearer and nearer to crypto, with this development beginning when the govt. established limits to the amount of bucks voters might exchange, establishing an overseas currency exchange management, like the one established by the Venezuelan government before that. Inflation numbers have conjointly influenced the interest during this new, different economic system.

The exchange is gambling that this new interest in crypto, because of national and international market conditions, can power the demand of Argentinian users within the close to future for brand new applications. About this, Gonzalo Lema, director of Bybit operations for Argentina, stated:

Although economic conditions became an element in increasing the adoption of cryptocurrencies in Argentina, because the client base grows, interest in different potential uses of those assets can increase, like the likelihood of receiving remittances or maybe paying for products and services with them.

The company can provide all of its accessible services and investment instruments in Argentina, associated with an APY of 22% on Dai deposits, to Argentinians registering before Gregorian calendar month eleven.

The post Singapore Based Crypto Exchange Bybit Expands to Argentina first appeared on BTC Wires.

Source link

You may like

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Binance

Triggers Nearly $300 Million In Total Liquidations

Published

2 months agoon

March 22, 2024By

admin

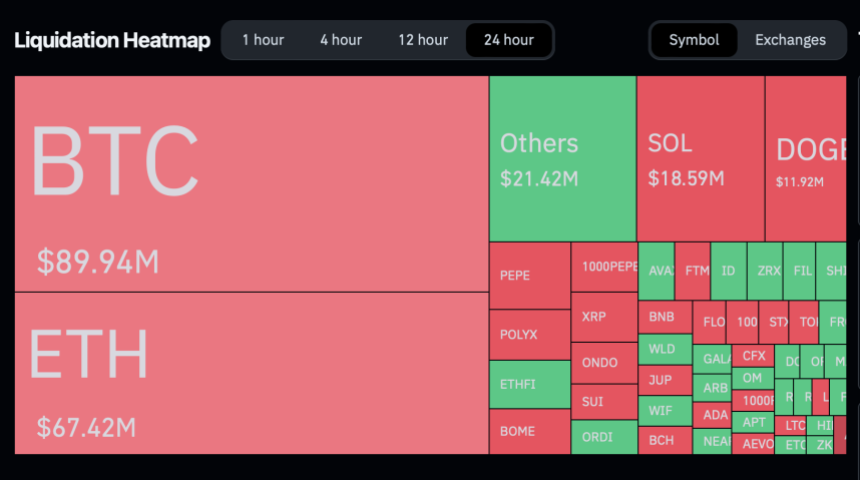

The crypto market has recently experienced a wave of liquidations, amounting to nearly $300 million, closely following Bitcoin’s sharp reclaim of the $67,000 mark.

This surge in Bitcoin’s value, a stark reversal from its previous downtrend, caught many traders off guard, especially those who had placed bets on the continuation of the market’s decline.

Over 80,000 Traders Faces Liquidation

The data provided by Coinglass sheds light on the magnitude of the liquidations, revealing that approximately 86,047 traders suffered losses exceeding $250 million within a mere 24-hour period.

Major exchanges like Binance, OKX, Bybit, and Huobi were the arenas for these significant financial setbacks, with Binance traders bearing the brunt of the liquidations.

Particularly, Binance recorded $128.7 million in liquidations, while other major platforms such as OKX, Bybit, and Huobi also experienced significant liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. Meanwhile, despite also facing liquidations, the smaller exchanges had a comparatively minor impact.

Most affected positions were short trades, reflecting a widespread anticipation of a market downturn that did not materialize as expected. Short positions recorded an estimated 57.55% of the liquidations, equivalent to $164.10 million, from traders betting against the market.

On the flip side, long position holders also faced their share of losses, contributing to nearly 40% of the total liquidations, amounting to $121.07 million.

Bitcoin Recovery And Future Prospects

The sharp recovery of Bitcoin, momentarily reclaiming highs above $67,000, has reignited interest in its market behavior and future trajectory.

Despite a 6.6% dip in its market capitalization over the past week, Bitcoin’s value saw a notable 6% increase in the last 24 hours, with its market cap presently sitting above $140 billion. This resurgence in trading activity, with daily volumes climbing from below $60 billion to heights above this mark, signifies renewed investor confidence and heightened trading interest.

Adding to the discourse, cryptocurrency analyst Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle reminiscent of the market patterns observed in 2013.

According to Woo, this pattern could herald two significant price surges for Bitcoin in the coming years, with the first peak anticipated by mid-2024 and a subsequent, more substantial rise in 2025.

While such dual surge scenarios are rare, Woo’s analysis, based on current market conditions and Bitcoin’s growth potential, offers a glimpse into the future of the world’s leading cryptocurrency.

At the rate the #Bitcoin Macro Index is pumping, I wouldn’t be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Binance

Digital Asset Markets Display Robust Momentum and Heightened Activity – Blockchain News, Opinion, TV and Jobs

Published

3 months agoon

March 4, 2024By

admin

Bitcoin (BTC) wrapped up the week at approximately $63,100, marking a notable 22% surge from the previous week’s closing price of around $51,725. The week witnessed vigorous price action, particularly in the first half, as BTC experienced a substantial appreciation from Monday to Wednesday, peaking at $64,000 on Wednesday. Subsequently, the price stabilized in the latter half of the week, closing at about $63,100. As of the time of this writing, BTC has regained momentum and is currently trading above $65,000.

The BTC Spot ETFs continue to exhibit strong momentum, with a cumulative net inflow of approximately $1.7 billion recorded last week, bringing the total net inflow since inception to about $7.4 billion. Leading the race is the Blackrock Bitcoin ETF (IBIT), which surpassed $10 billion in assets under management (AUM) last week, setting a record as the fastest ETF in history to achieve this AUM milestone.

Trading volumes for BTC Spot ETFs saw a significant surge during the week, totalling $22.3 billion, with an average daily trading volume of almost $4.5 billion. This marked a remarkable 265% increase from the average daily trading volume of $1.7 billion recorded since inception. The cumulative trading volume now exceeds $73.9 billion, with the daily average volume surpassing $2 billion, currently standing at $2.1 billion.

Similarly, trading volume surged on centralized digital assets exchanges, reaching a cumulative trading volume of $73.4 billion for the week. This represents an 80% increase from the previous week’s volume of $40.7 billion and marks the highest weekly trading volume recorded since May 2022. The data underscores the recent price appreciation accompanied by robust trading activity.

The rise in open interest, which represents the total number of outstanding derivative contracts for an asset that have not been settled, is observed both for BTC and the digital assets market in general, across both centralized digital assets exchanges (e.g., Binance, Coinbase, ByBit, etc.) and traditional finance investors’ platforms (e.g., CME). This indicates heightened activity from both digital assets native and traditional finance investors.

The strong momentum extends beyond Bitcoin to the overall market, with the total digital assets market cap currently standing at $2.5 trillion, approaching the all-time high of $3 trillion. Notably, the Total3 metric, which excludes Bitcoin (BTC) and Ethereum (ETH) and represents the market cap of the top 125 capitalised digital assets, has surged to $660 billion, reflecting a 19.3% growth week-on-week and a 31.5% year-to-date increase. This underscores the broad impact of BTC Spot ETFs on market momentum beyond BTC’s price action.

Examining the total stablecoin supply also provides insights into heightened demand. During periods of low demand, the supply of stablecoins typically decreases as investors exchange them for fiat currencies like USD, GBP, or EUR, thereby reducing the overall circulating supply. Conversely, during phases of increased liquidity injection into the market, the supply of stablecoins tends to expand. Presently, the total stablecoin supply stands at approximately $145 billion, reflecting a continuous uptrend from around $129 billion noted at the end of September 2023. This confirms sustained strong investor demand observed throughout Q4 2023 and into Q1 2024.

Source link

bybit

Canadian Regulator OSC Takes Action Against Crypto Platforms Kucoin and Bybit

Published

2 years agoon

June 28, 2022By

admin

The Ontario Securities Commission (OSC) has taken action against 2 cryptocurrency commercialism platforms. Kucoin is for good prohibited from collaborating in Ontario’s capital markets. Bybit is secure to require steps to follow rules and register with the OSC.

OSC Sanctions a pair of Crypto Trading Platforms

The Ontario Securities Commission (OSC) declared Wednesday the result of social control actions against 2 foreign cryptocurrency commercialism platforms operative in its jurisdiction.

The first is Bybit, a crypto commercialism platform operated by Bybit Fintech Ltd., incorporated within the British island. the opposite is Kucoin, operated by FTO international Ltd., incorporated within the Republic of Seychelles, and Phoenixfin Pte. Ltd., incorporated in Singapore.

“Bybit and Kucoin each operate unregistered crypto quality commercialism platforms and allowed Ontario investors to trade securities while not a prospectus or any exemption from the prospectus needs,” the Canadian regulator explained.

Regarding Kucoin, the announcement states:

“The OSC with success obtained orders for permanently forbidding Kucoin from collaborating in Ontario’s capital markets and requiring Kucoin to pay a body penalty of CAD $2,000,000.”

Kucoin should additionally pay an extra CAD $96,550.35 ($74,497) towards the prices of the OSC’s investigation.

As for Bybit, the regulator settled with the exchange. The OSC explained that, in contrast to Kucoin, Bybit more responsible its social control action, maintained associate degree open dialogue, provided requested data, and committed to partaking in registration discussions.

The Canadian securities watchdog described:

“As a part of a settlement agreement, Bybit has disgorged USD $2,468,910 and paid an extra CAD $10,000 towards the value of the OSC’s investigation.”

“Bybit has additionally given associate degree enterprise to the OSC, that holds the firm answerable for taking steps to bring its operations into compliance,” the regulator accessorial. The exchange will need existing Ontario retail investors to wind down their positions in bound restricted product.

In March last year, the OSC told crypto trading platforms that supply derivatives or securities commercialism in Ontario to begin registration discussions with it by Apr 19, 2021, or face social control action. The Canadian regulator noted:

“Despite this warning, Bybit and Kucoin failed to contact the OSC by this deadline and continued operations in Ontario.”

The post Canadian Regulator OSC Takes Action Against Crypto Platforms Kucoin and Bybit first appeared on BTC Wires.

Source link

Insight Into The Timing And Factors

Bitcoin About To ‘Blow Higher’ Despite This Week’s Pullback, According to Glassnode Co-Founders – Here’s Why

Azuro and Chiliz Working Together to Boost Adoption of Onchain Sport Prediction Markets – Blockchain News, Opinion, TV and Jobs

Robinhood Bleeds 164 Million Dogecoin

AIGOLD Goes Live, Introducing the First Gold Backed Crypto Project – Blockchain News, Opinion, TV and Jobs

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized3 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs