crypto

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Published

10 months agoon

By

admin

In a long-awaited decision, Judge Torres ruled in favor of XRP in their case against the U.S. Securities and Exchange Commission (SEC) yesterday. The verdict is a positive development for the cryptocurrency industry, particularly with a focus on whether digital assets should be deemed securities in the US.

The ruling is expected to set a precedent for the industry moving forward. It is positive for both altcoins and the wider industry, as the default expectation is that these assets are not deemed securities so long as they are made available to the public.

This event will likely have wider implications for ongoing legal cases and may help rebuild confidence in the industry for developers and attract more liquidity to the ecosystem.

XRP Defies Expectations With Massive Price Surge And Trading Volume Spike

Following the news, XRP saw a surge in price, reaching as high as $0.93, the highest price since May 2021, and closing at $0.82.

According to data compiled by the research company CCData, the news led to an influx of trading activity, with XRP trading pairs on centralized exchanges (CEX) recording a total volume of $6.05 billion on the day, an increase of 1351% from the previous day.

The relisting of the asset on other centralized exchanges, including Coinbase, Kraken, and Gemini has also contributed to the spike in volumes.

The news surrounding the ruling also led to almost 100% daily gains for XRP, with other tokens such as Solana (SOL) and Cardano (ADA), recently deemed securities, seeing significant gains of 35% and 28%, respectively.

Despite the negative backdrop that XRP has faced due to the lawsuit, its market depth liquidity at the 1% level has remained resilient year-to-date (YTD). XRP’s 1% bid/ask side depth at Yearly Open was 26.5 million XRP, which saw a variance of 0.41% throughout the year and remained strong at 25.1 million XRP on the 12th of July.

Derivatives Data Shows Positive Sentiment

According to the report, Derivatives data indicate that XRP’s positive funding rate remained steady over the past few days, in line with the wider positive market sentiment.

The lawsuit news generated a significant rise in speculative interest on the bid side, with a $280 million increase in Open Interest, from $635 million to a high of $913 million across exchanges. Moreover, funding rates reached over 0.03% across exchanges, over three times higher than its baseline level of under 0.01% before the announcement.

On the other hand, the funding rate history of XRP shows that speculators trading perpetual contracts have been favoring the upside, with minimal time spent this year in negative funding rate territory.

This underscores the positive sentiment of traders for XRP, which was recently rewarded with a large price rise due to the announcement. While it remains to be seen whether XRP will maintain its extremely positive funding rate, it is currently a good standard for gauging positive sentiment within altcoins, given the attention and volume it is generating.

Considering the lawsuit’s success, the implications for the market are overwhelmingly positive, and the ruling provides clarity that did not exist before the judgment.

According to CCData, the market could see a few trends emerge, such as coins deemed securities recovering well and potentially outperforming and the potential for Bitcoin dominance to drop as an overall percent of market cap, given renewed optimism in altcoins.

Despite the recent surge in positive sentiment and renewed investor confidence, XRP has experienced a significant price drop. After coming close to reaching the $1 mark, which it has not seen since November 2021, XRP is currently trading at $0.7002, marking a decrease of over 11% in the last 24 hours.

Featured image from Unsplash, chart from TradingView.com

Source link

You may like

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

Altcoin

Here’s Why This Analyst Is Predicting A Rise To $360

Published

15 hours agoon

May 8, 2024By

admin

Recently, a popular crypto trader and YouTuber has predicted a substantial surge in Solana price, forecasting it could reach as high as $360 soon.

This prediction is underpinned by a technical pattern on Solana’s chart—a bullish signal suggesting a potential reversal from bearish to bullish momentum.

Technical Insights Into SOL Potential $360 Rise

According to the trader, CryptoJack on X, SOL has developed a “rounding bottom pattern” over an extended period, indicating it is on the brink of a significant breakout.

Notably, the ’rounding bottom’ pattern, characterized by a gradual decline followed by a stabilizing trend and an upward breakout, is a classic bullish indicator in technical analysis.

CryptoJack’s analysis points out that Solana is setting up for a significant uptick, aiming for a price target double its current value of approximately $146.

Solana formed a rounding bottom pattern over many weeks and is primed for an explosion any moment now.

I entered a Long position on $SOL and expect it to break ATHs this year! #Solana pic.twitter.com/ApUazaXXz5

— CryptoJack (@cryptojack) May 8, 2024

Not only does CryptoJack see a bright future for Solana, but other analysts, such as Altcoin Sherpa, also maintain a bullish stance, with projections of the token potentially surpassing $500 this year.

This would represent a 300% increase from its current level, adding to the 589% growth it has already achieved year-to-date.

Solana Challenges Ethereum

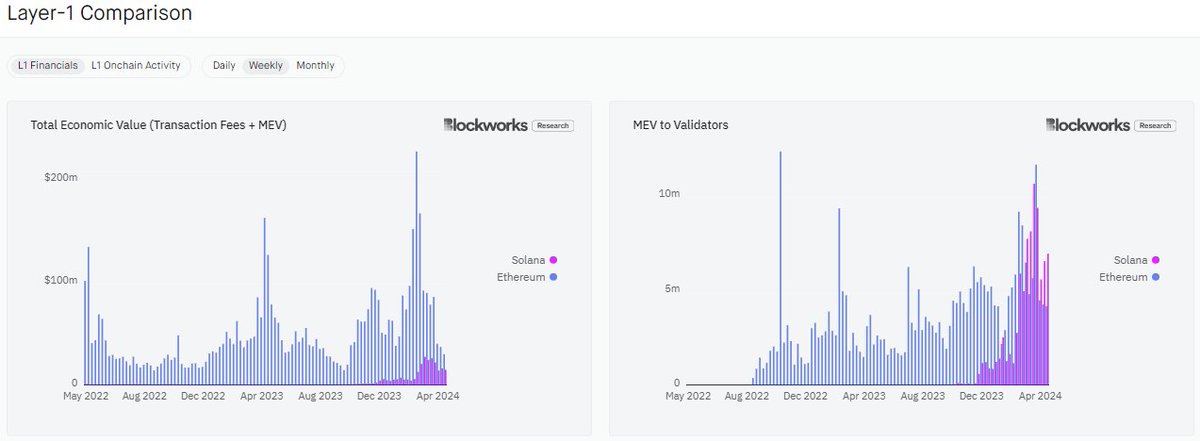

While Solana has shown notable growth, some of its key metrics are also beginning to keep up the pace. Dan Smith, a senior research analyst at Blockworks, suggests that Solana could soon surpass Ethereum regarding transaction fees and capture Maximal Extractable Value (MEV).

Smith’s analysis of X highlights that Solana’s total economic value is nearing Ethereum’s, indicating its increasing relevance in the blockchain space.

Solana will flip Ethereum in transaction fees + captured MEV this month, maybe even this week

— Dan Smith (@smyyguy) May 7, 2024

Despite this competition, Ethereum maintains a significant lead in daily transaction fees and total value locked (TVL). In the last 24 hours, Ethereum generated over $2.75 million in fees, compared to Solana’s $1.49 million.

Moreover, according to data from DeFillama, Ethereum’s TVL of over $53 billion dwarfs Solana’s $3.96 billion, representing just about 7.2% of Ethereum’s scale.

Meanwhile, Ethereum does not come close to Solana in terms of market performance. Solana has seen quite outstanding growth in the past year, surging by over 500%. On the other hand, Ethereum has only seen a 66% surge over the same period.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

coinbase

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

Published

1 day agoon

May 8, 2024By

admin

A crypto whale has withdrawn $75.8 million USDC from Coinbase institutional and invested a significant amount in Ethereum’s biggest presale, ETFSwap (ETFS).

An anonymous crypto whale reportedly withdrew a whopping $75.8 million in USDC from their Coinbase Institutional account on Friday night. This move follows the bull market widely predicted to happen in the coming weeks. An in-depth investigation into the event reveals that a large chunk of the money was used to acquire ETFSwap (ETFS) tokens in Ethereum’s biggest presale, making waves in the crypto community.

Crypto Whale Withdraws $75.8 Million In USDC From Coinbase Institutional

Whale Alert, an X (formerly Twitter) account notable for reporting large and exciting transactions in the crypto community, shared the news of a colossal $75.8 million USDC withdrawal from Coinbase institutional to an unknown wallet on Friday night.

The post that went viral in the crypto community has caught the attention of crypto enthusiasts, garnering several reactions. Some enthusiasts insist that the anonymous whale enacted the move to diversify their portfolios and gain big in the upcoming bull market later this year. Others believe that the whale wants to sell off the majority of their holdings and probably settle some of the debts they accrued.

However, whichever the case may be, a click on the web link to the eye-catching transaction shows that the anonymous transaction was made from a Coinbase Institutional account to a new project, ETFSwap (ETFS), firmly believed to be Ethereum’s biggest presale.

ETFSwap (ETFS) Becomes Ethereum’s Biggest Presale

Like the anonymous whale that bought a large amount of the ETFSwap (ETFS) presale tokens, thousands of crypto investors are still flooding into the presale, with over 50 million tokens already sold out in what is now believed to be Ethereum’s biggest pressale. This reiterates the fact that the crypto community believes in the viability and genuineness of the ETFSwap (ETFS) platform.

ETFSwap (ETFS) is an Ethereum-based decentralized finance (DeFi) platform that enables users and investors to buy, trade efficiently, and own a wide variety of cryptocurrencies and tokenized exchange-traded funds (ETFs) in a one-stop shop.

This innovative platform has come at a time when the tokenization of Real-World Assets (RWAs) is being embraced in the cryptocurrency world. At the forefront of this niche, ETFSwap (ETFS) users and investors enjoy the benefits provided by the innovation and flexibility of the decentralized finance realm while trading their various assets.

With the market-making and perpetual futures services available on the platform, trading is fun, seamless, liquid, and efficient on ETFSwap (ETFS). Consequently, users and investors are assured of continuous trading activities without any expiration dates.

Users can also take absolute advantage of the leverage tool on the platform. The ETFSwap (ETFS) platform enables users and investors to amplify their gains with the 10x leverage option provided. This tool is great for seasoned investors who want to maximize their gains by up to 1,000%, meaning a $1,000 gain can easily be turned into a $10,000 gain.

Another feature that has swept crypto enthusiasts off their feet is that on ETFSwap (ETFS), users and investors are not required to undergo rigorous KYC verification. They are afforded the platform to trade anonymously. This will, in return, absolve them of any third-party interference, such as banks or regulated bodies.

Additionally, CyberScope, a leading blockchain security provider, has audited ETFSwap’s (ETFS) smart contracts, and the results show their resistance to cyberattacks.

Whale’s Investment In The ETFSwap (ETFS) Presale Sends Crypto Community Into A Buying Frenzy

After the whale invested a large amount of his withdrawal from Coinbase into the ETFSwap (ETFS) presale, the platform has seen major market activity, with investors actively buying the token.

Presently, in Stage 1 of the presale, the ETFS token is priced at $0.00854 and is selling fast due to this being the lowest price the token will ever be. Therefore, there is no better time to invest in the highly esteemed ETFSwap (ETFS) project than now, especially after analysts have predicted it will go parabolic when the bull run begins.

For more information about the ETFS Presale:

Source link

Analyst

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Published

2 days agoon

May 7, 2024By

admin

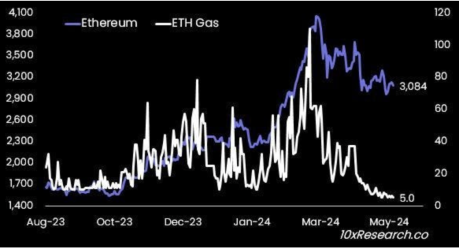

Ethereum has put on a disappointing performance for its investors over the last few weeks, leading to concerns on whether the second-largest cryptocurrency by market cap has lost its shine. The cryptocurrency continues to skirt around the $3,100 level, not making any significant breaks upward. This points to weak fundamentals that could trigger a price decline.

Ethereum Fails To Make Meaningful Moves

Markus Thielen, Head of Research at 10x Research, has pointed out some worrying developments with the Ethereum price. In a new report shared with NewsBTC, he explains that despite Ethereum remaining highly correlated to Bitcoin with an R-Square of 95%, it continues to perform poorly while the latter has made new all-time highs.

Thielen points back to ETH’s performance in the last bull market, which was closely tied to new sectors popping out of the network, such as decentralized finance (DeFi) and non-fungible tokens (NFTs). This caused demand to skyrocket, and in turn, the price followed as users gobbled up ETH for the high gas fee required to transact on the blockchain.

However, Ethereum has failed to maintain this momentum, which can be attributed to its inability to bring the upgrades that users needed in time. Thielen explains that the Dencun upgrade which helped solved the high gas fee issues had come three years too late because by 2024 when the upgrade arrived, users had moved on to Layer 2 networks. Also, during this time, other Layer 1 networks have seen a rise in users and Solana is one example of this.

Source: 10x Research

The researcher further explained that the weak fundamentals of ETH are now not only affecting its price but has had a spillover effect to Bitcoin. “Ethereum’s weak fundamentals are becoming a roadblock for Bitcoin as they prevent broad fiat inflow into the crypto ecosystem,” Thielen stated.

Better To Short ETH

Thielen’s analysis of Ethereum also spreads to the drop in stablecoin usage on the network. Back in 2021, Ethereum had dominated stablecoin transactions such as USDT and USDC. However, it seems like, with other things, the high fees have driven users towards other networks. Blockchains such as Tron (TRX) are now dominating stablecoin transactions, leaving ETH in the dust.

Additionally, there is also the fact that ETH’s issuance is turning inflationary once again. After the London Hard Fork, also known as EIP-1559, was completed in 2021, the network saw its issuance turn deflationary for the first time as ETH burned quickly surpassed ETH being brought into circulation.

However, this has now changed in the past months as there have been more ETH issued than those burned, Thielen notes. To put this in perspective, a total of 74,000 ETH were issued compared to only 43,000 ETH burned. This inflation, coupled with the fact that staking rewards have now dropped to 3%, below the 5.1% offered by Treasury Yields, Ethereum has had a hard time maintaining bullish sentiment.

Given these developments, the researcher believes it is better to be bearish on Ethereum right now. “Right now, we would be more comfortable holding a short position in ETH than a long one in BTC as Ethereum’s fundamentals are fragile, which is not yet reflected in ETH prices,” Thielen concludes.

ETH price fails to hold $3,100 | Source: ETHUSD on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Source link

Analyst Benjamin Cowen Warns Ethereum ‘Still Facing Headwinds,’ Says ETH Will Only Go Up if Bitcoin Does This

Tron Price Prediction: TRX Outperforms Bitcoin, Can It Hit $0.132?

Ethereum-Based Altcoin Leads Real-World Assets Sector in Development Activity, According to Santiment

Here’s Why This Analyst Is Predicting A Rise To $360

Hackers With $182,000,000 Stolen From Poloniex Starts Moving Funds to Tornado Cash

Cardano Faces Make-Or-Break Price Level For Bullish Revival

A Premier Crypto Exchange Tailored for Seasoned Traders – Blockchain News, Opinion, TV and Jobs

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

CFTC Chair Says ‘Another Cycle of Enforcement Actions’ Coming As Crypto Enters New Phase of Asset Appreciation

Spectral Labs Joins Hugging Face’s ESP Program to advance the Onchain x Open-Source AI Community – Blockchain News, Opinion, TV and Jobs

DOT Price (Polkadot) Reaches Key Juncture, Is This Bulls Trap or Correction?

‘Last Dip Ever’ – Analyst Predicts Solana Rally, Says Three Memecoins Will Surge Alongside SOL

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

Coinbase Gets Hit With New Class Action Lawsuit Accusing Crypto Exchange of Selling Digital Asset Securities

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry – Blockchain News, Opinion, TV and Jobs

Bitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

What does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

BNM DAO Token Airdrop

NFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

New Minting Services

Block News Media Live Stream

A String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

SEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs

Friends or Enemies? – Blockchain News, Opinion, TV and Jobs

Enjoy frictionless crypto purchases with Apple Pay and Google Pay | by Jim | @blockchain | Jun, 2022

Block News Media Live Stream

How Web3 can prevent Hollywood strikes

Block News Media Live Stream

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Block News Media Live Stream

Trending

Altcoins2 years ago

Altcoins2 years agoBitcoin Dropped Below 2017 All-Time-High but Could Sellers be Getting Exhausted? – Blockchain News, Opinion, TV and Jobs

Binance2 years ago

Binance2 years agoWhat does the Coinbase Premium Gap Tell us about Investor Activity? – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

BNM DAO Token Airdrop

BTC1 year ago

BTC1 year agoNFT Sector Keeps Developing – Number of Unique Ethereum NFT Traders Surged 276% in 2022 – Blockchain News, Opinion, TV and Jobs

- Uncategorized2 years ago

New Minting Services

Video2 years ago

Video2 years agoBlock News Media Live Stream

Bitcoin miners2 years ago

Bitcoin miners2 years agoA String of 200 ‘Sleeping Bitcoins’ From 2010 Worth $4.27 Million Moved on Friday

Bitcoin1 year ago

Bitcoin1 year agoSEC’s Chairman Gensler Takes Aggressive Stance on Tokens – Blockchain News, Opinion, TV and Jobs