cryptocurrency

Stablecoins, Explained. Stablecoins have become an essential… | by Blockchain.com | @blockchain | Oct, 2022

Published

2 years agoon

By

admin

Stablecoins have become an essential part of decentralized finance (DeFi) used for trading, purchases, and more.

In this article we’ll cover:

- What a stablecoin is

- Why people may buy stablecoins

- How stablecoins are used

- How stablecoins work

Stablecoins are cryptocurrencies pegged to currencies like the US dollar or euro or assets like the price of gold.

Because they’re “tied” to the value of less volatile assets, stablecoins provide an alternative way for people to participate in crypto without having exposure to bitcoin and other tokens known for their potential wide price swings.

The main draw of stablecoins is that they provide the speed of crypto with the stability of dollars and other trusted assets.

Reasons why people may buy stablecoins

- Cash alternative. Stablecoins could minimize fluctuations in holdings since they stay pegged to a fiat currency or physical commodity, such as the US dollar or gold.

- Building and protecting wealth. People whose currencies have devalued through inflation may buy stablecoins as an alternative to their local currency.

- Payments. In areas where it’s difficult to get physical dollars, stablecoins could be a viable way to do commerce.

- Trading. Crypto exchanges often offer stablecoin pairs against dollars, bitcoin, ether, and other assets.

Some of the most common use cases of stablecoins may include:

- Hedging against market volatility. The ability to pull funds out of volatile cryptocurrencies, especially during extreme market fluctuations, could be an attractive use case of stablecoins.

- Cheaper payments. Because stablecoins circumvent traditional banks and clearing houses, users may avoid many of the traditional fees associated with cross-border transfers.

- Faster payments. Bank payments usually take between 3–5 days while stablecoin payments could settle in a matter of minutes or hours.

- Primarily centralized. Advocates of a fully decentralized financial system often criticize stablecoins because they’re controlled by centralized entities, meaning that they’re not truly trustless.

- Counterparty risk. When you buy a stablecoin, you’re trusting that the issuer will honor its promises and redeem your coins for the appropriate amount of fiat currency. If the entity controlling the stablecoin mismanages its reserves or becomes insolvent, you could lose money.

- Smart contract risk. If there’s a bug in the code governing the stablecoin, it could lead to loss.

- Lack of transparency. Some stablecoin companies skirt or ignore audit requests, meaning that users never really know if the necessary reserves to hold the peg are actually in place. Without audits, those funds can be embezzled or used for purposes other than collateralization.

No. Some stablecoins are completely collateralized by cash, holding at least a 1:1 ratio in reserves to maintain their peg.

However, each stablecoin project manages peg maintenance and collateralization uniquely, so reviewing the documentation from the company can help you understand their process.

There are four kinds of stablecoins and each works a little differently.

Fiat-backed stablecoins

- Stablecoin value is pegged to a fiat currency, like the US Dollar.

- Fiat reserves ensure a 1:1 collateralization ratio.

Commodity-backed stablecoins

- Stablecoin value is pegged to a single commodity or index of commodities.

- Collateral reserves are tied to the commodity.

Crypto-backed stablecoins

- Stablecoin value is pegged to another cryptocurrency, like BTC.

- Many crypto-backed stablecoins hold more collateral than needed, and in different currencies, to ensure peg.

Algorithmic stablecoins

- No collateral is required to start or operate a true algorithmic stablecoin.

- Relies on smart contract algorithms based on supply and demand.

It’s important to note that a stablecoins peg is not the same as its collateral currency.

The peg is the value the stablecoin is tying itself to, such as the US dollar. If a stablecoin is pegged to USD, that means that one unit of the stablecoin will equal one US dollar.

The collateral currency is what’s backing up the stablecoin; it’s the stored value that helps the stablecoin maintain its peg.

For example, a stablecoin could be pegged to the Euro, but be backed by various assets, such as fiat currency or gold, that essentially proves the value of the stablecoin.

Asset-backed stablecoins have real assets held in reserve as collateral for the stablecoin.

Many asset-backed stablecoins currently available are fiat-backed, using a fiat currency such as the US dollar. Other asset-backed stablecoins use commodities like gold or even other cryptocurrencies as their collateral.

Fiat-backed stablecoins are pegged to a traditional fiat currency, such as the US dollar or the Euro, and maintain their peg by using a one-to-one (1:1) collateralization ratio, meaning that for one stablecoin, there is one unit of the fiat currency held in reserve.

One of the primary criticisms of fiat-backed stablecoins is that the collateral must be held by a custodian, which means trusting a centralized organization.

A good example of a fiat-backed stablecoin is PAX USD:

BCDC Digital Dollar video (https://youtu.be/CH_U0hdg4ao)

Fiat-backed stablecoins

Commodity-backed stablecoins use a physical asset, like gold, oil or real estate, as a peg for a digital currency. Asset-backed stablecoins that use commodities as collateral can be more volatile than stablecoins collateralized by fiat currencies.

Gold-backed tokens, for example, are fairly stable and offer the advantage of being able to hold the value of an asset like gold without needing to store and secure the physical gold coins or bars. Stablecoins backed by gold often use a measurement of the metal, such as one gram, as the peg for the stablecoin.

Some companies even take a blended collateral approach, using a mix of assets to back their stablecoins, similar to a precious metals index or using multiple fiat currencies.

You’re probably ahead of us at this point: Crypto-backed stablecoins are cryptocurrencies that hold their value at a 1:1 ratio to a different, more established, cryptocurrency.

Some cryptobacked stablecoins are overcollateralized, meaning they hold more reserves than needed, in order to minimize the risk of losing their peg.

This is why some crypto-backed tokens use a mix of multiple cryptocurrencies, or crypto and fiat currency, to collateralize the stablecoin. In the event that the pegged crypto has an extreme drop in value, the stablecoin can maintain value.

MakerDAO’s stablecoin DAI (which runs on multiple blockchains) is one of the most popular stablecoins available and makes use of this model.

MakerDAO made this change after ETH experienced a massive drop in 2020, creating extreme losses in DAI since it was pegged to ETH.

Since then, MakerDAO has implemented overcollateralization and uses multiple cryptocurrencies as reserves.

Many DeFi purists consider algorithmic stablecoins to be the pinnacle of dollar-pegged stablecoins, as they don’t require any centralization or reliance on an underlying reserve.

Algorithmic stablecoins are non-collateralized, which means that these stablecoins do not necessarily require any assets held in reserve in order to function. Instead, they use complex formulas in smart contracts to determine when to create or destroy tokens to maintain parity with the chosen peg, which is often one dollar.

Some of these stablecoins provide rewards when they are valued over their dollar peg, selling what’s called “seigniorage shares” to bring the token back down to the peg value.

Algorithmic stablecoins function as standalone central banks, burning existing tokens when the value falls below the fiat peg, and creating new tokens when the price goes higher than the tracked currency.

Stablecoins have received a lot of attention in the last few years, and the jury is still out on what their place is in the future of finance. In some cases, stablecoins are the only option for people who need their crypto to maintain a stable value while being useful for everyday purchases.

A great example of this took place in Argentina in 2022 when economy minister Martin Guzmán resigned, sending the peso into further decline and driving the demand for stablecoins up. Argentinians bought stablecoins to hedge against devaluation of the peso.

Some fear that central banks may take over the role that decentralized networks play in stablecoins and issue currencies of their own. So-called “central bank digital currencies” (CBDC) would have all the capabilities of cryptocurrency without any of the privacy protections or pseudonymity that most crypto provides.

It’s hard to tell how long that adoption will take, so in the meantime, stablecoins fill a valuable need in the crypto ecosystem.

— — — — — — — — — — — — — — — — –

Disclaimer: This information is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional advisor. Some of the stablecoins mentioned above are not supported by Blockchain.com

Source link

You may like

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

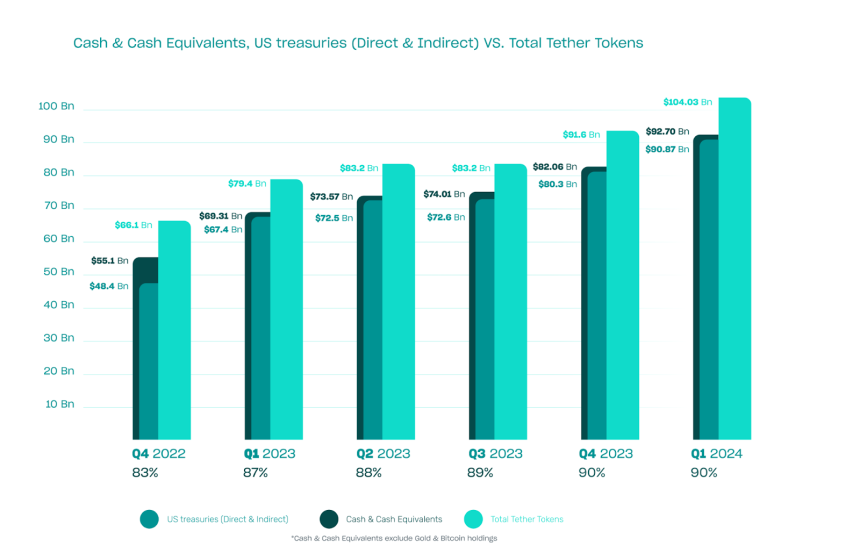

Stablecoin issuer Tether, a prominent player in the cryptocurrency market behind the widely used USDT stablecoin, has released its audit statement for the first quarter of 2024, accompanied by a report conducted by independent accounting firm BDO.

The report, which provides additional financial information beyond the reserves backing Tether’s fiat-denominated stablecoins, shows the company’s profit for the first quarter of the year, which saw an increased influx of capital into the market.

Tether Q1 2024 Financials Soar

Digging into the numbers, the first quarter of 2024 proved highly profitable for Tether, with a net profit of $4.52 billion.

The main contributors, the entities responsible for issuing stablecoins and managing reserves, reportedly generated approximately $1 billion of this profit from net operating gains, primarily from US Treasury holdings. The remaining profits were attributable to mark-to-market gains on Bitcoin (BTC) and gold positions.

The report also highlighted Tether’s success in increasing its direct and indirect holdings of US Treasuries to over $90 billion. This includes indirect exposure through overnight reverse repurchase agreements collateralized by US Treasuries and investments in US Treasuries through money market funds.

In a sign of significant growth, Tether also disclosed its net equity for the first time, revealing a figure of $11.37 billion as of March 31, 2024. This is an increase from the $7.01 billion equity reported as of December 31, 2023.

The report also highlighted a $1 billion increase in excess reserves, which support the company’s stablecoin offerings, bringing the total to nearly $6.3 billion.

CEO Emphasizes Transparency And Stability

The BDO confirmation reiterated that Tether-issued tokens are 90% backed by cash and cash equivalents, underscoring the company’s stance on maintaining liquidity within the stablecoin ecosystem. Furthermore, the report revealed that over $12.5 billion worth of USDT was issued in the first quarter alone.

Tether Group’s strategic investments, which exceed $5 billion as of the report date, span various sectors, including artificial intelligence (AI) and data, renewable energy, person-to-person (P2P) communication, and Bitcoin Mining.

In response to the latest report, Paolo Ardoino, CEO of Tether, expressed the company’s commitment to transparency, stability, liquidity, and responsible risk management.

Ardoino highlighted Tether’s record-breaking profit benchmark of $4.52 billion and the company’s efforts to increase transparency and trust within the cryptocurrency industry. Ardoino further claimed:

In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

cryptocurrency

Forget Meme Coins And NFTs, RWA And DePin Are The Next Big Things – Blockchain News, Opinion, TV and Jobs

Published

3 days agoon

April 29, 2024By

admin

Meme coins and NFTs have outlived their relevance, and it is now time for crypto investors to focus on DePin and RWA projects like ETFSwap (ETFS).

Over the last three years, meme coins and non-fungible tokens (NFTs) have been among the leading narratives in the crypto space. Thanks to the hype around these meme coins and NFTs, crypto investors have made insane returns on their investments,

However, there is a change in the tide that the time has come to pivot from these meme coins and NFT projects and focus on new narratives such as RWA and DePin.

Real World Assets (RWA) and Decentralized Physical Infrastructure (DePin) are two sectors that are gaining traction and could become the center of attraction soon enough.

RWA And DePin Take Over From Meme Coins And NFTs

Asset tokenization continues to be widely discussed, with BlackRock’s CEO Larry Fink even referring to it as the “next generation for markets.” This has put more focus on RWA projects, which are bringing this concept to life. Basically, these projects are tokenizing real-world assets like real estate, royalties, securities, contracts, ETFs, and art with the aid of blockchain technology.

This changes how investors interact with these assets since they will become more accessible and easier to trade. On accessibility, asset tokenization further promotes fractional ownership, which means that individuals can now own a share of assets they wouldn’t otherwise have the means to access.

With these assets being easier to trade, previously illiquid assets will become more liquid. Generally, all asset classes will become more liquid since there is expected to be an inflow of new money into all of them. That is why the RWA industry is projected to become a trillion-dollar market by 2030.

Meanwhile, it is worth noting that RWA projects will be the tunnel through which this liquidity will pass through. That is why crypto investors should pay more attention to them and look to position themselves accordingly.

Like the RWA industry, the DePin market also boasts great potential. As the name suggests, these projects, with the aid of blockchain technology and tokenization, manage their physical infrastructure in a decentralized manner. These physical infrastructures include telecommunications, health systems, power grids, and road networks.

Unlike traditional companies, these projects’ decentralized mode of operation helps simplify their operations and reduce their operating costs. Meanwhile, this business model is also a win for their users, as they are incentivized (with tokens) to contribute to the services these projects provide.

Given such massive potential, the narrative shift from meme coins and NFTs to these RWA and DePin projects is expected to happen sooner rather than later. In fact, these projects could already be the leading narratives, seeing how they have recently achieved more success than meme coins and NFT projects in this cycle.

Crypto expert Michaël van de Poppe called this correctly, as before the Bitcoin Halving took place, he mentioned that there would be a narrative shift to RWA and DePin projects after the Halving.

ETFSwap (ETFS) Presale Sees Increased Demand

The ETFSwap (ETFS) token presale is already seeing increased demand, with crypto investors turning their attention to RWA and DePin projects. ETFS is the native token of ETFSwap, a decentralized finance (DeFi) platform that enables on-chain trading of exchange-traded funds (ETFs).

That explains why investors are rushing to accumulate as many ETFSwap (ETFS) tokens as possible since the platform is already ranked as one of the most promising RWA projects.

Meanwhile, with RWA and DePin projected as the next big things in the crypto space, the ETFSwap (ETFS) is an instant pick as one of the tokens likely to run hard in this market cycle. Experts have also predicted impressive price gains for the crypto token in particular, saying it could rise as Shiba Inu (SHIB) did in 2021.

They say this is possible because ETFSwap (ETFS) has many bullish narratives working in its favor. Besides the RWA narrative, ETFSwap will offer ETFs like the Spot Bitcoin ETF, which has already gained a lot of attention in the crypto space since launching.

Furthermore, staking rewards have recently become more attractive to investors looking for passive income. ETFSwap (ETFS) is set to stand out in this regard since it provides attractive yields that are second to none.

Privacy concerns also continue to be raised in the crypto space, with users complaining that many projects are not truly decentralized and do not protect users’ data. This plays out in ETFSwap’s (ETFS) favor since the platform prioritizes its users’ privacy above anything else. For instance, Know-Your-Customer (KYC) requirements are non-mandatory on the platform, so users do not have to worry about sharing sensitive data or their information being tracked and leaked.

So far, over 30 million ETFSwap (ETFS) tokens have been sold in stage 1 of the ongoing presale. This presale stage is still ongoing, and each token costs $0.00854. However, with the increased demand for these tokens, they are expected to sell out even before the scheduled end date.

For more information about the ETFS Presale:

Source link

Bitcoin

Forbes Unveils 20 Crypto ‘Zombies,’ Declares Ripple And XRP Among The Undead

Published

5 days agoon

April 27, 2024By

admin

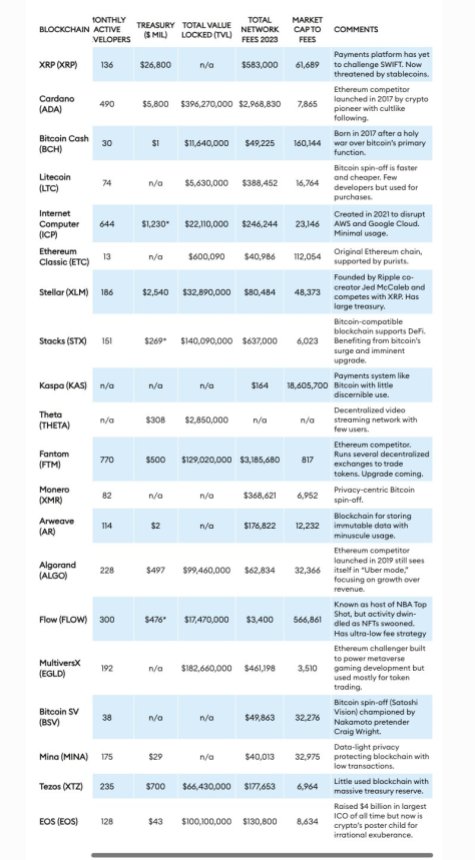

In a controversial report, Forbes unveiled a list of 20 “crypto billion-dollar zombies,” Layer 1 (L1) tokens, which the news outlet defines as crypto assets with substantial valuations but “limited utility beyond speculative trading.”

These cryptocurrencies and projects include Ripple, XRP, Ethereum Classic (ETC), Tezos (XTZ), Algorand (ALGO), and Cardano (ADA), among others.

XRP And Ethereum Classic In The Spotlight

Ripple Labs, the company behind XRP, was highlighted as a prominent crypto zombie. Despite XRP’s active trading volume of around $2 billion daily, Forbes asserts that the token’s primary purpose remains “speculative” and “lacking meaningful utility.”

However, Ripple Labs and XRP are not alone in this regard. Forbes reveals that 50 blockchains, excluding Bitcoin (BTC) and Ethereum (ETH), currently trade at values surpassing $1 billion, with at least 20 of them classified as “functional zombies.” Collectively, these 20 blockchains hold a market value of $116 billion, despite having “limited user bases.”

According to Forbes, an example of a “functional zombie” is Ethereum Classic, which maintains the distinction of being the original Ethereum chain.

While ETC has a market value of $4.6 billion, its fee generation in 2023 was less than $41,000, raising questions about the blockchain’s viability for the news organization.

Another crypto project in Forbes’ report is Tezos, which raised $230 million through an initial coin offering (ICO) in 2017.

Tezos’ XTZ token currently holds a market capitalization of $1.2 billion. However, the blockchain’s fee earnings were meager, with $5,640 in February 2024 and a total of $177,653 for all of 2023.

Algorand, once hailed as an “Ethereum killer” due to its capability of processing 7,500 transactions per second, faces similar challenges.

Despite a market cap of $2 billion and a treasury holding of $500 million, Algorand earned $63,000 in blockchain transaction fees throughout 2023. For Forbes, this casts doubt on its actual adoption and utility.

Crypto ‘Zombie’ Blockchains

The zombie blockchains are categorized into two groups by Forbes: spin-offs and direct competitors to established blockchains like Bitcoin and Ethereum.

Spin-off zombies include Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic.

These blockchains, collectively valued at $23 billion, reportedly emerged from “disagreements” among programmers regarding the governance and direction of the original chains.

Forbes notes that when such conflicts arise, hard forks occur, resulting in new networks that share the same transaction history as their predecessors. The agency claims that their market value “often exceeds” their real-world usage.

Overall, The report highlights a growing disparity between the valuations of certain projects in the cryptocurrency industry and their actual utility and usage. Consequently, Forbes refers to these projects as “zombies.”

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Solana Co-Founder Says Cosmos and One SOL Rival Are Clear Winners in Building Sovereign Blockchains

Achieves Record Net Profit Of $4.5 Billion In Q1

Ripple Forms Partnership With Tokyo Unit of $1,200,000,000 Firm To Push for XRPL-Powered Solutions in Japan

Nektar Network begins Epoch 1 of Nektar Drops

Polkadot-native Acala Expands to Multichain Horizons Through The Sinai Upgrade – Blockchain News, Opinion, TV and Jobs

Bitcoin Price Dips Below $57,000: 4 Key Reasons

Bitcoin Is a Multi-Decade Story That Will Eat Other Massive Asset Classes, Says Macro Expert Lyn Alden

World of Dypians Offers Up to 1M $WOD and $225,000 in Premium Subscriptions via the BNB Chain Airdrop Alliance Program

DOT Price (Polkadot) Approaches Key Level: Should Traders Brace for Sharp Drop?

Ethereum and Altcoins Associated With ETH May Witness Rallies Sooner Than Expected, According to Santiment

Crypto Expert Says ETH Is Yet To Bottom Against Bitcoin

Russian Authorities Introduce New Restrictions on Cryptocurrency To Prevent Ruble From Being Replaced: Report

CARV Announces Decentralized Node Sale to Revolutionize Data Ownership in Gaming and AI – Blockchain News, Opinion, TV and Jobs

Yue Minjun Revolutionizes Bitcoin Art Scene with Pioneering Ordinals Collection on LiveArt – Blockchain News, Opinion, TV and Jobs

Sui Teams Up with Google Cloud to Drive Web3 Innovation with Enhanced Security, Scalability and AI Capabilities

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs